- Tuesday's trading session saw a notable increase in the price of gold as the market continued to experience a lot of "FOMO trading" as it accelerated toward all-time highs.

- In the end, I believe that this market will remain extremely noisy, but you need to exercise caution since this is the point at which individuals are damaged by getting overconfident and pursuing too much.

Gold Continues to See Upward Momentum Begetting Upward Momentum

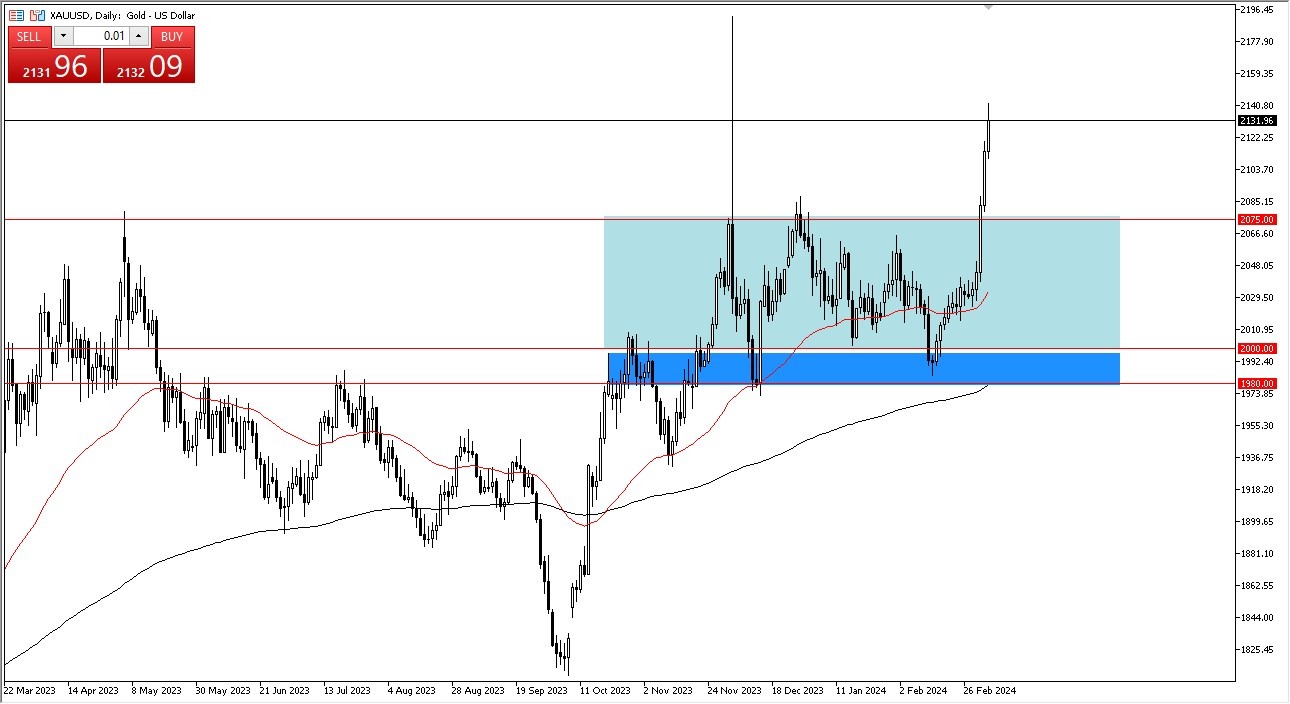

As gold prices keep rising, it's evident that there isn't much of a case to be made for shorting this market other than how swiftly it has moved. Having said that, our momentum is far from running out. You must consequently exercise extreme caution while dealing with shorts. On the other hand, you might not want to pursue this all the way up. It would be quite risky at this point. In my opinion, a lot of investors will want to enter this market if there is a drop, since the $2,075 level provides strong support. Unfortunately, the risk isn't worth it if you haven't previously invested in gold.

Top Forex Brokers

If it does reverse course, you will need to be prepared to withstand a loss of $75 per ounce until you get credible assistance. Generally speaking, I believe you just need to exercise patience in this scenario. This is probably going to be one of those occasions where you get paid to wait. I don't want to chase this market, but I also don't want to short this. Regretfully, all you can do is wait. Remember that interest rates naturally have a big impact on gold, so if they start to decline, that will benefit gold. Additionally, given the abundance of global problems at the moment, gold has undoubtedly benefited from them recently, but this is just lunacy defined. After three days, we are up 5%. We could go farther, but the farther we go in a shorter period of time, the more probable it is that we will experience a completely brutal retreat.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.