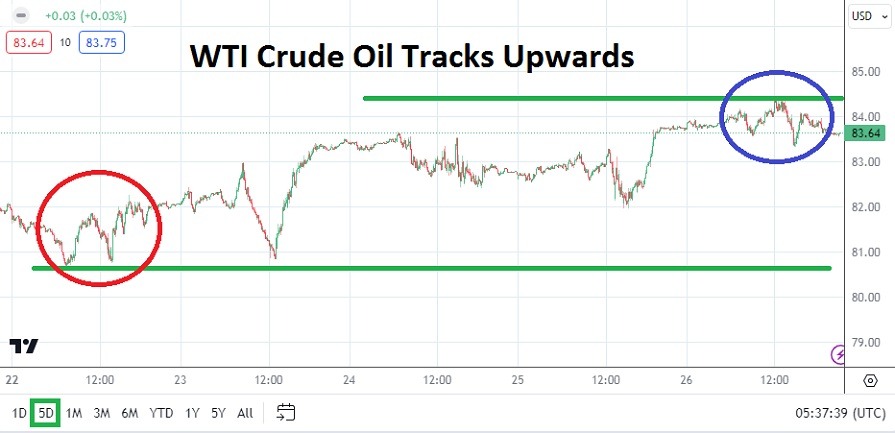

WTI Crude Oil finished last week’s trading within the stronger part of its weekly technical chart and may remain a speculative favorite in the coming days.

- WTI Crude Oil finished the week of trading near the 83.640 level, this after attaining a high earlier on Friday near the 84.450 mark.

- The commodity started last week within lower realms below the 82.000 level and saw its greatest depth on Monday the 22nd of April around the 80.700 vicinity.

- For all the talk about the conflict in the Middle East the prior two weeks, traders seemed to be able to focus on speculative supply and demand consequences in WTI Crude Oil.

While the costs of energy is a big part of global inflation concerns, the price of WTI Crude Oil remained rather polite last week, but its incremental climb upwards may raise some concerns. However, the price of the commodity as it begins trading tomorrow will be located within the middle ground of its one month price range. And the inability to remain above 84.000 USD going into the weekend will be noted.

Speculative Technical WTI Crude Oil Thoughts for the Week

The price of WTI Crude Oil on the prior Friday, the 19th of April, had seen volatile price action, this as Israel and Iran rattled swords and the values jumped to 85.600 momentarily. However large traders realized developments in the Middle East would remain calm, and the low on the 19th fell back to the 81.170 ratio before finishing higher.

There is another viewpoint which may intrigue technical and fundamental traders, WTI Crude Oil finished this past Friday’s trading at its highest close since the 16th of April. And as this week begins the USD remains within the stronger elements of its range in Forex. The opening for trading this week needs to be watched to see if WTI Crude Oil remains above the 83.400 ratio, if the commodity is able to sustain its relatively higher price it may mean some buying sentiment remains strong.

Top Forex Brokers

Concerns from Afar and the Experienced WTI Crude Oil Traders

News regarding the Middle East must continue to be watched, but day traders need to understand that large players in WTI Crude Oil understand the gyrations of noise from developing news better than most. The price of WTI Crude Oil will likely remain guided by supply and demand trades with speculative technical elements mixed into the rhythm of its value.

- The low for WTI Crude Oil did fall slightly below the 82.000 mark on Thursday, but then ignited buying.

- The support level of 82.000 appears to have provided impetus for bullish speculators who believed WTI Crude Oil had been oversold.

- It took only around 2 hours to take the commodity from the 82.000 level back above the 83.0000 level, and then to higher ratios and the apex for the week eventually on Friday.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 81.60 to 85.450

Having produced an upwards trend technically last week, the start of trading on Monday and Tuesday needs to be watched. The U.S Fed will conduct its FOMC Meeting on Wednesday but no significant changes to policy are predicted. The price of WTI Crude Oil will likely be affected mostly by speculative positions which react to the larger forces in the energy market.

The value of WTI Crude Oil appears to be rather comfortable for the moment as it resides in the middle of its one month range. But if the 84.000 level is challenged again quickly this week, this could set off notions which believe higher values will be pursued by buyers who may believe the 85.000 target is legitimate. If the commodity opens trading this week to the downside and the 83.000 level falters, the price velocity of downside momentum should be watched. If the 82.700 to 82.6000 level prove durable this could simply mean a slight speculative bearish test was pursued and failed. If Crude Oil were to fall below the 82.400 mark, this could create additional downwards momentum.

Ready to trade our Crude Oil weekly forecast? Here are the best Oil trading brokers to choose from.