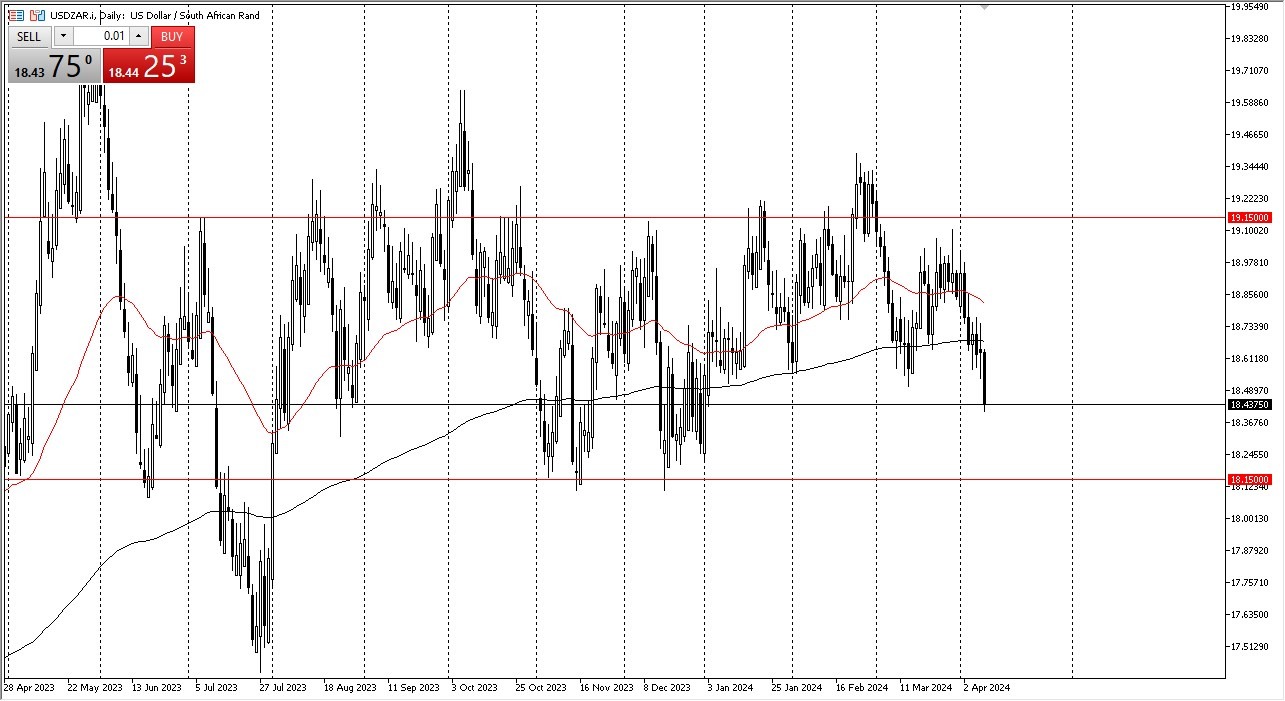

- The US dollar has fallen rather significantly against the South African Rand during the trading session on Tuesday, as the South African Rand ended up seeing inflows after the South African central bank showed that foreign reserves increased last month.

- With that being said, it does firm up the Rand, as it gives it a little bit more in the way of backing. Later this week, traders will begin to focus on the February gold in mining productions and the manufacturing figures, due on Thursday.

Emerging Market Currencies

This is one of the charts that I follow to get an idea on how the US dollar may be going against emerging market currencies, as the South African Rand is one of the biggest ones, especially as it is backed by quite a bit of commodity production. With that being said, we also have to keep in mind that the interest rate differential will continue to favor South Africa, trading on its 2030 government bond at a whopping 10.585%. This obviously means that the interest rate situation favor South Africa well over the United States.

Top Forex Brokers

Consumer Price Index

That being said, we get the Consumer Price Index numbers coming out on Wednesday in the United States, which could cause a significant amount of volatility. With that being the case, we will have to pay close attention to the markets overall, and whether or not they turn around. If we were to rally above the 200-Day EMA after the CPI numbers, then we could see this pair trade to the 19.15 level above. As things stand right now, the 18.15 level is a massive support level that a lot of traders will be paying attention to, as this pair does tend to trade in very well-defined ranges over longer periods of time.

I do think the downside is somewhat limited in the short-term, but if we were to break down below the 18.15 level, then we probably go looking to the 18 ZAR level below, and anything below that would probably send this market plummeting. While I don’t see that happening, it is most certainly something to keep in the back of your mind.

Ready to trade our Forex daily analysis and predictions? Check out the top forex trading brokers in South Africa worth using.