- The Australian dollar has been all over the place during the trading session on Thursday, as we initially tried to rally, but then turned around to show signs of negativity.

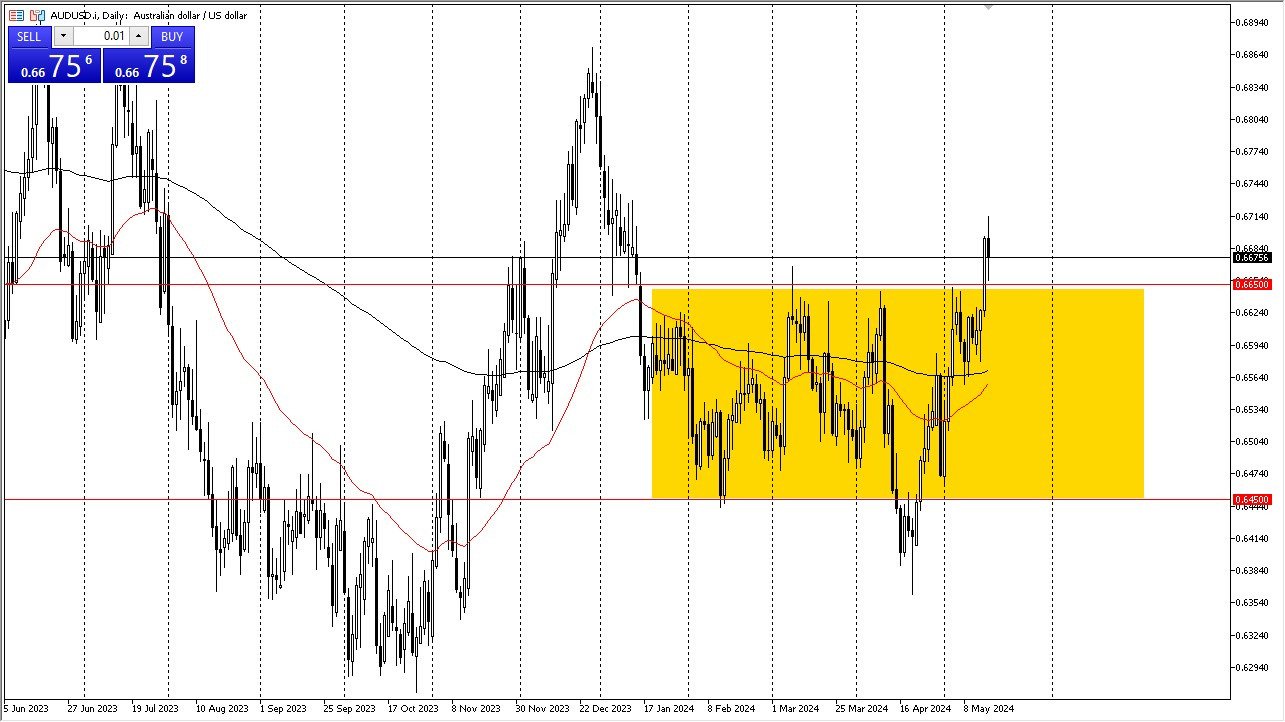

- The 0.6650 level is an area that a lot of people will be paying close attention to, due to the fact that the area previously had been massive resistance.

- With that being the case, I think you get a situation where plenty of traders will look at that as an area to get involved in, due to “market memory.”

Technical Analysis

Taking a look at the technical analysis in this market, it doesn’t take too much in the way of imagination to believe that the AUD/USD pair has started to prove that the breakout of the rectangle is in fact valid, at least based on the initial reaction. If we can break higher from here, then it’s likely that we could go looking to the 0.69 level given enough time. It’s also worth noting that the 50-Day EMA is racing toward the 200-Day EMA, perhaps kicking off some type of “golden cross.”

All things being equal, the market is more likely than not going to continue to be noisy, and it could very well start to focus on commodities yet again. After all, commodities are a major export of Australia, so as demand picks up for things like copper, iron, and aluminum, it makes sense that demand for the local currency also picks up. As long as we stay in this general vicinity, I suspect that correlation will continue to play out as well.

I do anticipate that there could be a lot of choppiness, due to the fact that the AUD/USD market is a little stretched, but the pullback during the early hours on Thursday could of course alleviate some of that issue. The Wednesday candlestick was very bullish, so one would have to assume that there are at least a lot of people out there willing to get involved on the dip.