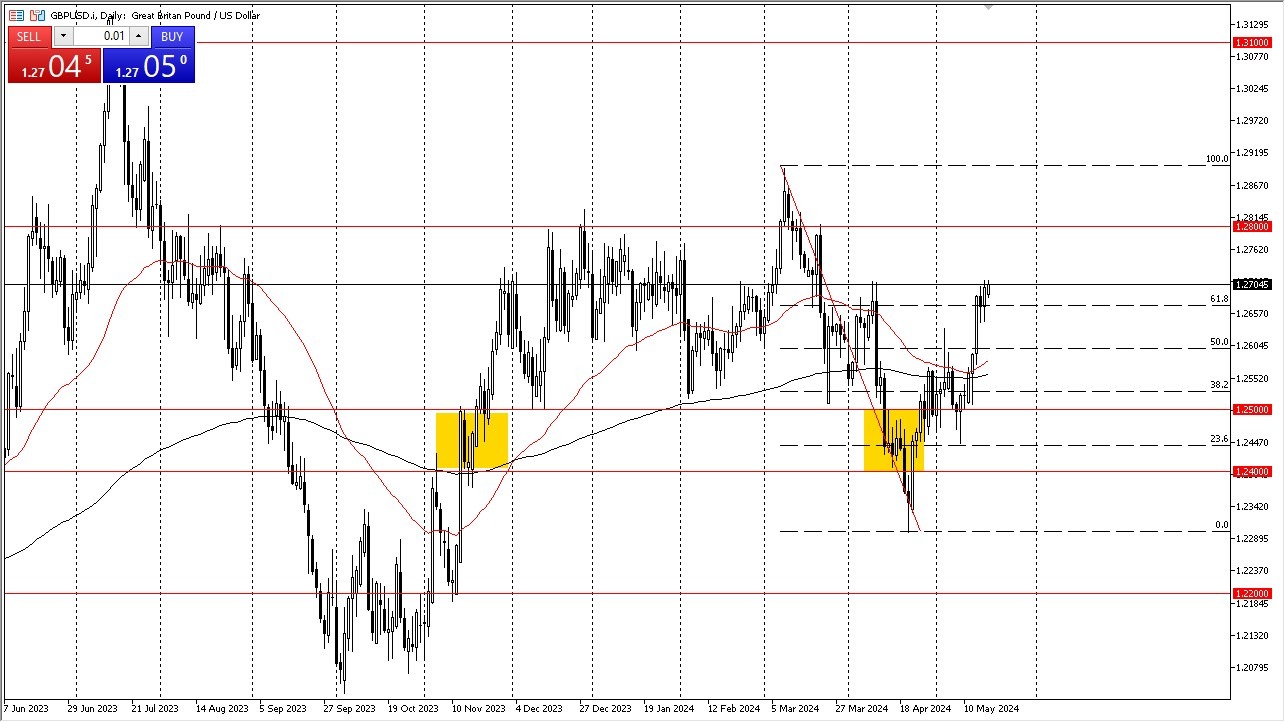

- The British pound has rallied slightly during the trading session on Monday as it looks like we are threatening the 1.27 level.

- The 1.27 level is an area that’s previously been important, so it’s not a huge surprise to see that we might stall here.

- Regardless, I do think that this pair is doing everything it can to break out and go looking to the 1.28 level.

Underneath, I see a lot of support near the 1.2650 level, an area that we have bounced from a couple of times over the last several days. Furthermore, we also have the 50-Day EMA near the 1.26 level. All things being equal, I think this is a market that is on the precipice of making a bigger move, but the question remains whether or not that move will be to the upside, or if the whole thing will fall apart. I do think that there is a lot of momentum out there, and of course momentum is something that tends to be a major driver of where we go next.

Top Forex Brokers

Near the top of the range

All things being equal, I think we are getting closer to the top of the range than the bottom. The reason I say this is that there are a lot of arguments for range bound currencies this year, and this is an area that I think leads as high as 1.28 above, but whether or not we can break above that level is a completely different question. After all, I can give you a whole litany of reasons why the US dollar might pick up strength, not the least of which would be geopolitical issues. Furthermore, the Federal Reserve is nowhere near cutting interest rates, and I think people are trying to front running a move that just is not going to happen.

This isn’t to say that the British pound is going to be particularly week, it’s just that is difficult to see the US dollar shrinking for the longer term, because quite frankly we’ve seen this move multiple times over the last couple of years, only to see it completely turned around.

Ready to trade our Forex daily forecast? We’ve shortlisted the best regulated forex brokers UK in the industry for you.