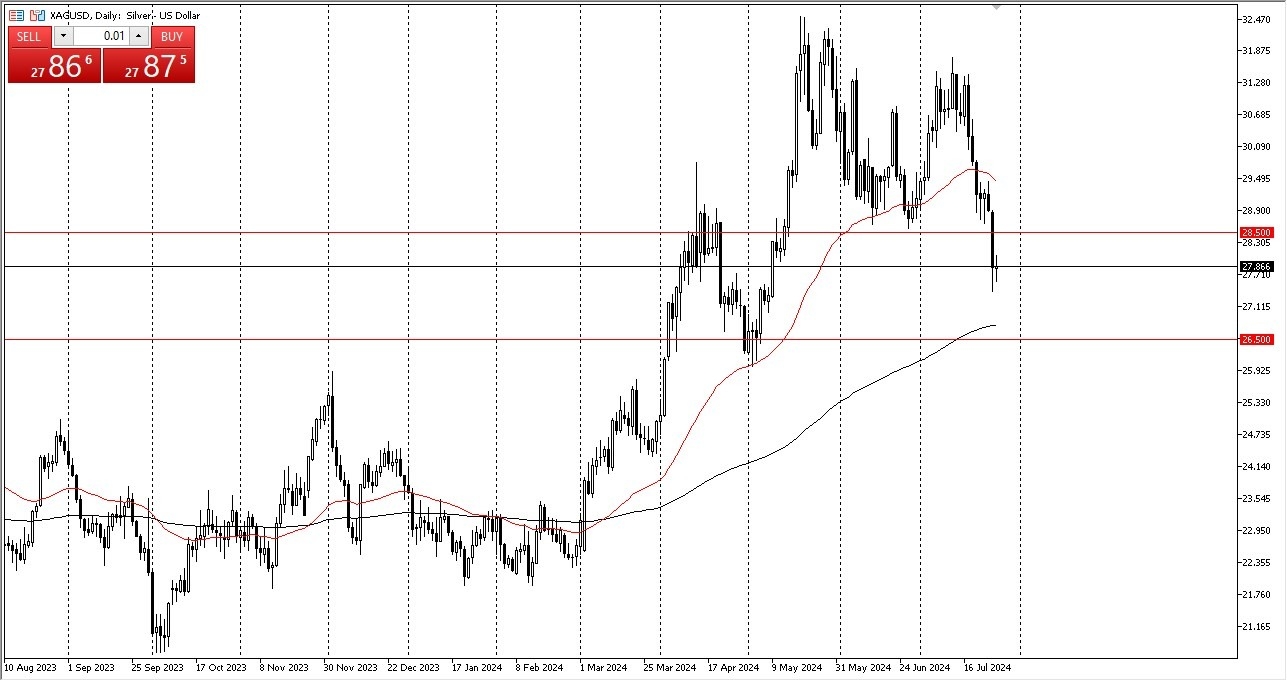

- I noticed that we are hanging about and perhaps trying to stabilize.

- This is something that we desperately needed to see after the last couple of sessions, and now the question is going to be whether or not we can recapture the crucial $28.50 level.

- The $28.50 level has previously been both support and resistance. So, it does make a certain amount of sense that we should be paying close attention to it.

If we were to take it back and rise above that level, I think you would see a lot of fear of missing out trading, jumping into the market and perhaps sending silver towards the 50 day EMA near the $29.50 level. After that, then the market could go as high as $31.50. On the downside, there is quite a bit in the way of support closer to the $26.50 level, which is also where we see the 200 day EMA. All of that being said, I think you have to pay attention to a lot of different things right now when it comes to the silver market. The first thing of course is going to be the interest rate situation and if rates start to drop a little bit, that could help silver. For what it's worth, we did see rates drop in the United States during the Friday session, so that has helped. The question is, can we see more of that? If we do, then silver may get a little bit of a boost.

Top Forex Brokers

Between Two Massive Levels

Right now, we are basically in no man's land, just kind of hanging out between two major support levels. So, I am a bit cautious, but I do think we've at least made the first attempt to stabilize and perhaps turn things around. With that being said, I'm watching this market closely, but I'm not quite ready to jump on it. After all, there are few markets that will punish you like the silver market, and therefore you always want to trade with caution.

Ready to trade our daily forex forecast? Here are the best online Silver trading brokers to choose from.