- Silver initially plunged during the early hours on Tuesday again, but then turned around to show signs of life.

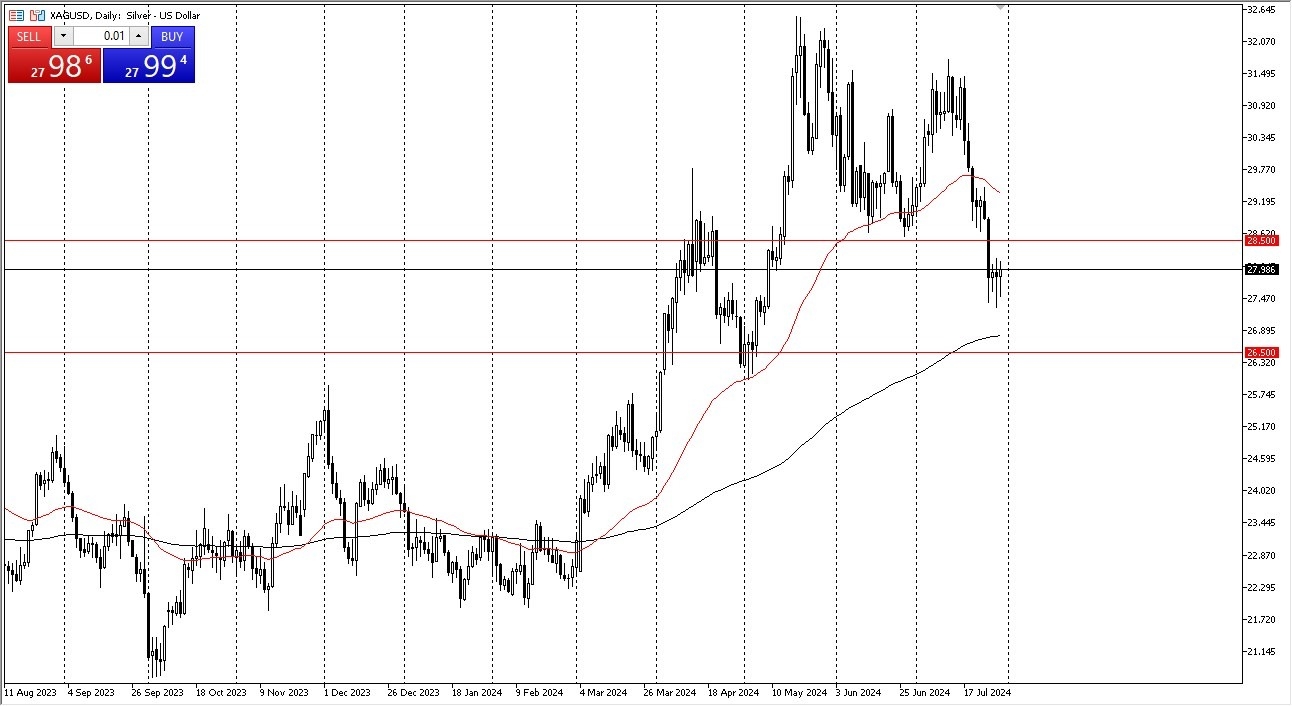

- Ultimately, this is a market that I think is hanging about and just above the 50% Fibonacci retracement level, so I think that's worth paying close attention to.

- Furthermore, the 200-day EMA is just above the crucial $26.50 level, an area that I think has certainly proven itself to be important.

The market of course is waiting for the Federal Reserve on Wednesday and that will have a major influence on the US dollar and by extension, a major influence on bond markets and silver. If silver can break above the $28.50 level, it could really start to take off from here and perhaps go back towards the 30 level.

Top Forex Brokers

There is a Ton of Noisy Moves Ahead

This is a market that I think you need to recognize could be very noisy along the way, but I also recognize that we could see a situation where volatility seems to be offering value. We have been in an uptrend for a while, and I think at this point it still is very much intact, but after the Federal Reserve meeting, we might have a bit of a change. We'll just have to wait and see how this moves the markets, as it could be a situation where the moves could be very dangerous.

If Jerome Powell sounds dovish in the press conference, we could see Silver really start to take off. It'll be interesting to see how this plays out, but I do like the idea of perhaps starting to jump into a small position, something that isn't so big that if you get stopped out, it will hurt you, but maybe an opportunity to at least take advantage of what could be a very fruitful move on Wednesday and beyond on a breakdown below the $26.50 level that would change everything. But right now, it doesn't look like we're threatening to do that.

Ready to start trading the daily analysis and predictions? Get our list for best commoditiy brokers here.