Fundamental Analysis & Market Sentiment

I wrote on 21st July that the best trade opportunities for the week were likely to be:

- Long of the EUR/USD currency pair following a daily close above $1.0939.

- Long of XAU/USD (Gold) following a daily close above $2,469.

- Long of the S&P 500 Index following a daily close above 5,668.

None of these trades set up.

Top Forex Brokers

Last week’s key takeaways were:

- The week began with President Biden withdrawing from the 2024 Presidential election. This was not a complete surprise following weeks of speculation following the President's stumbling performance in his debate with former President Trump. His Vice President, Kamala Harris, quickly secured the pledges of a majority of conference delegates and the backing of almost every major Democrat. She is polling better than Biden was against Trump, taking a small lead in many polls. However, betting markets still suggest former President Trump is the likely winner in November, with a 62% chance of victory.

- The Japanese Yen made extremely strong gains last week, with unusually large price movements that are rarely seen in the Forex market. This is partly due to risk-off flows as stock markets see heavy profit-taking, with money moving into the Yen as a safe haven, and partly due to an increasing feeling that the Bank of Japan can now begin to move towards a more hawkish monetary policy, including a possible rate hike this week. Technically, the Japanese Yen is likely to see a fall in value over the coming week.

- The Bank of Canada cut its Overnight Rate by 0.25% for the second consecutive meeting, arguably contributing to the relative weakness in the Canadian Dollar.

- US Advance GDP came in higher than expected, suggesting more growth in the US economy than previously thought.

- US Core PCE Price Index data came in exactly as expected, showing a month-on-month increase of 0.2%.

There were a few other events last week which were of lower significance:

- US, German, UK, French Flash Services & Manufacturing PMI– mixed, giving no clear indication.

- US Unemployment Claims – almost exactly as expected.

The Week Ahead: 29th July – 2nd August

The most important items over this coming week will be:

- US Federal Funds Rate and Statement.

- US Average Hourly Earnings.

- US Non-Farm Employment Change.

- US JOLTS Job Openings.

- US Unemployment Rate.

- Eurozone CPI Flash Estimate.

- German Preliminary CPI.

- Bank of Japan Policy Rate and Monetary Policy Statement.

- Bank of England Official Bank Rate and Monetary Policy Statement.

- Swiss CPI.

- Australia CPI.

- US ISM Manufacturing PMI.

- US CB Consumer Confidence.

- Canadian GDP.

- US Unemployment Claims.

- US Employment Cost Index.

- Chinese Manufacturing PMI.

Monthly Forecast July 2024

This month, I forecasted that the USD/JPY currency pair would increase in value. The performance of this forecast to date is as follows:

Weekly Forecast 28th July 2024

Last week, I made no weekly forecast, although the NZD/JPY currency cross experienced an unusually large directional price movement. I did not have faith that the price would revert over the week, so I made no weekly forecast.

This was a great call, as the NZD/JPY currency cross fell again.

Last week, all the Japanese Yen crosses (except CHF/JPY) experienced unusually large directional price movement. I, therefore, think next week we are likely to see rebounds in all these crosses, which suggests that next week will see good long trade opportunities and price advances in:

- AUD/JPY

- CAD/JPY

- EUR/JPY

- GBP/JPY

- NZD/JPY

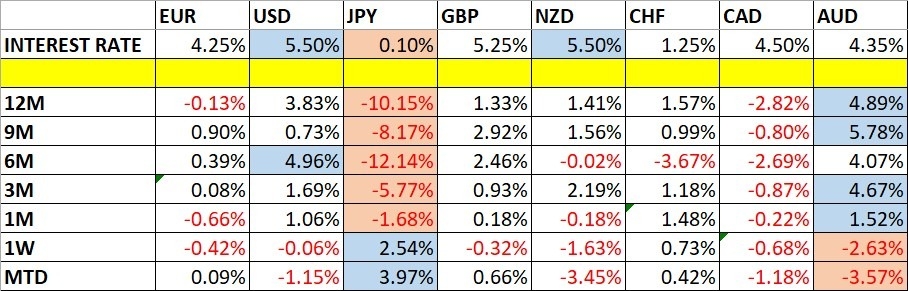

Directional volatility in the Forex market rose last week, with 52% of the most important currency pairs fluctuating by more than 1%.

Last week, the Japanese Yen was the strongest major currency, while the Australian Dollar was the weakest.

You can trade these forecasts in a real or demo Forex brokerage account.

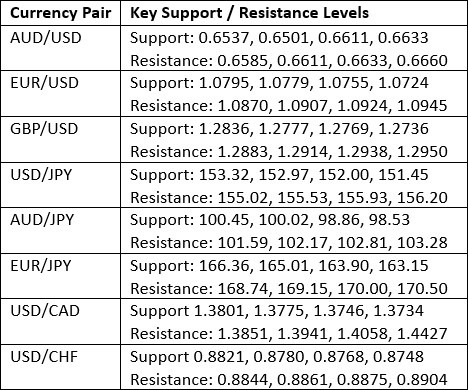

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

The US Dollar Index printed an indecisive doji candlestick last week, with almost all the price action occurring between the new support level at 103.71 and the older resistance level at 104.15. This is a sign of indecision, as although the latest support is bullish, the fact that the price has been unable to escape to above 104.15 is a sign that this zone of resistance is still holding.

The greenback has no long-term trend: it is above its price of 3 months ago but below its price of 6 months ago, showing mixed trends. This adds to the picture of indecision and choppiness here.

If the US Dollar can establish itself above 104.15 over the coming days, that will be a bullish sign and likely a signal to stop trading the Dollar short. On the other hand, if it establishes itself below 103.71, that will be a bearish sign.

The Dollar will probably come to life later in the week when the Fed's policy meeting is held, but in the meantime, the Forex action will likely focus on the volatile Japanese Yen.

EUR/USD

The EUR/USD currency pair came off a 3-month high price it made two weeks ago and closed lower at the end of last week. However, the bearish retracement has not yet been deep enough to knock long-term trend traders out of this trade.

The price seems to have found support at $1.0833 but has not risen above the resistance level at $1.0870. The past few days have seen the price consolidate weakly between these levels.

The Euro, the Swiss Franc, and the British Pound have held their value relatively well against a very strong Japanese Yen and a firm US Dollar, but there is not much to say about the Euro right now.

The policy meeting of the US Federal Reserve will probably most strongly influence this currency pair this week.

I will enter a long trade if we get a daily close this week above $1.0939. However, the bullish outlook here is quite weak and unconvincing.

USD/CHF

I expected the USD/CHF currency pair to have potential resistance at $0.8923.

The H1 price chart below shows how the price doubled inside bars, marked by the down arrow within the price chart below, rejecting this resistance level just before last Tuesday’s London close, signalling the timing of this bearish rejection.

This trade could still be open, but it has been extremely profitable so far, giving a maximum reward-to-risk ratio of approximately 14 to 1.

AUD/JPY

The AUD/JPY currency cross fell extremely strongly last week to close lower by more than 4%. This is an unusually large price movement that has not been seen for months, possibly even years. It was a very bearish weekly candle, although there was a significantly lower wick, which suggests that the price may have found some support towards the end of the week.

Although the Australian Dollar traded significantly lower last week on declining risk appetite, the Japanese Yen remains the real story. It enjoyed another week of dramatic strengthening but by even more than the previous week's strong advance. This is driven by anticipation that, at last, economic data is showing inflation sustained firmly above the 2% target, making a rate hike by the Bank of Japan this week extremely likely.

Later this week, the Bank of Japan's policy meeting injects a major element of uncertainty regarding the Yen. The Bank may hike its interest rate.

Although the price action can be seen as a bearish development, it is worth noting that such strong weekly directional movements in currency crosses tend to bounce back the next week. We already saw the price stop falling, and we may have found support towards the end of last week. Furthermore, almost all the Yen crosses had similar outsized moves.

Therefore, I expect this currency pair's price to rise over the coming week.

S&P 500 Index

The S&P 500 Index fell again last week, after the previous week when the major stock market index posted a weekly loss for the first time in seven weeks.

The move down was reasonably strong, but nothing out of the ordinary. Most trend traders won't be long here any longer despite the recent strong bullish run, as the price has retraced by more than three times the long-term daily average true range.

Technology stock indices like the NASDAQ 100 have performed even more bearishly over the past week, suggesting that the stock market has made a rotational shift. Broader market investments now look likely to outperform leading technology stocks. Some major tech companies, such as NVIDIA, have seen massive drops over recent days.

I think the best approach to stocks right now is to stand on the sidelines and wait to see if the bullish trend resumes, whether we see a deeper bearish retracement or just a consolidation.

Bottom Line

I see the best trading opportunities this week as follows:

- Long of the AUD/JPY currency cross.

- Long of the CAD/JPY currency cross.

- Long of the EUR/JPY currency cross.

- Long of the GBP/JPY currency cross.

- Long of the NZD/JPY currency cross.

Ready to trade our weekly Forex forecast? We’ve made a list of the best Forex brokers that you should review.