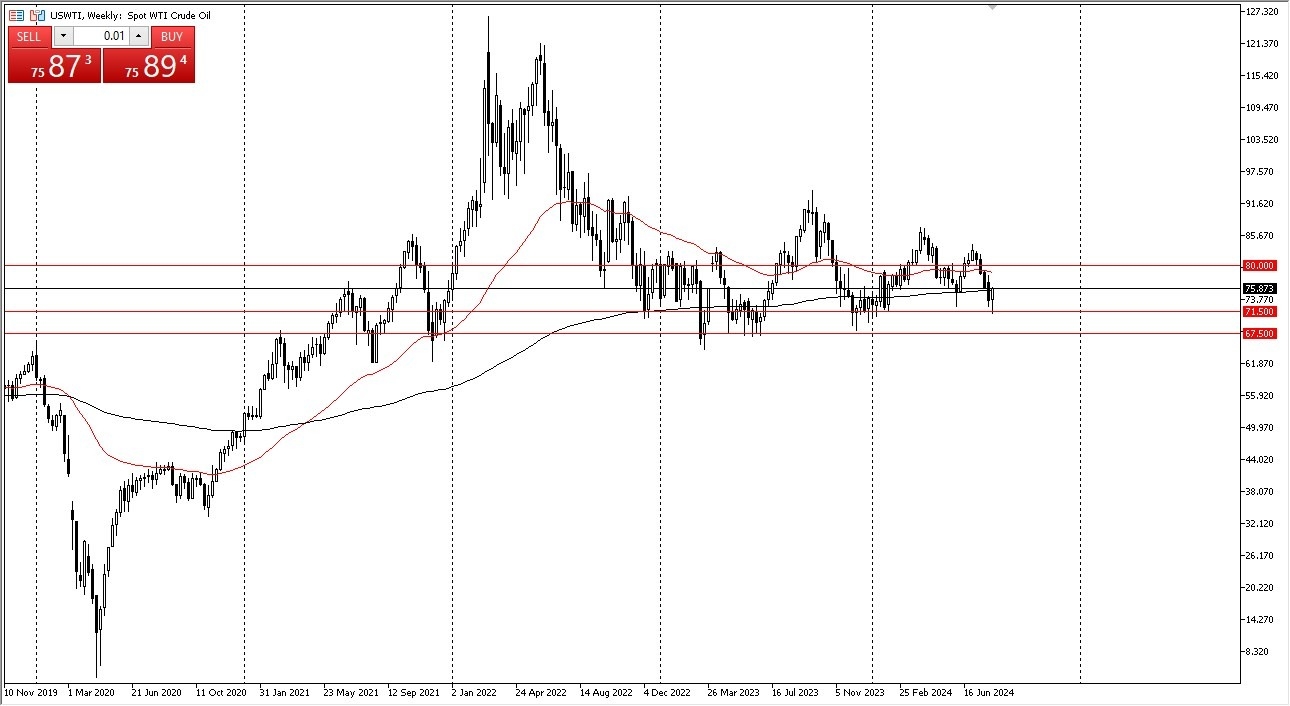

WTI Crude Oil

The West Texas intermediate crude oil market fell initially during the week only to turn around and show signs of life. In fact, we have bounced hard enough for me to think that we are perhaps getting ready to bounce toward the $80 level. That being said, it’s worth noting that the market has been very range bound over the last 2 years, and I don’t think that will change anytime soon. This might be a short-term bounce that you can take advantage of, but I would not get married to this position due to all the various problems around the world.

Silver

Silver has been battered during most of the week, but we bounced from the crucial $26.50 level, and the 50-Week EMA. By doing so, it looks like we are at least trying to save the uptrend, but we have a lot going on around the world that could cause issues for silver in general. Ultimately, I think the Silver market sooner or later will bounce and go looking to rally again, but if we were to break down below the $26 level, that would essentially end up being the end of the trend. As things stand right now, I think you continue to see a lot of volatility and it might not be a market you want to be involved with.

Top Forex Brokers

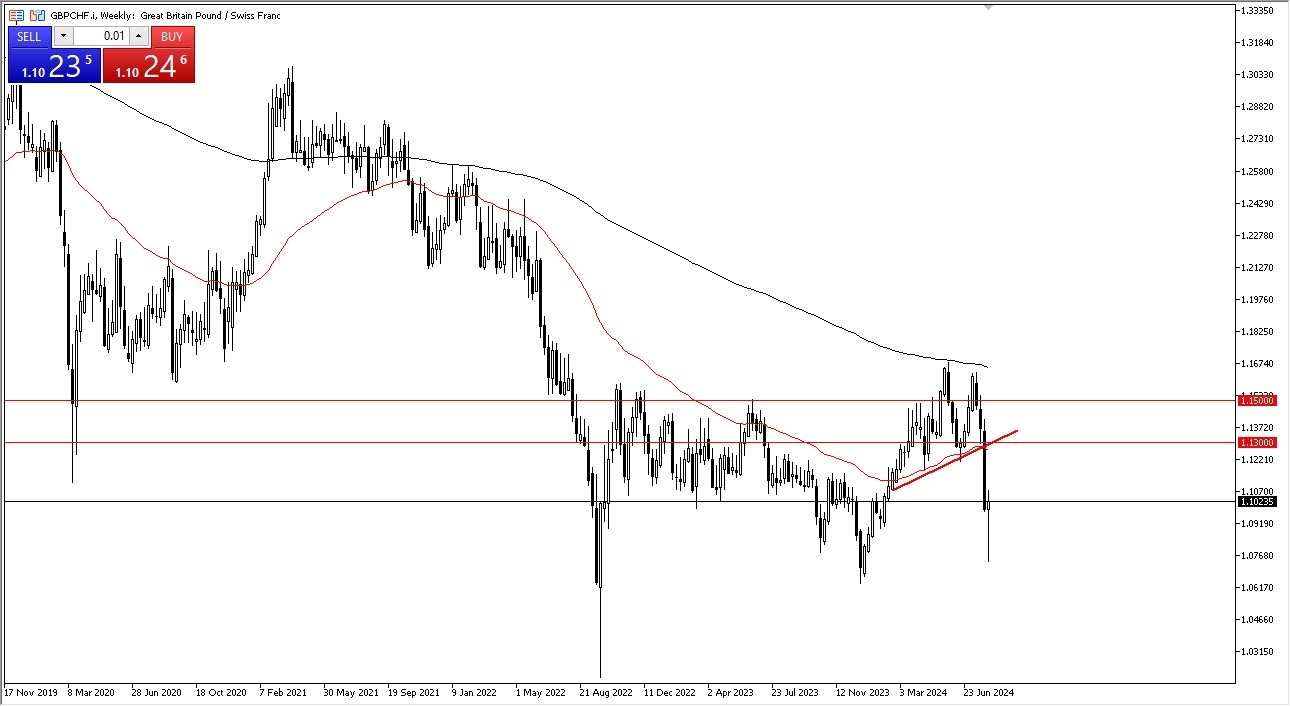

GBP/CHF

During the week, we have seen the British pound get absolutely crushed against the Swiss franc, but we have also seen it turn around and show signs of life. It’s worth noting that the 1.0750 level is an area that previously had been massive support, and as we are heading into the weekend it looks like we are trying to do everything we can to break back above the 1.10 level. If we break above the high of the week, it’s very possible that this pair could try to recover and go higher, reaching the 1.13 level before it is all said and done.

Bitcoin

The bitcoin market plunged during the week right along with everything else, and even managed to pierce the $50,000 level. However, by the time Friday came back around, the market had risen to break above the $60,000 level, meaning that we are essentially unchanged. This is an extraordinarily bullish sign, and it’s likely that we will continue to see plenty of buyers out there every time this market dips.

DAX

The German index plunged during the week to break below the €17,000 level, only to turn around and show signs of life. It looks like the 50-Week EMA will continue to be a bit of a support level and turning the market back around to show some kind of life, as we are forming a hammer for the week. If we can break back above the €18,000 level, I suspect that there will be a lot of “FOMO traders” joining this market. Alternatively, if we break down below the candlestick for the week, that would be a horrific sign.

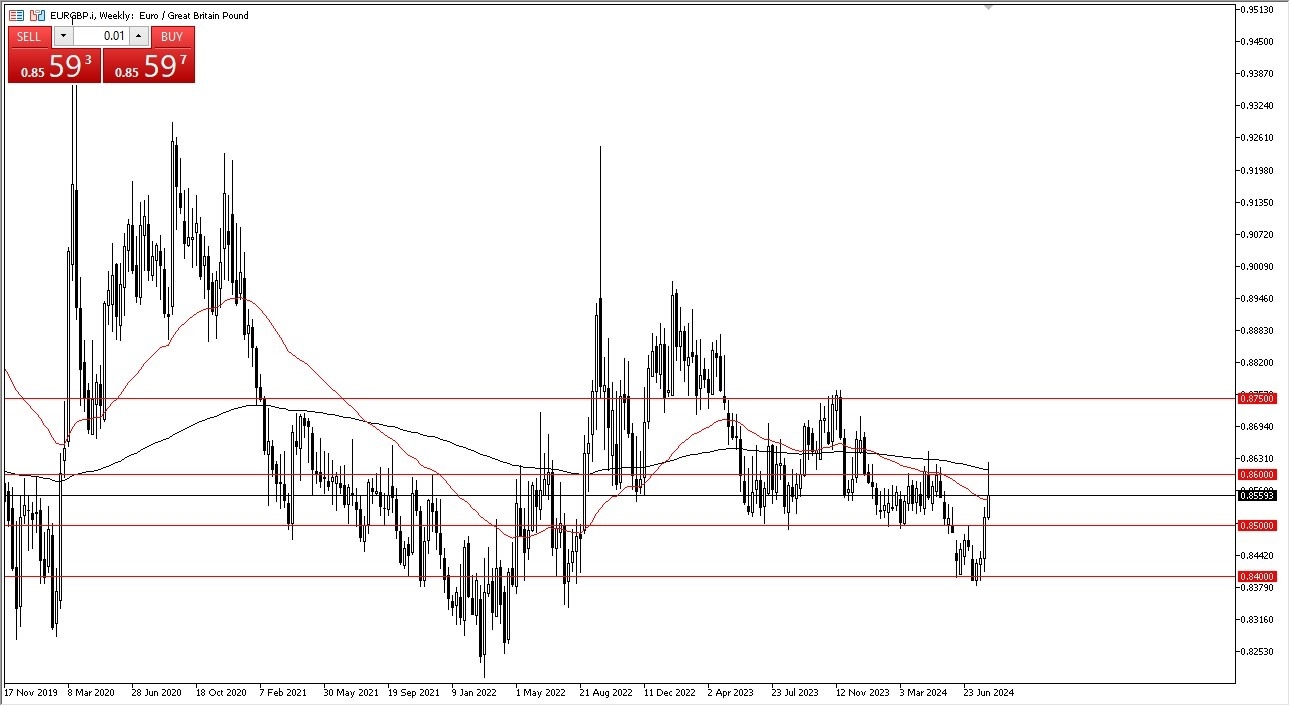

EUR/GBP

The euro spiked against the British pound during the week, but it looks as if the 0.86 level is going to continue to be a major barrier. While I do think that short-term pullbacks probably attract a certain amount of attention, we need to keep the EUR/GBP market above the 0.85 level to build confidence. If this is in fact the beginning of a trend change, these are typically messy affairs, so don’t be surprised at all to see a lot of volatility.

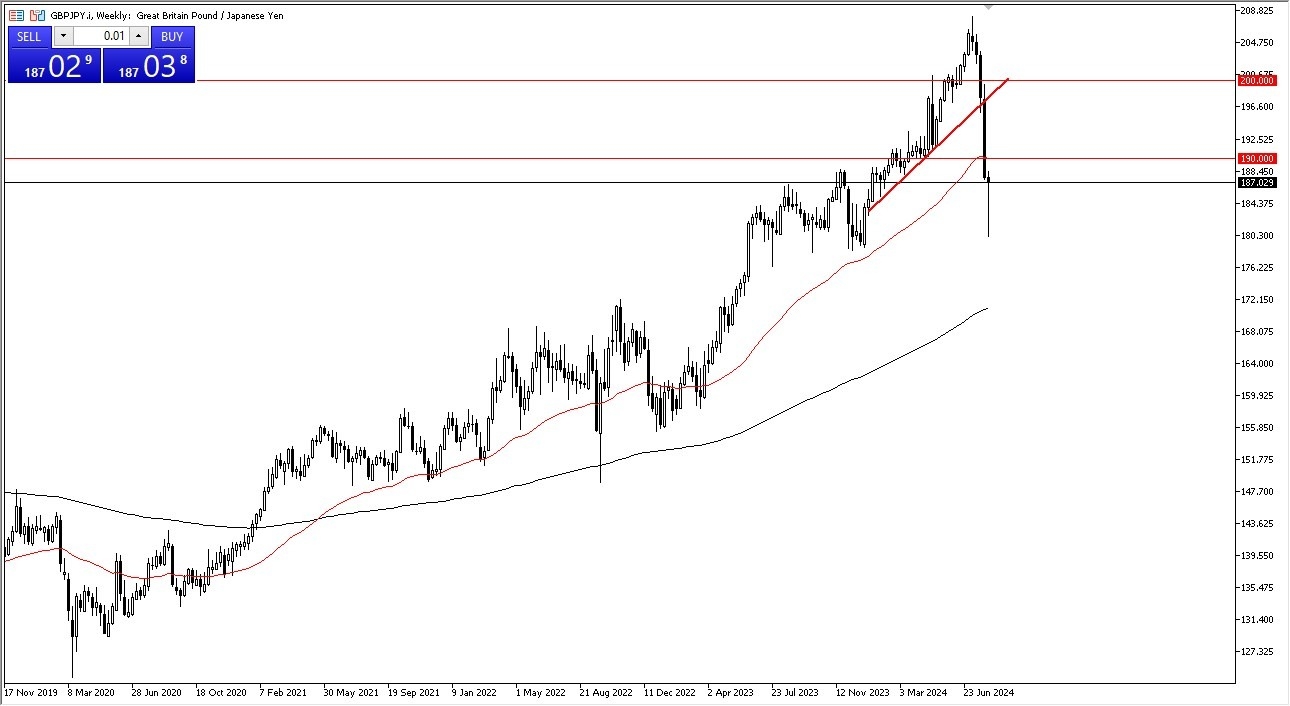

GBP/JPY

The British pound crushed the Japanese yen after initially being crushed by it in what has been extraordinarily volatile week. The ¥180 level has offered a massive amount of support, insomuch as to spook the market back to the upside, reaching above the ¥187 level! At this point, if we do see a little bit of follow through, meaning that we can break above the top of the hammer, then the market is likely to go looking to the ¥190 level, and anything above there probably brings in a lot more FOMO going forward.

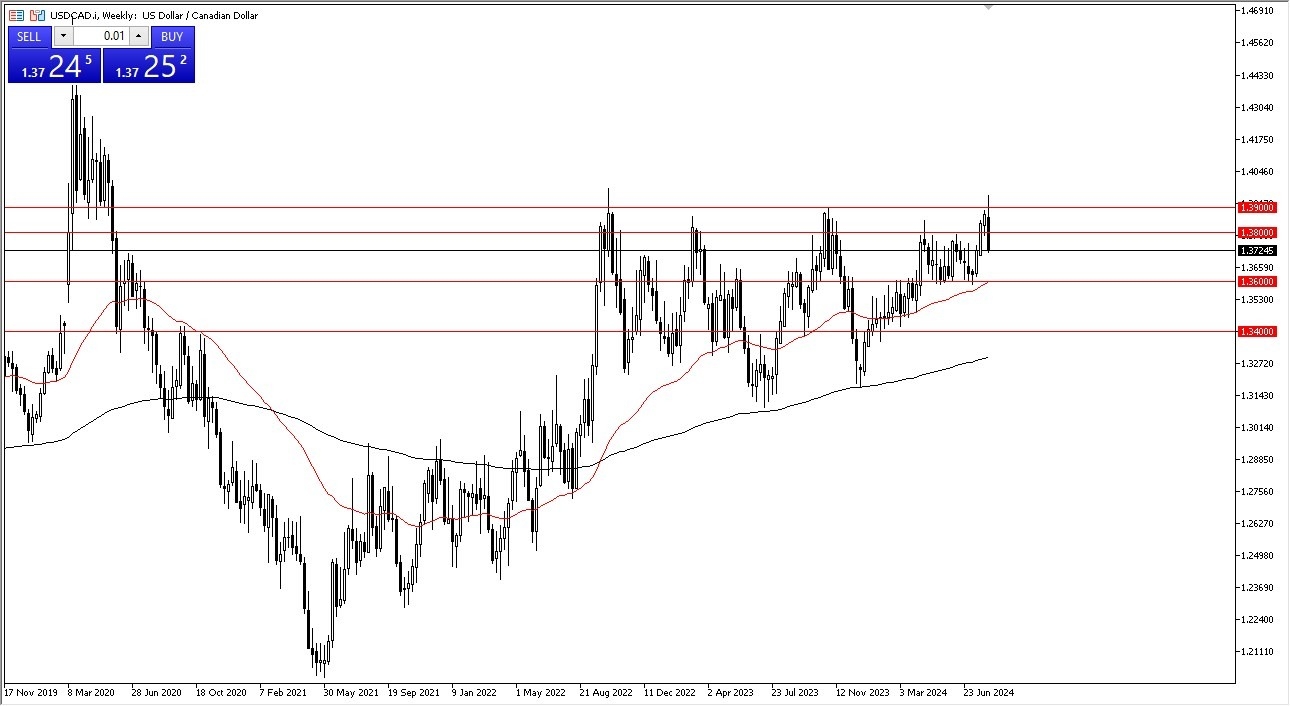

USD/CAD

The US dollar initially tried to break above the crucial 1.39 level during the course of the week, but we have seen a lot of fear in the market dissipate. The US dollar has been on its back foot, despite the fact that on Friday we got horrible jobs numbers in Canada. Because of this, I think you’ve got a situation where the USD/CAD market will be watching the 1.36 level underneath very closely for any signs of support. If we were to breach that level, then it’s likely that the US dollar breaks down to the 1.34 level.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.