- It's easy to see that we are bullish in the early hours.

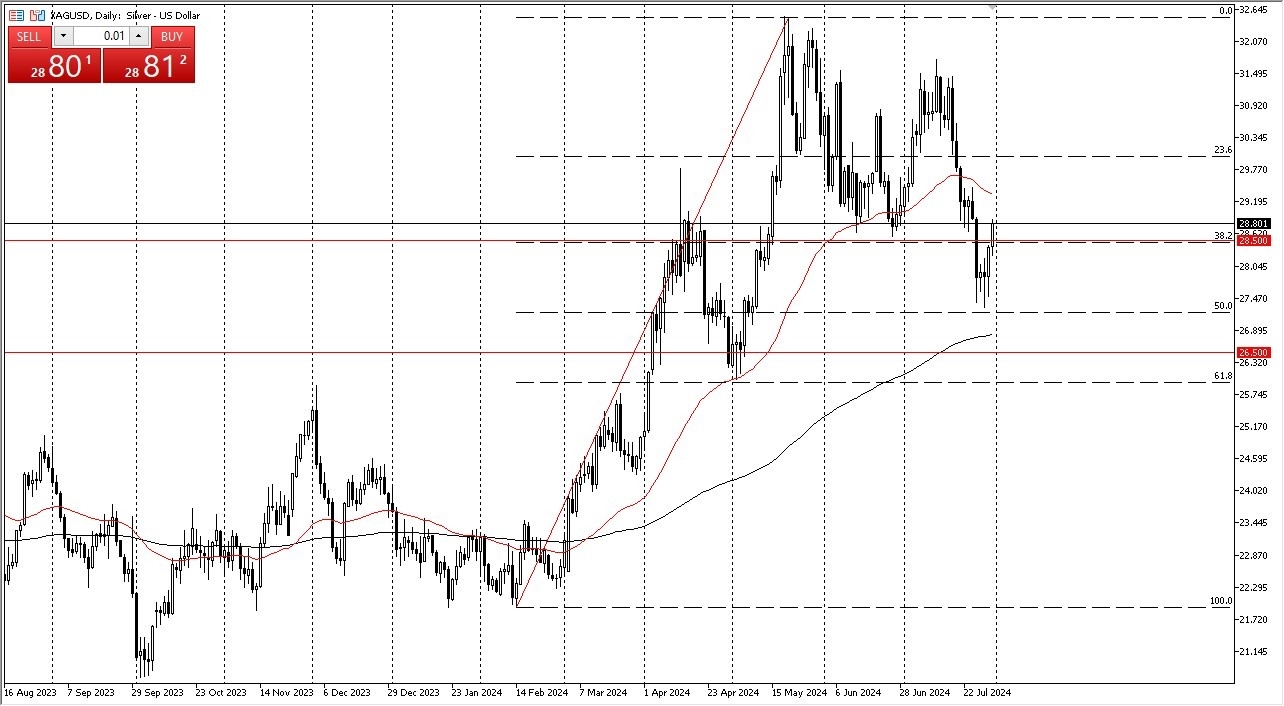

- The question now, of course, is whether or not we can keep up the upward momentum after the end of the session when we have the Federal Reserve meeting and the announcement breaking above the $28.50 level, of course, is very bullish.

- And it does suggest that we are going to continue to at least see people interested in buying on dips.

The Federal Reserve Will Have Its Say

Top Forex Brokers

That being said, you also have to keep in mind that the Federal Reserve could very well shock the market, although I'm not necessarily anticipating it. If they do sound overly hawkish and suggest that they aren't anywhere near cutting rates, that will work against silver and could send the US dollar flying. If that's the case, you'll quite often see silver struggle. The recent pullback has found support at the 50% Fibonacci retracement level, which of course is an area that a lot of technical traders will pay close attention to. So, with that being said, I think you've got a situation where short-term pullbacks, I think, continue to attract a certain amount of attention. If we can break above the 50-day EMA, which is sitting above near the $29.37 level, then I think the market really starts to take off to the upside.

It's been a nice constructive pullback and now we have to see whether or not the momentum can come back into the market and re-ignite the overall uptrend that we had seen. If we were to turn around and break down from here, I'd pay close attention to the 200 day EMA and then underneath there at the $26.50 level, which is a major support region in general. This is a market that I think continues to see a lot of volatility, but I still see a lot of upward potential here. However, always keep in mind that the volatility in the silver market is legendary and can be very dangerous to say the least. Trade accordingly.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.