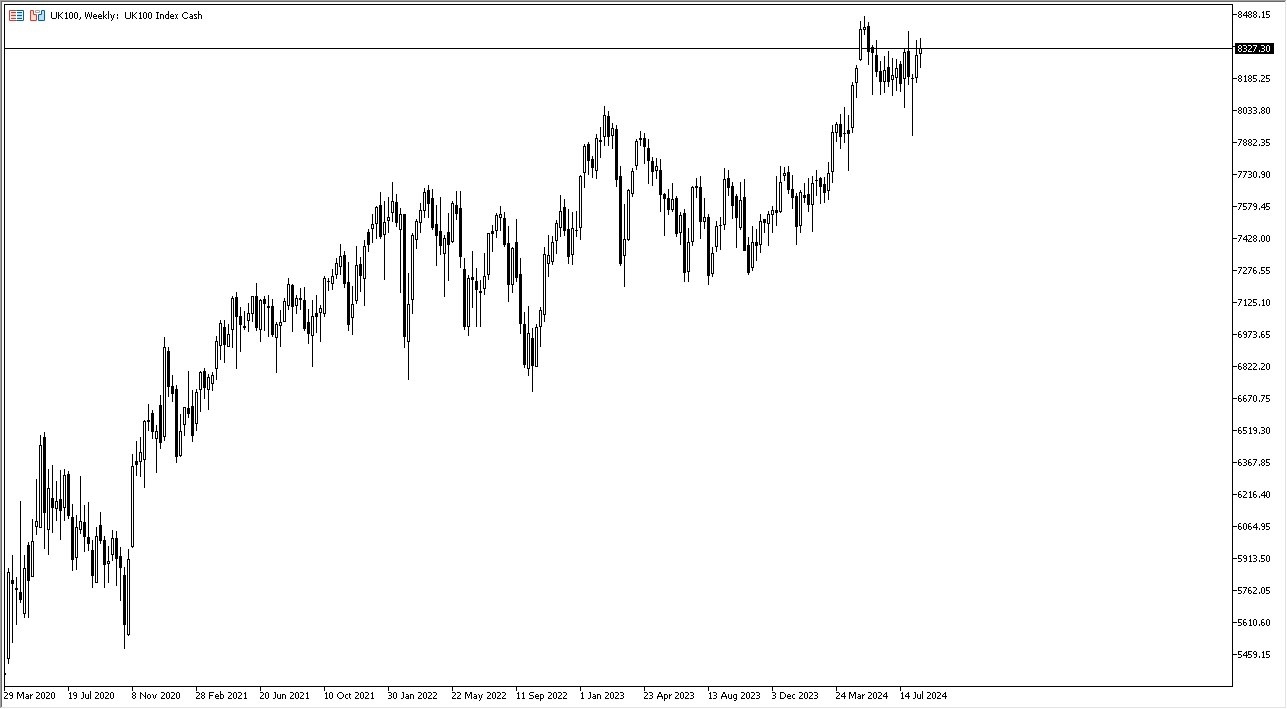

FTSE 100

The FTSE 100 initially pulled back during the week, but it looks as if we still have plenty of support underneath. The fact that we have turned around to bounce, and it looks like central banks around the world are willing to step in and provide liquidity, I suspect that in the short term, we will continue to see a lot of stocks rally, and that probably continues to be the case in London as well. As long as we can stay above the 8100 level, I think this is a market that is higher.

USD/CHF

The US dollar has dropped rather significantly during the course of the week as we are testing the 0.85 level. This is an area that had previously been support, and it’s interesting that we are here again. That being said, Jerome Powell stated on Friday that the Federal Reserve is likely to cut rates, and that of course has put some downward pressure on the US dollar. That being said, it is still a positive swap. I think we probably bounce sooner rather than later. All things being equal, if the market were to break above the top of the weekly candlestick, I think the market goes looking to the 0.91 level above.

Top Forex Brokers

NZD/USD

The New Zealand dollar has rocketed higher during the course of the week, as we are now breaking above the 0.62 level. If the NZD/USD market could continue to go higher, I think it’s ultimately that this is a market that could go looking to the 0.6350 level. The size of the candlestick does suggest that there is a lot of pressure to the upside here, and we could see the US dollar take it on the chin due to the Federal Reserve almost certainly cutting rates over the next several months.

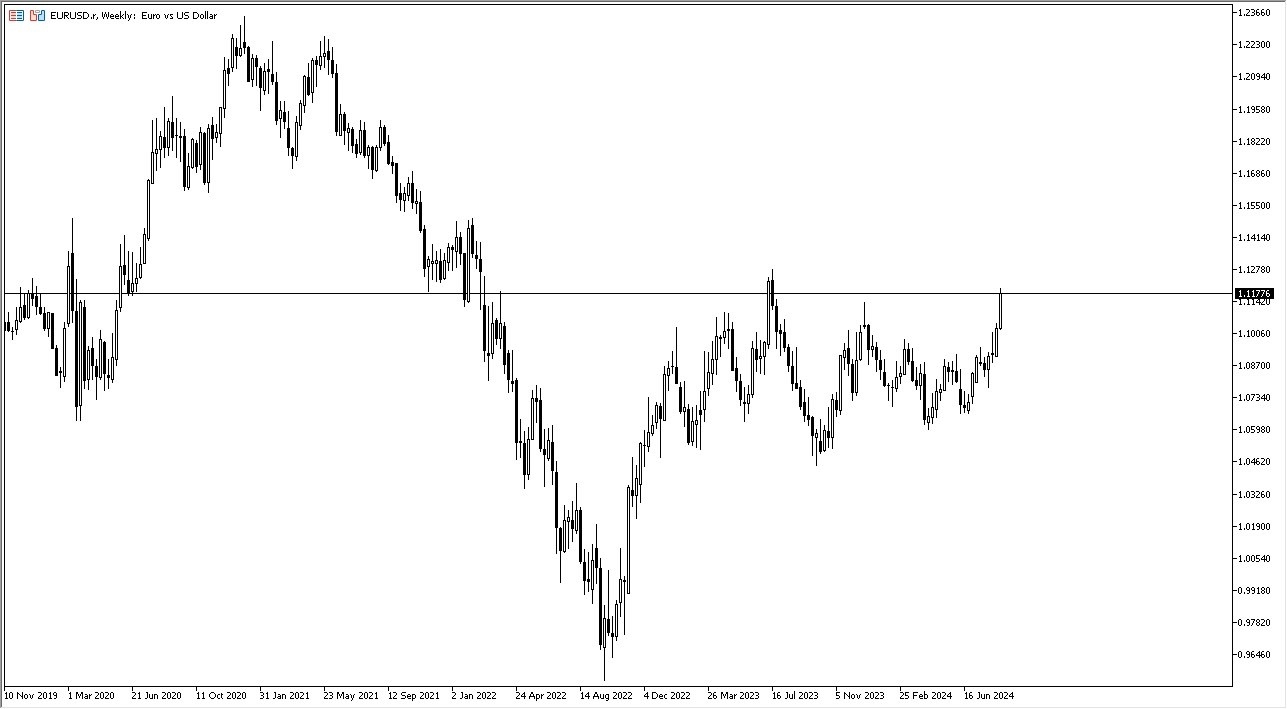

EUR/USD

The Euro has rallied rather significantly during the course of the week against the US dollar as Jerome Powell has finally admitted that the Federal Reserve is going to cut rates. Ultimately, the 1.1250 level above offers significant resistance, as it was previous support. All things being equal, the EUR/USD market were to show signs of weakness, then I think the market probably pulls back toward the 1.11 level. At this point, I’m not a huge fan of the euro, but I also recognize that it’s the direction that we are going.

Gold

Gold markets have been all over the place during the week, but Friday saw quite a bit of noisy behavior, and at this point in time it looks like we are continuing to hang around the $2500 level. This is an area that is a large, round, psychologically significant figure, and it does make a certain amount of sense that we have seen some noise here. That being said, the Federal Reserve is going to cut rates, and that has a lot to do with what gold does going forward, and it certainly looks positive at this point in time.

ASX 200

The Australian Stock Exchange 200 has rallied during the course of the week as we are continuing to threaten the AU$8100 level. All things being equal, this is a short-term pullback just waiting to happen, but that pullback should be thought of as a potential buying opportunity. All things being equal, this is a market that looks very bullish, and even if we do pull back a bit, I still think that there will be plenty of buyers out there willing to get involved in buying these equities.

USD/JPY

The US dollar has plunged against the Japanese yen during the course of the week as Jerome Powell has finally admitted that the Federal Reserve will be cutting rates, and that they are concerned about employment. At this point, the USD/JPY market is trying to sort out what was to do next, because despite the fact that this is a very negative candlestick, it’s not like we broke down. This is a market that you need to watch very closely, but if we were to break down below the hammer from the candlestick 2 weeks ago, then I think this pair truly falls apart.

WTI Crude Oil

The West Texas Intermediate Crude Oil market has pulled back a bit to show signs of weakness but has bounce from the crucial $71.50 level. This is an area that has been significant support, and the fact that we ended up forming a bit of a hammer, then I think the market is likely to go higher. At this point, it’s possible that the WTI Crude Oil market goes looking to the $80 level above, which is a large, round, psychologically significant figure, and a bit of a barrier.

Ready to trade our Forex weekly forecast? We’ve made this forex brokers list for you to check out.