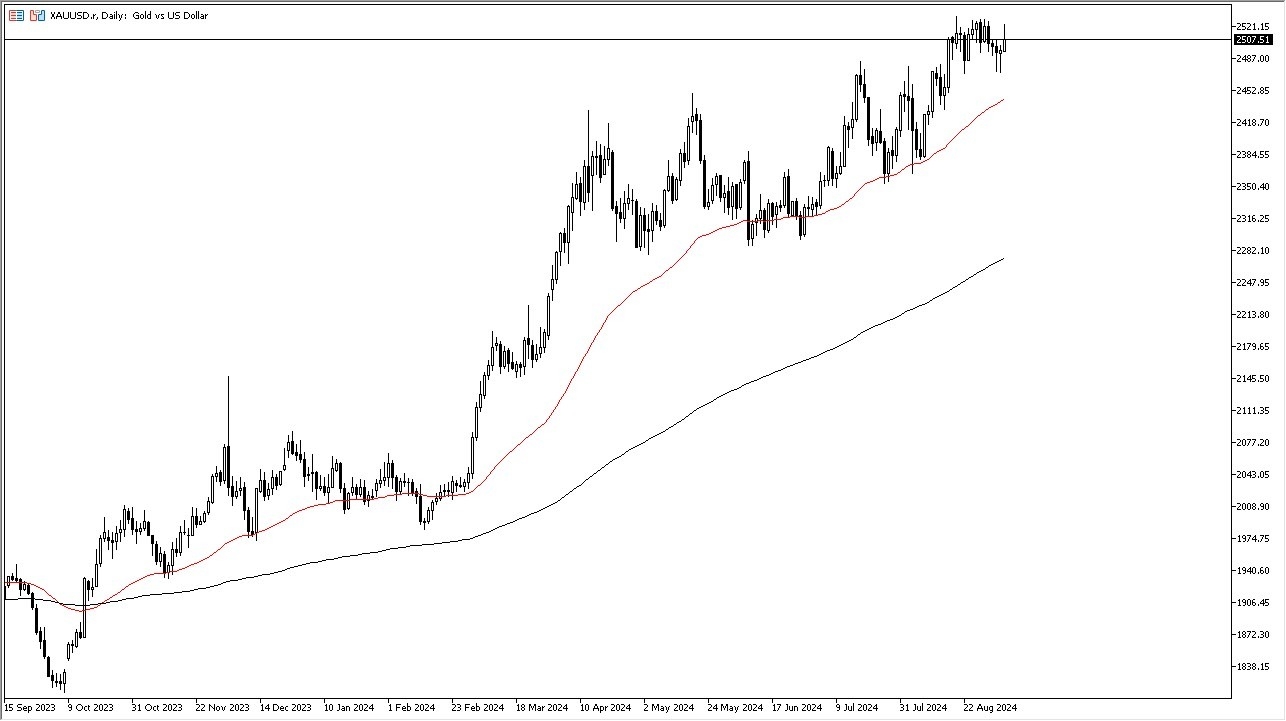

- In my daily analysis of the gold market, the first thing that I notice is that although we were very strong in the early part of the session, it’s worth noting that we gave back about half of the gains by midday during New York trading.

- This suggests that there is still a significant amount of hesitation to break out going forward, and of course there does seem to be a lot of resistance.

- Because of this, I think this is a situation where we need some type of fundamental reason to get going.

In the meantime, I think that any time we pull back there will be plenty of buyers willing to get involved in gold, because there is a massive plethora of reasons for gold to go higher over the longer term. If we can break above the $2525 region on a daily close, I think that’s the sign that we are going to go much higher. In that environment, I don’t see any reason why the market will go looking to the $2600 level rather quickly. That being said, it’s obvious that there is little bit of hesitation at the moment, and perhaps that has something to do with the fact that we are waiting around to see what the Federal Reserve is doing.

External Pressures

The gold market has plenty of external pressures on it, and these are things that you cannot ignore. Not only do we have the interest rate situation coming out of the United States and other places, but we also have to worry about geopolitical issues, as there are plenty of hotspots in the world that could kick off a much larger war. Gold is considered to be a safety asset in these environments, and therefore I think it makes a certain amount of sense that we would see gold perform well.

Beyond all of that, there are political concerns as there are a massive amount of elections to be held worldwide, and of course we have a situation where the market could very well see a lot of surprise election results causing havoc to risk appetite. Beyond that, we also have central banks around the world buying gold, so I think it’s probably only a matter of time before it goes higher.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.