- The silver market has been so negative.

- At this point, it looks like we are continuing to see a lot of people worry about the overall risk appetite, and that of course works against the value of silver, as it is such a heavily volatile market.

- With this being the case, I think you’ve got a situation where traders are trying to figure out what to do with silver, but it’s also worth noting that Monday is Labor Day in the United States, that almost certainly has a major influence here.

Keep in mind that the futures market is mainly a US phenomenon, although foreign traders are most certainly involved. The largest amount of volume comes during the North American session, so with the Americans celebrating Labor Day on Monday and closing down the markets, it makes a certain amount of sense that we would see this as a market that is a bit dangerous to get involved in, because we could have a massive gap while nobody’s at the office. If that ends up being the case, you could see a lot of ugliness so therefore a lot of people probably wanted to eliminate any risk.

Top Forex Brokers

Silver and external pressures

Keep in mind that silver has a lot of external pressures when it comes to where it goes, not the least of which would be risk appetite. Furthermore, it’s also an industrial metal that you need to pay attention to, so industrial demand ends up being a major factor as to where we go next. The silver market continues to see a lot of noise due to the fact that we don’t really know where the economy is going, and that of course has a major influence on whether or not people are comfortable enough to get long in this market again.

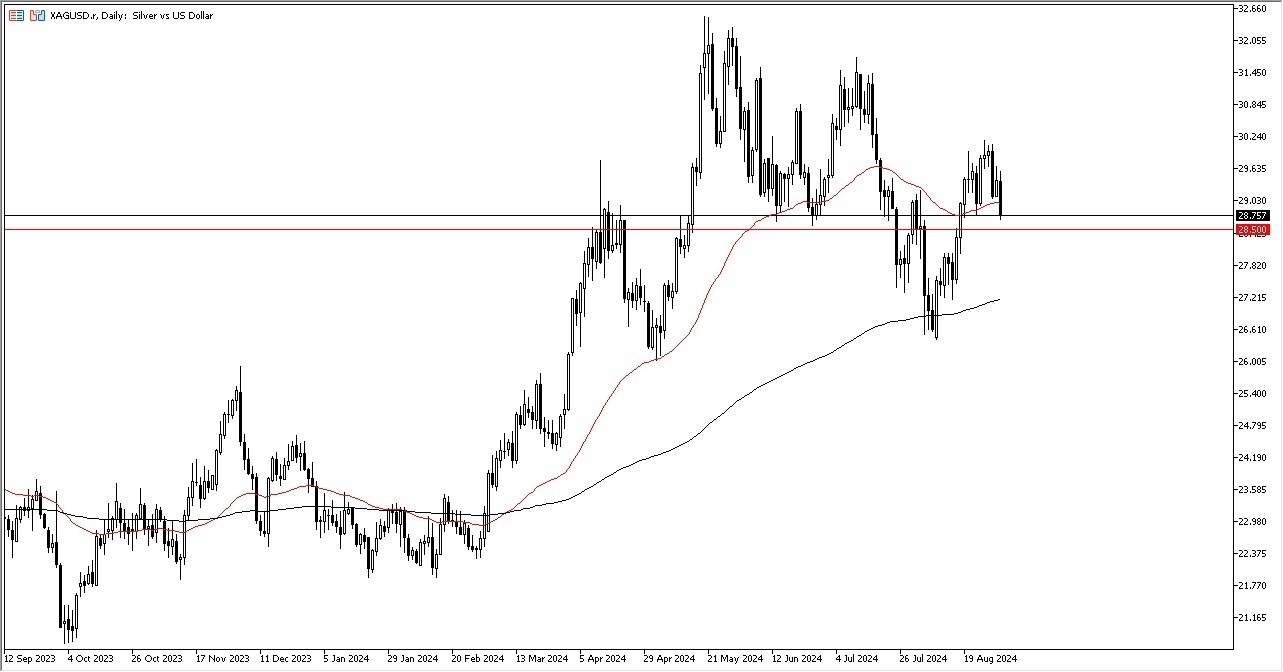

Furthermore, you also keep in mind that interest rates are dropping so that does help silver, so it is a little bit of back-and-forth just waiting to happen. If we were to break down below the $28.50 level though, then it could open up the possibility of a move down to the 200-Day EMA. A break above the top of the candlestick for the Friday session would be very bullish, and the $30 level being broken to the upside would be a major positive sign.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.