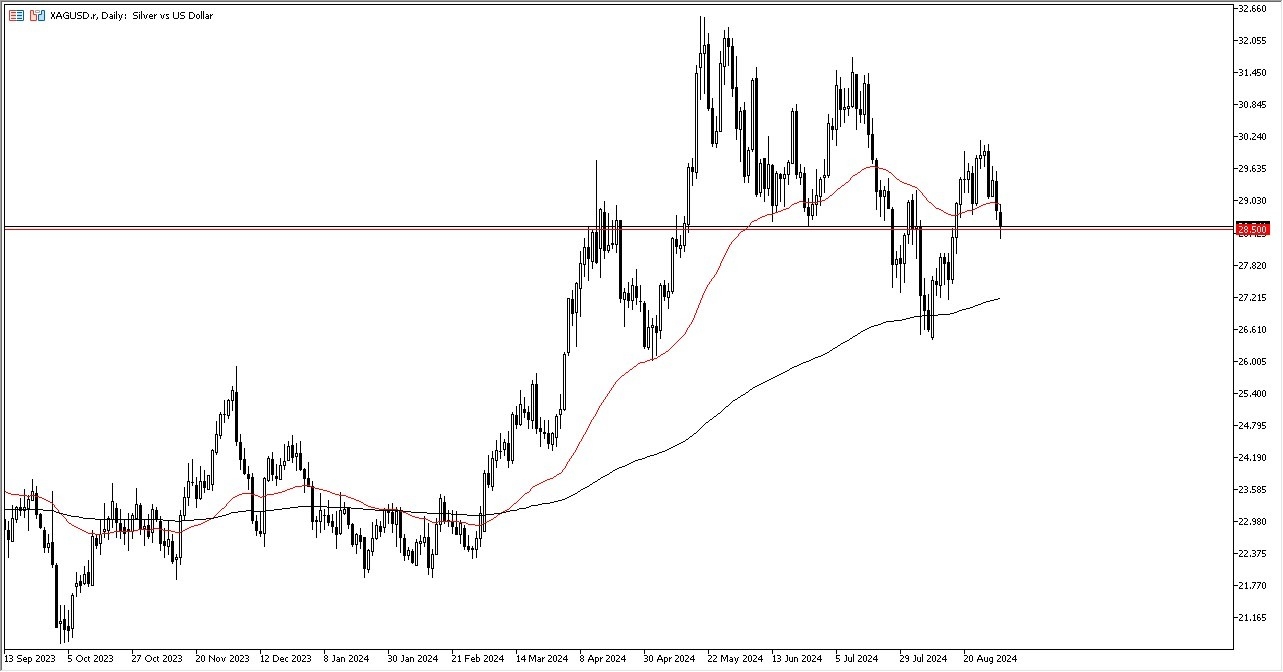

- This asset is clearly drifting toward a major support level.

- That being said, it should be noted that the Americans in the Canadians were both the way for the Labor Day holiday, and therefore liquidity may have been a bit of an issue at certain times of the day.

- Most of what you are seeing on the chart at this point in time is going to be either spot silver trading or electronic overnight futures trading.

- Either way, it is not a representation of a typical trading session.

That being said, it is worth noting that the $28.50 level has offered a bit of support, and it is an area that a lot of traders have paid close attention to for a while. Because of this, it’s not a huge surprise to see that we are hanging around this area, trying to figure out where we are going to go next. All things being equal, this is a market that, given enough time, will almost certainly have to make up its mind and make a bigger move, but in the short term, it looks like we are simply going to continue to grind back and forth.

Top Forex Brokers

External Pressures

Silver of course is very susceptible to external pressures. The first thing you need to pay attention to is the US dollar. If the US dollar strengthens, under most circumstances you will see the silver market drift a bit lower as it takes less of those US dollars to buy an ounce of silver. On the other hand, if the US dollar starts to weaken, then you will also typically see the silver market rallied.

Beyond that, we also have to pay attention to interest rates, although they are not as influential on silver as they are on gold. The idea being that if interest rates are lower, then you have a situation where the makes more sense to pay for storage when it comes to silver, instead of buying paper that yields a percentage return like a bond does. However, the other thing that most retail traders don’t get is that silver is an industrial metal as well, so it should be thought of as a hybrid between a precious metal and an industrial metal, as it is used in so many of the newer technologies. Because of this, I believe that silver will continue to be noisy, but there certainly seems to be buyers just below the current area.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.