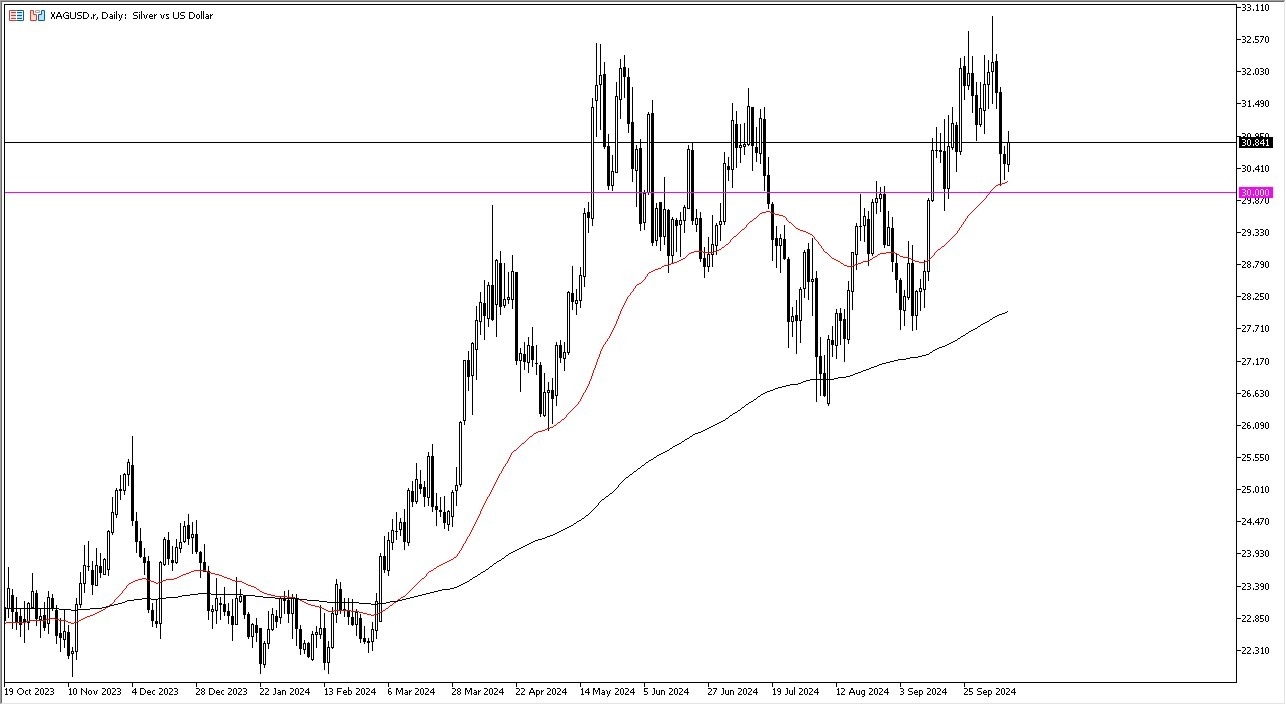

- The silver market rallied a bit during the early hours on Thursday as we continued to bounce after the significant sell off.

- The 50 day EMA, of course, is an indicator that a lot of people will pay close attention to.

- You also have to keep in mind that the $30 level is a large round psychologically significant figure and an area that I think has a certain amount of market memory attached to it.

- Keep in mind that silver is going to see a lot of volatility due to the possibility of interest rates shrinking as central banks around the world cut rates.

Silver Will See Volatility

All things being equal, if the market were to see more risk off behavior, it'll be interesting to see how it behaves in the silver market, mainly due to the fact that silver, although it is technically a precious metal, it is also a metal that is industrial and it's also very, very noisy behavior. So, with all of this being said, I think you've got a situation where you're probably buying dips, but you probably do so carefully.

Top Forex Brokers

After all, there's no point in trying to get too cute here and over levered as the market obviously isn't an uptrend. But I think we also have to keep in mind that the silver market has seen a massive move, so a little bit of a pullback probably comes into the picture to offer traders an opportunity to get involved.

The $32 50 cents level above for me is going to be a major barrier. So that is something worth watching because if we get a daily close above that level, then I think we probably break out and go looking to the $35 level. While this seems possible at this point in time, I also recognize that the markets will continue to see a lot of erratic external pressures.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.