- During my daily analysis of commodities, the silver market stood out due to the fact that we shot higher, but then gave back some of the gains.

- At the beginning of the trading session, it looked as if the precious metals markets were going to go screaming higher as traders started to freak out at the open, especially in New York.

- That being said, things have calmed down a bit, and now we have given back about half of the gains as of the middle of the afternoon session in New York.

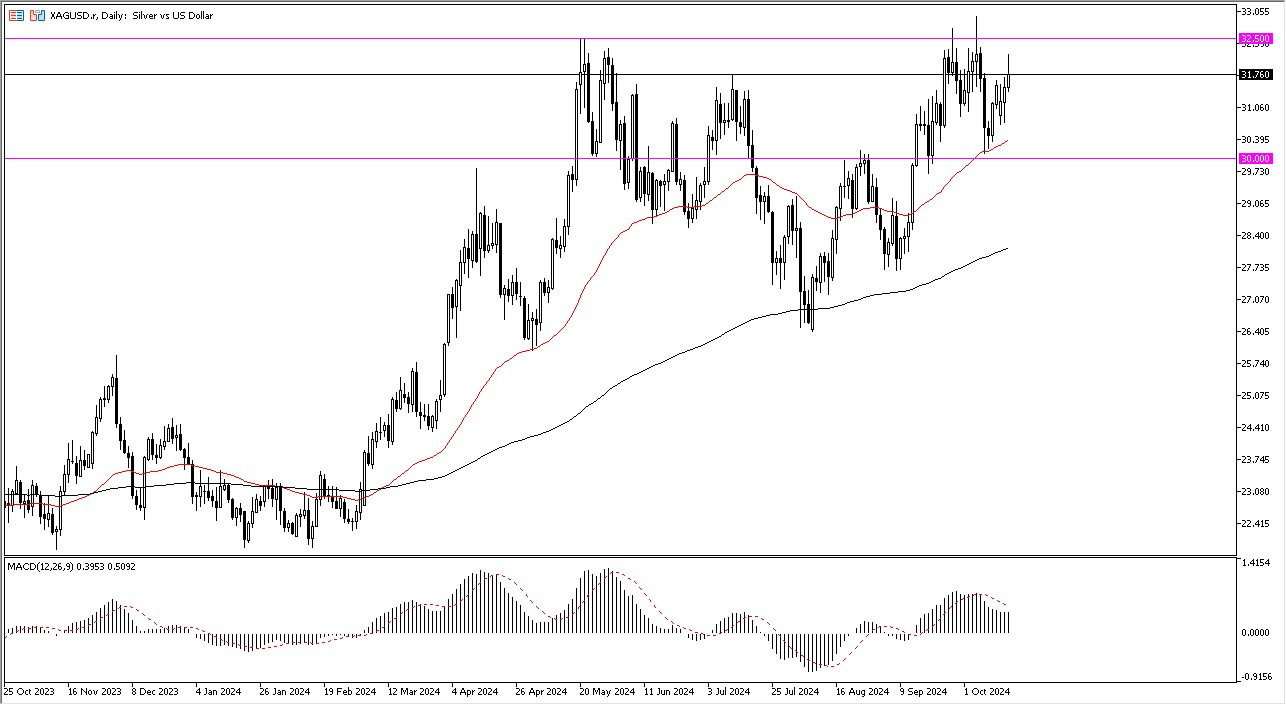

At this point in time, the market looks as if it continues to go back and forth between the $30 level in the bottom, and the $32.50 level above. We are a little closer to the top, and I think at this point in time I think that short-term pullbacks offer buying opportunities. Furthermore, we also have the 50 Day EMA, underneath is an area that a lot of people would be looking to. After all, it is a technical indicator that a lot of people watch, and therefore it makes a certain amount of sense.

Top Forex Brokers

Silver is not Gold

Keep in mind that silver is not gold. Yes, I recognize that both are considered to be precious metals, but silver does behave a little bit differently than gold. After all, the silver market is highly tied to a lot of the “green technologies” that a lot of people are so excited about, so keep in mind that when you start to see things in that sector attract more attention, it suggests that perhaps there will be more demand for silver. Furthermore, you also have the interest rates around the world dropping so that could end up being a driver of silver being positive as well. After that, we also have geopolitical concerns, which like gold, some people will put money toward silver.

That being said, silver is not gold. What I mean by this is that it does have a few other aspects that move the market, and of course it’s a much more volatile and dangerous contract. The contract size is larger from a nominal value position, so therefore it’s likely that the average trader needs to be very careful with their position size, because it can be so dangerous to your account. I prefer buying dips, as long as we can stay above the $30 level, but I also recognize that things will be very noisy.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from.