- The US dollar initially has fallen a bit against the Swiss franc only to turn around and show signs of life again.

- If you've been following me here at Daily 4x, you know that I have been a buyer of this pair for a while, although I'll be the first to admit it's not the most exciting trade to be involved in.

- However, if you are looking for stability and more of a grinding kind of slow.

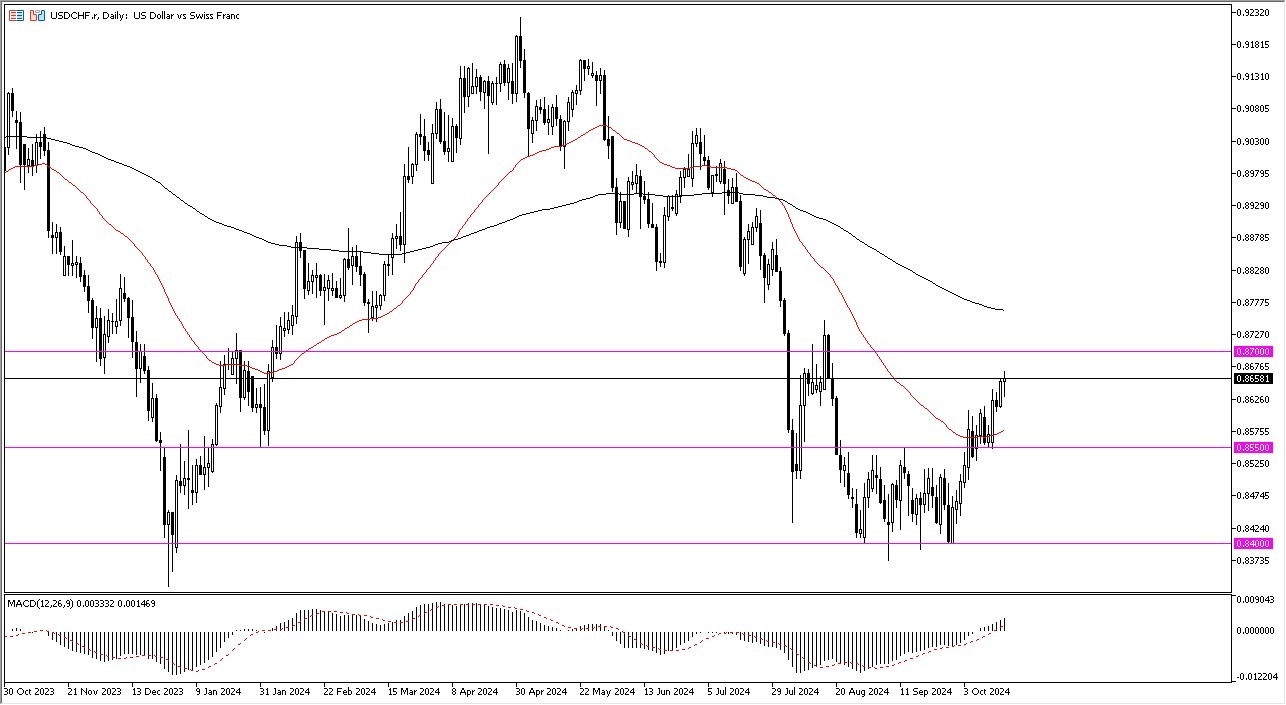

This is a pair that I find quite often gives those opportunities. We are currently threatening the 0.87 level, which for me is a significant resistance barrier. The 0.87 level has been important multiple times in the past, and I think it's probably only a matter of time before it shows a significant amount of importance again.

Top Forex Brokers

On the Breakout

However, if we can break above that level, then the US dollar is likely to go much higher. We had recently formed a bit of a double bottom or a rectangle, just kind of how you're looking at it, depends on what you see, with the 0.84 level offering a massive support and floor in the market. Now that we have attempted to rally and then actually were successful in doing so from that level, it tells me that we are more likely than not ready to go higher.

This is a huge stretch that we have seen over the last several weeks, but at this point, I think short-term pullbacks continue to get bought into, just as we had seen in the early part of the session on Thursday, the 50 day EMA sits near the 0.8575 level and is rising. And then again, we have supported the 0.8550 level, so it all ties together for plenty of buyers. I don't think it's going to be easy to simply smash through the 0.87 level, but it is something that I will be watching to see whether or not it happens, because if it does, I'm probably going to start thinking about adding to my position.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.