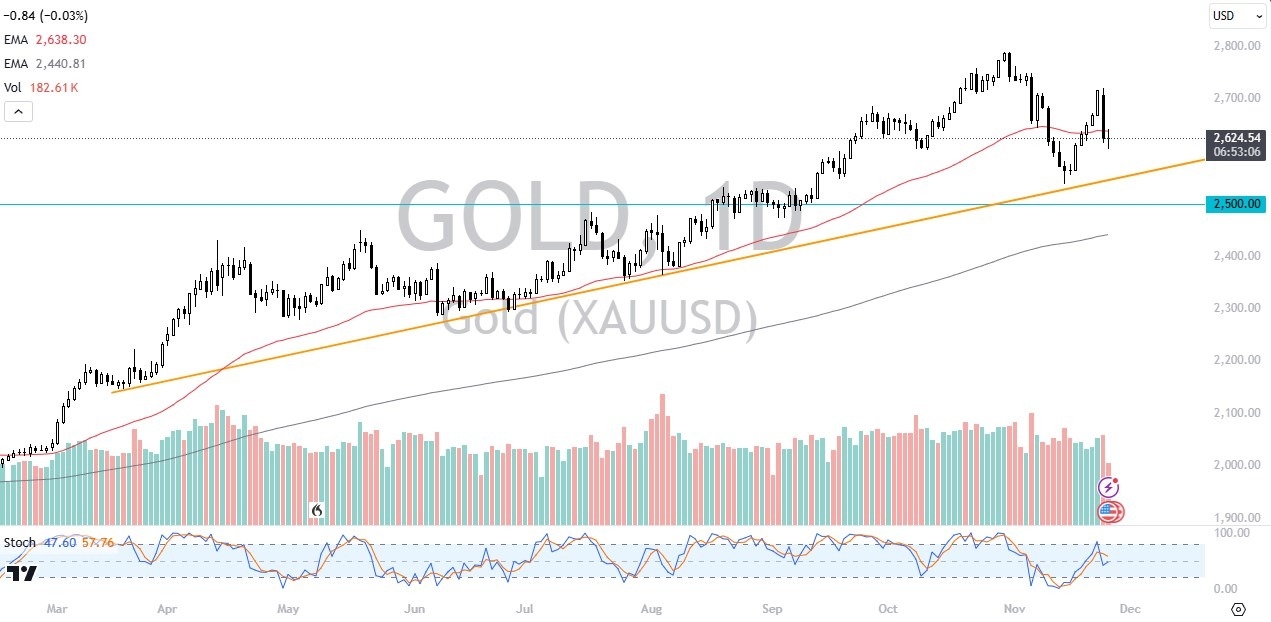

- During my daily analysis of the gold market, the first thing that I notice is that we are sitting just below the 50 Day EMA, which of course is an indicator that a lot of people will be paying close attention to.

- The previous session on Monday was brutal for gold, as Israel and Lebanon have agreed to a cease-fire, which has taken out some of the geopolitical aspect of owning gold.

- However, we still have a major war in Ukraine that seems to only be accelerating, so therefore I think you have to look at this through the prism of a short-term pullback more than anything else.

Top Forex Brokers

Technical Analysis

The technical analysis for the gold market of course is fairly bullish, although we’ve recently seen a little bit of a pullback. If we can break above the 50 Day EMA, it’s very likely that it opens up the possibility of a move to the $2700 level rather quickly. On the other hand, if we were to pull back from here, there is a major trend line that sits just below that could offer support near the $2600 level.

In general, this is a market that I think continues to ride the momentum, and it’s really not until we break down below the $2500 level that I would be somewhat concerned. The momentum indicators don’t necessarily look overbought, so I think at this point in time there will be plenty of traders out there willing to get involved and take advantage of these dips for a longer-term move. Shorter-term traders will continue to deal with a lot of noise, and perhaps even a bit of profit-taking, but at the end of the day this is a market that has been bullish for a long time and not much has changed.

Ultimately, I do think that the $2800 level will be targeted again, but it may take some time to get there. Before it’s all said and done, I do believe that gold reaches $3000 as well. I don’t have any interest in shorting this market anytime soon, as it has been so bullish.

Ready to trade our Forex daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.