GBP/USD

The British pound has plunged during the course of the week, as we continue to see the US dollar act like a wrecking ball against almost everything. At this point in time, it looks like this pair will eventually go down to the 1.25 level, an area that could be significant support from a psychological standpoint, as well as a previous reactionary standpoint. All things being equal, the candlestick that we form for the week typically means that you are going to see some follow-through based upon its size and the fact that we are closing at the very bottom of the range.

USD/CHF

The US dollar has been strong during the course of the week again, and therefore it has seen quite a bit of upward pressure against the Swiss franc. That being said, we are a little bit overextended at this point in time, so a short-term pullback does make a certain amount of sense. I would look at the 0.8750 level as a potential support level, so you have to be very cautious on that pullback, but that’s an area that if I got the right price action, I’d be interested in buying. On the other hand, if we do just go straight up in the air, it’s possible that we could see the market try to go to the 0.90 level above.

S&P 500

The S&P 500 has been negative during the course of the week, but we still are reeling from that shot higher from the previous week. After all, we had seen the elections turbocharge the markets, and therefore it’s not a huge surprise to see that we had to give back some of that in digesting those gains. All things being equal, this is a market that has a massive amount of support near the 5700 level, so I don’t think that the market drops below there. That being said, I think eventually the buyers will return.

Top Forex Brokers

Gold

Gold markets have fallen rather significantly during the course of the week, as we have plunged toward the $2550 level. Underneath there, we have the $2500 level offering support, and I think this will be a scenario where that area continues to be important. That being said, this is a horrific looking candlestick, so we may have further downward pressure ahead, only time will tell. What is worth noting is that Thursday and Friday both were relatively quiet, so it might be the beginning of an attempt to turn things back around.

AUD/JPY

The Australian dollar has continued to dance around the ¥100 level, which makes a certain amount of sense, as it is a large, round, psychologically significant figure, and therefore a lot of people will look at it through the prism of being somewhat magnetic to price action. Keep in mind that this pair is highly sensitive to risk appetite, but it is worth noting that the 50 Week EMA sits just below as well, so I think we are still just simply trying to figure out where to go next over the longer term as we have struggled for footing.

USD/JPY

The US dollar has plunged on Friday, but did end up putting a positive week up against the Japanese yen. Quite frankly, the market probably was think it’s a prophet, as we had gotten a little bit ahead of ourselves. Furthermore, I am hearing some whispers about potential Japanese intervention, but that is an unsubstantiated rumor at the moment. Either way, I am a buyer of dips, and I do think that given enough time we will see this market go higher again, if for no other reason than the interest rate differential between the 2 currencies.

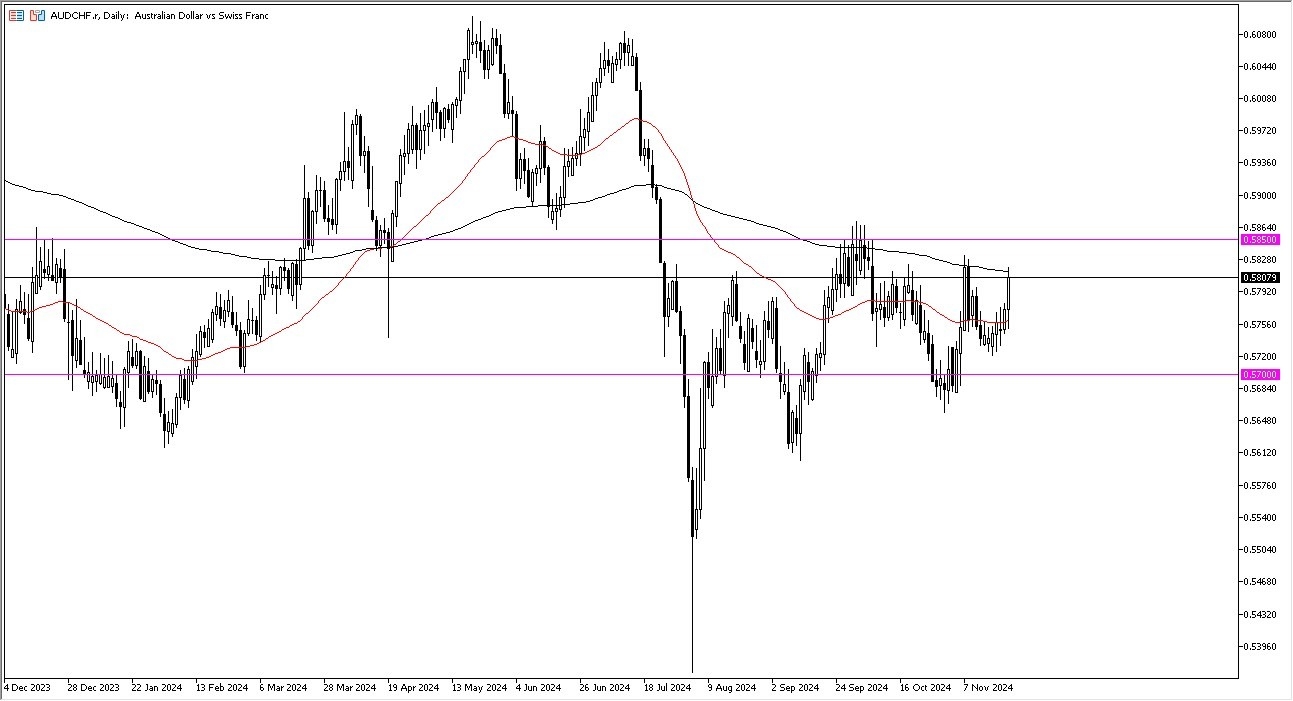

AUD/CHF

The Australian dollar initially tried to rally against the Swiss franc for the week but has found quite a bit of resistance just below the 0.58 level. At this point in time, the market is still very much range bound so I think that if we get a little bit of a drop from here, is the potential buying opportunity in what has been a fairly stable currency pair for most of the last year or so. The 0.56 level underneath continues to be a massive floor that I will pay close attention to in order to get involved.

USD/MXN

The US dollar has rallied against the Mexican peso again during the past week, but that does seem to be a lot of noise just above the 20.50 MXN level, which I expect to extend all the way to the 21 MXN level. Underneath, the 20 MXN level should be support, followed by the 19.70 MXN level. Quite frankly, I think that short-term pullbacks will continue to be buying opportunities as long as there are a lot of concerns around the world when it comes to global growth, and of course as long as we have interest rates rising in the bond markets of America.

WTI Crude Oil

The West Texas Intermediate Crude Oil market has fallen a bit during the course of the week, but it still sees a lot of support near the $65 level. I do expect that sooner or later sometime this upcoming week we will see a bit of a bounce in the crude oil market, if for no other reason than OPEC will almost certainly tried to defend the price of oil if we get out of control here. It would be a short-term trade, not necessarily something that I look to turn the trend around.

Ready to trade our weekly Forex forecast? We’ve made a list of some of the best regulated forex brokers to to choose from.