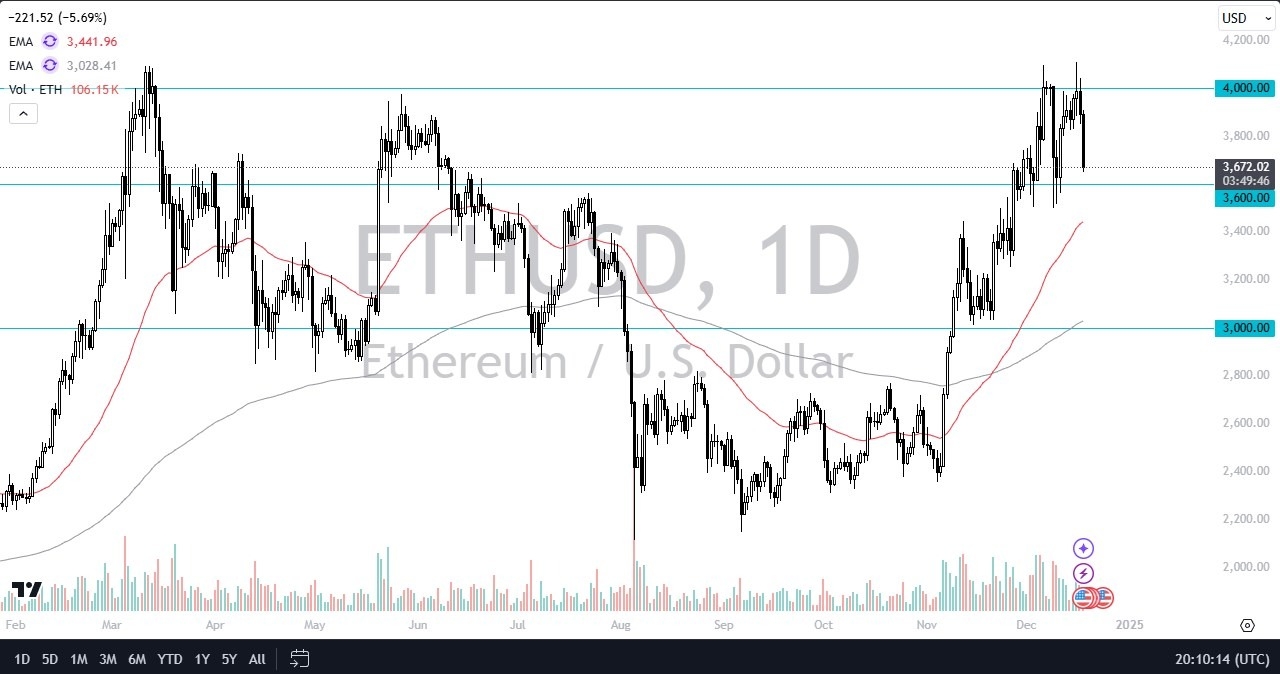

- The Ethereum market pulled back rather significantly during the trading session on Wednesday, reaching the crucial $3600 level.

- The $3600 level of course is an area that has been important multiple times, so I think you’ve got a situation where traders will continue to look at this through the prism of a market that is doing everything it can to break out to the upside.

- Keep in mind that the $4000 level has been a bit like a “brick wall” recently, and therefore I think you have to understand that breaking through that level could kick off the next “FOMO trading” in this market.

- Ultimately, if we get that, it’s very likely that Ethereum could go looking to the $4500 level.

Top Forex Brokers

Bitcoin

Keep in mind that bitcoin is a major influence on the Ethereum market, and therefore we need to see Bitcoin really start to take off to the upside. While it does look very bullish from a longer-term standpoint, recently it has ran into a bit of trouble. This is just simple exhaustion from what I can see, and therefore we have seen Ethereum follow Bitcoin to multiple pullbacks, only to turn around and show signs of strength again. Given enough time, I do believe that Ethereum will eventually go looking toward the $4000 level than and breakout, but it will probably be tied to the Bitcoin market moving higher as well.

If we were to break down below the $3500 level, then Ethereum could drop down to the $30,000 level. Ultimately though, I think this is the least likely of paths, as the market looks more likely than not to do a bit of consolidating in this area, as it is necessary to build up the inertia to break for a bigger move. Ultimately, this is a market that I think will continue to be noisy, but over the longer term I fully believe that Ethereum will continue to rally as money flows into the crypto sector.

Ready to trade ETH/USD? Here’s a list of some of the best crypto brokers to check out.