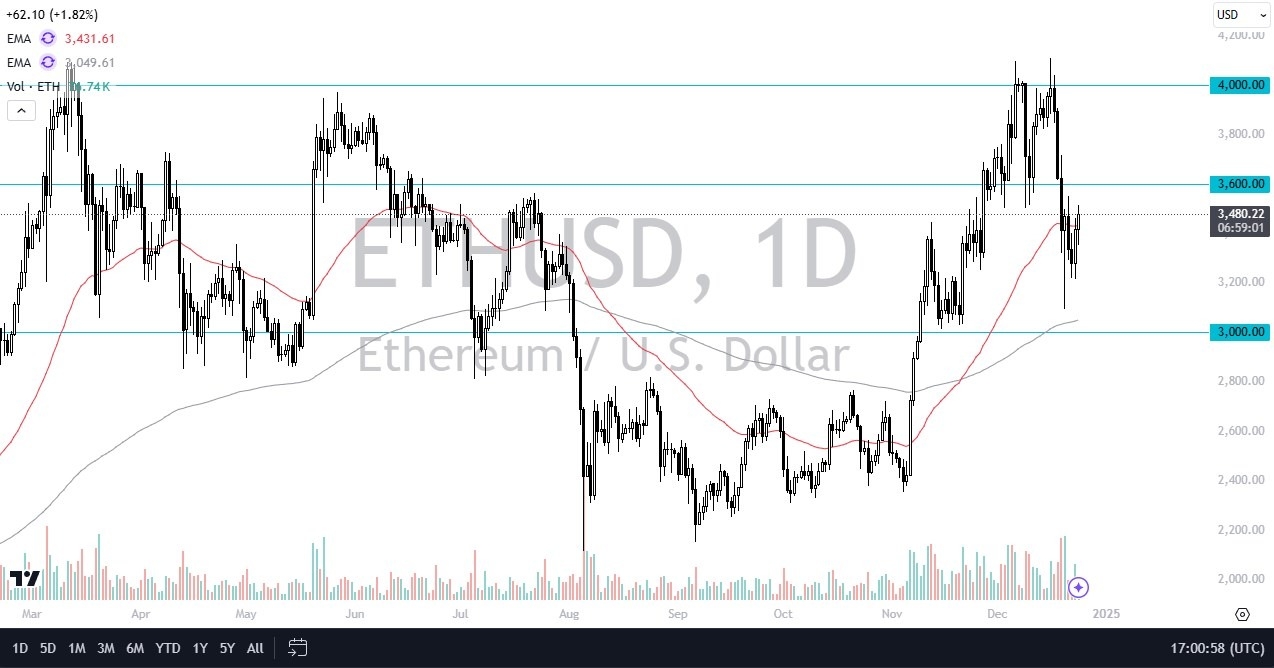

- Ethereum initially pulled back just a bit during the early hours on Tuesday, only to turn around and rally.

- At this point, the market is likely to get a look into the $3,600 level, an area that previously has been both support and resistance in the past.

- This “market memory” is something that you will have to pay close attention to.

It's also worth noting that Bitcoin really started to take off during the trading session, which does have a knock-on effect over here in the Ethereum market. So, I think it all ties together for crypto going higher. A move above the $3,600 level allows Ethereum to go looking towards the $4,000 level, but that's going to take a little bit of momentum.

Top Forex Brokers

The markets will be thin between now and early next year, so that could be a reason possibly. Or we could just get more bullish behavior out of Bitcoin that has people running to Ethereum as well. Keep in mind that a lot of the alternative coins out there run on top of the Ethereum ecosystem, so that is a little bit of a built-in bid.

Short Term Pullbacks

Short-term pullbacks, I believe, find support all the way down to the 200-day EMA, which is right around the $3,050 level. I don't want to short this market, but I also recognize this time of year will probably be fairly stagnant. So, I'm not really looking for much here. I just think it's going to be sideways with more or less a bit of an upward tilt to any movement.

I do think that Bitcoin needs to clear the $100,000 level to really get people excited again and to get them buying other assets, such as Ethereum. Ultiamtely, they will move in concert over the longer term, but Ethereum will need a bit of help at this point in time to get overly strong and bullish.

Ready to trade Ethereum? Here are the best MT4 crypto brokers to choose from.