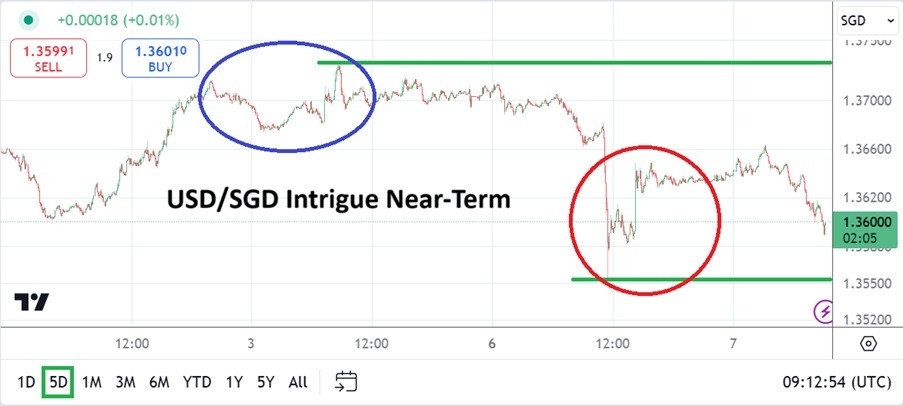

The USD/SGD is currently priced near the 1.36000 ratio as financial institutions are clearly trying to position, and still have a healthy fear of current Forex conditions as nervous sentiment remains intact.

- The USD/SGD is battling near a key psychological price level at the time of this writing: 1.36000.

- The mark has been achieved with a selloff since yesterday’s opening when the USD/SGD was around 1.37100.

- Price velocity downwards a bit later on Monday took the USD/SGD to a depth of nearly 1.35550, but after this swift impetus of selling the currency pair then began to incrementally rise.

The ability of the USD/SGD to develop fast bearish pace yesterday happened perhaps as larger institutional traders started returning from the holidays and entered their European offices. The current value of the USD/SGD is still within the higher ratios of its mid-term range. Behavioral sentiment remains rather fragile and the near-term is likely to stay choppy.

Equilibrium and Support Ratios in Play with the USD/SGD

The USD/SGD is a significant Forex pair as a barometer, this because of its power in the world of international trade transactions, particularly commodities. The outlook of the USD/SGD also provides financial institutions a way to measure the dynamics and seriousness of President-elect Trump’s incoming transition into the White House. Trump issued another warning yesterday that he is going to keep a tough stance going into negotiations via trade.

While some traders may not agree with the notion the USD/SGD is a measuring stick for USD centric price action in Forex, it should be remembered that Singapore also conducts a large amount of transactions with China. The notion that the 1.36000 price level will work as a magnet in the short-term and serve as a focal point for speculators should be considered.

Top Forex Brokers

USD/SGD Considerations and Speculation

Many traders may believe the USD/SGD remains in overbought territory and this is logical. However, nervous global sentiment in Forex has helped created a whirlwind of power in the USD over the past few months and this is not about to suddenly change overnight. Therefore, speculators who are aiming for lower values in the USD/SGD should probably remain cautious as they launch selling positions using resistance levels as ignition points when they seek reversals.

- The 1.36000 level last saw sustained trading below this mark around the 18th of December.

- Yes, the USD/SGD has traded below the 1.36000 level since then but it has been hard to sustain.

- The 1.35800 level seeing sustained lower momentum remains important as a sign sentiment has shifted slightly.

- Traders in the next two days also need to keep in mind that U.S jobs numbers via the Non-Farm Employment Change will be published on Friday.

- And traders need to also keep their ears open for noise coming from President-elect Trump and his team which will continue to influence behavioral sentiment for the moment.

Singapore Dollar Short Term Outlook:

- Current Resistance: 1.36045

- Current Support: 1.35930

- High Target: 1.36170

- Low Target: 1.35850

Ready to trade our daily forex forecast? Here are the best forex platforms in Singapore to choose from.