Signals for the Lira Against the US Dollar Today

Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 36.15.

- Set a stop-loss order below 35.95.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 36.70.

Bearish Entry Points:

- Place a sell order for 36.75.

- Set a stop-loss order at or above 36.90.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 36.30.

" dir="auto" id="content-1686574122635">

Turkish lira Analysis:

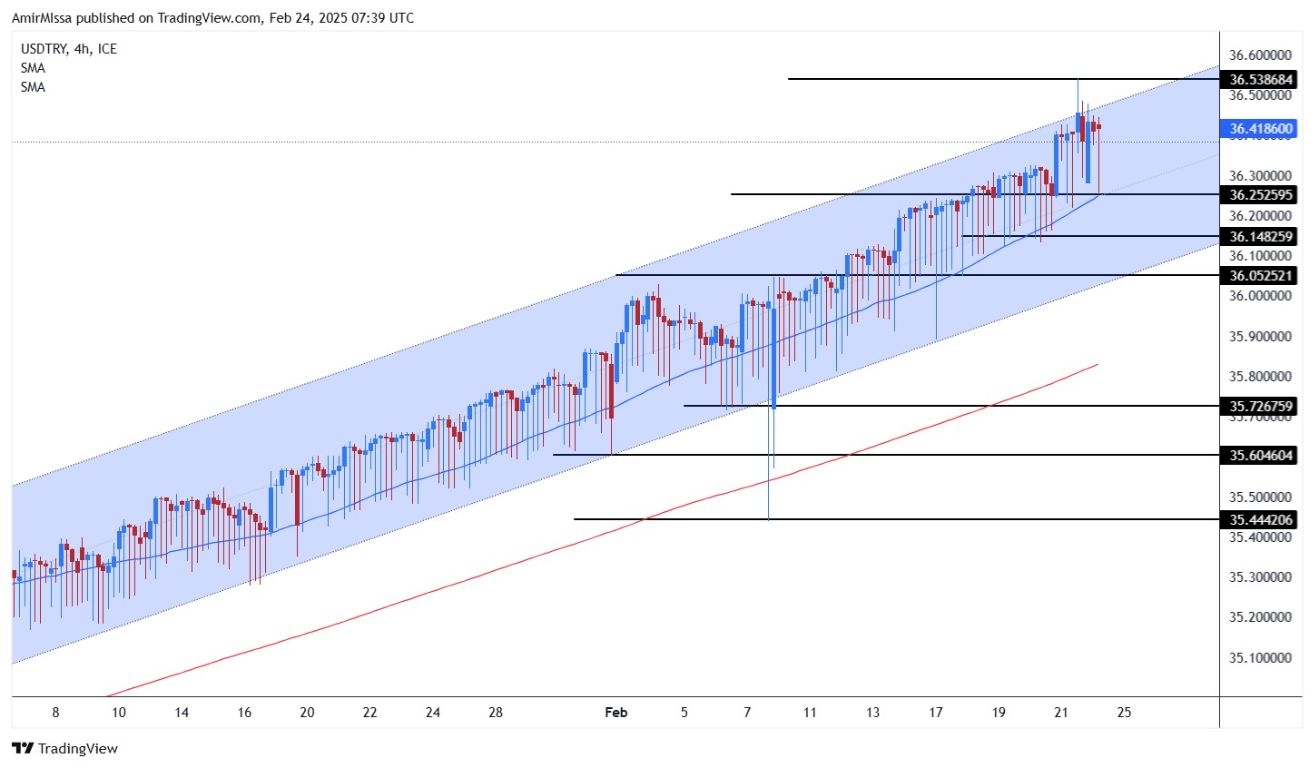

The USD/TRY pair rose at the start of the week, maintaining its continuous daily upward trend, which is characterized by being sustained despite being slow increases. Meanwhile, the dollar price in Turkey recorded record levels during the past weekend after the pair rose to 36.53 lira levels. While it recorded 36.40 levels at the time of writing the report. The current rise pattern of the pair reflects the extent of the monetary and financial authorities' control in Turkey over the lira's movements, which are declining in a limited and similar pattern daily.

Meanwhile, Turkish President Recep Tayyip Erdoğan stated during the weekend that the Central Bank's reserves recorded their highest level ever after exceeding 173 billion dollars, while his country's share of the global economy rose to about 1.1% compared to the 0.7% recorded previously. It is mentioned that the high interest rates in the country have attracted a large segment of interest investors, which supported the rise in the country's monetary reserve. In terms of investments, the volume of foreign investments increased from 15.1 billion dollars until 2002 to more than 272 billion dollars during the past 22 years. This is according to the Turkish president's statements. Regarding inflation, Erdoğan said that the annual rate decreased to 44.4% in December 2024, recording its lowest level in 19 months, with expectations of further decline to 21% by the end of 2025, according to Central Bank estimates. As for the minimum wage, it increased by 49% in 2024, exceeding the inflation rate of 44.38%, within the framework of the government's efforts to preserve the purchasing power of citizens.

It is mentioned that raising the minimum wage in Turkey raises experts' concerns about its negative impact on inflation, as this increase supports higher demand, which negatively affects the already high inflation rates.

TRYUSD Technical Analysis and Expectations Today:

Technically, the USD/TRY pair maintained its upward trend this morning, recording levels of 36.45 lira compared to the 36.53 levels recorded last Friday. The price is heading to breach the upper limit of the rising price channel, which it has been stable within for several months. Negativity dominates the Turkish lira's price expectations in the medium term.

On the other hand, the dollar receives support through the 50-movement average on the four-hour time frame, as every decline in the pair to that average represents an opportunity to re-purchase. Finally, the pair targets levels of 36.60 lira and 36.75 lira, respectively.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from