- Silver initially did try to rally a bit during the trading session here on Wednesday but gave back the gains to show signs of hesitation.

- This has been a very volatile day for most assets. It's not just silver.

- So, I think at this point in time, you have to look at this as a market that is struggling to finally break out.

- But I do think that there is a lot of pressure here and I do think that it happens given enough time.

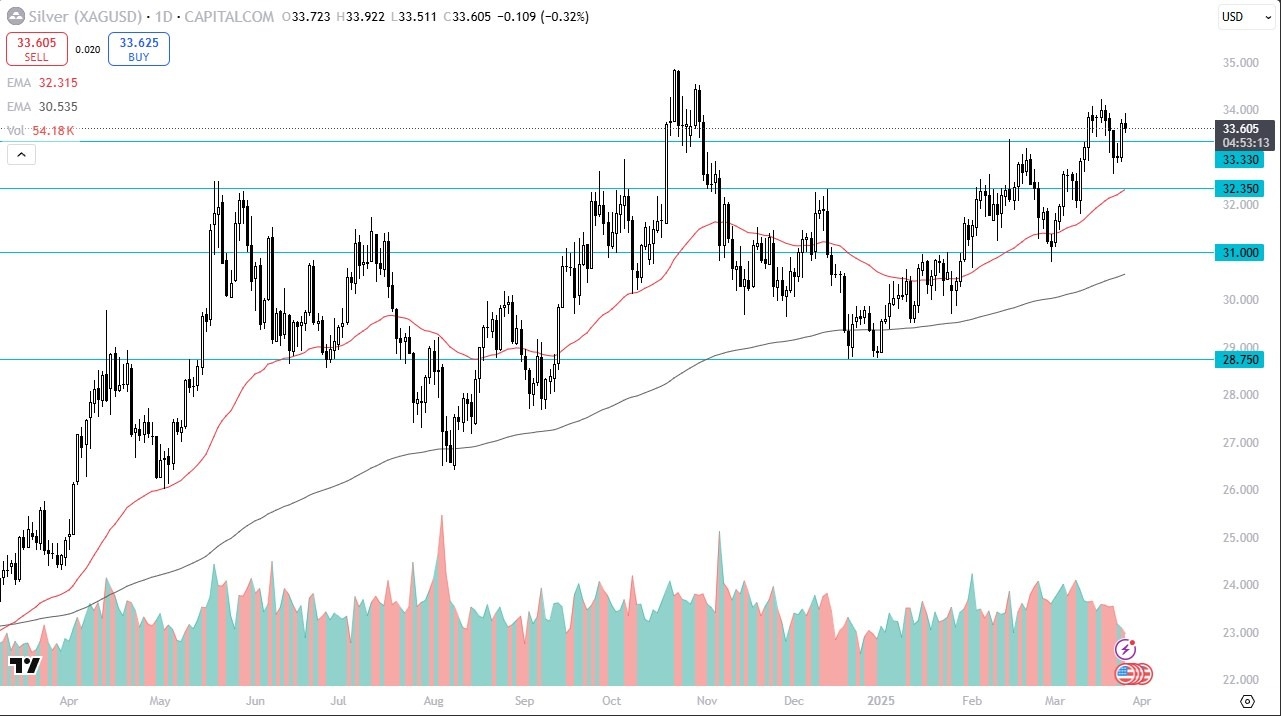

Ultimately, I am a buyer of dips. I have no interest whatsoever in trying to short silver. I think there are plenty of buyers underneath to keep it afloat. The 50 day EMA is currently at the $32.35 level and rising. This is an indicator a lot of people will probably be following going forward, as usual.

Top Forex Brokers

Support Below?

So, I think you've got a situation where you probably have to look at that as a potential support level, as well as the crucial $33.33 level and area that has been important multiple times over the last several months. If we can clear the $34.25 level, then you have a real shot at this market taking off to the upside and challenging the crucial $35 level.

Anything above the $35 level in this market probably checks out for a huge move. I don't have any interest in shorting, not at least in this environment, but I do think that volatility will continue to be a major problem for traders, and you must be very cautious in this type of choppy environment. Silver of course has some influence externally due to the US dollar and interest rates, so pay attention to those, but right now I think silver still is something that most people want to own.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.