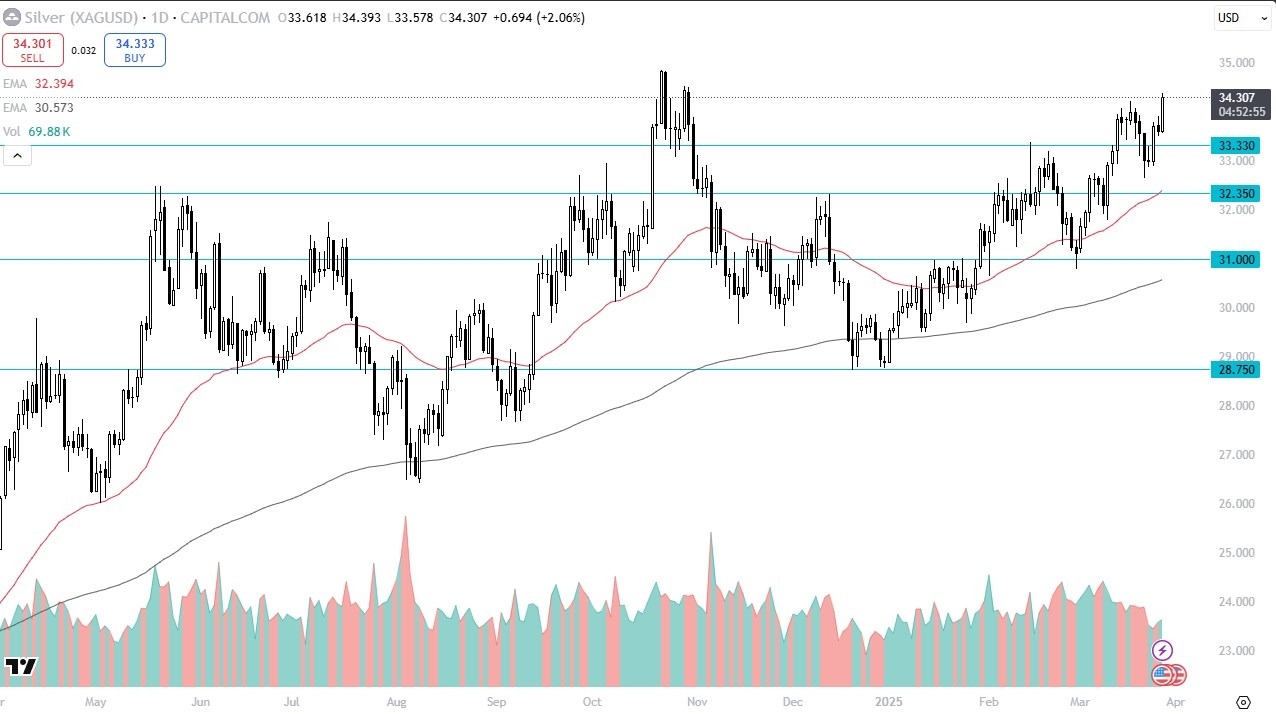

- Silver rallied quite significantly during the trading session on Thursday, as we broke above the crucial $34 level.

- This is a market that's been very bullish for a while.

- At this juncture, we should also keep in mind that pretty much everybody in the world is panicking in the stock market.

- So that continues to throw money into silver and gold as well. This could very well continue to be the case in these turbulent markets.

Money Continues to Run to Metals

Top Forex Brokers

I think that continues to be the case. We're in a very strong uptrend and I just don't see any reason to think that's suddenly going to change. Short-term pullbacks will be thought of as potential buying opportunities. And if we drop down to the $33 level, I would be very interested in buying in that area. But after today's action on Thursday, I don't know if that happens. I would anticipate a little bit of a pullback, but it is probably only a matter of time before we rally and take out the $35 level.

The reason the $35 level matters so much is that if you look at historical charts, $35 opens up the possibility of a move all the way toward the $50 level. That is a massive move. Silver is extraordinarily volatile, so when it does break out, it tends to be very, very rapid. I have no interest in shorting this market and wouldn't even have that conversation until we break below the 50 day EMA. And even then, I would have to have the right fundamental situation coming into the picture. All things being equal, this is a market that looks like it has plenty of momentum. And anytime it pulls back, you must think of silver as being on sale.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.