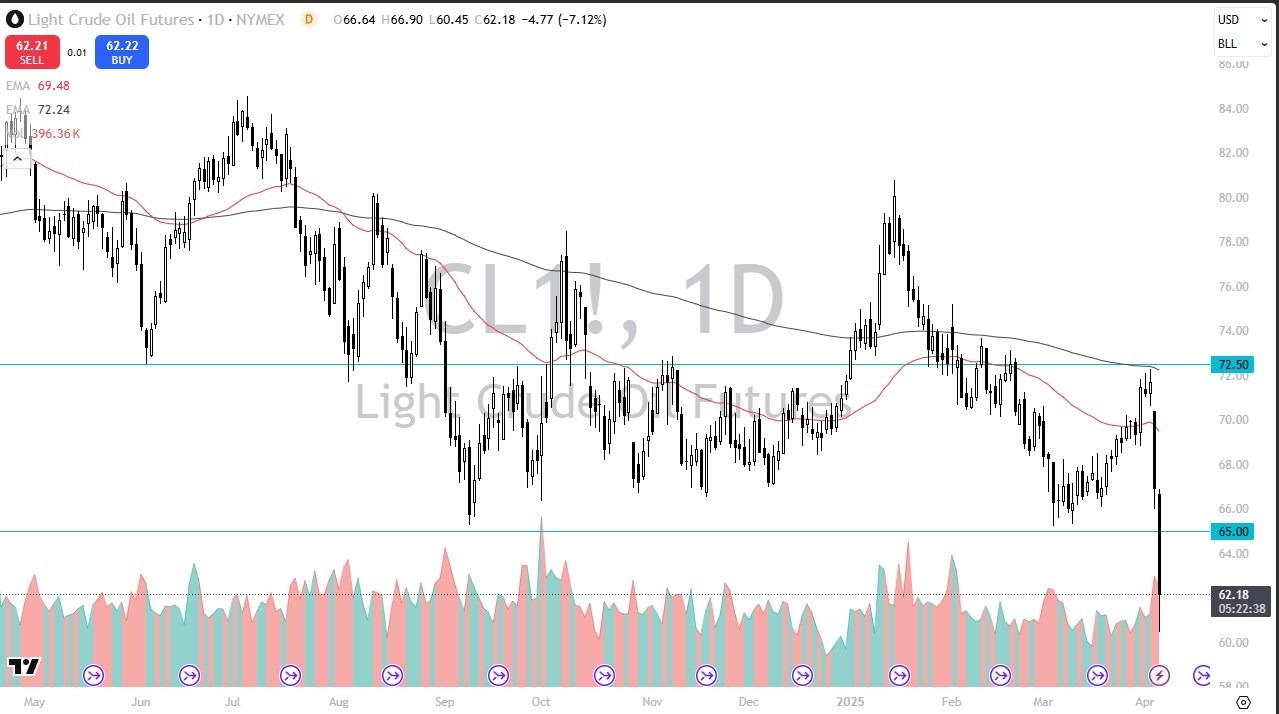

- The trading session on Friday saw the WTI Crude Oil market breakdown rather significantly during the trading session, slicing through the crucial $65 level.

- The $65 level was a major support level going back 3 years, and it was an area that I thought perhaps the market would try to at least defend.

- There was no real signs of strength, and the fact that OPEC announced that they are still going to produce 400,000 more barrels a day only puts more downward pressure in this market.

Supply and Demand

Top Forex Brokers

The supply and demand question out there for crude oil is a major issue, and therefore it’s going to be difficult to get overly bullish on the crude oil market anytime soon. In fact, I would need to see the market turned around and recapture the $65 level on a daily close to even begin to look at that as a possibility. Ultimately, this is a market that I think given enough time will probably be one that recovers, but as long as there are a lot of concerns about supply overwhelming demand, not only due to the addition of barrels put into the market by OPEC, but also the fact that there is a tariff for heating up, kicking off a potential recession, there will be a lot of negative pressure on this market.

At this point in time, it would not surprise me at all to see this market try to go sub $60, but I also believe that there will be a lot of barriers in that area. However, if we see a headline crossed the wires that the tariff situation may be cooling off, then I think the crude oil market might be one of the first places that you would see a reaction. Typically, this time of year is very bullish for crude oil, as demand picks up by the general public, and of course the fact that more goods tend to be moved. However, we have no signs that we will see buyers rushing into this market.

Ready to trade Oil daily analysis and predictions? Here are the best Oil trading brokers to choose from.