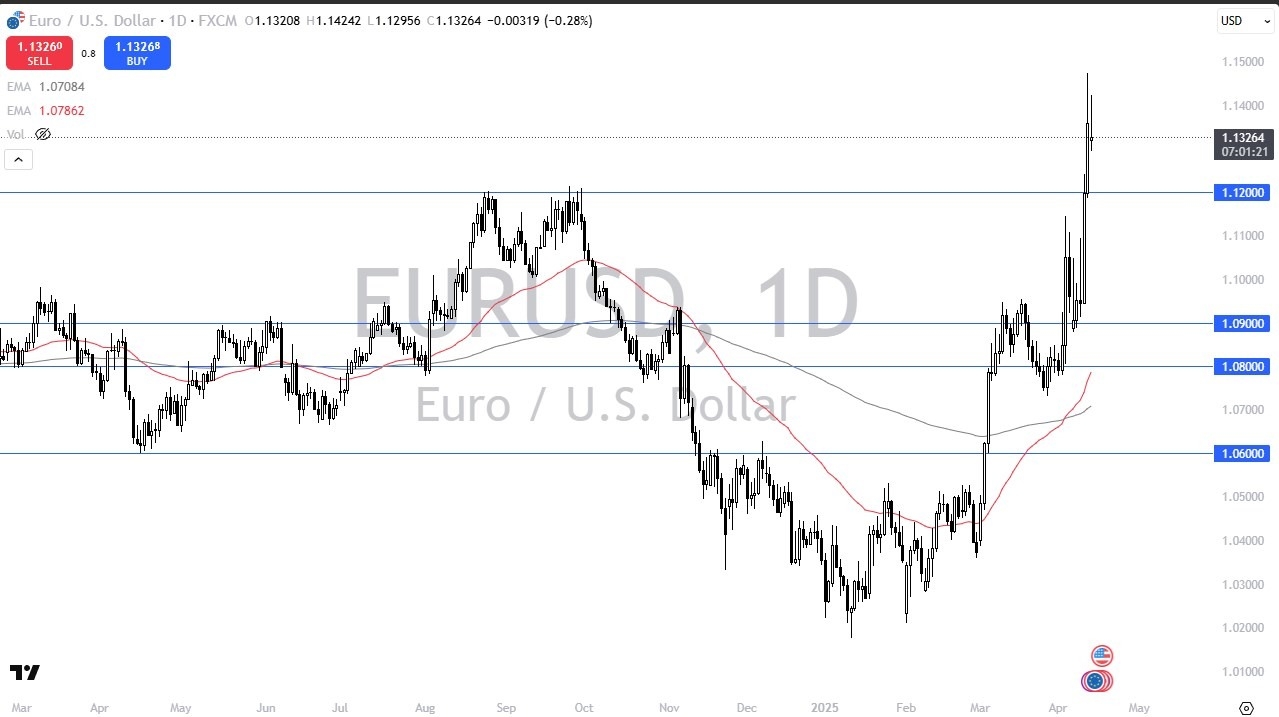

- The Euro gave up early gains during the trading session on Monday, which quite frankly does make a certain amount of sense because this is a market that's gone straight up in the air.

- The dollar weakness at the very least has to slow down if not completely end because what we've seen is an exodus of capital out of the United States and people have been selling their bonds and converting it back into Euros.

- The problem is that sooner or later, a lot of debt has to be rolled over in US dollars. That's part of what gives the US dollar a bit of a permanent bid.

However, having said all of this, with the uncertainty in the US with the tariffs and everything else, and the fact that Germany, of course, has recently exited a recession, it does make sense that money would flow back across the Atlantic Ocean. In fact, it's been piling into the US for a while. So, these things ebb and flow. Looking at the candlestick on Friday, it was bullish, but we did give back quite a bit. And now we are starting to see more resistance again around the one point one four level. So, with all of that, I think you've got a situation where you very well could see a little bit of hanging back and perhaps a pullback to the 1.12 level.

Top Forex Brokers

Pullbacks Make Sense

I think that makes perfect sense. It's an area that's been significantly resistant in the past. So, a little bit of a market memory play, perhaps the market trying to reestablish its footing there makes a lot of sense to me. However, if we were to break down below the 1.12 level, then we could drop to the 1.10 level. On the upside, the 1.15 level continues to be significant resistance, and a breakup of there would be a real statement, but with the action that we've seen over the last several trading sessions, it doesn't make any sense to get overly aggressive here. It's just simply chasing the trade.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.