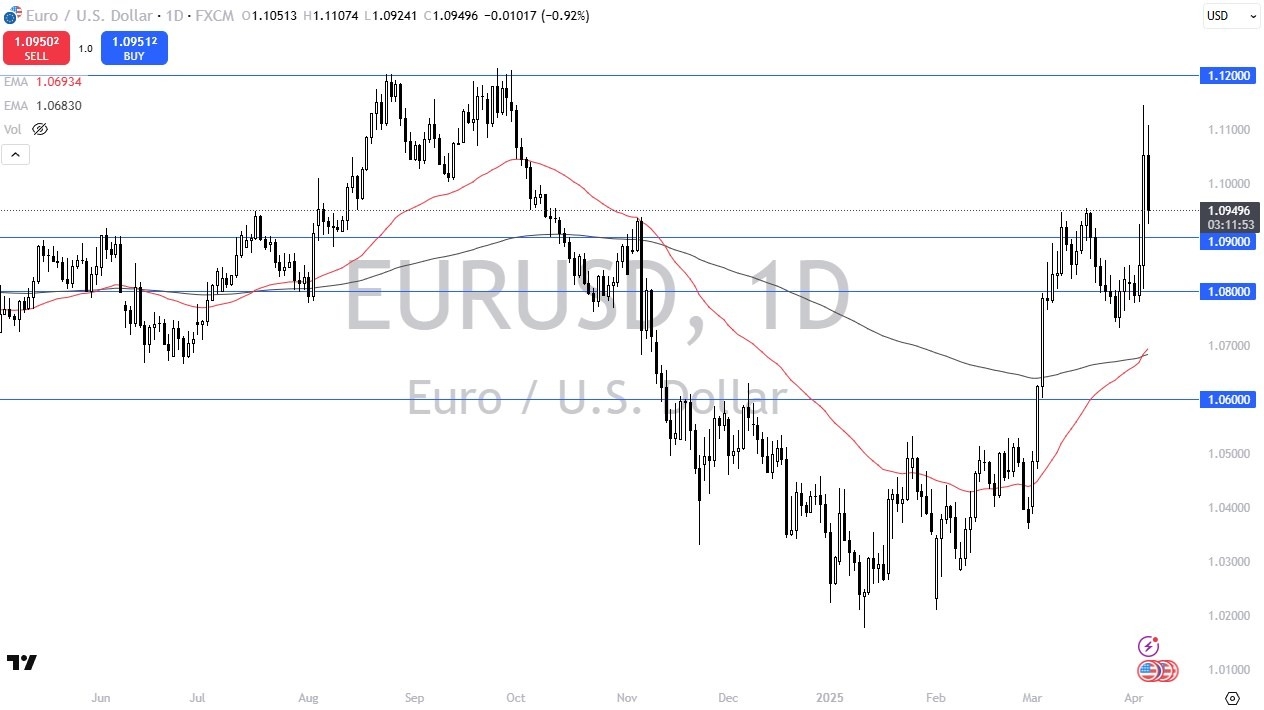

Potential signal:

- I know we are a distance form ti, but a break below 1.08 has me shorting this pair, and buying USD against most, if not all major currencies.

- I would aim for 1.0650 and use a 1.0875 stop loss.

The euro initially did try to rally against the US dollar, but I think a little bit of reality is starting to creep into the marketplace. These tariffs and tariff wars that are probably going to be kicking off are going to hurt everybody. It isn't a one way trade. If traders are running into the bond market, that demands US dollars.

Furthermore, people are going to have to accumulate US dollars to pay their debts. What most people don't realize, at least most traders, is that most of the debt in the world is denominated in US dollars. So, it puts a little bit of a bid in the greenback, regardless of what's going on. That being said, it isn't exactly like the euro is going to fall apart here. I think what's realistically going to happen is the knee-jerk reaction that we had seen during the day on Thursday, I think, is probably going to settle into a range.

The Potential Range

This range that I see at least at the moment will probably be between the 1.08 and the 1.12 level for the Euro. And this range probably lasts for quite some time, at least until we get through the tariff situation. However, it is worth noting that the DAX in Germany is playing catch up today to all of the negativity in New York exchanges. So, money might be leaving Europe, I don't know, I haven't researched it enough. But with the stronger than anticipated jobs number in America, it shows that America can probably sustain this fight much longer than a lot of people gave it credit for. If you understand the euro dollar system, not the euro against the dollar, but the dollar system around the world, you understand how true that really is.

Top Forex Brokers

So, with that being said, expect a lot of volatility, but I think right now we're right around the fair value area. And therefore, I’m somewhat neutral. If we break down below 1.08, I think the Euro will fall hard. If we break above the 1.12 level, this will be a situation where the U.S. dollar is probably falling against everything. That being said, it's gaining against several currencies during the session, especially those like New Zealand dollar, Australian dollar, Canadian dollar, also the Swiss franc, they're all taken a beating at the hands of the US dollar as I make this video.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.