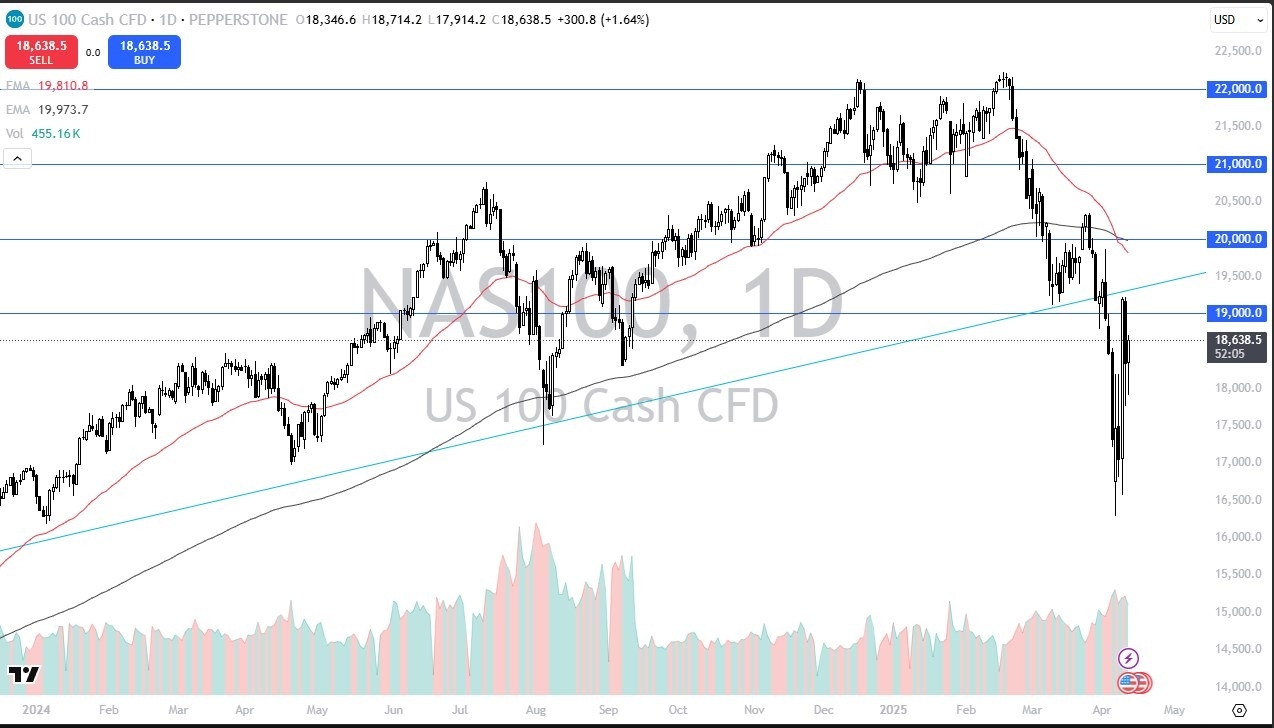

- During the trading session on Friday, we saw the NASDAQ 100 all over the place, as it looked at one point in time that we would be plunging below the 18,000 level, only to see the market turned around.

- This is especially after a Federal Reserve member stated that the Federal Reserve was willing to step in and stabilize the markets if they need it.

- In other words, it’s possible that we may be getting closer to quantitative easing in the United States, which of course stocks in the NASDAQ 100 level, as they are essentially fueled on low interest rates.

Technical Analysis

The technical analysis for this Nasdaq market is very ugly, but it is worth noting that the last couple of candlesticks have at least seen the market try to turn things around. The 19,000 level above is a significant barrier, and then we have a major trend line that we have to pay close attention to as potential resistance as well. If we can break above that, then it’s possible that the NASDAQ 100 could go looking to the 20,000 level.

Top Forex Brokers

On the other hand, if we break down below the 17,750 level, then the NASDAQ 100 could plunge toward the 17,000 level. In general, this is a market that I think will continue to be very noisy, especially as there’s no way to know what Donald Trump will say over the weekend, which could be a major driver of where we go on Monday morning.

Quite frankly, the most important thing you need to do is to keep your position size reasonable, and your stop losses very wide in these times where volatility is skyrocketing. Unfortunately, that’s just the way this game is played, sometimes things are so chaotic that you have to trade minuscule positions in order to survive and then take advantage of the market once it starts moving in a more stable and somewhat predictable manner.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.