- The US dollar initially fell pretty hard during the trading session on Friday to continue the overall nastiness that we had seen on Thursday.

- However, during the Friday session, we have seen a lot of dollar shorts turn things around.

- Not only here, but in the Euro, the British pound, the Swiss franc, the Australian dollar has cratered against the US dollar. The New Zealand dollar looks like it's probably going to try to do the same thing.

So, this tells me that perhaps people were starting to look at this tariff war thing through the prism of a major risk off event, as opposed to Thursday, when I think a lot of people got stuck in the mind frame that the United States was going to implode. That being said, it'll be interesting to see how this plays out, because I think part of what we've also seen has simply been people not wanting to be short the US dollar over the weekend and then have Trump say a few things on Sunday just to watch the market gap against them.

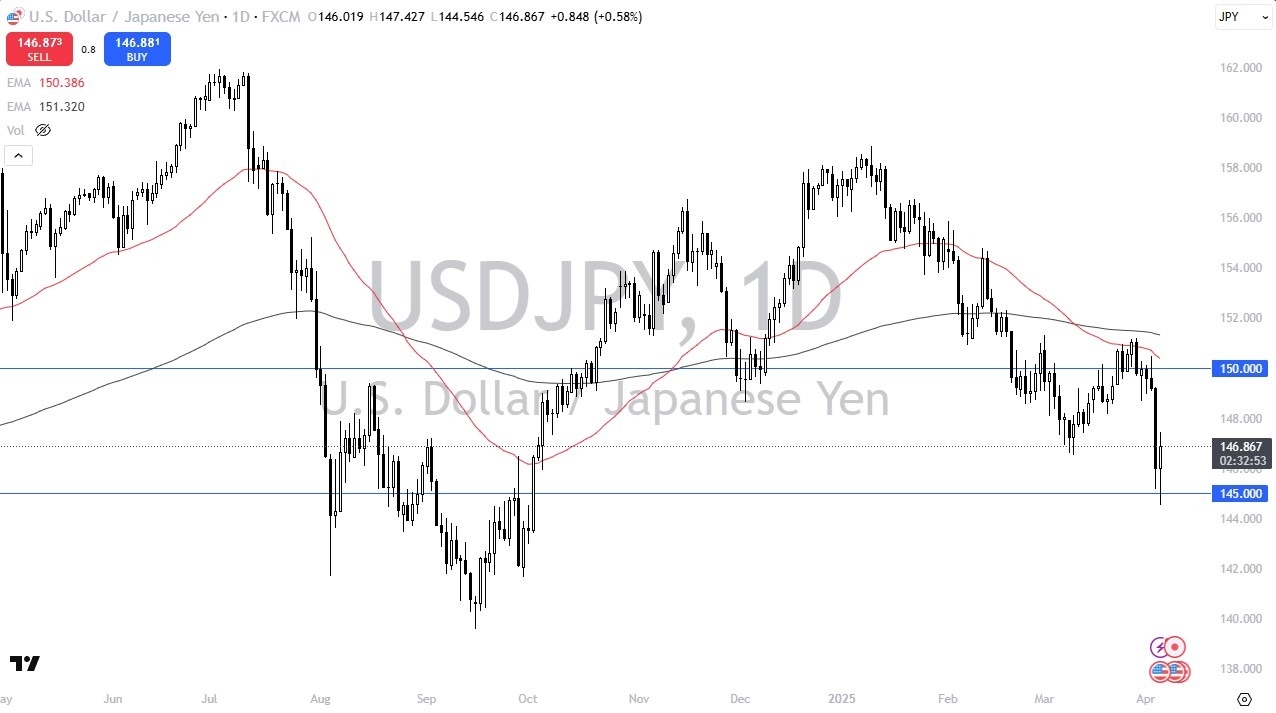

Bounced From a Crucial Level

Top Forex Brokers

So, because of this, it makes a lot of sense that this USD/JPY pair has bounced from the crucial 145 yen level. The question of course is, can we continue to rally from here? And I think that is going to be a difficult question to answer.

From a technical analysis standpoint, it does look like we could bounce, but we are still very much a downtrend. And if that's the case, I think the real ceiling right now is 150 yen. Anything above could be an opportunity for this pair to really take off. On the other hand, if we break down below the lows of the day on Friday, then I think the 142 yen level becomes a very real possibility as well. The interest rate differential does favor holding this at the end of the day. So that could come into the picture as well. But right now, I don't think people are worried too much about the swap.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.