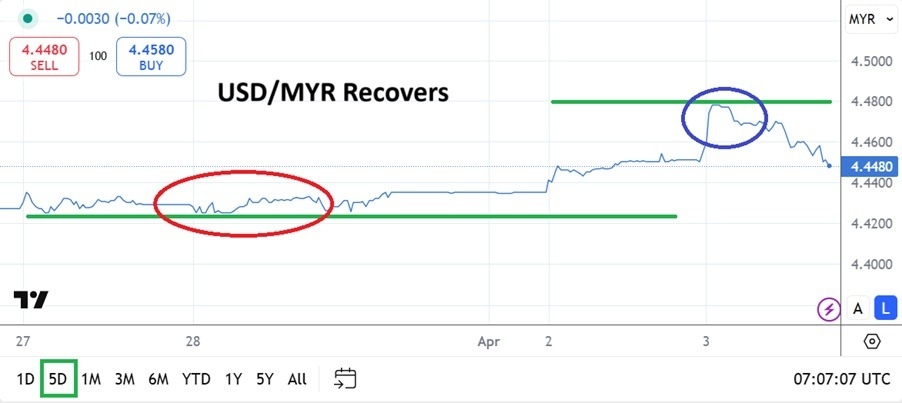

The USD/MYR jumped in early trading this morning and touched the 4.4785 vicinity, this as financial institutions reacted to the 24% tariff imposed on Malaysia by the U.S White House.

Fast trading was seen in the USD/MYR early this morning as Asian financial institutions reacted to tariff implications. Malaysia faces a 24% tariff from President Trump unless the nation lowers its levies it imposes on imported U.S goods. The USD/MYR surged to the 4.4785 ratio as buying dominated, but has recovered and as of this writing is near the 4.4500 ratio with a wide spread being demonstrated.

Top Forex Brokers

Though there isn’t significant volume in the USD/MYR day traders should remain cautious today and tomorrow in the currency pair as behavioral sentiment tries to find a tranquil price equilibrium as they consider outlooks. It is likely that risk adverse trading may continue to dominate in the short-term, which could cause additional fast movements in the USD/MYR, particularly if Malaysian politicians and government officials make statements regarding the tariffs and ruffle emotions.

Price Velocity Demonstrated but Calm Conditions Prevail

While the surge higher in early trading this morning was likely not received well by any speculators who had a short position in the USD/MYR, the ability of the currency pair to recover lower ground was a solid sign. The broad Forex market will also remain in a state of flux today and tomorrow, day traders are advised to remain cautious regarding speculative positions near-term.

The USD/MYR is essentially trading within values seen in early March and this is not a coincidence when behavioral sentiment is contemplated. On the 3rd of March financial institutions also faced a day of volatility as they were confronted by tariff rhetoric from the U.S White House. What makes today different is that official sanctions are now being imposed and the Malaysian government will likely respond in some manner.

USD/MYR Price Range and Wide Spreads for Traders

Traders of the USD/MYR who are used to rather predictable calm spreads need to remain alert to wider bids and asks today and tomorrow. Traders should use entry price orders if they insist on wagering in the Forex market. The USD/MYR is within the higher elements of its one and three month technical charts, and financial institutions will now be challenged with concerns about resistance levels which may be deemed vulnerable near-term.

- However, resistance from the 4.4800 to 4.5000 levels have been durable since early August of 2024.

- Outliers above the 4.5000 have been seen, yes, but the USD/MYR has done rather well and since November has essentially traded between 4.4000 and 4.5000.

- Short-term traders should be careful and not get overly ambitious regarding targets.

- Perhaps using higher moves as a place to look for some downwards momentum and quick hitting trades will be worthwhile bet.

USD/MYR Short Term Outlook:

Current Resistance: 4.4630

Current Support: 4.4470

High Target: 4.4750

Low Target: 4.4430

Ready to trade our daily forex forecast? Here are the best forex brokers in Malaysia to choose from.