I have written a few times about how stock markets are excitingly bullish when they are making new all-time high prices. For “all-time”, there is a consensus that 5 years is OK. In any case, the U.S. stock market is literally making new all-time highs: both the broader S&P 500 Index and the Dow Jones Industrials 30 Index made new all-time high prices last Thursday and Friday, just when the markets in general were getting so boring that I had nothing to blog about!

There had been increasing speculation over the last couple of weeks that the “Trump Rally” had run its course, with trading volumes in stocks looking quite thin and with volatility low too. However, as I have also pointed out before, it is statistically not a profitable idea to guess the end of a market rally before the price starts going down and breaking past significant lows that have been printed on the way up! This is one of the oldest and most frustrating trading mistakes – that of taking a profit too early and then becoming emotionally anchored to staying out, while sitting on the sidelines and watching the market continue to advance. This can be a particularly bad mistake to make in stocks markets, which typically are prone to large prolonged bullish moves.

The best thing about all-time high prices is that they sit within “blue sky”. There is no anchoring bias, no historical resistance levels, no “market memory” to act as a technical break on the advance.

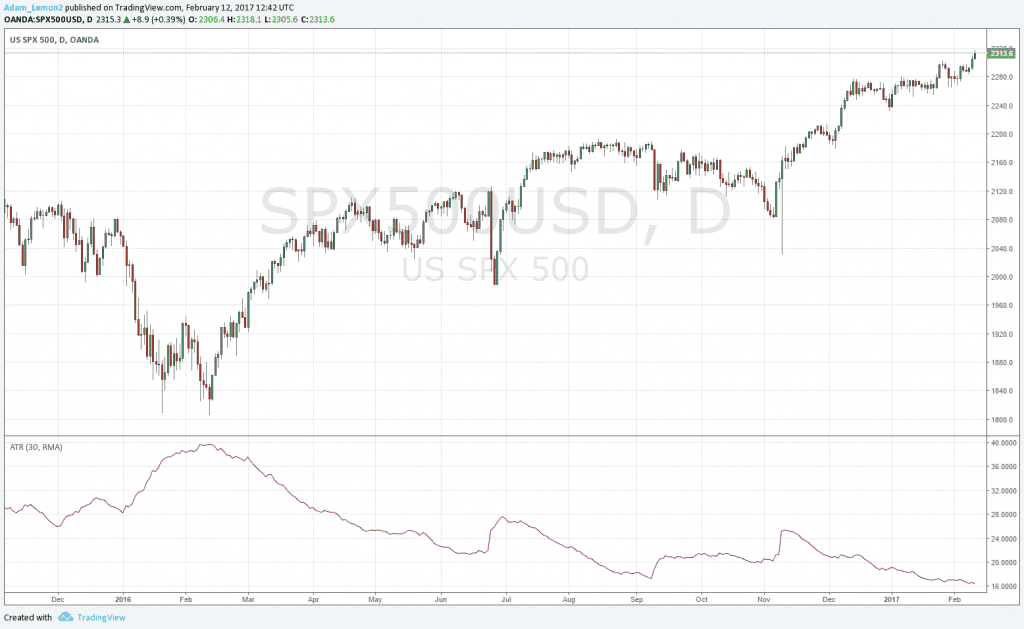

Looking at a copy of the daily S&P 500 Index chart below, I do not see any reason at all to stop being bullish, even though volatility is falling, as shown by the 30-day average true range indicator presented at the bottom of the image.