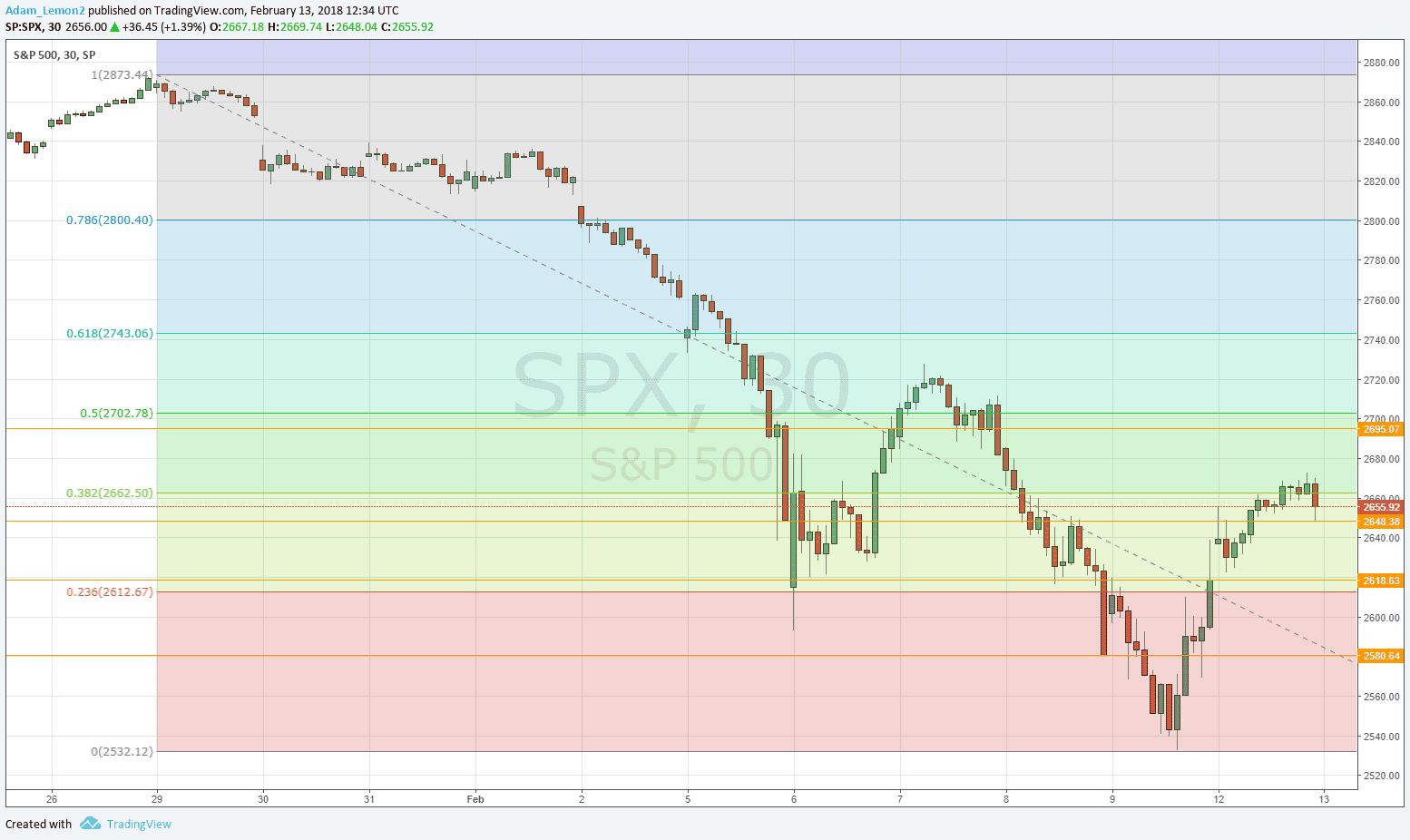

I’ve been warning for several days now that the “buy the dip” message going out from people who should know better is way, way too early. I don’t have a problem with the concept that bull markets which fall quickly tend to rebound, that is true enough. What I do have a problem with is the failure to appreciate that even in these cases, it pays to wait until the rebound has made up most of the loss; and started to make meaningful major higher highs. This has not yet happened; the overall flow is still bearish. Just look at the hourly chart below of the S&P 500 Index and tell me otherwise:

Another technical development here is the possible lessening of volatility, with yesterday’s action producing the lowest price range in the past seven trading days. It is too early to be certain, but if we have some more lower-volatility days, this will probably be good news for the bulls as this typically suggests a continuation of a trend following a correction. As I have suggested previously, if you want to be truly safe, you should wait for a daily close above the swing high just above the 50% retracement level at about 2728.

Turning to the Forex market, the biggest items on today’s menu are the multi-month high price made by the Japanese Yen against the U.S. Dollar, and a surprisingly high British inflation rate. The Japanese Yen is strong today, which has helped the breakout happen, but the deeper cause is a resumption of U.S. Dollar weakness in line with the long-term trend. The British Pound has also got a boost from CPI at 3.0% compared to the consensus forecast of 2.9%, placing the Bank of England in a difficult situation: rates will have to be raised from the relatively low level of 0.50% to fight inflation, but this will probably have the effect of boosting the value of the Pound, which in turn will make Britain less internationally competitive as it approaches an uncertain post-Brexit future concerning its terms of trade.