Lately, I have been exploring how traders can use volatility to improve their trade entry edge while trading in the direction of a trend. I’ve done this by bringing together a lot of historical price data and examining it, and the findings are interesting reading.

I took the last 17 years of daily price data. The first thing I tested was whether the following entry strategy produced an edge over this long time period:

SMA 10 and SMA 50 are both higher than they were at the close of the previous candlestick.

The current candlestick closes above both the SMA 10 and the SMA 50.

This was for long trades. For short trades, just reverse the rules from “higher” to “lower” and from “above” to “below”.

After each entry, I measured the performance of the hypothetic trade using two metrics, subsequent candle by subsequent candle:

Edge Ratio – what was the percentage of favourable movement to unfavourable movement from the “entry” to the close of that candlestick? For example, if the price moves 110 pips in favour and 100 pips against, the edge ratio would be 10%.

Win Ratio – at the close of the subsequent candlesticks, what percentage of “entries” were in profit?

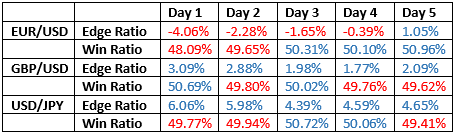

So, let’s look at the results for the first five days after a hypothetical entry when the price meets these moving averages criteria for some major Forex currency pairs over the period 2001 to 2017.

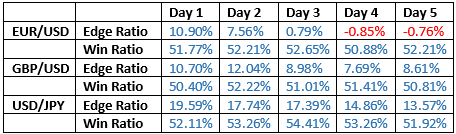

We could summarize this results table by arguing it does show evidence of a statistical edge, because after 5 days, all three currency pairs show that the price on average moves a little further in the direction of the trend. Let’s dig further and see how the results look when we only take trades where the candlestick is of an above-average level of volatility. We can quantify this by saying the range of the candlestick must be at least 125% of the average daily range of the past 15 days, as measured by the average true range indicator. The new results table looks like this:

No matter how you spin it, the results of “entries” taken after candlesticks with relatively high volatility produce both higher edge ratios and high win rates – it is striking that every single win rate is over 50% in all 15 statistics.

This is detailed evidence that it can pay to enter trades on unusually high volatility.