Editor’s Verdict

FXDD is a Forex broker with 20+ years of experience, featuring MT4/MT5 trading platforms, proprietary alternatives, and impressive order execution statistics. Manual traders benefit from Autochartist, and VPS hosting is available for low-latency, 24/5 algorithmic strategies. I reviewed this broker to evaluate if it delivers a competitive edge for Forex traders and focused on the Malta subsidiary. Should you trade with FXDD?

Overview

FXDD offers deep liquidity, excellent order execution, and upgraded trading platforms.

I like the liquidity at FXDD, making it ideal for scalpers and algorithmic traders. With 20+ years of operational experience, FXDD provides traders with a trusted Forex broker with superb order execution and a 99% fill rate. I also like that its proprietary web-based trading platform supports algorithmic trading.

Headquarters | United States |

|---|---|

Regulators | FSC Mauritius, LFSA, MFSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2002 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Average Trading Cost EUR/USD | 1.2 pips |

Average Trading Cost GBP/USD | 1.5 pips |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.24 |

Average Trading Cost Bitcoin | Not applicable |

Retail Loss Rate | 75.30% |

Minimum Raw Spreads | 0.3 pips |

Minimum Standard Spreads | 1.8 pips |

Minimum Commission for Forex | $5.98 |

Funding Methods | 9 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

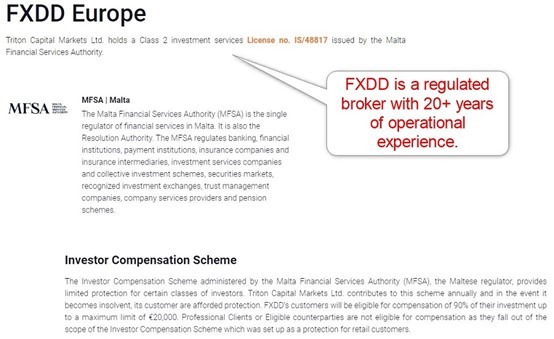

FXDD Regulation & Security

Trading with a regulated broker such as XM is usually safer than trading with an unregulated one. I always recommend traders check and verify the regulatory licenses of brokers with the relevant regulatory database. FXDD has three regulated subsidiaries with clean records.

Is FXDD Legit and Safe?

FXDD, founded in 2002, established itself among the most trusted Forex brokers amid a clean track record spanning 20+ years. It segregates client deposits from corporate funds and offers negative balance protection to retail traders. An investor compensation fund protects client deposits up to 90% or €20,000. FXDD also operates a subsidiary regulated in Mauritius.

My review did not find any misconduct or malpractice by this broker. I can confidently rate FXDD as a legitimate and safe Forex broker.

Country of the Regulator | Malta, Mauritius, Labuan |

|---|---|

Name of the Regulator | FSC Mauritius, LFSA, MFSA |

Regulatory License Number | IS/48817, C117017252, MB/23/0107 |

Regulatory Tier | 1, 4, 2 |

Fees

Average Trading Cost EUR/USD | 1.2 pips |

|---|---|

Average Trading Cost GBP/USD | 1.5 pips |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.24 |

Average Trading Cost Bitcoin | Not applicable |

Minimum Raw Spreads | 0.3 pips |

Minimum Standard Spreads | 1.8 pips |

Minimum Commission for Forex | $5.98 |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | true |

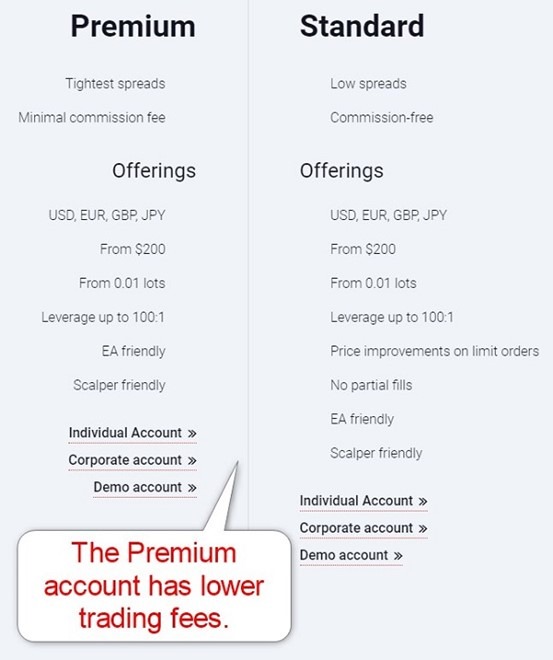

Trading costs are significant when evaluating a broker, as they directly impact profitability. FXDD offers an expensive commission-free cost structure and a notably cheaper commission-based alternative. I highly recommend the latter since the minimum deposit requirement is $0 for either account.

The commission-free Standard account shows average spreads from 1.8 pips or $18.00 per 1.0 lot. Traders can lower costs to 0.3 pips for a commission of $5.98 for total trading fees of $8.98 in the commission-based Premium alternative.

The minimum trading costs for the EUR/USD at FXDD are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.8 pips (Standard) | $0.00 | $18.00 |

0.3 pips (Premium) | $5.98 | $8.98 |

The most ignored trading costs are swap rates on positions held overnight. In a long-term trading strategy, it may become the most significant fee.

MT4/MT5 traders can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based Premium account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the Pro ECN MT4 account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading |

|---|---|---|---|---|

0.3 pips | $5.98 | -$24.84 | X | $33.82 |

0.3 pips | $5.98 | X | $6.99 | $1.99 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the Pro ECN MT4 account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading |

|---|---|---|---|---|

0.3 pips | $5.98 | -$173.88 | X | $182.86 |

0.3 pips | $5.98 | X | $48.93 | -$39.95 |

Here is a snapshot of FXDD trading fees:

Noteworthy:

- FXDD offers favourable swap rates on qualifying assets, allowing traders to earn money, like in the example above.

- Swap rates on leveraged long positions are high, making FXDD ideal for short-term traders but more expensive for other strategies.

- Commissions currency pairs other than EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, EUR/JPY, and GBP/JPY increase to $9.98 per 1 standard round lot.

- Equity CFD traders pay $16.00 per round trade.

Range of Assets

FXDD offers 54 currency pairs, 10 commodities, 12 indices, 51 equity CFDs as well as more than 10 Cryptocurrency CFDs. Cryptocurrency CFDs are offered in certain jurisdictions. The broker also offers Futures, On-Exchange Stocks & ETFs through its MT5 trading platform. Most trading instruments at FXDD are highly liquid, except for some exotic currency pairs, which are nice to have as part of a wide sector coverage. Overall, I rate FXDD as best suited for short-term Forex traders.

FXDD Leverage

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Maximum leverage for professional traders varies by jurisdiction.

FXDD offers a maximum retail Forex leverage of 1:30, which increases to 1:500 for professional account holders. Some currency pairs have increased margin requirements based on liquidity, and maximum leverage can drop as low as 1:2. Commodities and equities max out at 1:20, with many at 1:10. Equity CFDs have a maximum of 1:5.

Negative balance protection ensures traders cannot lose more than their deposits. Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

FXDD Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 00:00 | Friday 23:55 |

Commodities | Sunday 22:00 | Friday 20:45 |

Crude Oil | Sunday 22:00 | Friday 20:45 |

Gold | Sunday 22:00 | Friday 20:45 |

Metals | Sunday 22:00 | Friday 20:45 |

Equity Indices | Sunday 22:00 | Friday 20:15 |

Stocks | Monday 13:30 | Friday 20:00 |

Account Types

Traders have the choice of 4 account types at FXDD: the Cent, Micro, Mini & Standard accounts. There is no minimum deposit to open an account at FXDD and available account base currencies are USD, EUR, GBP, JPY, CHF, BTC & USDT. My review did not find any restrictions on trading strategies. FXDD offers corporate accounts and swap-free Islamic options.

FXDD Demo Account

FXDD offers demo accounts, but a 90-day expiry applies. It suffices to test the trading platforms or forward-test strategies. Still, more is needed for other demo trading requirements, like bug-testing EAs or evaluating signal providers. Traders can contact customer support to request an extension or open a new demo account, but they will lose valuable trade data.

Since MT4/MT5 offers customization options, I advise traders to select parameters similar to planned live portfolios for a more realistic demo trading experience.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

FXDD provides traders with out-of-the-box MT4 and MT5 trading platforms, where MT4 remains superior. It is also enhanced via the Autochartist MT4 plugin, offering clients a more competitive trading experience. MT4/MT5 is available as a desktop client, a web-based alternative, and a mobile app.

FXDD also maintains its proprietary WebTrader that supports automated trading solutions similar to MT4/MT5. Many brokers need to implement it in their proprietary products and focus only on manual traders. FXDD Mobile follows in the footsteps of its web-based counterpart. It is a rare mobile alternative that allows for the creation of automated trading solutions on the go, making it one of the most advanced mobile trading apps in the industry.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

Besides the proprietary trading platforms with full support for algorithmic trading, MT4/MT5 VPS Hosting enhances algorithmic trading requirements. The service costs between $30 and $85 per month unless FXDD clients have a minimum of $2,500 and 5.0 lots in volume per month.

Research & Education

Auotchartist delivers the bulk of actionable trading recommendations. FXDD also sources in-depth analytics from TraderMade, generating numerous trading ideas daily. The available research is satisfactory, especially since the FXDD core audience is scalpers and algorithmic traders.

FXDD does not provide educational content for beginner traders, which is different from the target market for this broker.

Therefore, beginners should consult online educational resources available for free. I recommend they begin with in-depth content covering trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |        |

FXDD customer support is available from Sunday through Friday between 17:05 and 16:55 EST. Traders should consider live chat for non-urgent matters or e-mail their questions. Phone support exists, including a trading desk. I did not find an FAQ section. However, FXDD explains its products and services well, and customer support is easily accessible.

Bonuses and Promotions

FXDD provides active bonus campaigns for its clients, setting itself apart from other platforms by providing cash bonuses instead of credits offered by most brokers. It is important to remember that bonuses are available only in select jurisdictions.

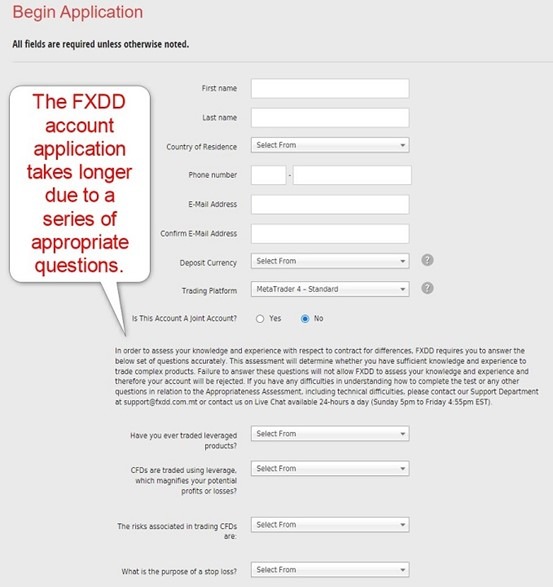

Opening an Account

FXDD has a lengthy account application, typical of EU-based brokers. The first step includes seven questions, which traders must answer correctly. Additional questions will follow, including collecting personal and financial data.

FXDD fully complies with its regulator and global AML/KYC requirements. Therefore, account verification is mandatory, which most traders will satisfy by uploading a copy of their government-issued ID and one proof of residency document. FXDD may ask for additional information on a case-by-case basis.

Minimum Deposit

There is no minimum deposit required at FXDD.

Payment Methods

FXDD payment methods are bank wires, credit/debit cards, Neteller, Skrill, Zotapay, Sticpay, Payment Asia, Crypto & other local deposit methods.

Prohibited Countries

FXDD accepts clients resident in most countries except American Samoa, Angola, Belarus, Bermuda, Burundi, Cameroon, Central African Republic, Chad, Congo, Congo (Democratic Republic of the), Cuba, Equatorial Guinea, Gabon, Iran (Islamic Republic of), Korea (Democratic People’s Republic of), Lebanon, Libya, Marshall Islands, Puerto Rico, Russian Federation, Sao Tome and Principe, Somalia, Sudan, Syrian Arab Republic, United Kingdom of Great Britain and Northern Ireland, United States of America, Venezuela (Bolivarian Republic of), Virgin Islands (US), Yemen, and Zimbabwe.

Deposits and Withdrawals

The secure FXDD back office handles all financial transactions for verified clients.

FXDD provides several deposit and withdrawal options to traders. Payment methods include VISA, Mastercard, Neteller/Skrill, Union Pay, Wire Transfer, Zotapay, Sticpay, Payment Asia & other deposit methods depending on the region. The minimum deposit requirement is $0, and the minimum bank wire withdrawal amount is $100. Any withdrawals inferior to $100 will result in a $25 fee. The broker allows each client to place a withdrawal request without any charge once a month. Requesting a second withdrawal during the month incurs a $40 fee. FXDD will send withdrawals to the payment processor used for the deposit, but it does not specify internal withdrawal times. The name on the payment processor and FXDD trading account must match in compliance with AML regulations. I would prefer a more transparent deposit and withdrawal section.

Is FXDD a good broker?

I like the trading environment at FXDD for its four trading platforms that support algorithmic trading. VPS hosting and API trading are available. Adding value is the research provided by FXDD in partnership with Autochartist and TraderMade. FXDD is best suited for scalpers and algorithmic traders using short-term strategies. FXDD has 20+ years of experience, and I rate it among the most trusted Forex brokers.

FAQs

Does FXDD charge a commission on trades?

Yes, in certain account types. The Standard Account is commission-free with high spreads. At the same time, the commission-based ECN alternative lowers mark-ups for reasonable commissions.

What documents are needed to open a live account with FXDD?

Traders must submit a copy of their ID and one proof of residency document dated within three months.

Is FXDD safe or a scam?

FXDD remains fully compliant with two regulators and maintains a safe trading environment. Therefore, it is a safe broker with 20+ years of experience and not a scam.

What is FXDD?

FXDD is an online multi-asset broker operating out of Malta, with offices in several countries.

Where is FXDD located?

The headquarters is in New York, and FXDD has offices in Malta, Mauritius and Labuan.

Is FXDD regulated?

Yes, the Malta Financial Services Authority (MFSA), the Labuan Financial Services Authority (LFSA) in Labuan, and the Financial Services Commission (FSC) in Mauritius provide the regulatory environment for FXDD.