Editor’s Verdict

Overview

Review

Headquarters | New Zealand |

|---|---|

Year Established | 2013 |

Execution Type(s) | No Dealing Desk |

Minimum Deposit | None |

Trading Platform(s) | Other, MetaTrader 4, Proprietary platform |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Juno Markets is a Forex and CFD broker providing traders throughout Asia with access to currencies, stocks, indices and CFD’s in spot gold and silver. Juno Markets is headquartered in Wellington, New Zealand and in St. Vincent and the Grenadines.

With its emphasis on Asia, all of their technology including websites, trading servers, and liquidity providers are locally hosted in Asia. I was surprised to see they had no regulation.

Accounts

Juno offers two different trading accounts-the Juno and the Juno Intro accounts. Not too much information was provided about these accounts. Since it was not mentioned, I assumed when doing this review that there is no minimum deposit requirement for either of the accounts.

Standard leverage for all Forex crosses is 200:1 in the Juno and 400:1for the Juno Intro Account with a maximum account size of $2,000.

It was nice to see that a free demo account is available with no risks or obligations. Indeed, the use of $50,000 in virtual funds is quite generous.

Features

Juno Markets provides traders with access to over 30 FX crosses and spot metals tradable on the market-leading MT4 platform. All the Forex instruments are offered through their no-dealing desk execution mode while working with the world’s top tier liquidity providers so as to ensure deep and consistent liquidity for their clients. No requotes or dealer interventions are done. They offer generous leverage of up to 200:1 for their Juno Account and 400:1 for their Juno Intro accounts.

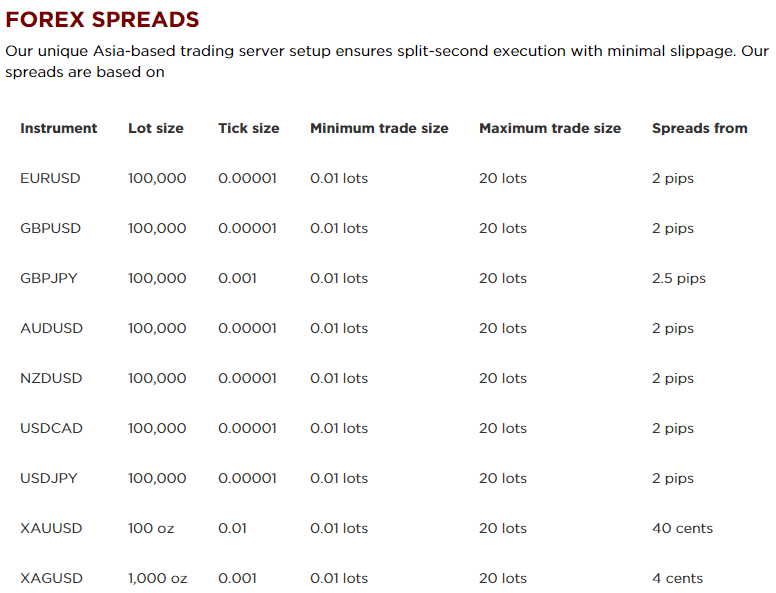

Juno Markets Spreads

With Juno Markets, traders can trade the entire index, with the possibility of short-selling to profit from a falling market. So no need to have an opinion about individual stocks in the market. They can simply trade the index to capitalize on major moves in the market. 25:1 leverage is available and with expanded trading hours, trading a stock index can be done even when the exchange is closed for trading on normal stocks.

Juno Markets offers commodity trading in low lot sizes with generous leverage. There are no commissions or trading fees when trading commodities with Juno Markets. The price shown is the price used for trading.

Traders have the opportunity to use Tradeworks, a developer of cloud-based trade automation software designed for individual traders of FX and CFDs. Their aim is to help traders optimize their trading performance through innovative but simple-to-use trading technology. Tradeworks makes it easy to build their own trading algorithms or work from a number of preset trading strategy templates.

Tradeworks on Juno Markets

Partnering

Juno Markets places great value in their partners and offers opportunities to become an Introducing Broker (IB), Portfolio Manager, or Marketing Affiliate. Juno provides the tools each partner needs to better service their clients and the Juno team works in tandem with each partner using a host of reporting and analytical tools.

In addition, each IB receives a personalized back office portal and CRM system, a competitive and flexible commission structure, a mobile dashboard that allows them to track their business on the go and custom marketing material available in multiple languages.

Portfolio managers receive access to a personalized back office, automatic monthly payments of performance and management fees based on terms with their clients and access to web based portfolio manager dashboard that brings them a host of different fund management tools.

Through the Juno Markets Trader’s Room, becoming an affiliate is simple. Once an account has been created, Juno affiliates are able to track their commissions directly in our mobile dashboards.

Juno Markets has just released its new Juno Markets Portfolio Manager which gives money managers the ability to create Limited Power of Attorney (LPOA) electronically and send out digital copies to their clients to sign, totally removing any need for paper documents. This is a very innovative feature that is not even being used in major banks yet and it certainly makes trading simpler.

Education

There are some interesting tutorials on the basic concepts of online Forex trading, which cover concepts such as how interest rates correlate to the Forex market, support and resistance levels, technical indicators like the RSI and others. Other than these tutorials, there is no other educational material provided.

Juno Markets - Market Analysis

Deposits/Withdrawals

There are a number of ways to fund an account with Juno Markets and as a general rule withdrawals are processed using the same method as was used to deposit funds.

Acceptable funding methods include wire transfers, credit or debit card and online payment services, such as Neteller, Moneybookers or Skrill.

Juno Markets does not charge any fees in connection with deposits, but banks may charge a fee on wire transfers.

Withdrawals are processed on the day they are received, and the funds will arrive back in the account within 1-7 days depending on the method of withdrawal. Wire transfers are charged $25 per withdrawal. For accounts over $25,000, 1 free withdrawal per month is allowed.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |   |

Traders can reach a Juno Markets representative via telephone to their two main offices. Emails can also be sent. I was surprised to find that Chat was not available.

Trading can be done 24/5 Asia hours. The Juno Markets website is available in English, Indonesian, Korean and Vietnamese.

Conclusion

Juno Markets is a relative newcomer to the Forex scene. As such, it has established itself as one of Asia’s leading Forex brokers. It offers a wide choice of trading products and several trading accounts to choose from. It is also missing some important features.

Features

One of the nicest features about Juno Markets is its graphic-laden website. Each page is accompanied by a photograph that is relevant to the information presented and is straight to the point. The use of black and white rather than colors offers the website a retro look that reminds us of how trading used to be in the past, before the introduction use of upscale modern technology. Navigating the website is quick and setting up an account is easy.

Platforms

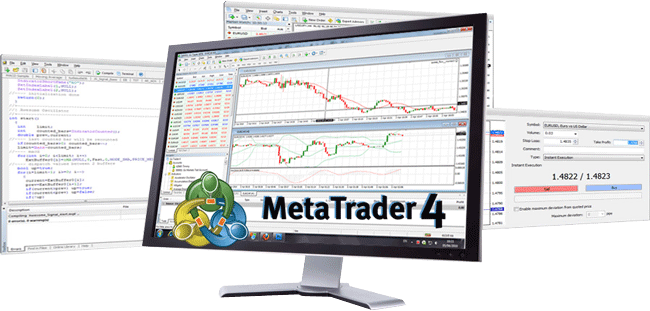

MetaTrader 4

Juno Markets offers traders the immensely popular MetaTrader4 platform which is simple enough for new traders to get started with yet advanced enough for professionals to run sophisticated trading systems on. The MetaTrader 4 platform gives them the stability and versatility they need.

MetaTrader 4 Trading Platform

Web-Based

Juno Markets also gives traders access to a web-based version of the MetaTrader 4 which lets them access the markets on public PCs or even on Macs.

Mobile

With a Juno account, traders have access to the MT4 Mobile app available for iOS and Android, and recognized as one of the most powerful mobile trading apps.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |