What are Trend Lines?

Trend lines are angled lines that can be drawn on price charts, connecting swing lows with other swing lows, or swing highs with other swing highs. Occasionally, a trend line might connect both swing highs and lows.

Technical analysts draw trend lines because they expect them to become pivotal points when the price next reaches them, giving an opportunity at that moment to enter a high-probability, high reward-to-risk ratio trade. Most trend lines are typically drawn with the expectation of being used to enter a reversal (fade) trade, but they can also be used to identify and trade breakouts.

There are essentially 4 types of trend lines:

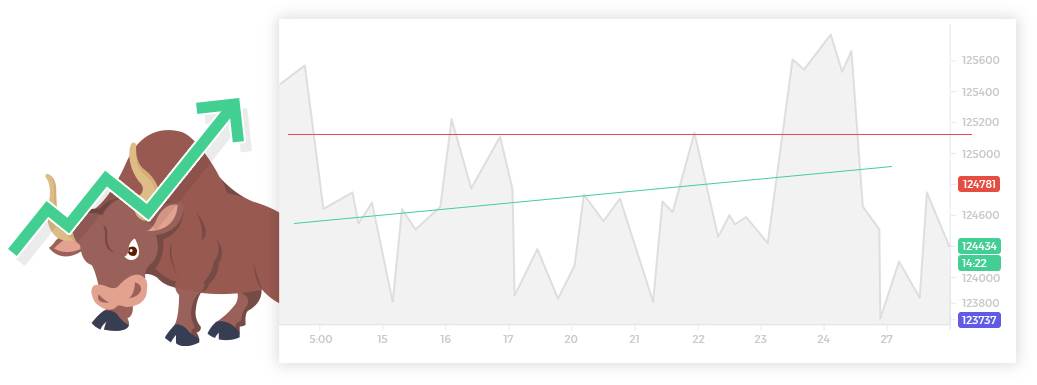

1- A rising (bullish) trend line connecting swing lows

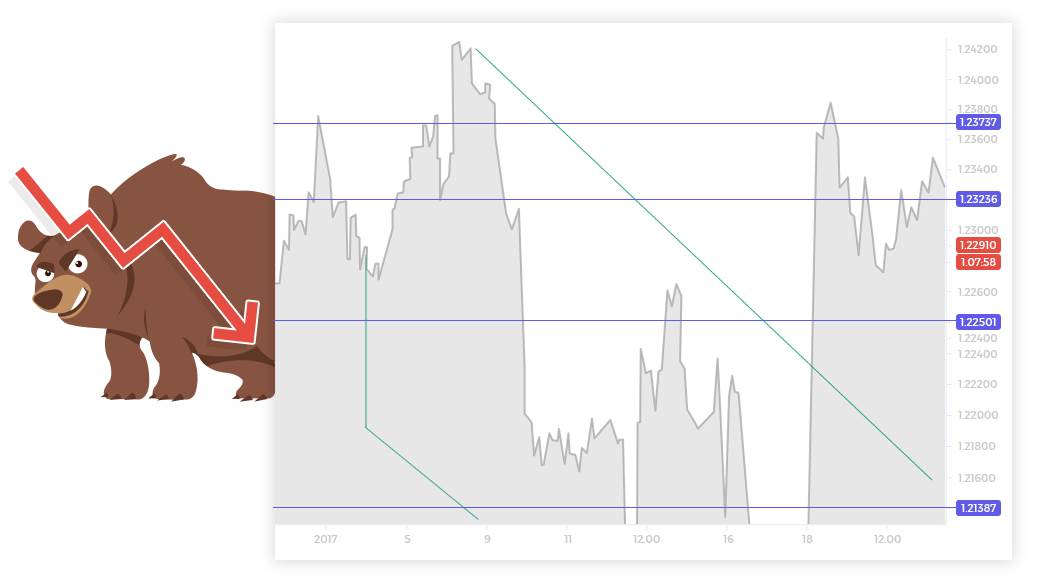

2- A descending (bearish) trend line connecting swing lows

3- A descending (bearish) trend line connecting swing highs

4- A rising (bullish) trend line connecting swing highs

Drawing Trend Lines

- 1 You need a minimum of two touches to draw a trend line, but do not trade it until the outcome of the third touch becomes clear.

- 2 Begin on the higher time frames, connecting swing lows to swing lows and swing highs to swing highs. A trend line that is many weeks or days old is important, a trend line of a few minutes or hours is worthless, unless it is a crucial piece of a bigger technical picture.

- 3 If the price has seriously violated the trend line since the minimum of two touches was made, it is no longer a valid trend line – so only draw what has not been invalidated by more recent price history.

- 4 The more symmetrical the price movements in both time and price that are being connected, the more objective the trend line is likely to be.

- 5 The steeper the trend line, the lower quality it is likely to be. Conversely, the gentler the angle of the slope, the more effective it is likely to be.

- 6 When you have identified where a good trend line can be drawn, drop down to the lowest time frame possible to draw the line, and be extremely exact. A trend line should connect the extremes of the points as exactly as possible on as many of the points as possible. This means that if for example there are three touches, but the third touch moves a little too far, the line should be drawn to exactly touch the extremes of the first two points, but to also allow the overshoot of the third touch. Don’t try to “average” between the touches.

- 7 When a trend line has not been touched for a much longer period than the longest period between any two previous touches, it has probably lost any significance.

- 8 If a trend line is hit and can be subsequently readjusted to better fit its touches, do not hesitate to readjust and redraw the trend line.

- 9 If a parallel trend line can be drawn either above or below a trend line at a similar ascending or descending angle, it is probably going to be an effective trend line, so draw it. You now have a price channel, and if you are trading with the trend, you will have an obvious place both to exit and to enter! See the example of a channel below:

An Effective Trend Line

How to Trade Trend Lines - Overview

Once you have your trend lines drawn and you ensure that you are regularly updating them by deleting invalidated lines, adjusting lines that have been hit, and drawing any good new lines that arise, you simply wait until the price hits one of the trend lines. It is important that you do not “force” any trend lines into the chart: most of the time, your chart will not offer any good-quality, obvious trend lines.

Trend lines, especially in Forex, are usually more useful for identifying probable reversals than breakouts, except where they are against an extremely obvious and strong trend in the opposite direction. In both cases, it is better to wait for price action to confirm the breakout or reversal as required, though the use of Japanese candlestick / price action analysis, than to simply place stop or limit orders before the touch and hoping that it works.

As a rule, steeper trend lines, and trend lines that have been hit very often (particularly where the hits are in an increasing frequency) are more likely to break than hold.

Breakouts

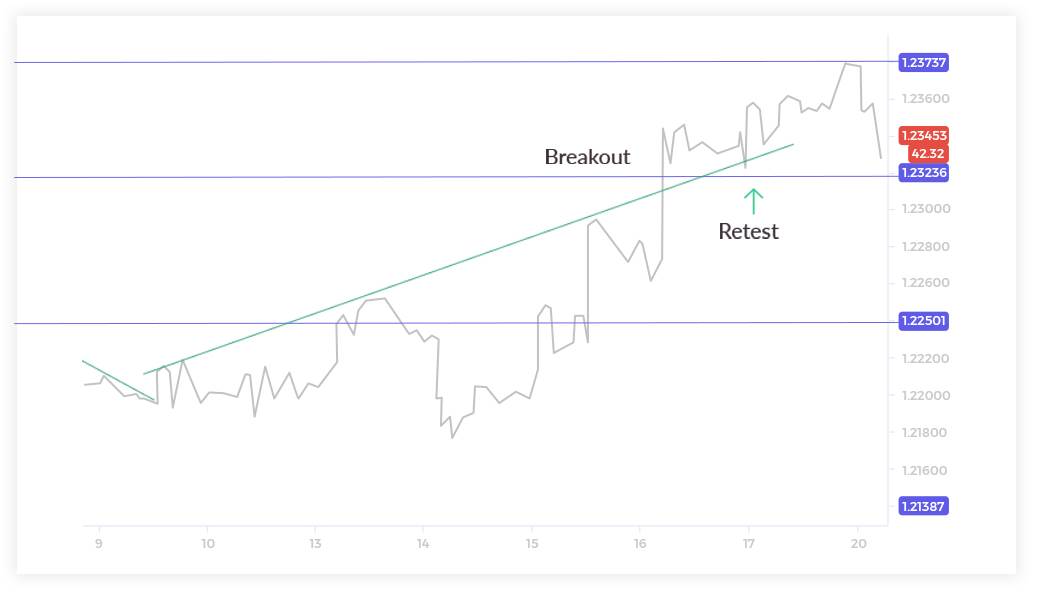

The most aggressive method that can be used (beyond placing a stop order just beyond the line without any confirming price action) is to simply wait for the price to print a very bullish or bearish candle (as required) which cleanly breaks past the trend line in the desired direction. This works best in very strong breakouts where the price does not pull back for a while after the breakout happens.

A more conservative method is to let the breakout to occur, then wait for the price to pull back and touch the trend line from the other side, and ideally form a new candlestick clearly rejecting the broken trend line. A good example of such a set-up is shown below:

Trend Line Breakouts

The aggressive approach will give you more losing trades, but you will not miss any winners, and you will secure earlier entries giving a better reward to risk ratio. The conservative approach should ensure a better ratio of winners to losers, although it will certainly miss some big winners.

One thing which can help increase the probability of any breakout trade is checking that the price is making more significant higher lows than highs (for a bullish trade) or vice versa (for a bearish trade).

Reversals (Faded)

An extremely aggressive method is to simply place a limit order at the trend line when the price gets close to it. However, this can be problematic because it is a rather aggressive strategy as the price level of the line shifts slightly with every unit of time. Additionally, sometimes the price comes very close to the trend line and reverses without ever quite touching it. For these reasons, it is usually a better idea to wait for a reversal to be confirmed by Japanese candlestick analysis / price action analysis to identify the turn, not entering the trade until the turn happens.

How can you identify the turn? If the price moves towards and rejects the trend line very quickly and strongly, a single turning candlestick might be enough confirmation. If the price is moving slowly, waiting for a compound candlestick formation of maybe 5 candles is usually a better method.

One thing which can help increase the probability of any reversal trade is checking that the price is making more significant higher lows than highs (for a bearish trade) or vice versa (for a bullish trade).

Finally, it helps to know when to give up – in other words, when to conclude that the turn is not going to happen. Again, if there are many consecutive or near-consecutive candles that violate the trend line and don’t react one way or the other – say between 5 and 10 candles – it is usually obvious that there is no good trading opportunity to be had.