Editor’s Verdict

Overview

Review

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Year Established | 2011 |

Minimum Deposit | €500 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

NBH Markets EU LTD is a Cyprus-registered, authorized and regulated Forex broker, with license number 208/13. This broker offers an STP (Straight-Through Processing) trading environment with an NDD (No-Dealing Desk) policy which means that traders’ orders are directly passed on to the Forex market. NBH Markets EU claims to have a client-centric approach that is both transparent and honest. Tier 1 bank liquidity and the popular MT4 trading platform are offered to clients ranging from new retail traders to multi-account managers (MAM). The brokerage also offers insurance up to $5 million by Lloyds of London.

Leverage for retail traders is 1:30, the recommended maximum by its regulator, and over 62 currency pairs are available for trading. Spreads from 0.06 pips are available on all accounts, but an $8 commission per lot applies in the entry account. A minimum deposit of €500 is required for the lowest-level account. NBH Markets EU prides itself on lightning-fast execution at less than 100 ms and no requotes. Overall it represents a solid offer for a broker in the mid-section of the global brokerage sector.

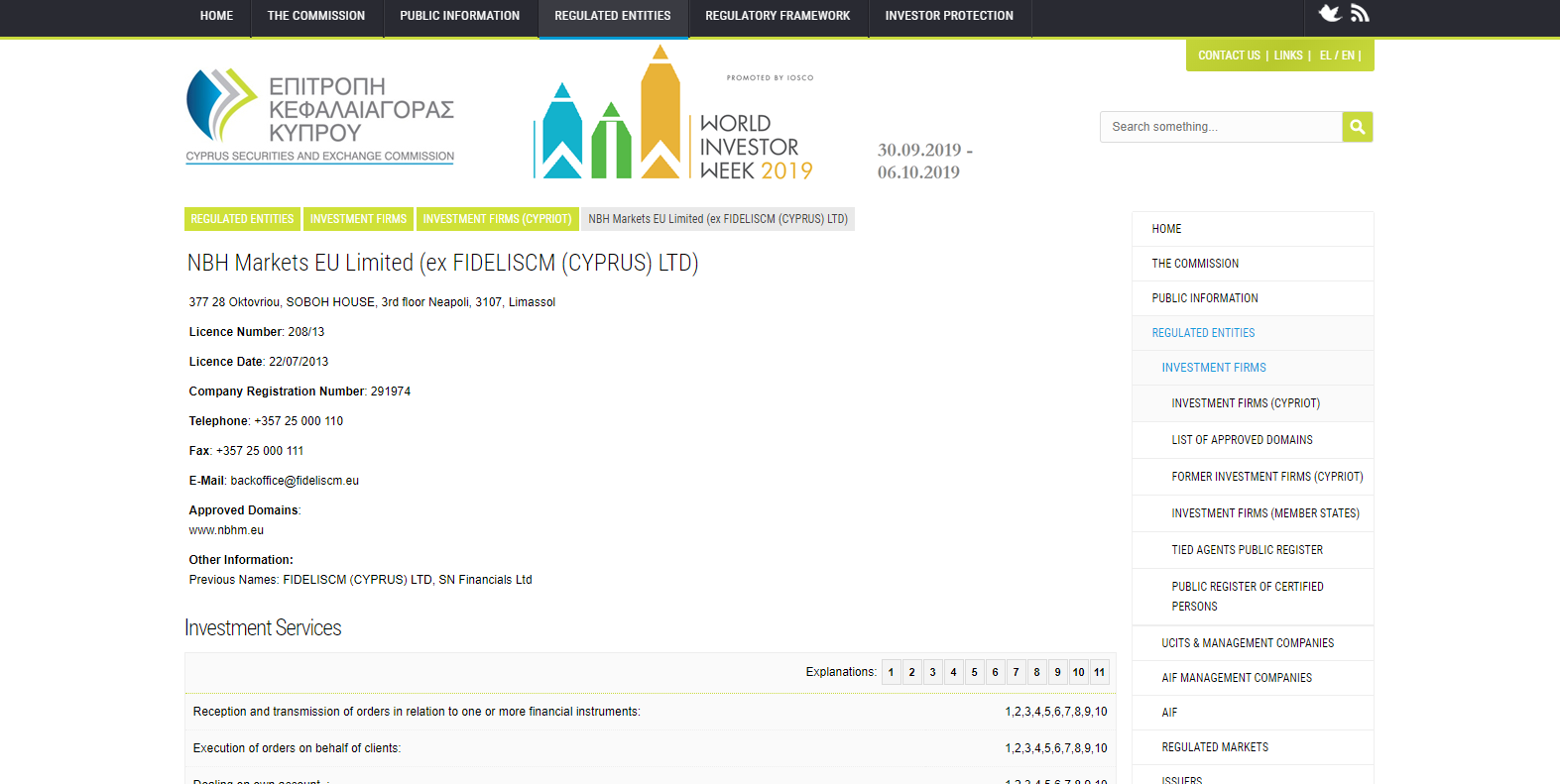

Regulation and Security

NBH Markets EU LTD is registered in Cyprus with the registration number 291974 and authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with the license number 208/13. As a CySEC regulated broker, client funds remain segregated from company funds and the company participates in the Investor Compensation Fund (CIF) as mandated by its regulator. This broker changed its name from Fideliscm Cyprus LTD to NBH Markets EU LTD and is now backed by National Bullion House (NBH).

As Cyprus is a member of the EU, the MiFID II regulatory framework as well as the 4th EU Anti-Money Laundering Directive also apply. All the legal documentation can be reviewed on the company’s website; the only items not listed were the Pillar III documents, part of the Basel Committee on Banking Supervision in order to “promote market discipline through regulatory disclosure requirements”. Overall, NBH Markets EU LTD is a transparent broker and traders should feel comfortable operating their portfolio with this broker.

Fees

NBH Markets EU LTD earns it fess through spreads, which remain competitive, as well as commissions which are also acceptable. As mentioned earlier in this NBH Markets EU review, spreads start at 0.06 pips in all account types. Commissions start from $8 per lot in its Standard account which is reduced to $5 per lot in its Pro account, a competitive commission for a minimum deposit of €25,000 and out of reach for the majority of its traders. The commission for Elite account holders is $20 per $1,000,000 notional trading volume. In order to put this into better perspective, this equals roughly 10 lots in a Euro-denominated account and therefore $2 per lot which is excellent; the minimum deposit for an Elite account is €50,000.

Swap rates apply and traders can easily check them from inside their MT4 trading platform by following these steps:

1. Right-click on the desires symbol in the “Market Watch” window and select “Symbols”.

2. Select the desired currency and then click on “Properties” located on the right side.

3. Scroll down until you see “Swap Long” and “Swap Short”

No deposit fees are charged by NBH Markets EU LTD, but third party fees from banks or payment providers will apply. Withdrawal fees are also applicable. According to the broker, there will be no fees for deposits above €5,000.

What Can I Trade

NBH Markets EU LTD offers traders a selection of Forex, precious metals, cash indices and energies. The Forex selection is good with 62 currency pairs while the other asset classes are thinly represented with three precious metals, ten cash indices and three energies. This broker is primarily a Forex broker and cross-asset diversification is not something traders can achieve here. NBH Markets EU LTD executes well for pure Forex traders and professionals who only operate in this space. Unfortunately, no cryptocurrency pairs are offered which suggests that this broker is either behind the competition or chose to ignore this emerging asset class.

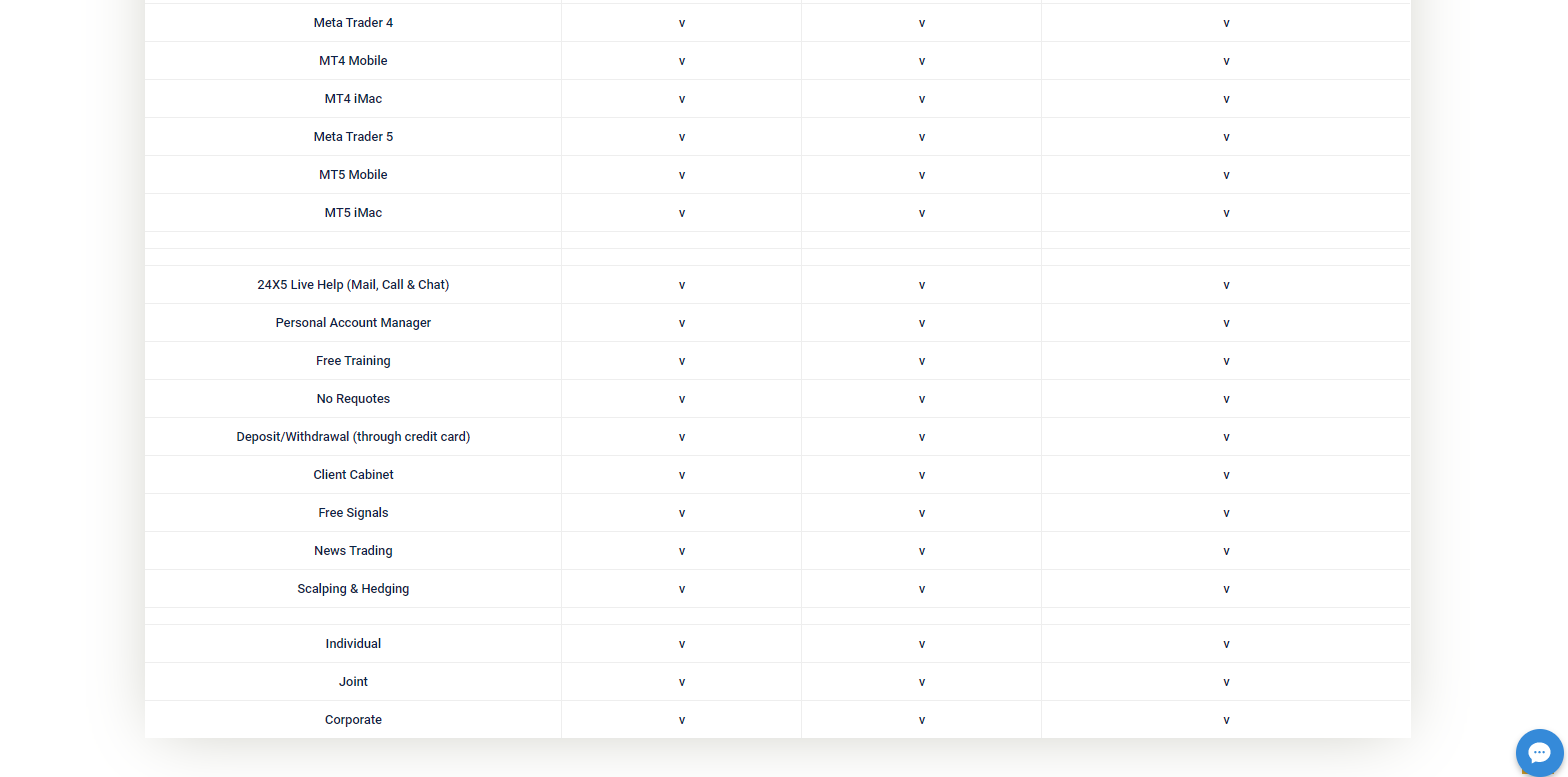

Account Types

Traders have three different account types to choose from at NBH Markets EU LTD. The entry account is labelled “Standard” and requires a minimum deposit of €500. It comes with a maximum leverage of 1:30 for retail traders and the starting spreads listed at 0.6 pips for the EUR/USD; this is the most liquid currency pair and usually carries the lowest spread. The commission is $8 per lot which is an acceptable starting commission for an entry account. Most Forex traders are likely to opt for this type of account, but for new retail traders it may already come with a high minimum deposit; this is especially true when compared to other brokers.

The “Pro” account has all the same trading conditions as the Standard Account, but the commission is lowered to $5 per lot for a minimum deposit of €25,000. While this is an acceptable offer, it is not competitive with many other offers available. The “Elite” account starts from a minimum deposit of €50,000 and the commission is lowered to $20 per $1,000,000 notional trading values which equals roughly $2 per lot for a EUR/USD position. The commission is excellent in this account type but given the limited overall asset selection the minimum deposit may be too high for traders to accept. It would be a great choice for serious Forex traders as part of a diversified broker approach, if the minimum deposit would come down. All traders can apply for reclassification as a professional trader and get better trading conditions, namely access to higher leverage.

Trading Platforms

During our NBHM review we found that the full suite of the MT4 as well as the MT5 trading platforms are offered. MT4 is the most popular trading platform and countless third parties have invested millions in creating automated trading solutions, custom indicators, professional charting tools as well as other add-ons in order to turn the MT4 into a powerful trading solution. As a standalone version without any additions, it lacks features established retail traders and professionals require; for retail traders it is a solid start.

It would be nice if NBH Markets EU LTD would take the extra step and offers its clients some important upgrades from third parties, especially with a minimum deposit of €500. That being said, the brokerage is fairly new and we hope/expect that additional features will soon be offered.

Unique Features

NBH Markets EU LTD doesn’t currently offer any unique features and sticks to the bare minimum required in order to operate as a Forex broker. There is nothing wrong with this approach and this broker executes well when it comes to pure Forex trading operations. It does offer a VPS solution which allows automated trading solutions to operate 24/5, but the price tag for it is $28 per month with a promo code. Given the high minimum deposit, we’d like to see the VPS offered for free; NBH Markets EU LTD offers it for free only if 20 standard lots are traded by clients per month.

Multi-Account Management (MAM) is offered where traders can manage accounts on behalf of other traders for a fee. This is part of the MT4 offering which supports MAM accounts and offers a MAM platform. While this hardly classifies as a unique feature, it is worth pointing out as traders who do manage accounts and earn an extra income stream do have the option. This may be the only case where an “Elite” account and its attractive trading conditions should be considered.

Research and Education

NBH Markets EU LTD targets professional traders which is why they don’t currently offer any educational material. At the time of this NBH Markets EU LTD review, only a form to subscribe to company news and offers is available under both sections.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |  |

Traders can access customer support either by calling NBH Markets EU LTD, using the web-form to send a message, live chat when available or through e-mail. An FAQ section is also available which covers most basic topics and while no support times were mention, normal business hours should be assumed. Customer support is, ideally, the least used service any trader will ever use.

Bonuses and Promotions

At the time of this NBHM review, no bonuses or promotions were offered by NBH Markets EU LTD, which is in keeping with CySEC regulations.

Opening an Account

As with all brokers, the opening of an account is accomplished online through a simple registration form. AML/KYC requirements need to be satisfied as required by NBH Markets EU LTD’s regulator which consists of the normal ID and proof of residence submissions. This broker claims it takes one minute to complete the process, though it may take longer.

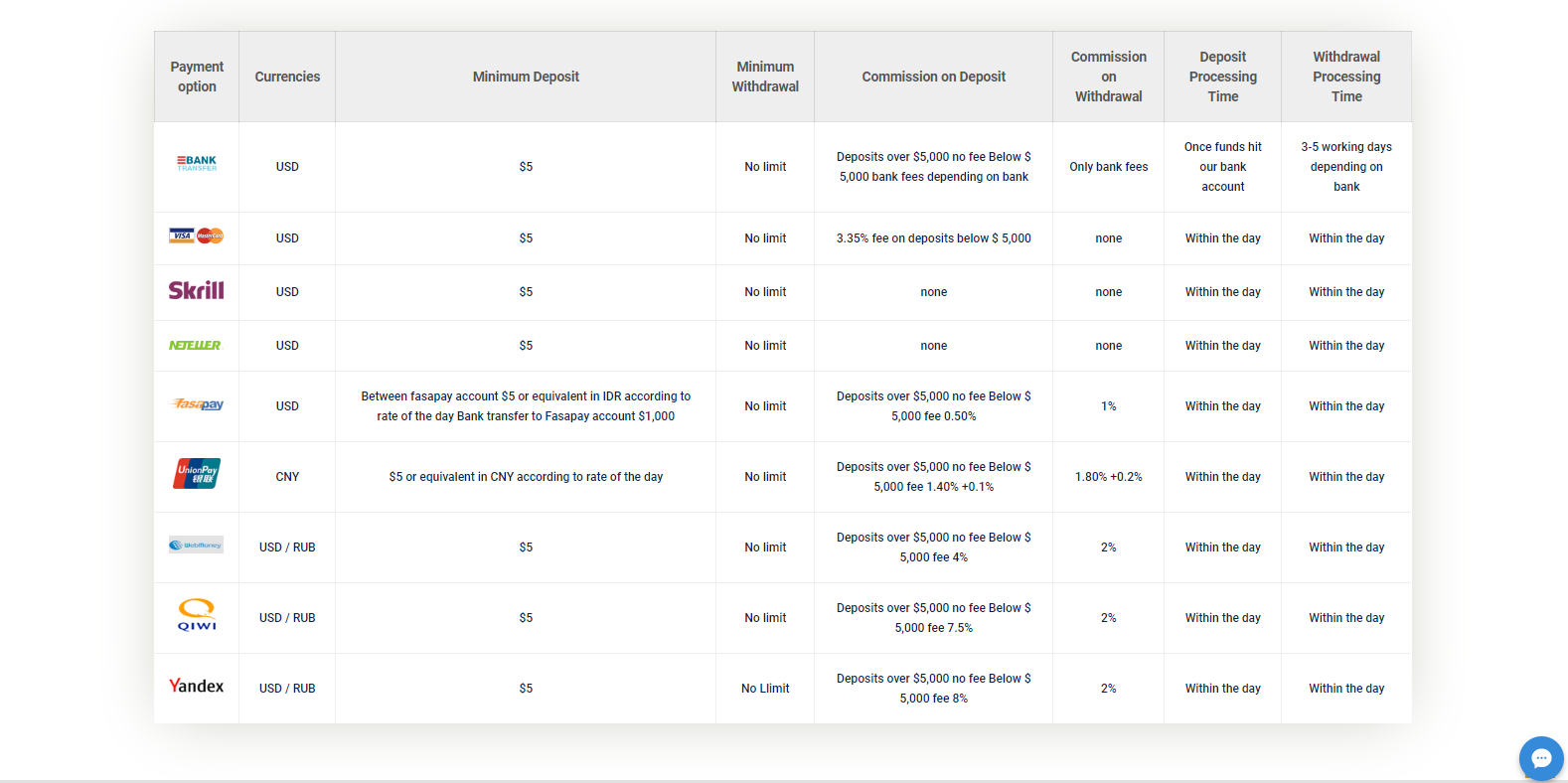

Deposits and Withdrawals

NBH Markets EU LTD does offer a nice selection of deposit and withdrawal options to its traders. While this broker claims to not charge for deposits, several deposit methods show a charge below $5,000. Commissions on withdrawals vary depending on the withdrawal option. A €500 minimum deposit is required to open an account with NBH Markets EU LTD.

Processing times are listed as same day across all options with the exception of bank wires which indicates a normal operation. For security reasons, the same option needs to be selected for withdrawals as the deposit option. Traders who used a credit card will only need to request the same amount back to the credit card and the rest can be send to a payment processor of their choice.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

NBH Markets EU LTD is a Forex broker which makes a solid first impression for a new broker, but leaves us wanting to see what comes next. This broker focuses on the bread-and-butter business of brokerage, allows market access through good spreads and an acceptable commission. The STP/NDD trading environment is rock solid and professional traders who

When it comes to security and safety of funds, this Cyprus regulated broker does offer everything required in order to ease traders’ minds about their capital. The regular hype regarding the MT4/MT5 platform exists which appears to be common amongst many brokers who seek market share in the low-to-mid section of the Forex market. VPS hosting is provided for a hefty price tag which is a true shame in today’s marketplace.

Trading conditions improve a great deal in the “Elite” account which may even warrant some to overlook the range of shortcomings at NBH Markets EU LTD. Since MAM accounts are offered, this could be a great match for account managers who have enough AUM to get an “Elite” account and if the managed account is a pure-play Forex portfolio. Again, there is nothing wrong with this broker; but plenty of work required in order to elevate it to the upper midfield. This could be a diamond in the rough, with a good foundation and potential to polish up its overall approach in order to compete with other Forex brokers who have been around a bit longer.

FAQs

Where is NBH Markets EU LTD based?

NBH Markets EU LTD is headquartered in Limassol, Cyprus.

How does NBH Markets EU LTD make money?

NBH Markets EU LTD earns its money through spreads, commissions and smaller charges on deposits and withdrawals. It also charges a monthly fee for its VPS service.

How can I deposit into an NBH Markets EU LTD account?

NBH Markets EU LTD offers a range of payment options which include credit/debit cards, eWallets and bank wires.

What is the minimum lot size at NBH Markets EU LTD?

NBH Markets EU LTD has a minimum lot size requirement of 0.01 standard lots for Forex pairs.

When does a margin call take place at NBH Markets EU LTD?

NBH Markets EU LTD issues a margin call at 100% with an automatic stop out at 70% in all three accounts.

Is NBH Markets EU LTD regulated?

NBH Markets EU LTD is registered in Cyprus with the registration number 291974 and authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with the license number 208/13.

What is the maximum leverage offered by NBH Markets EU LTD?

NBH Markets EU LTD offers maximum leverage to retail traders at 1:30 while professional traders can qualify for a higher leverage.

How do I open an account with NBH Markets EU LTD?

NBH Markets EU LTD has an online application form which is standard operating procedure.

Does NBH Markets EU LTD offer the MetaTrader Trading Platform?

Yes, NBH Markets EU LTD offers the full suite of the MT4 and MT5 trading platforms.