Tradeo Editor’s Verdict

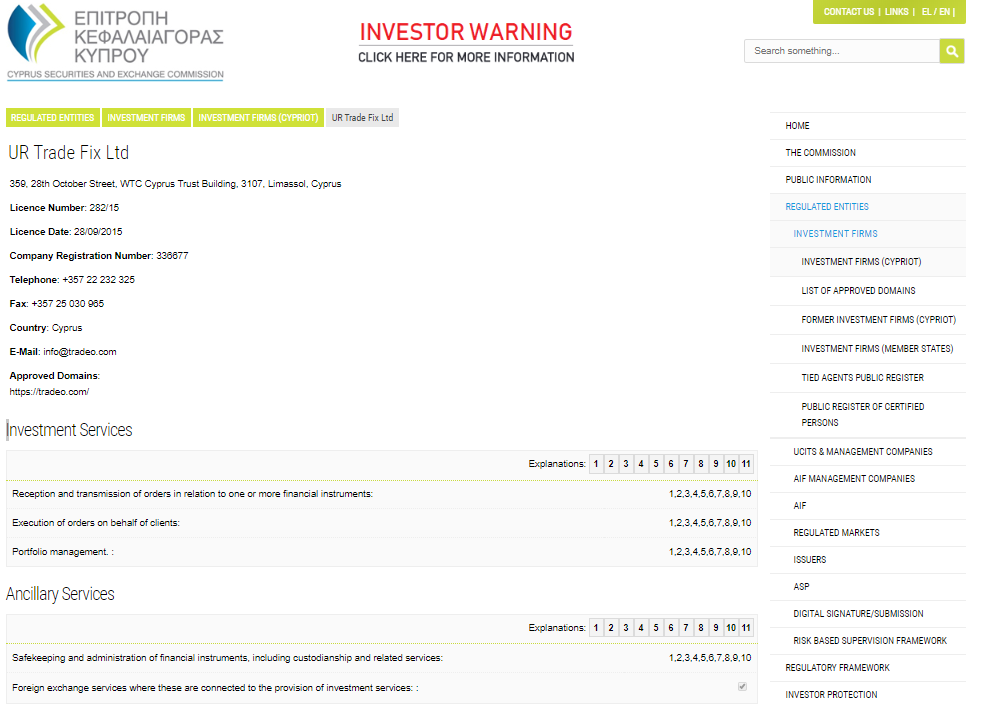

Tradeo is an online Forex and CFD brokerage that we’ve reviewed at length. The Tradeo review found here includes our findings, including the positive and negative aspects of using this brokerage. UR Trade Fix LTD operates Tradeo.com. UR Trade FIX LTD is a Cyprus Investment Firm (CIF) which is supervised and regulated by the Cyprus Securities and Exchange Commission (CySEC). It holds the CIF license number 282/15 and the company registration number is HE336677.

Overview

UR Trade Fix LTD is part a holding group, Tradeo ST PTE LTD which is registered in Singapore with the registration number 201728941H.

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Year Established | 2011 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $250 |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Tradeo.com Homepage

Regulation and Security

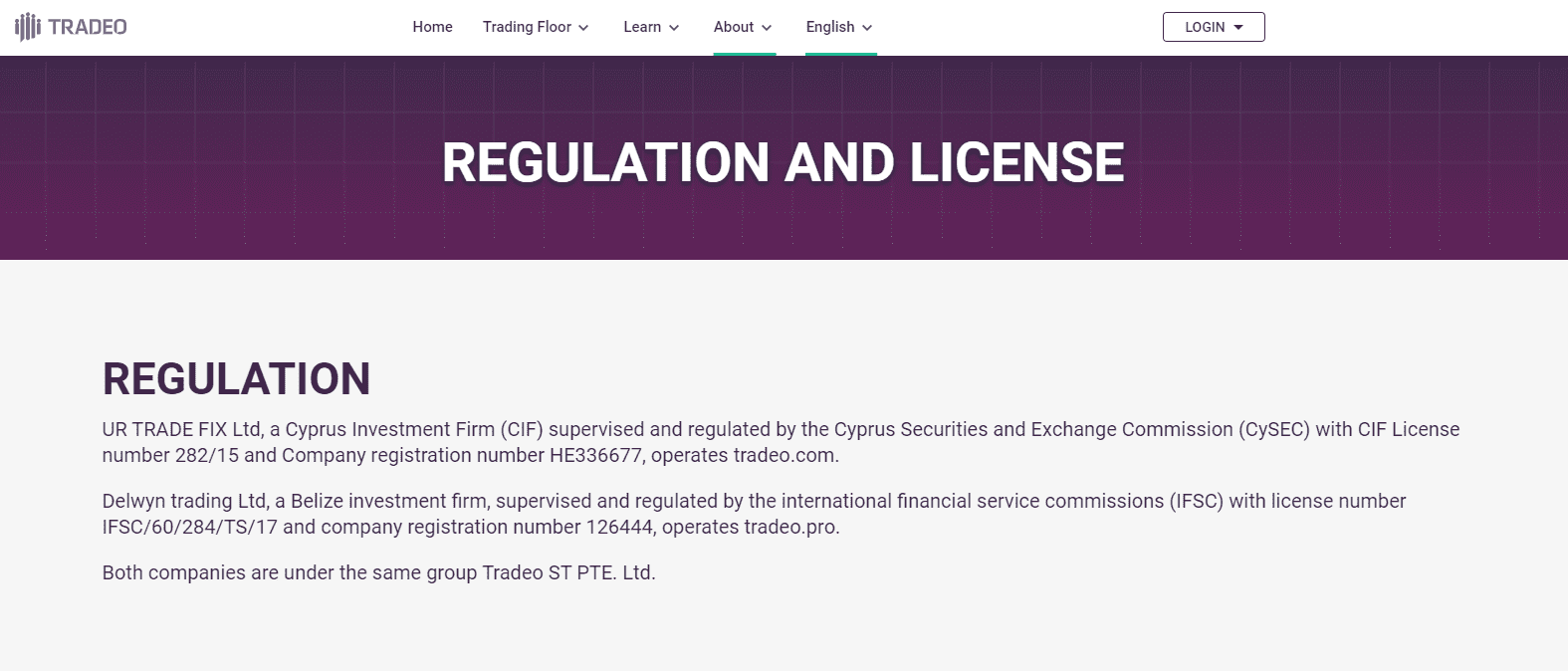

As mentioned earlier in this Tradeo review, this brokerage is regulated by CySEC, one of the most popular European regulatory bodies.

Tradeo's holding company holds CIF license number 282/15 and the company registration number is HE336677.

Tradeo.com is subject to the rules and regulation of Cyprus as well as the EU. This includes Markets in Financial Instruments Directive (2004/39/EC) or MiFIID. It has been in effect since November of 2007 which was updated in January of 2018 with MiFID II/MiFIR. It also includes the 4th Anti-Money Laundering Directive passed in June of 2015 and UR Trade Fix LTD published the Pillar III Disclosures on their website while also participating in the Investor Compensation Fund (ICF).

From a regulatory point of view, Tradeo.com is in full compliance, which means that this Forex broker is unable to offer the high leverage and attractive bonuses offered by brokers that are regulated in other (non-European) jurisdictions or are not regulated at all. That being said, despite these limitations, Tradeo's traders will enjoy stronger protection than those trading with brokers that have more relaxed (or no) regulation.

The broker also operates a global brand, Global.Tradeo.com, which is regulated by South Africa's Financial Services Provider (FSP).

Negative Balance Protection

Traders with Tradeo enjoy the peace of mind that comes from knowing their trading is safeguarded by our Negative Balance Protection, protecting their trading accounts from falling into negative territory.

Fees

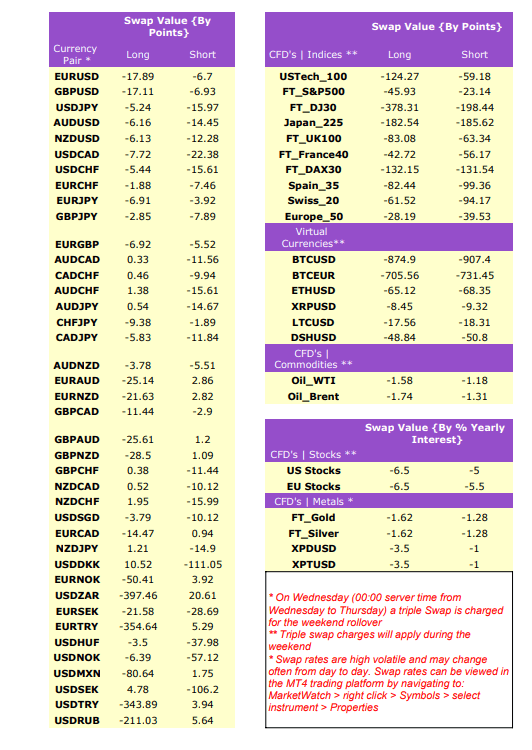

Tradeo.com generates the majority of its income from a mark-up on spreads, the difference between bid and ask prices. The broker operates an STP (Straight Through Processing) model which means that orders are send directly to liquidity providers who offer the best price/execution. Unlike market makers, Tradeo.com doesn’t trade against its clients. The firms also states that it doesn’t charge any commissions on trades. Spreads start as low as 0.9 pip and increase depending on the liquidity as well as asset traded. Swap fees are applicable on overnight positions.

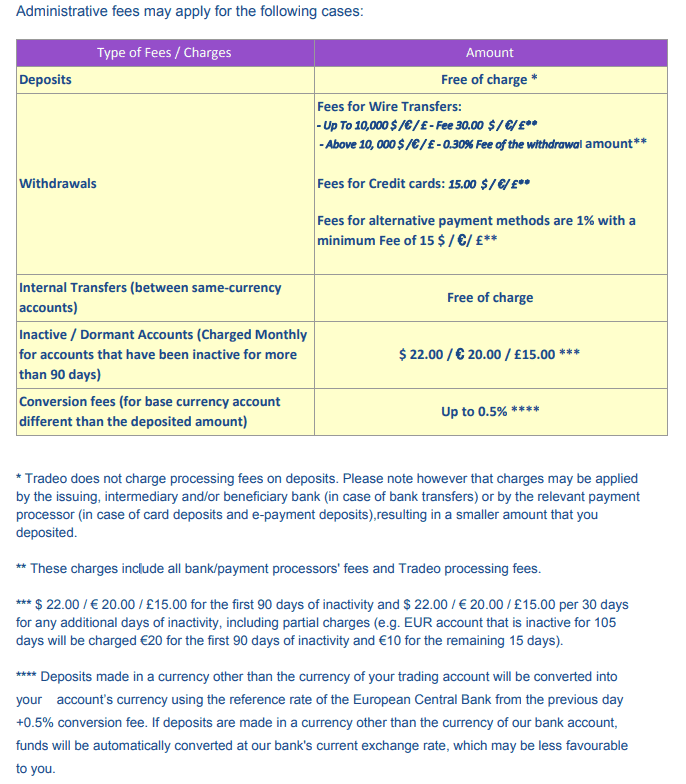

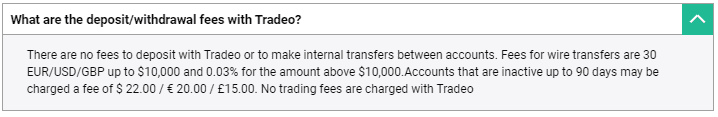

Fees on deposits from Tradeo.com are waived, but third-party fees are still applicable. Withdrawals face different fees which depend on the amount requested and the method use. They start as low as $/€/£15 for credit card withdrawals and as low as $/€/£30 for bank wires under $/€/£10,000 while withdrawals above $/€/£10,000 are charged at 0.30% of the total amount. Online payment processor fees start at 1% of the total amount with a $/€/£15 minimum. Tradeo.com also charges an inactivity fee if the account was dormant for 90 days in the amount of $22/€20/£15 which is standard in the industry. A 0.5% conversion fee is also charged for transaction different than that from the account base currency.

Overall, Tradeo.com's fees are on the high side, but remain firmly within the range of normal for most retail Forex brokers.

What Can I Trade

Tradeo gives you the chance to trade on multiple Forex Pairs, CFDs on global Indices, leading Stocks and Indices, as well as the most popular Commodities from several sectors. Tradeo also offers trading on the most popular Cryptocurrencies, including Bitcoin, Ripple, and Ethereum.+

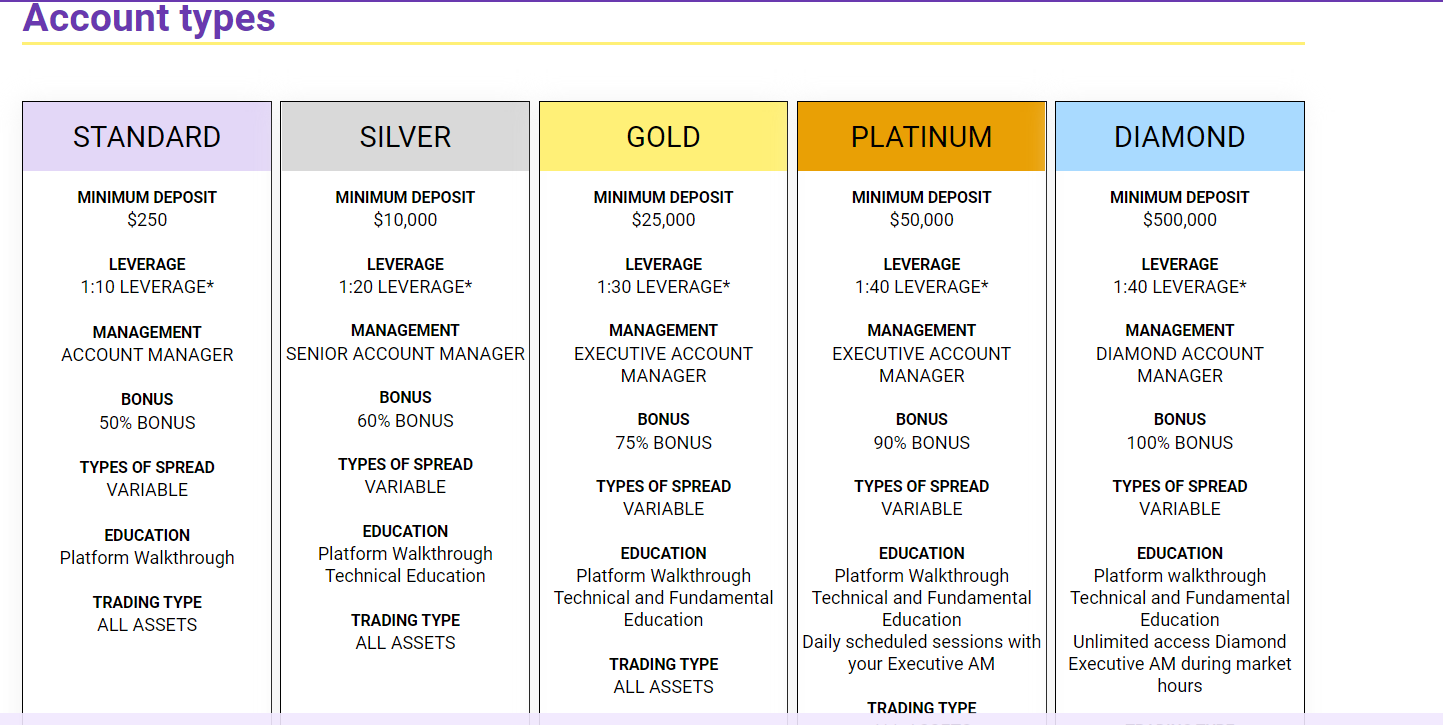

Account Types

Tradeo has five different account types including: Standard, Silver, Gold, Platinum, and Diamond accounts. The minimum deposit is $250 and the maximum leverage is 1:30 as required by CySEC. The Standard account is listed as having leverage of 1:10. Swap free Islamic accounts are available upon request.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

At one point, Tradeo was pushing it's Trade Z platform, though upon an update of this Tradeo review, information about that proprietary platform became scarce. The company now pushes the MT4 platform which is the industry standard, as well as being the most popular out-of-the-box trading solution.

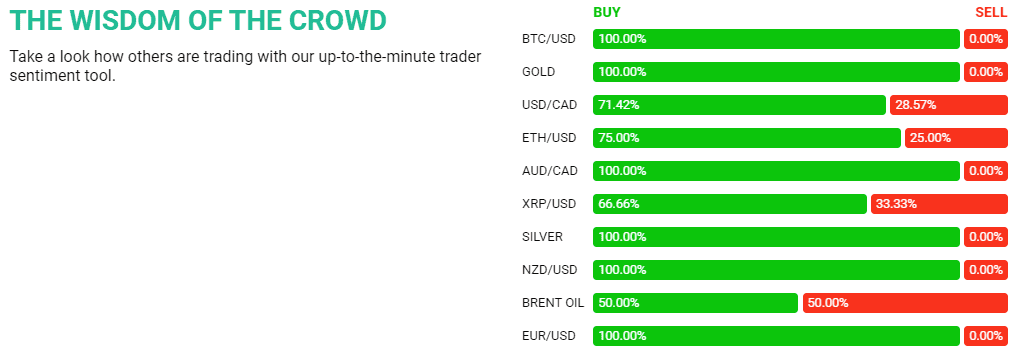

Unique Features

The most notable feature we found during this Tradeo review is that the Tradeo Z Web Platform comes equipped with a sentiment indicator. Tradeo.com refers to this as the “Wisdom of the Crowd”. This only takes into consideration trades taken in their Tradeo Z Web Platform and should be viewed with a healthy degree of skepticism as far as smart trading decisions are concerned.

Trade Calculators

A unique selection of trade calculators, designed to take the sting out of trading. Need to work out Fibonacci retracements and extensions? Trying to set your take profit levels? Use our trade calculators, and the answers are right there for you!

Interactive Economic Calendar

Not all economic calendars are created equal, and the Tradeo calendar is an entirely new take on how to present the events driving the markets. With a brand new visual layout and advanced search filters, you can drill down to the exact events you want to track.

Research and Education

Tradeo's education section consists of daily market updates including charts and analysis, and was a welcome, positive finding during our test of the brokerage. The insights were useful and can offer significant support for traders who want to get an expert's opinion about market movements.

A personal account manager is mentioned together with a wealth of educational videos, but little information was available.

Trader Education

A comprehensive library of video tutorials covering every aspect of trading Forex and CFDs, from the basics to advanced topics like technical analysis and the use of indicators in your trading.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |

While customer support is something most traders usually never require, given the number of red flags with this broker it may become one of the most used features. Those Forex traders willing to take their chances and look beyond all the issues may require sufficient customer service. Tradeo claims to have world class customer service available 24/5, but since not all claims on the website have proved to be accurate, we recommend testing the company’s customer service before depositing, to make sure they’ll offer what you need.

E-mail and phone options are available for contact purposes and a basic FAQ section provides a small glimpse into the company’s workings.

Bonuses and Promotions

Tradeo.com doesn’t offer any bonuses or promotions to traders in keeping with regulatory requirements.

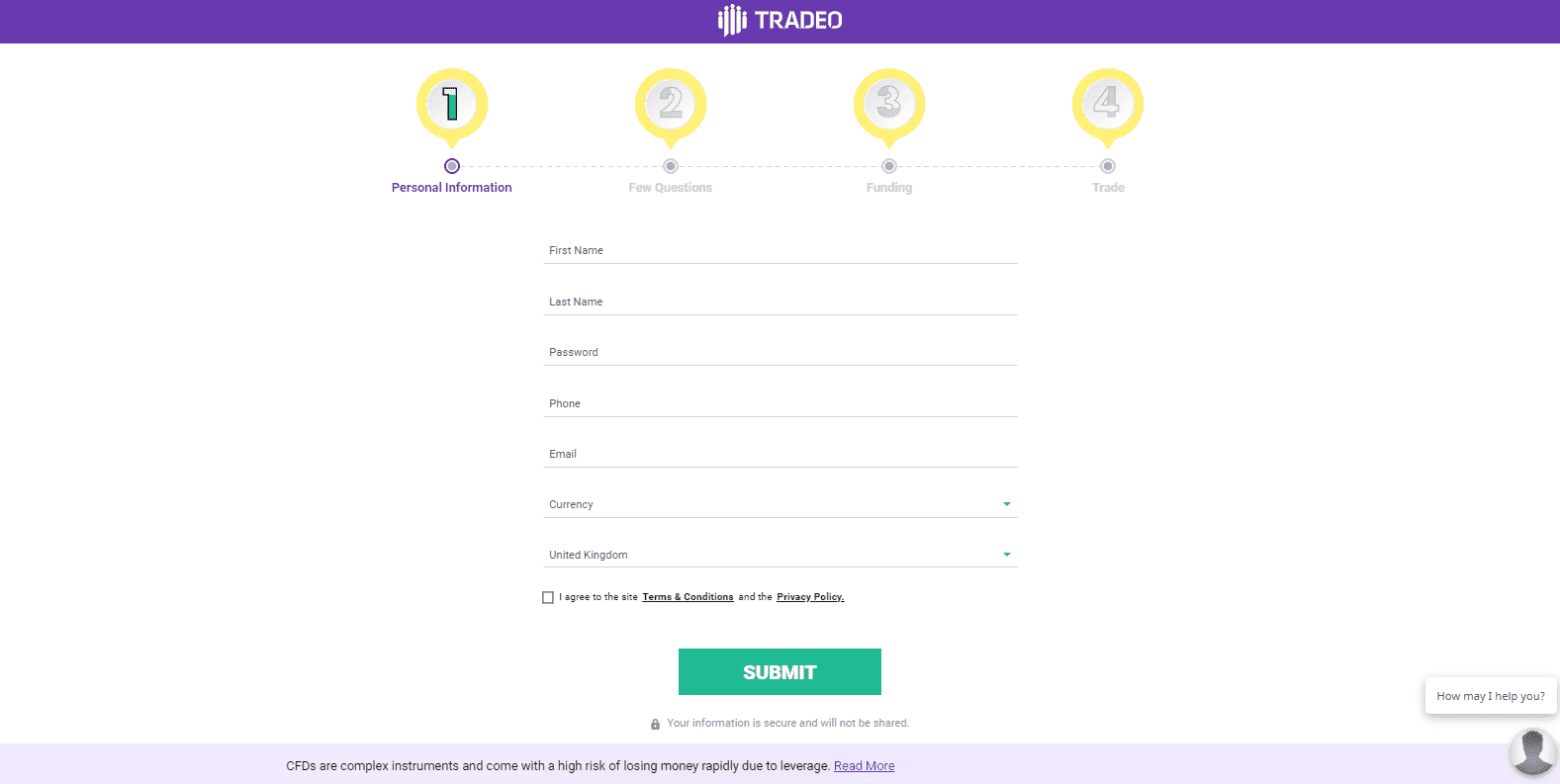

Opening an Account

Opening an account is done through an online form as is common practice in today’s marketplace. Tradeo claims it will take less than five minutes to open an account. Given the CySEC regulatory environment under which Tradeo.com operates, AML and KYC requirements should be provided and confirmed before trading commences.

Deposits and Withdrawals

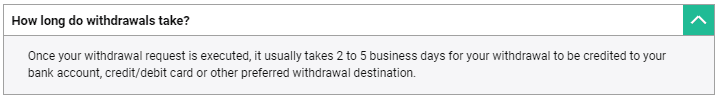

Tradeo.com states that it accepts all major credit and debit cards, wire transfers as well as e-wallets Skrill and Neteller. Depending on location, regional options may be available to traders. Deposit fees are waived which is basic industry practice, but withdrawal fees apply.

Summary

Tradeo.com is a regulated Forex broker in Cyprus and enjoys the regulatory body of the EU, as well as regulation in South Africa.

The bright spot with this broker is the range of assets offered. A suitable market research section is also a strength. Traders who are ready to test Tradeo's service can do so with a low minimum deposit and can see for themselves why this brokerage has endured while so many others have folded.

FAQs

Where is Tradeo.com based?

Tradeo.com is headquartered in Limassol, Cyprus.

How does Tradeo.com make money?

Tradeo.com makes money from spreads in currency pairs as well as from fees charged relating to withdrawals and inactivity.

How can I deposit into an Tradeo.com account?

Tradeo.com offers credit and debit cards, bank wires, Skrill and Neteller.

What is the minimum lot size at Tradeo.com?

Tradeo.com has a minimum lot size requirement of 0.01 standard lots for currency pairs while other assets classes start at a minimum lot size of 1.0.

When does a margin call take place at Tradeo.com?

Tradeo.com issues a margin call at a 50% Equity-to-Margin ratio as stipulated in the EU and enforced by CySEC.

Is Tradeo.com regulated?

Tradeo.com is regulated in the Cyprus Securities and Exchange Commission (CySEC).

What is the maximum leverage offered by Tradeo.com?

Tradeo.com offers a maximum leverage of 1:30 in all accounts.

How do I open an account with Tradeo.com?

Tradeo.com offers a quick and digitized online application form.

Does Tradeo.com offer the MetaTrader Trading Platform?

Tradeo.com offers their own Tradeo Z Web Platform as well as the MT4 trading platform, with a strong emphasis on their Tradeo Z Web Platform.