What is a Hammer Candlestick?

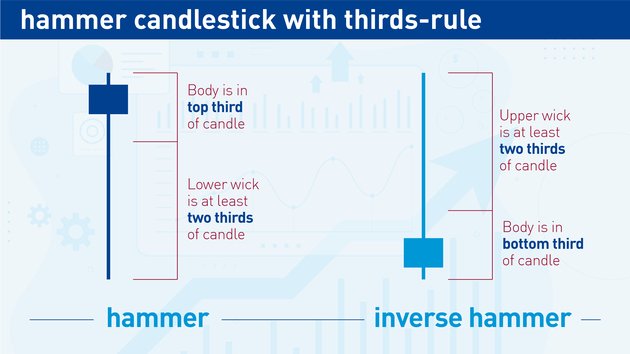

There are two characteristic features of any hammer candlestick:

It has a small real body which is near either the top or bottom of the candle, i.e., not in the middle of the candle.

A long wick extends from the top or bottom of the body.

All traders agree upon these two features as the definition of a hammer candlestick. There is a third rule I like to apply:

The real body is within the top or bottom third of the candle.

Not all traders use this additional rule, but it allows me to be more objective, which helps my trades be more precise.

Hammer Candlesticks

Hammer candles are one of the easiest candlestick patterns to identify on a price chart. If this is your first time learning about them, you’ll now see them everywhere on your charts!

Top Forex Brokers

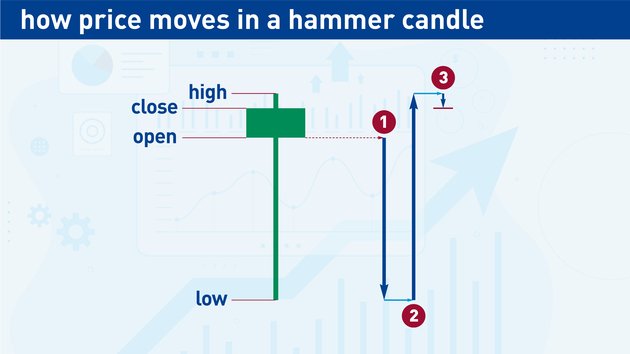

To better understand hammer candlesticks, let’s look at how price movement creates one.

How Price Movement Forms a Hammer Candlestick

When the candle opens, selling drives the price down away from the open.

As the price drops, new buying steps in and overcomes the selling causing the price to rebound.

The price eventually settles near where the candled opened, resulting in a small body with lots of price action beneath it.

The above diagram is a simplified example of how a hammer candlestick is formed, and of course, real price action is usually messier in real life. However, you can take any hammer candle on a chart and go to a lower timeframe to see how the price moved to form the candle. Let’s do that right now!

Here’s an example of a hammer candlestick formed on an S&P 500 Index daily chart:

Hammer Candlestick on a Daily Price Chart

Let’s drop down to a 15-minute price chart covering the same period to see how the price moved intraday to form the hammer candlestick on the daily chart:

Price Action Forming Hammer Candlestick on a Higher Time Frame

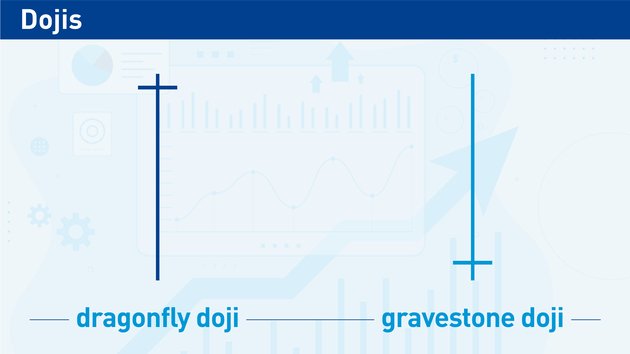

Hammers & Dojis

When a hammer candlestick has an open and close which are equal (or almost equal), it is also a type of “Doji” candlestick:

Hammer Candlesticks Can be Doji Types

- A Doji with the open & close near the top is called a “dragonfly doji.”

- A Doji with the open and & close near the bottom is called a “gravestone doji.”

For practical purposes, I treat hammers and dojis the same way in my trading. When I refer to hammers in this article, I’m also including the above two types of doji candlesticks.

Why are Hammer Candlesticks Important?

Hammer candlesticks indicate a potential change in price direction—one of the most valuable things a trader can identify, because it provides an opportunity to enter a trade very early in a price reversal.

The following two factors determine whether a hammer candle is either bullish or bearish:

The direction of the wick

The price action occurring just before the hammer candlestick

To help us understand these factors, let’s look at case studies of hammer trading.

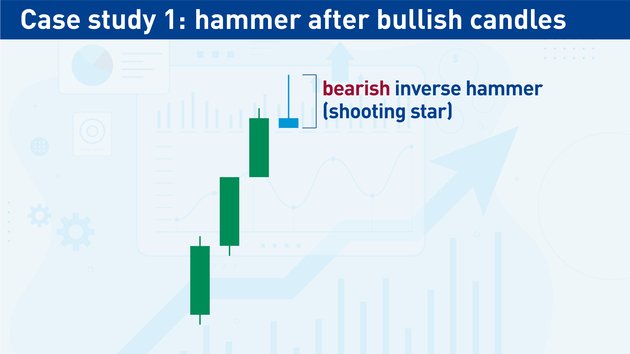

Case Study 1: Inverted Bearish Hammer / Shooting Star Candlestick

Bearish Inverted Hammer / Shooting Star

After a series of bullish candles, the price initially continues to move higher with another bullish candlestick but selling brings the price back to near the candle’s open, creating an inverse hammer candle. This suggests that the previous bullish momentum may pause or reverse.

This type of hammer candlestick is known as a “shooting star.”

Case Study 2: Bearish Hammer / Hanging Man Candlestick

Bearish Hammer / Hanging Man

After a series of bullish candles, the price retraces down. However, enough buyers step in to bring the price back to near the open, creating a hammer candlestick. The selling before the price rebounded suggests the bullish momentum is now weak. I pay more attention to this type of hammer candle when its body is bearish, i.e., the price closed below its open.

This type of hammer candlestick is known as a “hanging man.”

Bullish Hammer Candlesticks

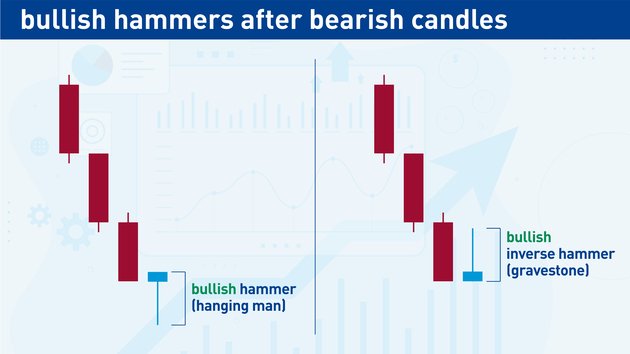

We have shown the above hammer candlesticks after a series of bullish candles, but the same logic applies after bearish candles:

Bullish Hammers After Bearish Candlesticks

Hammer Trading with Support and Resistance Levels

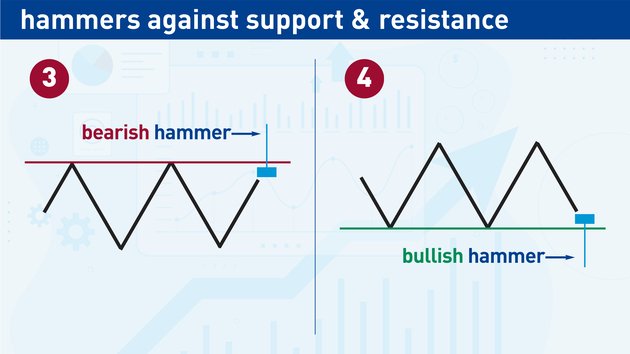

Now let’s look at hammer candles when they appear located against and rejecting support or resistance:

Hammers Candlesticks Rejecting Support or Resistance

A hammer candlestick rejecting a support level is a bullish signal because it shows that buying is stronger than selling in that area.

An inverted hammer candlestick rejecting a resistance level is a bearish signal because it shows that selling is stronger than buying in that area.

In the above diagrams, the wicks pierce the support and resistance levels. However, the hammer candlesticks are just as valid if the wicks only touch the support or resistance levels or even fall a little short of them.

When I trade hammer candlesticks which are rejecting support or resistance levels, I find the signal more valid when the closing price of the hammer candle is either above the support level or below the resistance level (as shown in the above diagram).

Strong vs. Weak Hammer Candlestick Patterns

Some hammer candlesticks are stronger signals than others. Let’s look at which factors tend to affect their strength.

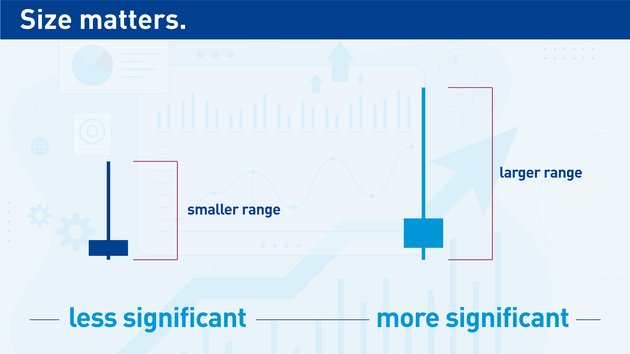

Size of Hammer Candlesticks

Longer hammer candles with longer wicks are stronger than short hammers with short wicks. This is because longer candlesticks cover more price and so usually contain more order flow and activity.

Size Matters in Hammer Candlesticks

At a minimum, I always want a hammer candle to be as big as the recent candles on the chart if I am going to use it as an entry or exit signal in my trading.

Consecutive Hammer Candlesticks are Strong

I have found that hammer candles next to each or close to each other are a powerful sign that price may turn around. For example, I take seriously two or three consecutive hammers next to each other at a support level because they tell me that the level continues to hold despite the price making multiple attempts to break it down.

Be Selective on Small Timeframes

In timeframes below H4, you often see a lot of hammer candlesticks because it does not take much price activity to create them. E.g., a Forex hammer pattern on a 5-minute chart might only have a 10-pip range. That hammer candlestick can happen randomly! If you see a lot of hammers on your chart, especially on short timeframes, be selective and focus on only the larger hammer candles that appear at significant price levels, such as support and resistance levels.

Hammer Formations with Price Action

Always include the context of price action with hammer trading. In other words, do not trade hammer candlesticks blindly! The best way to show how you can interpret hammer candlesticks in conjunction with price action is to look at some real trading examples.

Example 1: Short Signals on EUR/USD

Bearish Hammer Candlesticks

After a steep fall in the EUR/USD currency pair, shown near the beginning of this daily chart, the price pulls back, and two consecutive inverse hammers appear. That tells you that the pull back is probably over, and the hammer candles give you a short entry signal.

Later, a new resistance level forms at a lower price. A new hammer appears rejecting this resistance, giving you another short entry opportunity.

Example 2: Catching the top of the S&P 500 Index

In this case, we see a short entry near an all-time high made by the S&P 500 Index. Normally, catching the beginning of the trend is a very hard thing to do, but here’s how you might do it.

Hammer Candlesticks and Role Reversal Resistance

Let’s walk through the above diagram step-by-step.

Point 1: The S&P 500 Index begins to trade sideways after trending up for months. A prominent hammer with a long wick appears, making a support level in the sideways range.

Point 2: The price breaks the support that the wick of the hammer created. The market then sells off steeply with large bearish candlesticks. We now suspect a new downtrend is beginning, but we need confirmation and a safe point at which to enter a short trade.

Point 3: The support level created by the first hammer is now a resistance level with a new inverted bearish hammer. This new hammer is not large, but it is significant because it lines up with the previous support level. Some traders may decide this is enough confirmation to enter a short trade. When I saw this in real-time on the chart, I wanted extra confirmation because the market had previously been in a strong uptrend for months and could easily return to it.

Point 4: A prominent bearish engulfing pattern lined up with the resistance level. An engulfing pattern is a candle with a long body and short wicks followed immediately by a similar candle (but pointing in the opposite direction) whose body covers the previous candle.) Due to all the previous price context, this gave me a clean short entry signal.

Pro tip: if you are uncertain about the price action, spend time describing it in words to help give it clarity.

Final Thoughts

The hammer candlestick in Forex or any other market is easy to spot and analyze. You can use well-sized and positioned hammer candlesticks to enter within an existing trend or right at the first reversal signifying the beginning of a new trend.

When you see a hammer candlestick, look at the price action context to help you read the significance of the candle. With practice, you can find superior entries with excellent profit potential.

The best hammer candlesticks are at least as large, or ideally larger, than the several candlesticks immediately preceding them. One rule of thumb used by traders is to only act on hammer candlesticks with larger bodies (including both the wick and the real body) than any of the five preceding candlesticks.

Position is also extremely important when analyzing hammer candlesticks. When they are rejecting obvious support or resistance levels, they can be especially powerful signifiers of reversals. Additionally, when the immediately preceding and subsequent candlesticks emphasize the reversal, it is more likely to be a major one.