Forex swap is often overlooked in trading. I rarely see traders mentioning it when discussing potential positions in the market. In fact, many traders only discover Forex swap by accident when they see the debits & credits on their trading statements.

Forex swap can have a real dollar impact on profit or loss, particularly for long-term trades.

In this article, I explore what is Forex swap, how it’s calculated, when it’s charged, and how you can factor it into your trading to avoid unexpected losses.

Top Forex Brokers

The Forex Swap Explained

What is Forex swap? Forex swaps are interest payments that I either earn or pay for holding a trade from one day to the next (i.e., overnight). Forex swap is also known as overnight fees, or more traditionally rollover or carry because the currency has “rolled over” from one day to the next, or to put another way, I have “carried” the trade from one day to the next.

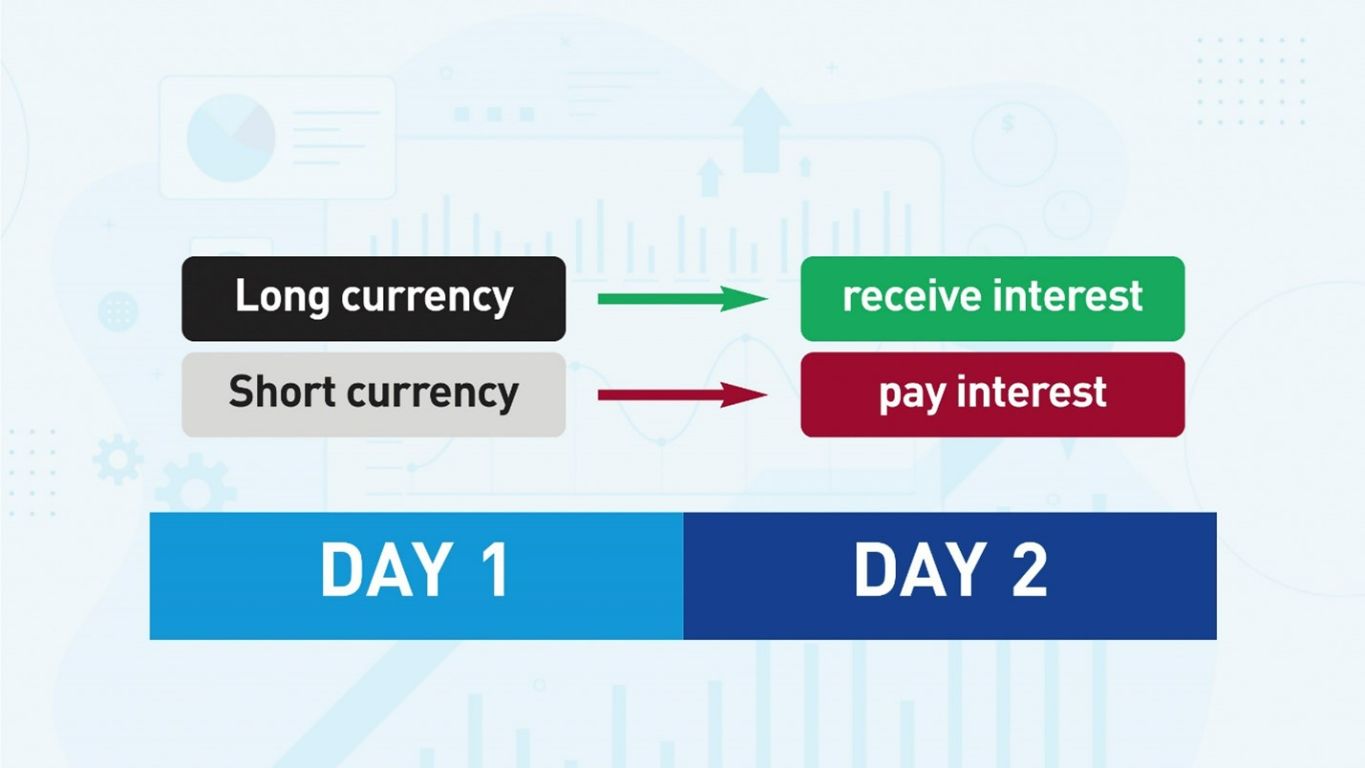

When you enter a Forex trade, you buy one currency using another currency. Every central bank around the world has an interest rate that it applies to their currencies. If I buy a currency and hold it overnight, I earn that currency’s interest rate. If I sell a currency, I owe the interest rate on that currency.

Let’s say I go short EUR/USD. I owe the Euro interest rate and receive the US Dollar interest rate.

The story is a little more complicated here, as the interest rates that are used are not the rates charged by the relevant central banks, but the market’s implied interest rates. These are known as tom/next rates, which determine the respective interest rates used in the Forex swap calculation.

So, the swap is the interest received on the long currency (USD) minus the interest owed on the short currency (EUR).

The difference or Forex swap rate can be positive or negative.

When Are Swaps Charged?

When Are Swaps Charged?

Brokers charge swaps once a day.

Most brokers charge swaps between 23:00 and 0:00 “server time,” which will vary from broker to broker but is often 5pm New York time.

Ask your broker’s support team if you are unsure about when a broker charges swaps.

If I have a trade open during the swap charge, there will be a swap credit or debit on my account (depending on whether the difference between interest rates is positive or negative).

If I open and close a trade but not over the swap time, i.e., an intraday trade, the broker does not charge a swap.

Most brokers update their swap fees once or twice a week.

It is worth noting that some brokers calculate swaps on a minute-by-minute basis instead of once a day, but this is rare. Again, check with your broker on when they charge swaps.

Weekend swap fees.

Brokers also charge a “weekend swap” fee to compensate for trades held over a weekend. Most brokers charge this on a Wednesday, but some charge it on a Friday. Weekend swap rates are triple the daily swap rate.

How Can You Calculate the Swap Rate?

There are several factors that go into a Forex swap calculation, and traders normally use a Forex swap calculator rather than doing the calculation by hand.

Most brokers have a Forex swap calculator. Alternatively, it is easy to find a free Forex swap calculator online.

The basic swap calculation starts with:

- The interest rate of the long trade multiplied by the lot size.

- Subtract the interest rate of the short trade.

- Divide the answer by 365 to give a daily swap rate.

A Forex swap calculator allows you to enter the currency pair, the account base currency, and it then gives a swap rate for a long trade and a short trade. The calculator often expresses the answer in pips. This way, it is easy to see how positively or negatively a swap rate will affect a trade.

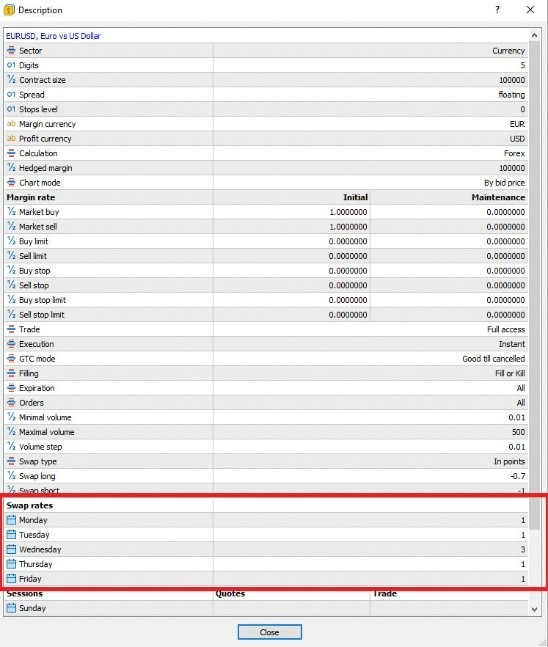

Swap Rates in MetaTrader 4 and MetaTrader 5

MetaTrader has a built-in option for users to find their broker’s swap rates for any currency pair. Simply follow these instructions:

- Right-click on any instrument in the ‘Market Watch’ window.

- Left click on the ‘Specification’ option from the dropdown menu.

- A new window will open, showing the long and short swap rates for the selected pair.

You can also see the swap rates in the terminal window of the MetaTrader platform.

Long-Term and Short-Term Trading

Since brokers charge swap rates daily, the hold time of a trade becomes a factor in how much swap rates affect profitability. There are no swap charges for intraday trades that do not go over the swap time (unless the broker charges swap rates on a minute-by-minute basis, which is rare).

Typically, for trades open for less than a week, the swap will be insignificant compared to the overall profit or loss of a trade. But when we are talking about swing or position trades, which are held for weeks or months, the swap becomes a major component affecting profit or loss. At that point, I recommend calculating swaps and knowing in advance if the Forex pair and direction (i.e., long, or short) has a positive or negative swap.

Swap-Free Trading Accounts

Many brokers now offer swap-free accounts to cater to religious parameters in finance, particularly Islamic finance which prohibits the payment of interest. For that reason, the industry refers to swap-free trading accounts as “Islamic” or “Shariah” accounts.

In swap-free accounts, instead of an interest-based rollover payment, the broker charges a fixed fee. This fee is always a debit on the account regardless of whether the Forex pair normally has a positive or negative swap rate.

In practise, anyone can open an Islamic account—brokers do not usually require proof that a customer follows a particular religion.

Futures Rollover—A Special Case

When traders refer to “futures rollover,” they do not mean it in the same context as Forex swap or rollover.

Forex is a spot market, also known as a cash market, meaning the currency is traded for immediate delivery. If you buy shares, these are also a spot or cash market.

On the other hand, futures contracts are derivatives designed to deliver underlying assets at a future date, known as the “expiration date.”

There is a settlement process when the futures contract reaches its expiration date. The contract can either be settled by cash or by physical delivery. Most futures contracts are cash settlements.

Traders “roll over” futures contracts by switching from the nearest expiration date before reaching it to one further out. This avoids the costs and obligations associated with the settlement of the contracts at the expiration date.

Currency Swap Strategy

A currency swap trading strategy, also known as a “carry trade,” tries to take advantage of large interest rate differences between currencies, which can result in high swap rates.

The idea in a currency swap trading strategy is to go long of a currency with a high interest rate and go short of a currency with a low interest rate. This gives the trader a guaranteed positive swap rate paid continuously. The trader will profit unless the price of the underlying pair or cross goes against the entry by more than the profit from the swap.

I personally feel that carry trades are limited. Let’s say I go long a Forex pair as a carry trade to pocket the swap. I have a guaranteed swap rate crediting my account every day.

However, the price of the Forex pair will not remain static. If the price goes down, the value of my trade may go down by more than the value of the swap.

It is also true that since 2008, when major central banks started to cut their interest rates to almost zero or in some cases even lower than that, it has been hard to find many currency pairs or crosses that represent a large interest differential.

That said, I can consider currency swaps when I trade. I may decide not to take a long-term trade on a certain Forex pair because it means having a high negative swap. Or I may look for trades with a high positive swap but only take them if I also feel strongly that the Forex pair’s price will move in my direction.

Bottom Line

Traders often overlook Forex swap / rollovers, but they should not as it will impact the profitability of any trades held overnight.

Forex Swap is the interest received on the long currency minus the interest owed on the short currency in an open trade held at the time of the rollover (usually 5pm New York time on weekdays).

A Forex swap calculator can work out the swap rate for a trade, so you don’t have to do the math manually. Brokers also usually present the current swap rates on their trading platforms, for example, MetaTrader.

Islamic or Shariah accounts, which do not accept interest-based payments, replace the swap rate with a fixed fee. This fee is always a debit on an account, even if the trade normally receives a positive swap rate.

Futures rollovers are not the same as Forex rollover. Futures rollover is switching contracts to a further expiration date before the current contract expires.

Carry trades aim to take advantage of swap rates, but any Forex pair or cross can still go against the direction of the trade, wiping out any benefit from receiving the swap.

In short, Forex swaps are mostly a concern for longer-term traders, who should factor in current swap rates into the expectancy of their trading strategy.

When Are Swaps Charged?

When Are Swaps Charged?