With the fast pace of financial markets, where opportunities and risks lie around each corner, why would a long-term strategy like position trading be so popular? Its appeal is essentially because the biggest profits over the long term come from being right and sitting tight, although Forex markets rarely exhibit the type of long-term moves seen in equity and, to a lesser extent, commodity markets.

In this article, we examine what a position trading strategy is, who it is for, and how to execute it.

What is Positional Trading?

Position trading includes taking long-term positions in assets such as stocks, currencies, commodities, and more. The position could be held for weeks, months, or even years in some cases. This is the opposite of day trading, where you need to be concerned about short-term volatility and market corrections.

A position trader is someone who buys an asset for the long term, with the expectation that its value will increase during that period.

Understand that a position trading strategy is unlike a “buy-and-hold” investment strategy. Buy and hold investors hold positions for a longer duration than position traders, maybe even until retirement. They invest to meet a long-term goal. On the other hand, a position trader identifies a trend, goes into a long position based on it, and waits for it to peak before getting out.

A Look at Position Trading Strategies

Positional trading strategies involve ignoring short-term market noise and focusing instead on the long-term picture. It needs a solid foundation in technical and fundamental analysis, since you will need to ignore short-term trend changes that can function as trading opportunities. This means identifying markets with narrow price ranges and well-defined trends.

Here are some popular positional trading strategies:

1. Support and Resistance Strategy

You can use support and resistance levels to find out whether an asset’s price will go into a downward trend or upward trend. This will help you decide whether to go long and try to gain from the long-term price increase or go short and try to benefit from potential prolonged price declines.

The support line creates a lower price limit and resistance is the upper price limit. Here is how you can identify support and resistance levels:

Historical price levels can be considered support and resistance for an asset. Past periods of significant gains and losses can be indicators of price direction.

Certain indicators like Fibonacci retracement levels can act as dynamic support and resistance levels.

Previous support and resistance levels can be indicative of future movements. When a breakout occurs, support and resistance lines can reverse their roles.

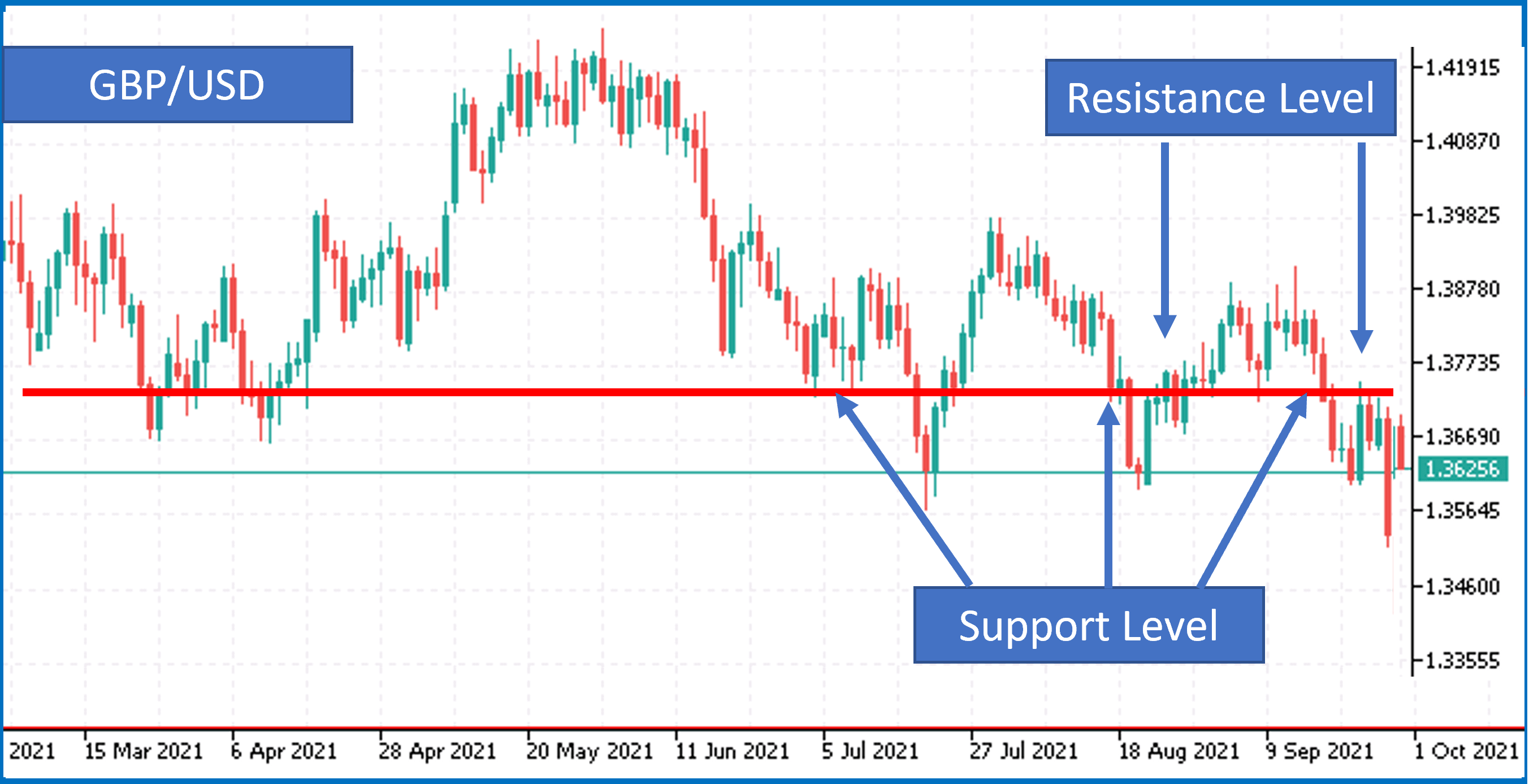

Example of a Support and Resistance Strategy

The first step is to draw the support and resistance zones on the chart. Drawing the zones is best done on a high time frame to look at the main reversal levels and see the critical levels clearly. Next, the support and resistance lines need to be drawn on the recent peaks and bottoms.

Support and Resistance Chart

A line that shows multiple historic touches by the price action can be considered more reliable, as it has clearly withstood the price action multiple times, and history tends to repeat itself on charts.

The next step is to wait for the price to touch a zone. It might take less time to hit these zones in a smaller timeframe, while on a larger timeframe, as should be used in position trading, it tends to take longer.

After the price touches the support or resistance, we need to watch the next candlesticks to see which shape it takes. As strong reversal candle will show that the price has reversed strongly, and the support or resistance level is likely to hold.

If the price breaks the levels, it could be a price breakout. Typically, a strong piercing candle will effortlessly break the level and continue in that direction. The next step is to wait for the candle to close when the price hits the zone. Here, we need to see the traits of the candle to determine the entry strategy. The qualities of a strong candle are:

Clear bullish or bearish candle

Long real body

Formed when price touched the level but didn’t break it

Engulfs the two previous candles

The entry should be made slightly above or below the strong candle in the desired trade direction. This can act as confirmation that the price will move in the expected direction. The stop loss could be placed at the other side of the zone, not too close to the level. This will give it some room to breathe.

2. Range Trading Strategy

If you have identified an oversold or overbought asset, range trading might work for you. The goal here is to go long on the oversold assets and short the overbought ones. The overbought asset here might be going towards the resistance level, while the oversold asset would be approaching the support level.

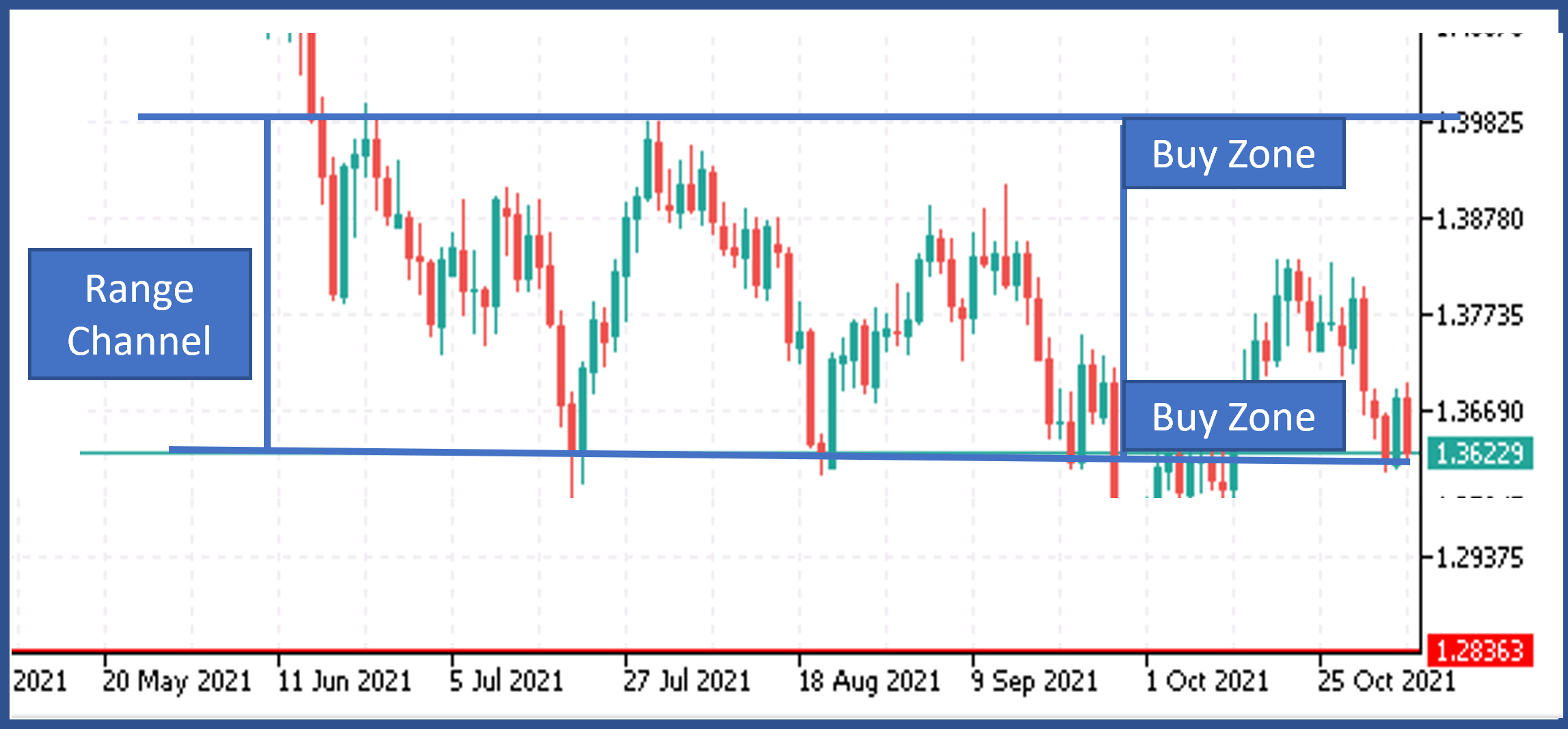

Example of Range Trading Strategy

There are many types of ranges on a chart, and the easiest ones to spot are the horizontal ranges. Here, you will see horizontal price movements between the upper and lower resistance lines. In the chart below, you can see the price moving between the upper and lower resistance lines, giving potential trade entry points.

Support & Resistance Trade Entry Points

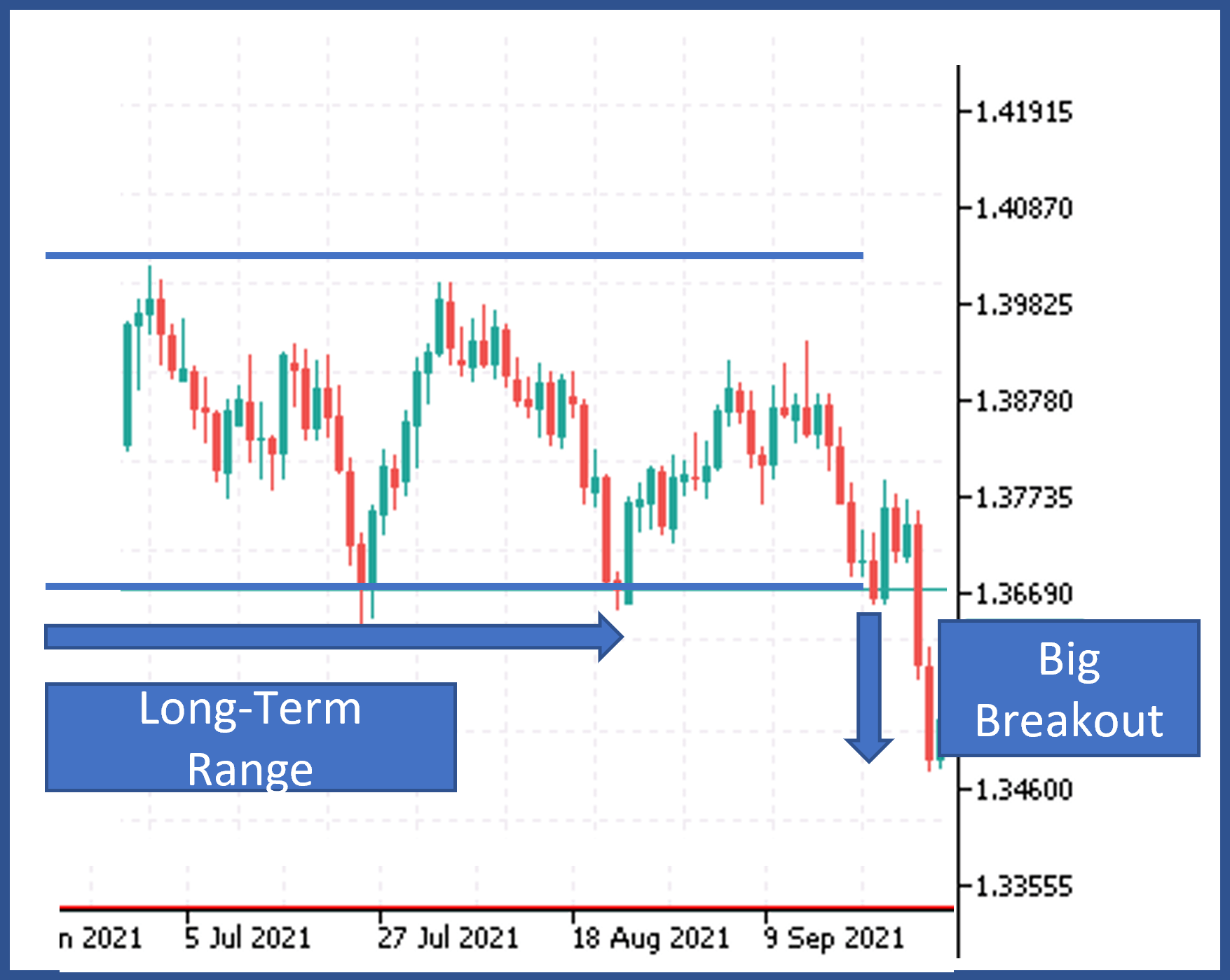

3. Breakout Trading Strategy

Here, you need to wait for the price line to cross the resistance or support level. A long position can be taken when a resistance level is broken, or a short position can be considered when the price breaks below a support level. However, make sure to open a position in the initial stages of a trend.

The market changes periodically, moving from ranges to trends. If a market has been ranging for a long time, it could breakout harder.

Breakdown Below Support Level

The price tends to stay above the 20-period Moving Average (MA) in a strong trend. The steps to trade breakouts in this case would include:

Entering a long position above the swing high

Placing the stop loss at 1 ATR (Average True Range) below the swing low

Exiting the position when the price closes below the 20-period MA.

4. Trading Around a Core Position

Trading around a core position includes taking a long-term position, but then buying and selling an asset as the market develops. It means taking a distinct perspective on risk, as and when, the market evolves and allows diversification by timeframe.

When an asset is traded in multiple time frames, you end up with a larger position in a single asset.

One of the best indicators for trading around a core position is the Moving Average (MA). Suppose you enter a long position for a stock, where the price goes below its 20-period MA but stays above the 200-period MA. Here, you could be taking advantage of a short-term weakness in a stock, while it continues its longer-term uptrend.

Position Trading Compared to Other Trading Styles

Swing trading involves taking advantage of upward and downward swings in asset price. The aim is to capture minor price movements within a larger trend. Most position trading strategies are like swing trading, where you can use similar indicators, charts, and candlestick patterns for entry/exits.

Position Trading vs. Swing Trading

Position trading involves holding an asset for an extended period. In swing trading, positions are entered and exited within days or a week or two. Swing trading tends to work better in quieter markets when prices typically rise and fall in wave-like patterns. In position trading, prices must begin a long-term bullish or bearish trend before you can make your move. Of course, even the best analysts are going to get that wrong much of the time, so position trading can require much patience.

Although swing trading might offer more potential trading setups within a specific timeframe, it might not be the best strategy for you if you cannot check your positions relatively frequently.

Position Trading vs. Day Trading

In day trading, you enter and exit multiple trades within the same day. This means short-term price fluctuations will be important for you to monitor.

Unlike position trading, day trading is a fast-paced strategy. You need strong risk management tactics to manage the volatility, and rapid decisiveness to enter/exit at the right time.

What are the Pros and Cons of Position Trading?

Advantages of Position Trading:

Since you hold a position for a lengthy period, your stop-losses should be wider. This should give more breathing space to your positions, rather than getting stopped out due to random market noise.

Position trading integrates fundamental and technical analysis to a larger extent than swing and day trading.

Psychologically you are potentially less prone to reacting to greed and fear which plagues many day traders.

It requires less monitoring so is not time intensive.

Disadvantages of Position Trading:

You will need longer-term capital commitments compared to other styles.

Overnight financing fees charged by most Forex brokers can erode the profit of long-term trades.

The longer-term the trading strategy, the “lumpier” the profits, so you will likely go through extended losing streaks.

Understanding the Position Trader

Position traders are trend followers. They hope a trend will continue over the long term, after it begins. So, they identify an asset that benefits from a trend and hold it till the trend peaks. This strategy is all about exploiting the bulk of a trend’s move, downwards or upwards.

A position trader relies extensively on fundamental analysis to identify assets that would rise in the long term. Technical analysis provides cues on potential trend reversals.

Tactics for Position Traders

Fundamental Analysis

You should look deep into the economy to understand which sectors of the market might perform well. Prevailing interest rates by central banks can determine the direction of currencies, equities, and even commodities.

Technical Analysis

Technical analysis involves studying chart patterns, price, and volume behaviour to see how long a trend might last. Based on them, you will need to decide your entry/exit points and stop-loss levels.

Indicators typically used in position trading include:

Simple Moving Averages (SMA) 50, 100, and 200-day

Fibonacci Retracement

Is Position Trading Right for You?

This depends mostly on how patient you are and how much capital you are prepared to tie up for prolonged periods.

A major element of position trading is that you will not make any profit until you are trading a market the trends strongly. I emphasize again, if your preference is for fast moves and you cannot endure losing streaks, position trading probably is not for you.

Position trading is also best executed with a broker and/or instruments that do not charge overnight fees, and you may not have the capital to access this. For example, a Forex broker might charge you 1 pip per day to hold an open long position in the EUR/USD currency pair. There would be little point in this scenario holding a position open for a year to make 365 pips. Micro futures are better but can be too expensive for many traders. ETFs can also be a more economical option although these tend to produce slightly worse returns that their spot equivalents.

Bottom Line

Position trading requires patience, commitment, and the ability to ensure long losing streaks – but the reward is high profits when the big trends finally arrive. In equity and commodity markets, position traders usually make the largest and easiest long-term profits, but as Forex markets tend to revert more to the mean, position trading is arguably not as effective as swing trading except in certain limited circumstances backed by strong fundamental analysis.

Position traders can also face the problem of charges applied by brokers daily against open positions and are best advised to either find one of the few Forex brokers offering highly competitive overnight financing fees (swaps) or no fee at all, or to use ETFs or futures as position trading vehicles. Islamic accounts which circumvent overnight fees can also be a good option.

FAQs

What is a Position Trading Strategy?

A position trading strategy involves entering a position when a trend begins and holding it until the trend peaks. This could take several weeks, months, or even a year.

How Much Do Position Traders Make?

This depends on the choice of asset, position size, leverage, and the impact of price movement. In equity and commodity markets, the easiest long-term profit can be made with position trading compared to other trading styles.

What is the Difference Between Swing Trading and Position Trading?

Swing trading aims to take advantage of interim lows and highs within a large overall trend. Swing traders usually execute a trade within weeks, contrary to position trading where positions are held for a longer duration.