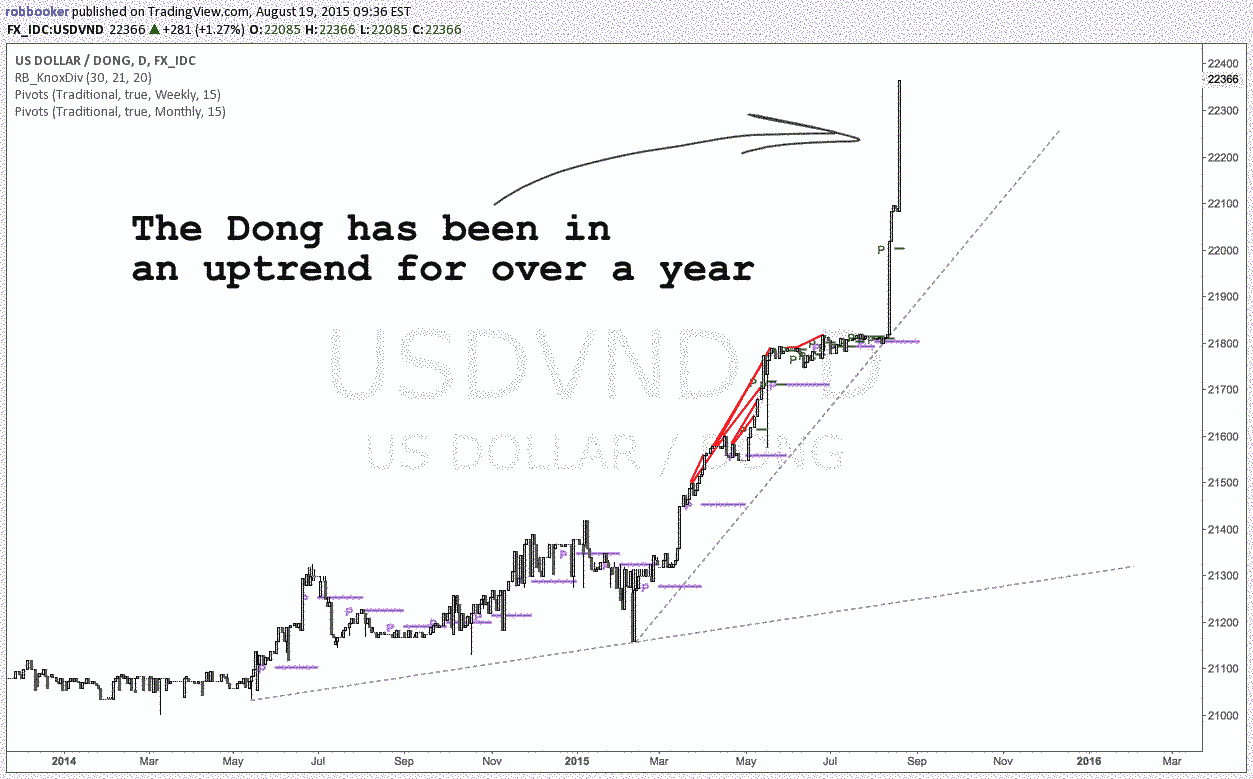

This question is particularly important for anyone who insists on trading anything but the major currency pairs. First of all, and perhaps most importantly, did you know that Vietnam’s currency is called the Dong? That is too good to be true. For simplicity’s sake and in case you do not yet trust me here’s a chart of the Dong:

What are Exotic Currencies?

That being said, for those of you who are unsure exactly what constitutes exotic currencies, they are often the ones you never hear about. No one talks about them because they tend to move a lot more, can be more susceptible to change and most likely scares many traders. However I have a secret for you…exotic currencies shouldn’t scare you. On the contrary, exotic currencies, or exotics tend offer some of the best opportunities in foreign exchange (FX).

Don’t believe me? Well here are three reasons you should consider adding an exotic currency pair to your watchlist:

1) They are “technically obedient”. What does this mean? This means that if there is a breakout from support or resistance, it’s for real, and you can use the next level of support or resistance for a very high probability target. This regularly is not the case with the majors, which are held hostage by a number of other market forces.

2) They MOVE. As I alluded to above, exotic currencies trend to move a lot, which scare people. However, nobody ever made profits with a stagnated currency pair. For example, if the Turkish Lira gives you a trade, it’s going to get down and boogey. It’s not going to move 10 pips and then stop and reverse.

One important note to make, an exotic currency pair could move 2,000 pips and then stop, stone cold. Why? Because only a small number of banks trade these exotics, so once a move starts, it continues and rumbles along, and once it’s over, there isn’t any other trader out there to reverse it. Coming back to our example of the Vietnamese dong, this is why you get savage trends like those seen in the chart above.

…exotic currencies shouldn’t scare you… exotics tend offer some of the best opportunities in foreign exchange…

3) Finally, trading exotics is FUN. Apart from the word exotic, which is sure to elicit some vision of a beach in Thailand or palm trees in some picturesque cove, exotic currencies help cut through the monotony of an otherwise moribund trade. As a corollary, trading should not be about excitement, however why not enjoy what you are doing, especially if this is your job, career, or in some cases life? Truthfully, it is much more fun to tell the cashier at the grocery store that you “trade the dong” than it is to say, “I trade forex.”

Another question entirely, and perhaps best fit for a future topic of discussion, is what kinds of strategies work for exotic pairs? Presently, I’ve got one that I use utilize a few times a week. I’ll share it with you right now, as long as you promise to stay in touch (see the end of this article), and because you caught me in a jubilant mood.

Exotic Currency Trading Strategy

Thus, here’s a simple system for trading an exotic currency pair - in this case, the American dollar vs. the Mexican Peso (USD/MXN). As a side note, do you know why I adore this currency pair (I call it the Taco, by the way)? Because if there is a short-term breakout on the pair, it’s usually good for a nice little run. Again, think MOVES. Here’s an example:

In the morning, around 8:00 Eastern US Time, I draw trend lines on the chart. I also draw basic horizontal support and resistance. For this, I use the 15-minute chart.

Then I wait for a breakout. If it breaks out above resistance or below support, I take a trade in the direction of the breakout. When should you stop, or a better question is when should you stop? Quite simply, I then hold the trade until it reaches the next level of support or resistance.

If the trajectory of the currency pair reverses (which is uncommon), I don’t hold the losing trade. Instead, I exit with a loss if it closes back inside the broken support or resistance. Simple. Easy. Bada-boom, bada-bing. Don’t try and be a hero.

If you’re not familiar with supports or resistances, just go to YouTube. There are twelve bajillion free videos about it or some word that the English language has not even caught up with that denotes an extremely large number.

Ipso facto, that’s it - that’s the entire system.

Most Popular Exotic Currency Pairs by Trading Volume

The below table shows the most popular exotic currencies ranked by trading volume, with their percentage of total Forex market volume in 2022. Exotic currency pairs are created by pairing any of these currencies with any other currency.

Rank | Currency Name | Currency Acronym | % of Market Volume Traded 2022 |

1 | HKD | 2.6% | |

2 | SGD | 2.4% | |

3 | SEK | 2.2% | |

4 | KRW | 1.9% | |

5 | NOK | 1.7% | |

6 | INR | 1.6% | |

7 | MXN | 1.5% | |

8 | TWD | 1.1% | |

9 | ZAR | 1.0% | |

10 | BRL | 0.9% | |

11 | DKK | 0.7% | |

12 | PLN | 0.7% | |

13 | THB | 0.4% | |

14 | ILS | 0.4% | |

15 | IDR | 0.4% | |

16 | CZK | 0.4% | |

17 | AED | 0.4% | |

18 | TRY | 0.4% | |

19 | HUF | 0.3% | |

20 | CLP | 0.3% | |

21 | SAR | 0.2% | |

22 | PHP | 0.2% | |

23 | MYR | 0.2% | |

24 | COP | 0.2% | |

25 | RUB | 0.2% | |

26 | RON | 0.1% | |

27 | PEN | 0.1% |

Risks of Dealing in Exotic Currencies

- Liquidity risk: Exotic currencies often very low trading volumes, which may lead to lower liquidity, making it hard for traders to get good prices.

- Volatility risk: Exotic currencies are usually more volatile than major currencies.

- Bid-ask spreads: Due to low liquidity, bid-ask spreads for exotic currencies can be very wide compared to major currencies.

- Market access: Some exotic currencies are offered for trading by very few brokers.

- Political and economic instability: Exotic currencies are often associated with countries that may have political or economic instability, which can cause sudden and wild swings in their relative values.

- Interest rate differentials: Exotic currencies often have higher interest rates, which can mean you pay high overnight swap rates or suffer exposure to the unexpected collapse of a carry trade.

Where are Exotic Currencies Traded?

Most Forex / CFD brokers offer at least some exotic currencies, but few brokers offer most of them, let alone all of them. For the non-retail market, exotic currencies are traded mostly between banks and other major financial institutions, just like other currencies. The biggest banks in the Forex market are JPMorgan, UBS, Deutsche Bank, and XTX Markets, in that order.

One thing to note about exotic currencies is that because they are small, they are usually of little interest outside their home countries, so trading in these home currencies is heavily dominated by their home venue. This means that liquidity can be extremely think outside the home country’s business hours.

Pros & Cons of Trading Exotic Currencies

Pros

- Higher profit potential: Exotic currencies often exhibit stronger price movements, offering traders the potential for higher profits compared to major currencies.

- Diversification: This can reduce the risk associated with exposure to a single currency or only a few currencies.

- Interest rate differentials: Exotic currencies often have significantly higher interest rates, providing opportunities for carry trades.

Cons

As well as the risks outlined above, there are some other cons of trading exotic currency pairs:

- Higher transaction costs: Due to lower liquidity, transaction costs in the form of spreads and commissions are usually higher with trading exotic currencies, which should always be factored into exotic currency trading strategies.

- Information and research limitations: Exotic currencies are often from small and obscure countries.

- Credit risk: Exotic currencies may be linked to countries with higher credit risk, and credit rating downgrades might suddenly reduce the value of the currency.

- Limited risk management tools: Some brokers offer only limited risk management tools for exotic currencies.

Bottom Line

Exotic currencies make up barely one quarter by volume of all the currency traded in the global Forex market. Many traders make profits and base careers on only trading the major pairs, maybe adding the minor pairs and crosses as well from time to time. However, these factors should not prevent you from understanding that exotic currencies can sometimes provide excellent trading opportunities, especially at times when the major currencies are doing little, due to their typically inherent instability.

If you are going to take advantage of the opportunities offered by exotic currencies, you must be sure you have a broker that can offer you access to them, and that you factor in their illiquidity, high overnight rates, and typically high spreads.

FAQs

What are the exotic currencies?

Exotic currencies are currencies from smaller or less economically developed countries which tend to be characterized by lower liquidity and higher volatility than major currencies like the USD or the EUR.

What are exotic currency pairs?

Exotic currency pairs are exotic currencies traded against any other currency, including other exotic currencies.

What are examples of exotic pairs?

Some examples of commonly offered exotic pairs are USD/TRY, USD/SGD, and USD/HKD.

Is AED an exotic currency?

Yes, the United Arab Emirates Dirham (AED) is an exotic currency.