In this article I will show whether it is really true to say that the Forex market ranges most of the time, and if this turns out to be true, whether there is a simple way to exploit this phenomenon profitably with any forex trading strategies, which are also worthwhile.

Trading Trend or Trading Range?

Not all clichés in Forex are necessarily true, but the old line that says the Forex market ranges approximately 80% of the time and trends only during the remaining 20% of the time is. “Ranging” means just mostly going backwards and forwards between similar price levels. “Trending” means sustained and continuous price movement in one primary direction.

I can “prove” this – as much as you can prove anything using historical market data - by performing a simple back test on the four major currency pairs, using a ridiculously simple trading strategy, and sharing the results with you here.

Let’s say that after every day where the price went up, we sold that pair. Also, after every day where the price went down, we bought that pair. Positions are closed after being open for one day. As we are just trying to use this test to prove a point, and not build a complete trading strategy, we will not worry about trading costs for now. You cannot get any simpler than that!

If the market ranges most of the time, this Forex trading strategy should produce a fairly steady and positive return.

Range Trade Back Test Results

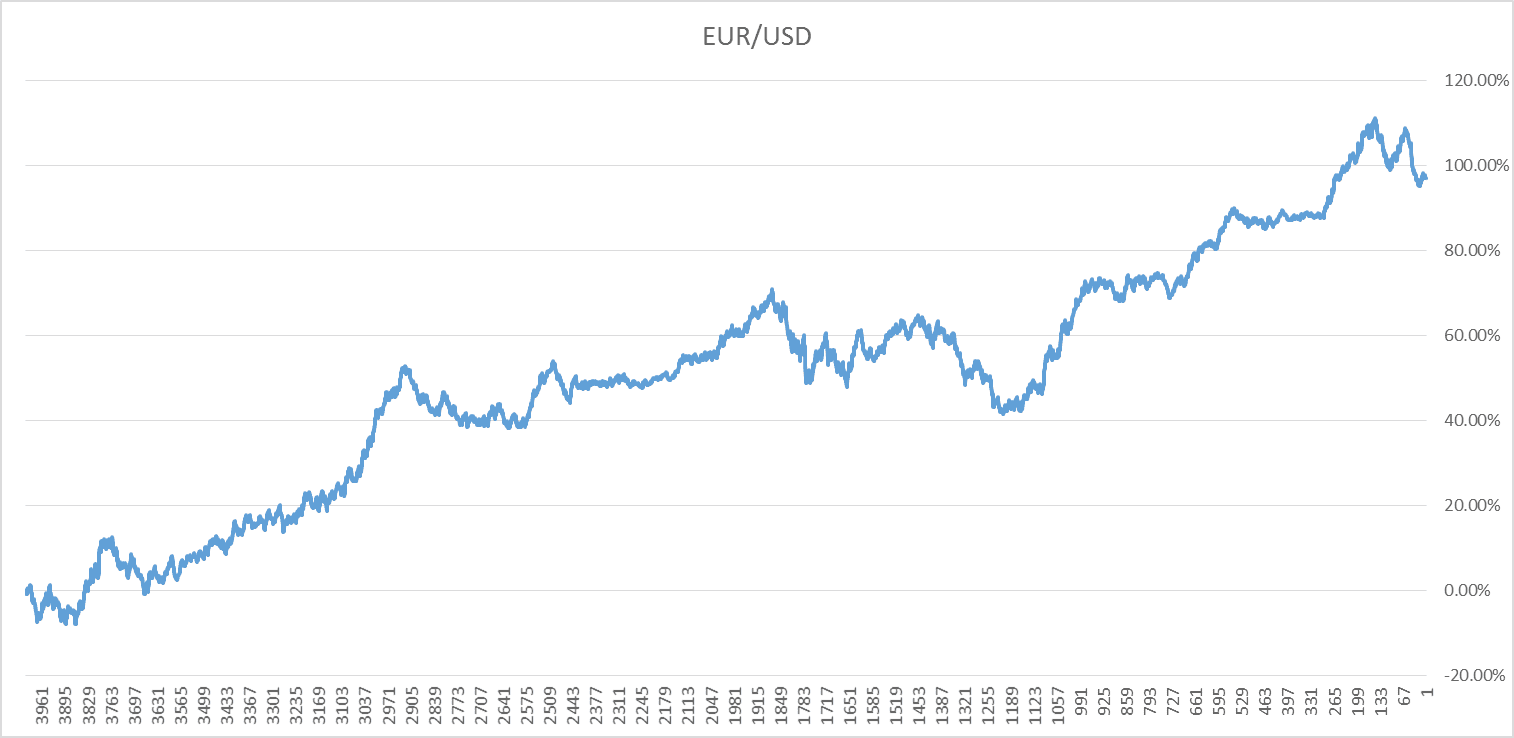

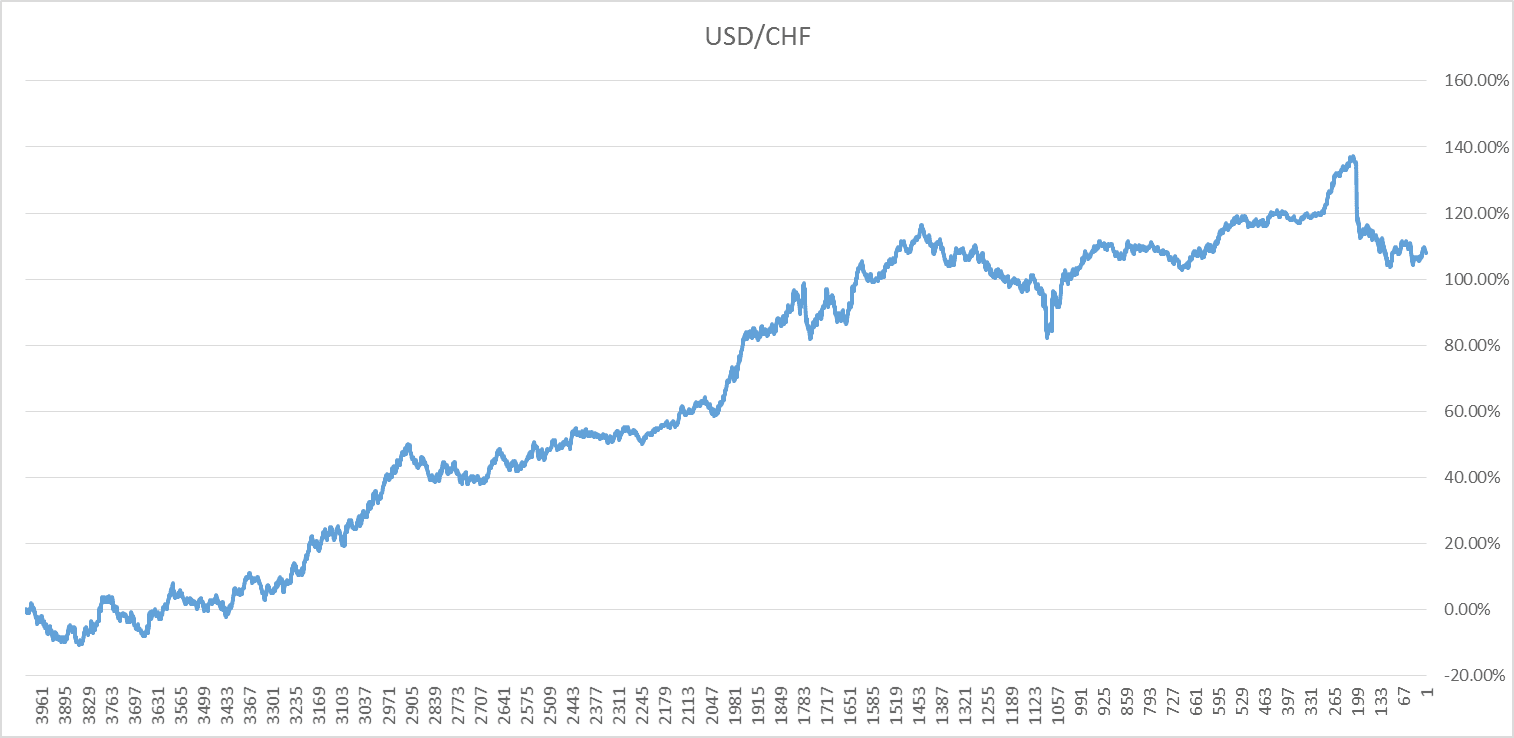

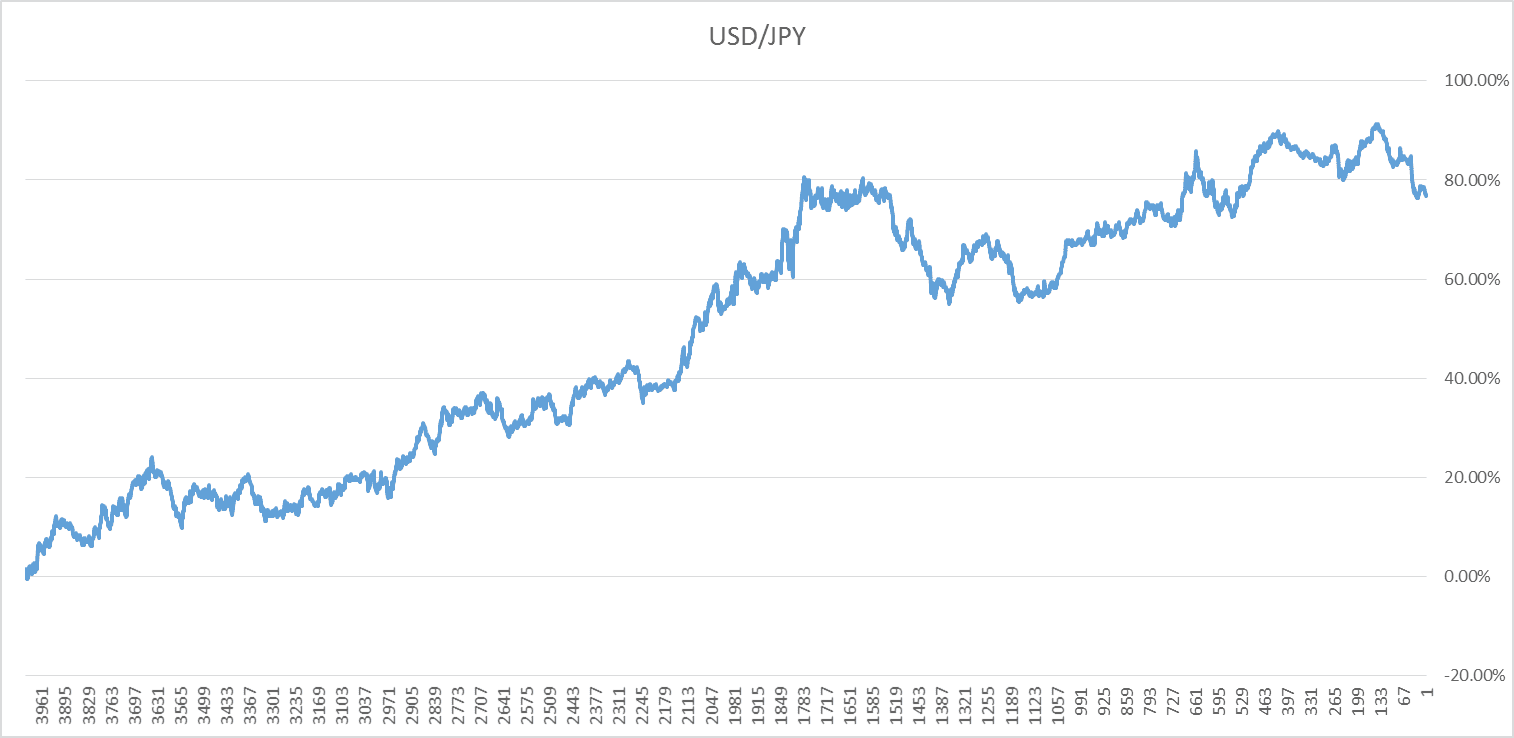

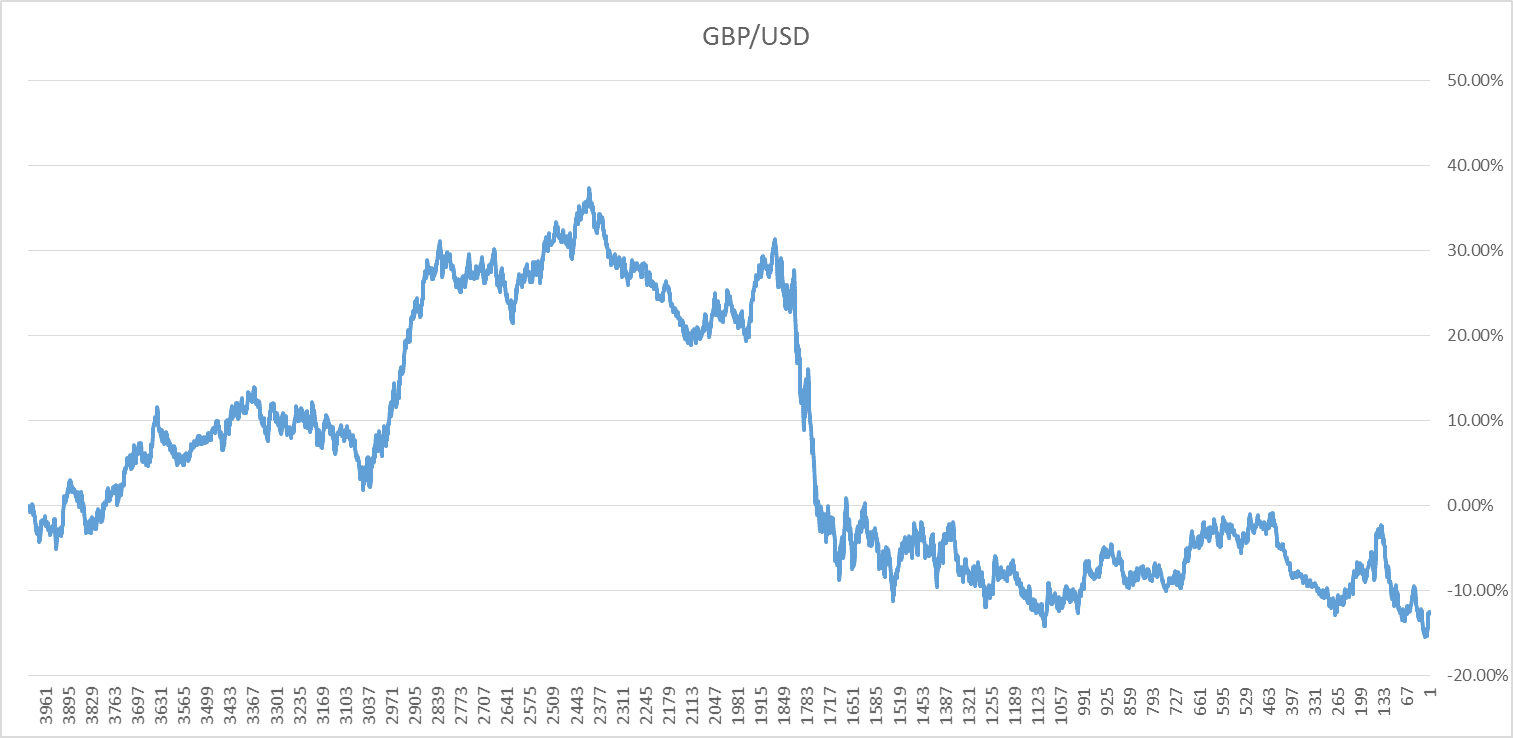

Here are the results that would have been achieved by each of the four major Forex pairs since the beginning of the year 2000, without factoring in any trading costs:

The graphs above show a very clear result: it was theoretically nicely profitable for each pair except GBP/USD. Note also that the upwards curves for the other three pairs slope upwards fairly smoothly. When a trading strategy does this, it is a good sign, because it means that compounding and aggressive money management strategies can be used to maximize profit.

The detailed results are shown in the table below:

Currency Pair | Total Return | Maximum Drawdown | Average Daily Return |

EUR/USD | 97.20% | -27.69% | 0.0240% |

USD/CHF | 107.92% | -33.41% | 0.0269% |

USD/JPY | 76.78% | -25.05% | 0.0190% |

GBP/USD | -12.56% | -52.75% | -0.0031% |

TOTAL | 269.34% | -69.75% | 0.0668% |

On the surface, these are quite good results for any trading strategy. The average annual return is about 16% and regarding risk management, the maximum drawdown experienced since the year 2000 is less than five times that number.

However, there is a big problem with trying to implement this range trading strategy: the cost of all the trades. Even with an excellent retail Forex broker, the spread and/or commissions charged on the four trades made every day at modern rates would wipe out about one third of the average daily return from the EUR/USD, more than half from the USD/CHF, just under half from the USD/JPY, and make the negative result from GBP/USD about four times larger.

In a sense, it is also meaningless to apply modern spreads against historical results going back all the way to the year 2000. In fact, if you applied historical retail spreads and costs of access to the market since 2000, I am certain it would wipe away all the profit. Spare a thought for the big banks that trade with no spreads or costs: look how much money they could have made just from fading every day’s move!

We have a solid concept here: the Forex market clearly ranges. Is there a robust strategy we can use to exploit this over the long term with good risk management that does not suffer excessively from associated trading costs?

Towards a Better Simple Range-Trading Strategy

In our search for a filter, let’s consider the concept. A ranging market means a market that does not get away from its average price for long. In fact, it stands to reason that the further and faster the price moves away from its moving averages, the greater and faster the profit there is to be made in focusing on fading those moves.

What if instead of trying to do something complex with Bollinger bands or moving averages, we only traded against daily moves that were greater than some predefined amount? This would produce less trades, but would reduce trading costs, and might make profits lumpier but also more probable.

It would make most sense to use a measure of average volatility. For example, trade against any daily move larger than the average true range (ATR) of the previous twenty days. However for our statistical analysis here, we can use defined amounts. An amended table is shown below exhibiting how the results would change if trades are taken only following daily moves larger than increments of 0.25% fluctuations in value.

All Pairs Filtered | Total Return | Maximum Drawdown | Average Return per Trade |

No Filter | 269.34% | -69.75% | 0.0167% |

>0.25% | 189.98% | -67.76% | 0.0190% |

>0.50% | 129.53% | -52.03% | 0.0225% |

>0.75% | 64.65% | -49.46% | 0.0203% |

>1.00% | 21.04% | -49.86% | 0.0128% |

Perhaps surprisingly, the best results seem to have been achieved by filtering out moves of less than 0.5%, which is approximately an average daily move for a major currency pair. Of course, you have to consider that the cost per trade will usually be about 0.0100%, so this would have produced a hypothetical return per trade of about 0.0125%. The maximum drawdown would be considerably larger and the average annual return would be only about 5%, and from a risk management perspective, that really does not look very good.

Conclusion

I have shown here that in the modern Forex era, range trading strategies “work”: normally, what goes up one day, comes down the next, and a small profit can be made exploiting this, even with a fairly competitive retail spread.

The problem is that it is very difficult to make a worthwhile return trying to exploit mean reversion unless you are a market-maker, and this is why although the profits are more irregular, retail traders should be able to make more money from trend trading than from range trading. You can even think of it this way: the big banks in Forex are “option writers” and the retail trader has to be an “option buyer”.

As I mentioned before, the big players can make serious money trading this way, and it is a major advantage that market makers have over retail traders.