Trading Gold vs Investing in Gold

There are several ways to invest or trade in Gold.

Investing in Gold means buying and holding for a long period of time, meaning months or years. Trading in Gold means both buying and selling several times within a shorter period, such as a few days, hours, or even minutes.

You can invest in Gold with just a few hundred US Dollars by buying physical Gold in the form of coins or nuggets or by buying small amounts of shares in Gold bullion held in secure vaults. However, these methods are not practical for trading as they are slow and do not provide the ability to sell short. Also, Gold coins do not directly mirror the value of Gold, as they are marked up at sale. Holding physical Gold as an investment can also involve problems involving proof and storage.

Trading Gold can allow you to make more frequent and larger profits from fluctuations in the price of Gold both up and down, than you would through “buy and hold” investing.

Top Forex Brokers

When is the Best Time to Trade Gold?

The price of Gold tends to move more at certain times of the day. Day traders should try to day trade Gold during these more volatile times to take advantage of the increased price movement.

Best Time of Day to Trade Gold

The data shows that the price of Gold tends to move the most on average between Noon and 8pm London time, roughly corresponding to the hours when markets are open in eastern and central U.S.A. This suggests that the best time of day to trade Gold, whether as Gold options, Gold futures, spot Gold, or XAU/USD is from Noon to 8pm London time. This is probably true because the major Gold market opening times are within this period.

The Best Gold Trading Strategies

Deciding upon the best Gold trading strategy or strategies to use requires you to consider the cases for trading Gold using fundamental or technical analysis, or a combination of both. Let’s consider the basis of such strategies and how they have performed over recent decades to help you make that decision.

Fundamental Analysis

Unlike stocks and shares, or a valuable commodity such as crude oil, Gold has very little intrinsic value as it has few practical uses. However, it is rare, and humans are attracted to it and have attributed value to it by consensus. It is impossible to measure minor fluctuations in that human perception from day to day, so in this sense, fundamental analysis is of limited value.

Another aspect of Gold which differentiates it from fiat currencies such as the U.S. Dollar is that its supply is limited. This should mean that a limited supply of Gold can be taken for granted. A problem with this analysis is that almost all the world’s known Gold is held by banks and governments, but nobody knows for sure exactly how much there is. It seems that the large banks, who have colluded for years to fix the price of Gold by means of a twice daily “Gold fix”, are able to manipulate perceptions of supply and demand.

Fortunately, a fundamental analysis of Gold can be applied through a macroeconomic analysis. For example, analysts traditionally see the value of Gold rising under the following circumstances:

- High inflation

- Economic crisis / instability

- Falling U.S. Dollar

- Negative real interest rates

Are these analysts correct? We can check the data since Gold’s fully free float began in 1976 to see whether the price of Gold correlates with these factors.

Correlations of Gold

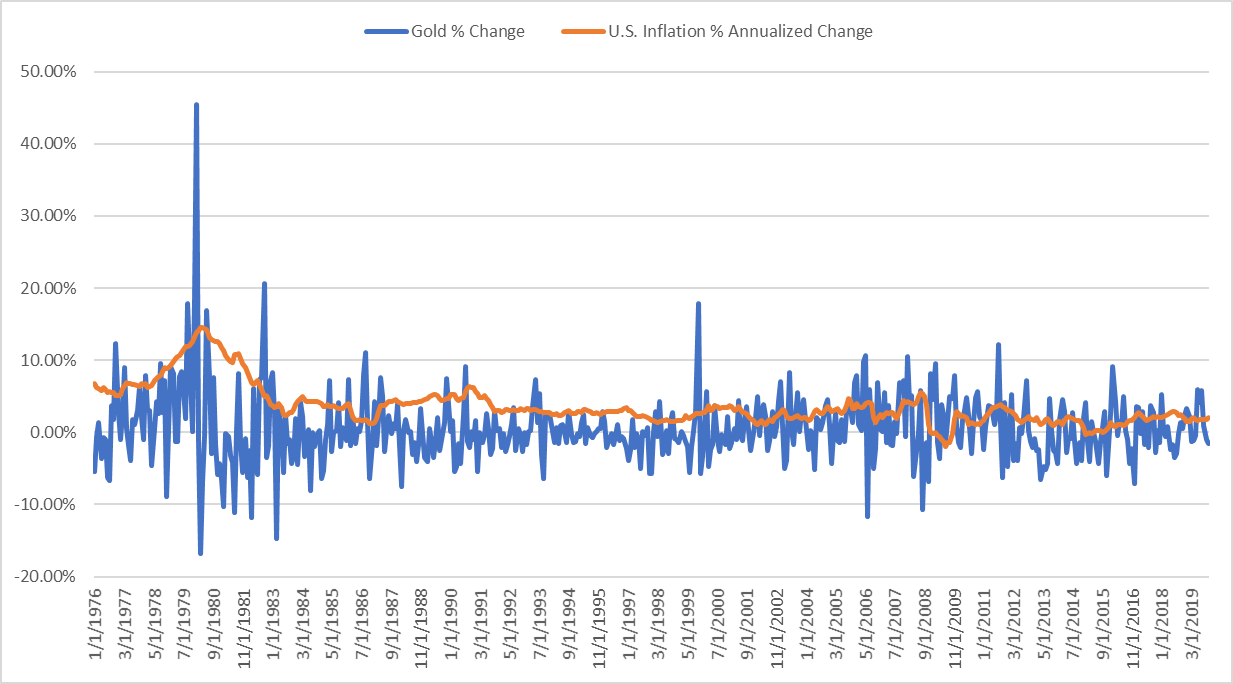

The U.S. has not seen historically high annual rates of inflation, defined as a rate greater than 6%, since the early 1980s. The U.S. suffered from high inflation during the late 1970s and early 1980s, and the price of Gold rose dramatically during this period. There was a strong correlation between Gold and inflation over this time, but when inflation rose again during the late 1980s the price of Gold fell.

The bottom line is that the price of Gold may be likely to rise when inflation reaches an unusually high level, and there is a small positive correlation between the monthly change in the Gold price and the monthly U.S. inflation rate over the entire period from 1976 to 2019. The correlation coefficient between the two was 17.24%, with 100% indicating perfect correlation and 0% indicating no correlation at all. This means that it is probably wise to only expect Gold to rise strongly when inflation reaches an unusually high rate, but it is also reasonable to be more bullish on Gold when inflation is rising and more bearish when inflation in falling.

Between October 2021 and January 2023, the US inflation rate was greater than 6% on an annualized basis. Over this period, the price of Gold in US Dollar terms rose by 9.73%. However, it is notable that the price of Gold mostly consolidated during this time, so relatively high inflation may not be as bullish for Gold as many suppose.

Gold / U.S. Inflation correlation chart

Economic Crisis / Instability

Economic crisis or instability is difficult to measure objectively. However, there can be little doubt that a country entering a major economic crisis tends to see the relative value of its currency depreciate. Additionally, the worst economic crisis in the U.S.A. in recent decades occurred during the 1970s, and this was a period during which the price of Gold in U.S. Dollars increased dramatically.

More recent evidence that Gold tends to rise during a period of serious economic crisis appeared in 2020 as the coronavirus pandemic hit the U.S.A. and other western nations starting in February. From March to July 2020, the price of Gold in U.S. Dollars increased by slightly less than 23%, from $1,586 to $1,948, exceeding the previous all-time high price of $1,921 made by Gold in 2011.

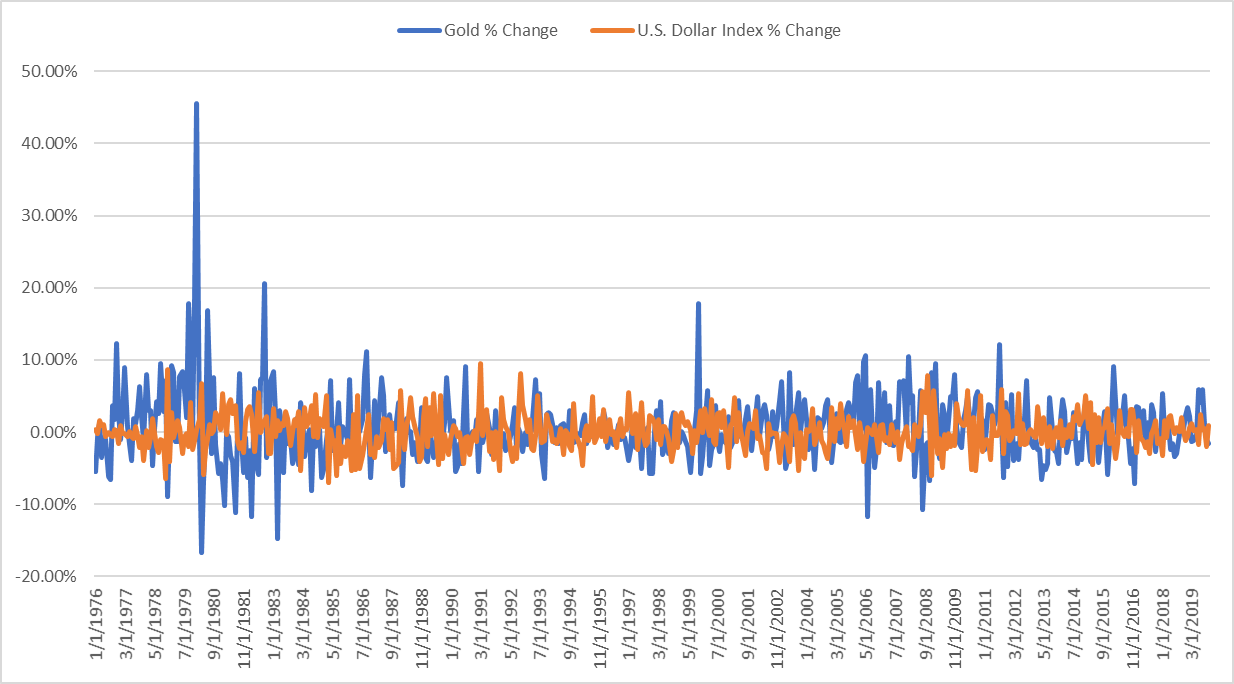

Correlation of Gold with the U.S. Dollar Index

As Gold is priced in U.S. Dollars, you would expect the price of Gold in Dollars to be very strongly positively correlated with the U.S. Dollar Index, which measures the fluctuation in the relative value of the U.S. Dollar against a volume-weighted basket of other currencies. A measurement of the correlation coefficient of all the monthly price changes in Gold and the U.S. Dollar Index from 1976 to 2019 shows a minor positive correlation of approximately 25.23%.

Considering we are measuring the price of Gold with the U.S. Dollar, this correlation is not very strong, but may have a use within technical analysis, which will be discussed later within this article.

Gold / U.S. Dollar Index correlation chart

Negative Real Interest Rates

As Gold is believed by many to be a store of value with a finite supply, while fiat currencies can be debased or artificially inflated by the central banks and governments which control them, it can be argued that the price of Gold in a fiat currency such as the U.S. Dollar will be bound to rise when the fiat currency is being debased. Indicators for the debasement of a currency include high inflation, which we have already discussed, and negative real interest rates. A currency has a negative real interest rate when its inflation rate is higher than its interest rate, because the currency is depreciating in value by more than it pays in interest, so depositors of that currency make a net loss over time.

The US Dollar has suffered negative interest rates during two major periods since it began to float freely: a very brief period in the late 1970s, and for most of the period from October 2018 to February 2023. During this latter, extended period of negative real interest rates in the USA, for each month the price of Gold rose by an average of 0.91% in US Dollar terms. This could be evidence that Gold tends to rise in value during periods of negative real interest rates in the USA.

The correlation between the price of Gold and the U.S. interest rate could also be examined, but as the interest rate tends to be highly correlated with the inflation rate, we effectively already covered it.

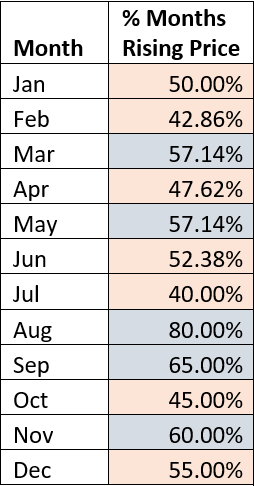

Trading Gold with Seasonality

“Seasonality” is a form of fundamental analysis which is based upon a theory that demand for an asset such as Gold tends to peak or ebb with the seasons of the year. For example, the price of natural gas would tend to rise during the winter in the northern hemisphere as cold weather brings more demand. It is hard to see the same logic applying to Gold, but the table below shows that there have been certain months of the year where the price of Gold has tended to either outperform or underperform its average. I do not believe the concept of seasonality applies well to trading Gold, but I present the data anyway. From 2001 to 2019, the price of Gold rose in 56% of months. The percentages of calendar months during this period when Gold rose are shown below:

Gold Seasonality

The data suggest that August and September have been especially good months for buying Gold while February and July have been good months for selling Gold.

Gold Fundamental Analysis: Bottom Line

The precious metal has historically shown a tendency to rise in price during periods of unusually high inflation, severe economic crisis, or negative real interest rates. Over the long term, Gold has not shown any meaningful positive or negative correlation with stock markets.

On a more micro level, it is often true that when markets are in “risk off” mode, money tends to flow into the Japanese Yen, Swiss Franc, and Gold. Therefore, Gold traders can learn to spot “risk off” sentiment and look to enter long Gold trades at these times.

Trading Gold (XAUUSD) with Technical Analysis

Technical analysis is the art of determining whether future price movements can be predicted from past price movements. Here we will look back at whether movements in the price of Gold over recent decades have been able to tell us anything useful.

Gold has shown a long bias since 1976. Its price has risen over 51% of months, and the average month has seen a price rise of 0.55%. The median monthly price change over this period was a rise of 0.07%. These statistics suggest that Gold, as a theoretically finite store or value, may tend to rise against fiat currencies. If true, this suggests that looking for long trades pays off more reliably than short trades. It seems logical that as fiat currencies suffer from inflation while real assets such as Gold and stocks do not, real assets like Gold and stocks will tend to rise in value over time.

Gold, like most major liquid speculative assets, tends to trend. This means that one of the best technical analysis methods you can use here is defining whether Gold is in a trend or not, and then trading in the direction of the trend.

Trend Trading Gold XAUUSD

Gold is a commodity, prone to strong price movements. It is well known that one of the best trading strategies for commodities is to trade breakouts in the direction of the long-term trend. Let’s check the historical data and see how well trend trading Gold has worked using two different methods.

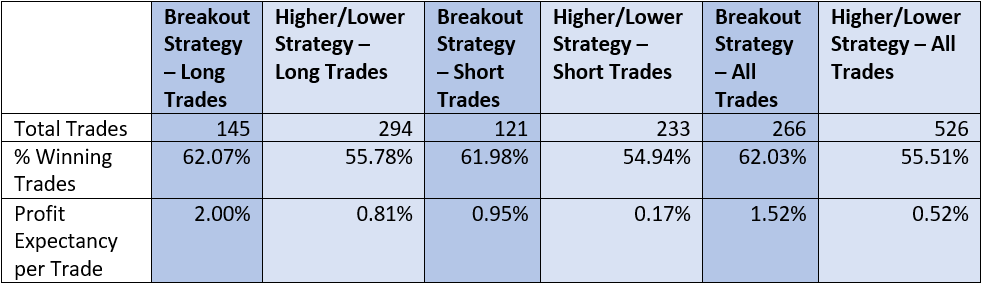

The first strategy involves trading breakouts. Let’s say that when the monthly closing price of Gold is the highest it has been in six months, that is a bullish breakout and we would take a long trade. Conversely, when the monthly closing price is the lowest it has been in 6 months, that is a bearish breakout and we would take a short trade. I will call this a “Breakout Strategy”.

The second strategy is also a trend trading strategy, but less of a breakout strategy: it enters long when a monthly close is higher than the closing price six months ago, or short where lower. I will call this “Higher/Lower Strategy”.

Let’s see how a back test of this strategy would have performed since 1976, assuming every trade was held for one month and then exited.

Gold 6-Month Breakout Strategy Back Test

Both strategies have performed positively over almost half a century, in both long and short trades, with the breakout strategy performing considerably better. It seems clear that the best technical trading strategy for Gold is to trade 6-month price breakouts, and trading with the 6-month trend even when the price is not making new highs or lows has also worked quite well.

These back-test results are very strong. It is not easy to find a trading strategy which would have performed as well as this over the same period using typical Forex currency pairs, which is a good reason why you should trade Gold if you are going to trade Forex.

Don’t forget that Forex / CFD brokers will usually charge you a fee to keep a trade open overnight if you do not have an Islamic account. When you are trend trading and holding trades for weeks or months, this can eat away at the profit of your trade. This is a reason why you might want to trade with the trend but exit the trade after it stops going in your favor for a few days, or even day trade Gold in the direction of the trend. When day traders close their trades before 5pm New York time, they pay no overnight swap fees.

One way to try to time entries to exploit the multi-month trend is to wait for some kind of retracement on a shorter time frame such as the daily time frame, and then when a new day closes in the direction of the trend and makes a higher close than the closes of the last two days in an uptrend, for example, you have a shorter-term entry signal to use.

How to Use Volatility to Trade Gold

“Volatility” in trading means how much the price of something fluctuates. You can use average price movement, which we call average volatility or average true range, to determine better trade entry points, because if volatility is relatively high today, it is likely to also be relatively high tomorrow, suggesting a stronger movement in your favor is more likely. Volatility is best measured using an indicator called Average True Range (ATR) which is available in almost every trading platform or charting software package.

For example, suppose that the price of Gold is closing today at a 6-month high price. We have already shown that there has been an edge in trading such long-term breakouts in the Gold price. If you switch on the ATR indicator on your daily chart and set it to the last 15 days, it will show you by how much the Gold price has moved per day on average over the last 15 days. If today’s price movement is significantly higher than the value shown by the ATR indicator, that means that the price is breaking out to new highs on above-average volatility. This means that tomorrow it is more likely to rise further than usual, as the volatility is above average.

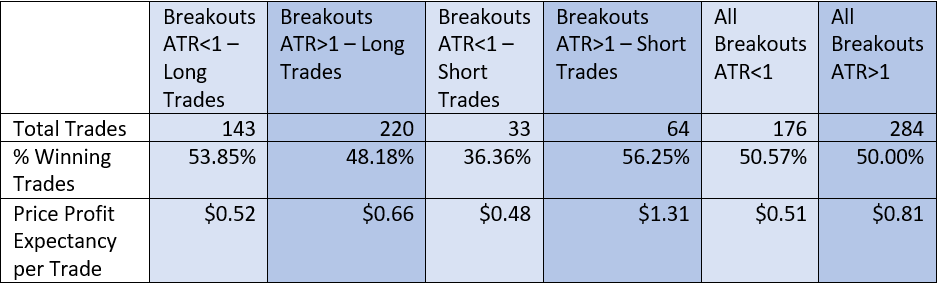

We can demonstrate this by looking at some historical data of the price of spot Gold from 2001 to 2019. Let’s compare the days when the price closed at a 100-day high or low price, see whether the price continued in the same direction over the next days and by how much, broken down by how strong the volatility was as measured by the 15-day ATR indicator.

Gold 100-Day Volatility Breakout Strategy Back Test

The historical data show that during this period, more profitable trades were triggered when the price of Gold moved in one day by more than the 15-day average daily price movement. On average, where the day’s price movement was above its 15-day ATR on a breakout, it closed by a further 81 cents in the direction of the breakout the next day. Where the day’s price movement was below its 15-day ATR on a breakout, it only made a further 51 cents the next day.

How to Day Trade Gold XAUUSD

Gold is very suitable for day traders. One advantage of day trading Gold is avoiding the cost of overnight swaps, which can be relatively large at many Gold brokers. The main disadvantage is that the spread plus commission for trading Gold is higher than in the major Forex currency pairs, but this is compensated for by the higher average price movement in Gold.

Gold day traders are best advised to trade with the longer-term trend:

- If the price is HIGHER than it has been for the past 6 months, be STRONGLY BULLISH

- If the price is HIGHER than it was 6 months ago but BELOW some of the prices reached since then, be WEAKLY BULLISH

- If the price is LOWER than it has been for the past 6 months, be STRONGLY BEARISH

- If the price is LOWER than it was 6 months ago but ABOVE some of the prices reached since then, be WEAKLY BEARISH

- If the price has shown little direction over the past 6 months, trade REVERSALS at obvious areas of support or resistance

Gold day traders should use shorter time frames to fine-tune entries in line with the above points.

Trading Gold Tips

- It is worthwhile trading Gold as its price moves a lot and often trends strongly.

- Almost every Forex broker offers Gold trading.

- Trade with the 6-month trend. New 6-month breakouts are best.

- Enter on a price breakout or a pullback following the breakout.

- Fundamental analysis can be used to determine which technical analysis signals are more likely to perform better.

- Take profit on winning trades by using some type of trailing stop.

- Beware of overnight swap fees if you hope to keep a trade open for more than a couple of days.

- Always use a hard stop loss based upon the value of the ATR indicator. Tight stops such as half of the daily ATR tend to give good results.

- If the U.S. Dollar Index is trending up, you may feel more confident in taking short trades in Gold priced in U.S. Dollars; if trending down, you may feel more confident in long trades.