Blockchain and cryptocurrencies have stormed the financial scene with promises of changing the world. In this article, I want to help you understand how blockchain works and what makes it unique.

Blockchain Overview

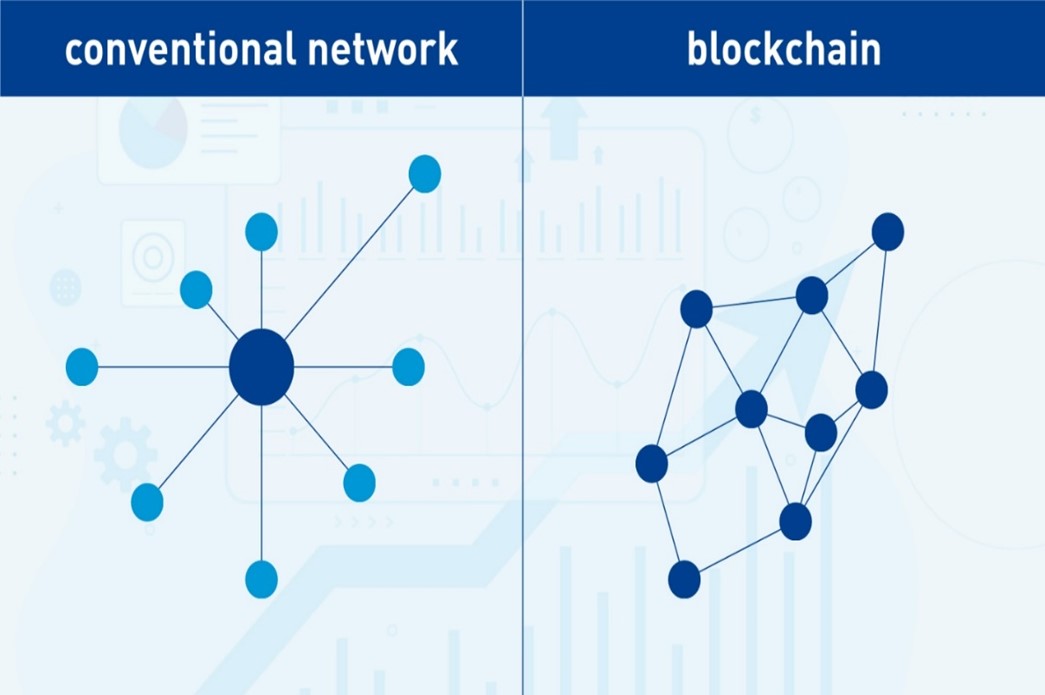

Blockchain is a decentralized ledger, or method, of record keeping. Unlike conventional record-keeping methods, such as financial records kept by accountants, the blockchain uses a network of computers to add new entries visible to everyone. That means there is no central authority controlling a single ledger. Instead, everyone who is part of the system controls a decentralized and shared record.

A cryptocurrency is a digital or virtual currency stored on a blockchain. In other words, the blockchain comes first, and the cryptocurrency sits on it. Think of blockchain as the actual technology. Bitcoin and other cryptocurrencies are the first applications to use this technology.

Blockchain’s decentralized structure makes it inherently different from conventional record-keeping. As a result, cryptocurrencies on a blockchain are nothing like traditional fiat currencies issued by a central bank.

Before we explore blockchain in more detail, let’s see how it started.

A brief history of blockchain

The concept behind blockchain has been around much longer than people realize. In 1982, a cryptographer named David Chaum wrote a dissertation that first proposed a blockchain-like protocol. Over the decades, researchers (notably Stuart Haber, W. Scott Stornetta, and Dave Bayer) built on his ideas. Today, David Chaum is known as the godfather of cryptocurrency for his early pioneering work.

It was not until 2008 that the first decentralized blockchain was conceptualized by a person (or possibly group of people) known as “Satoshi Nakamoto”. Nakamoto improved the blockchain design in important ways, specifically for Bitcoin to run on it.

On 3 January 2009, Nakamoto created the Bitcoin network when he mined the starting block of the chain, known as the ‘genesis block,’ also called ‘block zero.’

The identity of Satoshi Nakamoto remains unknown to date.

5 Key Elements of a Blockchain

- A growing list of blocks

A blockchain is a digital ledger or record-keeping system consisting of a growing list of blocks to record transactions.

- Each block contains data

Each block contains a timestamp, transaction data, and information about the previous block.

- The blocks link to form a chain

When a block is added, it securely links to the previous block using cryptography to form a chain, hence the term “blockchain.”

- It’s decentralized

Blockchains are decentralized across many computers that connect to form a peer-to-peer network.

- Blocks are permanent and irreversible

The data in a block cannot be altered retroactively (unless all subsequent blocks are changed). For practical purposes, that makes each block a permanent record from the time it is created.

How Does Blockchain Work?

Since today’s blockchain was invented for Bitcoin, many assume that blockchain transactions are only cryptocurrency transactions. But other industries are exploring how they can use blockchain technology for different uses, and like blockchain, this list is growing. As a sample to give you a flavour, there are developing blockchain uses for:

- Healthcare

- Insurance

- Securing personal information

- Accessing government benefits

- Logistics

- Supply chain tracking

- Smart contracts which are enforced in real-time on a blockchain

- Voting

- Artist royalties

- Data storage

- Gambling

- Domain names

Let’s walk through a typical blockchain transaction.

Step 1: Transaction request

The process begins when someone requests a transaction on the blockchain network.

Step 2: Broadcast to a P2P network

The requested transaction is then broadcasted to a decentralized peer-to-peer network of computers. Each computer is known as a ‘node.’

Step 3: Validation

The network validates the transaction and the user’s identity using known algorithms.

Step 4: New block creation

Once the transaction is verified, the system creates a new block of data for the ledger.

Step 5: New block is added to the blockchain

The blockchain methodology makes it so that each new block is permanent and unalterable. This final step completes the transaction.

Pros and Cons of Blockchain

I’ll talk about the pros & cons of both blockchain and cryptocurrencies because they are closely related.

Pros

Transparent and universal recording system

The blockchain records transactions in a public ledger that anyone can view. Blockchain eliminates the need for third-party verifiers. Any member of a blockchain network can check and verify the data at any time.

No single point of failure

Traditional centralized record-keeping has single points of failure, making it an easier target for malicious attacks to take over the network or just technical failures. In comparison, most of a decentralized network would have to fail or be taken over by a malicious attacker, making it highly resistant to complete failure.

Accuracy

Many thousands of separate network nodes must approve transactions in a blockchain and are irreversible once validated. For example, what if one of the computers in the network makes a mistake? The error would only be in one copy of the blockchain. For it to spread, at least 51% of the network would need to have the same error, which is very unlikely. This verification process, and the cryptography and security associated with many blockchains, make blockchain records highly accurate and tamper-proof.

Cons

Scalability

At this time, blockchain designs can only handle a relatively small number of transactions per second, which limits their scalability.

Energy consumption

One of the biggest issues with blockchain technology is its enormous energy requirements to maintain the network. For example, with the Bitcoin blockchain, “miners” who maintain the network must solve complex math problems that require huge computing needs. As Bitcoin has grown, so have the computing needs and Bitcoin’s energy footprint. Critics of Bitcoin are raising valid concerns about the environmental impact made by the Bitcoin blockchain.

Cryptocurrency transactions are not as private as people think

There is a common belief that cryptocurrency transactions are one hundred percent private and, therefore, untraceable. In the early days of cryptocurrencies, it was indeed nearly impossible to trace cryptocurrency transactions to end users. However today, specialized tech companies provide blockchain tracking services, so law enforcement and financial institutions can be more aware of what is happening with crypto funds.

In recent years, law enforcement agencies, such as the U.S. Federal Bureau of Investigation (FBI), have arrested suspected criminals by tracking their cryptocurrency transactions. Of course, you don’t have to want privacy only if you are a criminal—there are many legitimate reasons to want privacy.

Types of Blockchain Networks

There are four types of blockchain networks:

Public blockchain

- Also known as a permissionless blockchain.

- Anyone can participate without restrictions.

- Most cryptocurrencies run on a public blockchain governed by rules or consensus algorithms.

- Anyone can send transactions to a public blockchain and become a data validator.

- Usually, public blockchains offer economic incentives for those who secure them.

- For example, Bitcoin “miners” receive payouts in Bitcoin for helping to maintain the network. The Bitcoin and Ethereum blockchains are two of the largest and most well-known examples of public blockchains.

Permissioned or private blockchain

- Organizations can set controls on who can access blockchain data. You cannot join it unless invited by the network administrators.

- An example of a permissioned blockchain is the Oracle Blockchain Platform.

Hybrid blockchains

- A combination of centralized and decentralized features.

Sidechains

- Runs in parallel to a primary blockchain.

- Entries from the primary blockchain can be linked to and from the sidechain; this allows the sidechain to operate independently of the primary blockchain.

- Sidechains have become essential for helping existing blockchains like Bitcoin to scale and for different blockchains to work with each other.

Is Blockchain Secure?

Blockchain is the most secure method of record-keeping.

As a record-keeping system, Blockchain is incredibly secure and accurate. It is nearly impossible to change data entries or blocks retroactively. And it is next to impossible to take over an entire blockchain network or for the whole network to go down due to technical failure.

You can lose your cryptocurrency, or it can be stolen.

Wait, what? What about all the “blockchain is as secure as a vault?” Well, this has more to do with the logistics of how most people buy and sell cryptocurrencies.

When you buy a cryptocurrency, you are not buying money you put in a physical wallet. You are buying a digital asset, and in the case of cryptocurrencies, you are buying a pair of keys: one is public, and the other is private. These keys are unique and cryptographically generated on the blockchain. The private key unlocks your publicly stored portion of the blockchain.

Most people will hold their cryptocurrencies through an exchange or digital wallet service, which will hold the private key for you. But many crypto exchanges and wallet services are not regulated and not insured by a government like regular exchanges or banks.

If the exchange or wallet is hacked and your private key is stolen, you have lost your cryptocurrency.

Because of the lack of regulations, exchanges have disappeared overnight and taken everyone’s crypto assets with them. Yes—this is outright theft by the exchanges, and it has happened repeatedly.

Bottom Line

Blockchain is a decentralized digital ledger or record-keeping system. Because of its structure, it is nearly impossible to alter the data retroactively, and public exchanges are transparent to everyone. Blockchain networks are almost impossible to take offline through malicious attacks or suffer fatal technical failures. That makes them an accurate record-keeping system with high security.

We think of blockchain and cryptocurrencies as the same thing. Blockchain was invented for Bitcoin, but the two are separate. Blockchain is the underlying technology, and cryptocurrencies are stored on blockchains.

Many other industries are now developing uses for blockchain as a record-keeping and transaction system that do not involve cryptocurrencies because of blockchain’s transparency and security.

Most blockchains are public. The two biggest and most well-known examples are Bitcoin and Ethereum. Some private blockchains exist, such as the Oracle Blockchain Platform.

Cryptocurrencies, which are built on blockchain technology, can suffer theft or loss depending on how you store them. Malicious groups have hacked crypto exchanges and digital wallets and stolen crypto assets. The owners of exchanges and wallets have also disappeared overnight, stealing crypto assets along the way.

Blockchains have the potential to transform many industries. Much like the internet in its early days, smart people can disagree on how transformative blockchain will be and what uses it will have in the future.

FAQs

What is blockchain technology?

Blockchain technology is a decentralized digital ledger or record-keeping system. In contrast, conventional record-keeping systems are centrally controlled. Public blockchains are accessible to everyone without restrictions. The data is permanent and independently verified by a network of computers or nodes. The independent verification and decentralized structure make them more secure and accurate than conventional centralized record-keeping.

What are the 4 different types of blockchain technology?

- Public blockchains (which are most blockchains—two of the biggest are Bitcoin and Ethereum).

- Permissioned or private blockchains.

- Hybrid blockchains, which contain features of public and private blockchains.

- Sidechains, which are used to help blockchains scale and work with each other.

What is the main purpose of blockchain?

Blockchain was invented to store Bitcoin. Today, most blockchain activity is for cryptocurrencies, but any record-keeping or transactions requiring transparency and an audit trail can use blockchain technologies. Multiple industries such as healthcare, manufacturing, and government services are exploring blockchain.

What is blockchain vs cryptocurrency?

Blockchain is the underlying digital ledger or record-keeping technology. Cryptocurrencies are virtual currencies that are stored on a blockchain.

Why is blockchain the future?

Blockchain is technologically more advanced than conventional record keeping. It is highly secure, permanent, resistant to cyber attacks, and accurate. It can transform any process that requires record-keeping that is transparent and secure.

What is the biggest blockchain company?

Bitcoin is the largest public blockchain. Binance is the world's largest cryptocurrency exchange by trading volume.

Which blockchain is best?

Public blockchains like Bitcoin and Ethereum are more transparent than permissioned or private exchanges.