Are there such things as set and forget trading strategies? We’d like to think that there may be some trading strategies that can work this way, but they must be used with appropriate caution as well as a minimal understanding of the market, at the very least. When speaking of these types of strategies, the first thing that you should know right away is that they are all meant to be used with the lower leverage. After all, the last thing you want to do is be leveraged up 200 times, place a trade and simply walk away hoping that there isn’t some type of retracement against you as it could be very expensive.

Top Forex Brokers

In the investing world, a ‘set and forget’ strategy is the idea that you can buy or sell something and simply walk away. This is akin to what stock traders do, by purchasing stock in a company such as Walmart, as they assume there will be dividends and that the company will continue to exist. There are no concerns of a margin call. They simply buy shares and hold onto them. This isn’t the same in Forex, as the leverage and the volatility makes long-term holding a much more dangerous idea. Most retail traders are speculators, so they tend to focus on short-term strategies. One such exception was the old ‘carry trade’, but that strategy doesn’t exist for the most part anymore, as retail brokers have crushed interest rate differentials on pairs. Not long ago, people would simply buy something like AUD/JPY for the interest payment at the end of the day, understanding that they got paid just a little but at the end of the day, but many larger funds were taking advantage of this at the same time, lifting those pairs. The financial crisis wiped out a lot of accounts as that trade was unwound. Unfortunately, many retail traders face margin calls after months and years of reliability.

Investing and the lack of leverage

One thing that you should realize about most “set and forget trading strategies”, is that they are more appropriate for investors and less appropriate for speculators. It’s not that you can’t use them as a speculator, just that you need the proper amount of trading capital.

When you invest, you assume that the price of the underlying asset is going to appreciate over the longer-term. The average investor isn’t concerned about a 1% drop in an asset that they own. For example, if you were to buy Microsoft stock and it was down 1% today, you wouldn’t be that surprised or necessarily that concerned. You are probably looking to own that particular stock for several weeks, perhaps even months or years. You know that over the longer-term, Microsoft is likely to appreciate, or at the very least pay dividends. You may have an emergency stop placed in the market, but that might be 10 or 15% below current pricing. This is because you are only risking 10 or 15% because there is no leverage.

Dial down the leverage for these strategies

Just as you wouldn’t use leverage for a long-term stock trade, you don’t need to use it on other long-term trading strategies. Granted, leverage can make you extremely wealthy, but what’s more likely to happen is that you will either have a pullback that causes a margin call, or a pull back later on that gets you nervous enough to exit the trade, thereby making it almost impossible to hold on for the long move.

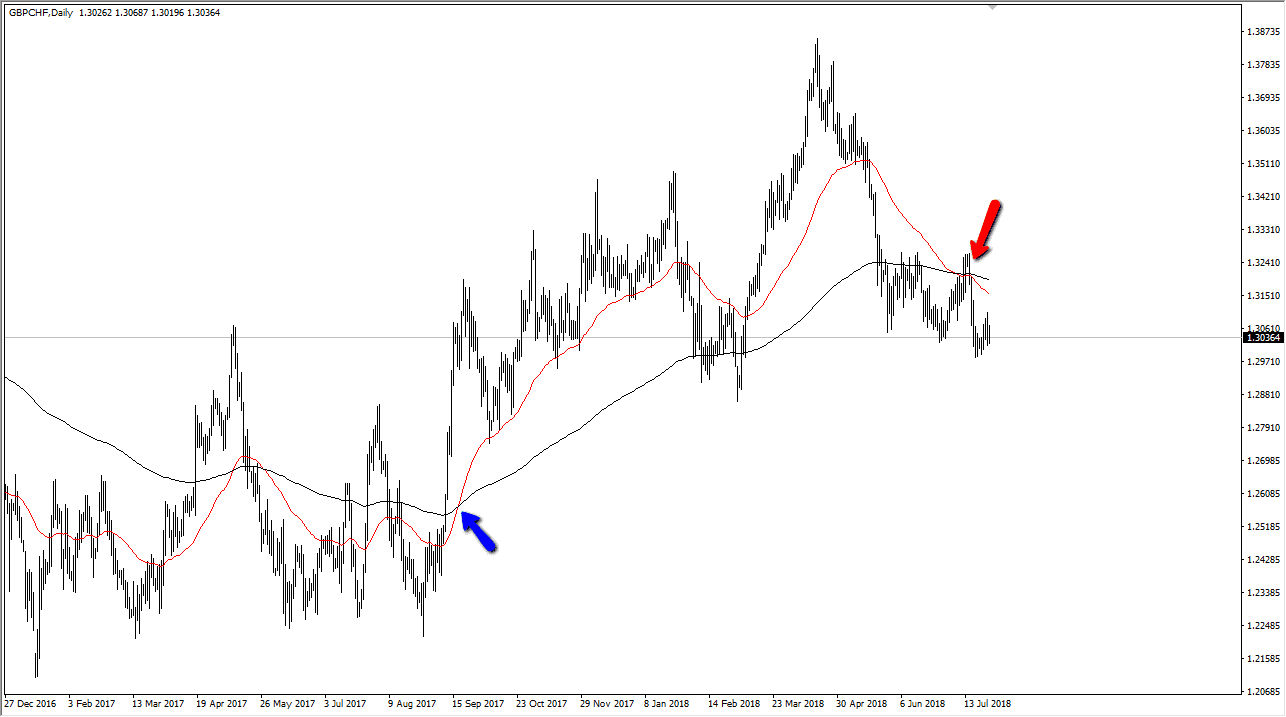

A perfect example would be using the moving average crossover system. While there are shorter-term versions of this, one of the most common ways to trade this system is to use a 50 day exponential moving average and a 200 day exponential moving average. If the 50 day exponential moving average crosses over the 200 day exponential moving average, you should buy and hold whatever asset you are trading. Conversely, if the 50 day moving average crosses below the 200 day moving average, you should be a seller. Traders will be in the market at all times, simply flipping back and forth as the moving averages cross each other. Needless to say, you need a trend to make this happen effectively. Sideways markets are killers when it comes to moving average crossover systems.

In the Forex world, the way to get around the potential danger is to take out a low leveraged position. For example, if you have $1000 in margin, your position size could be something like 5000 units. That is 5 to 1 leverage. I understand that it doesn’t sound like much, but it also gives you the ability to hang onto that trade for weeks, months, or even years if the system dictates. Beyond that, if you do take losses, and you will eventually, they are small.

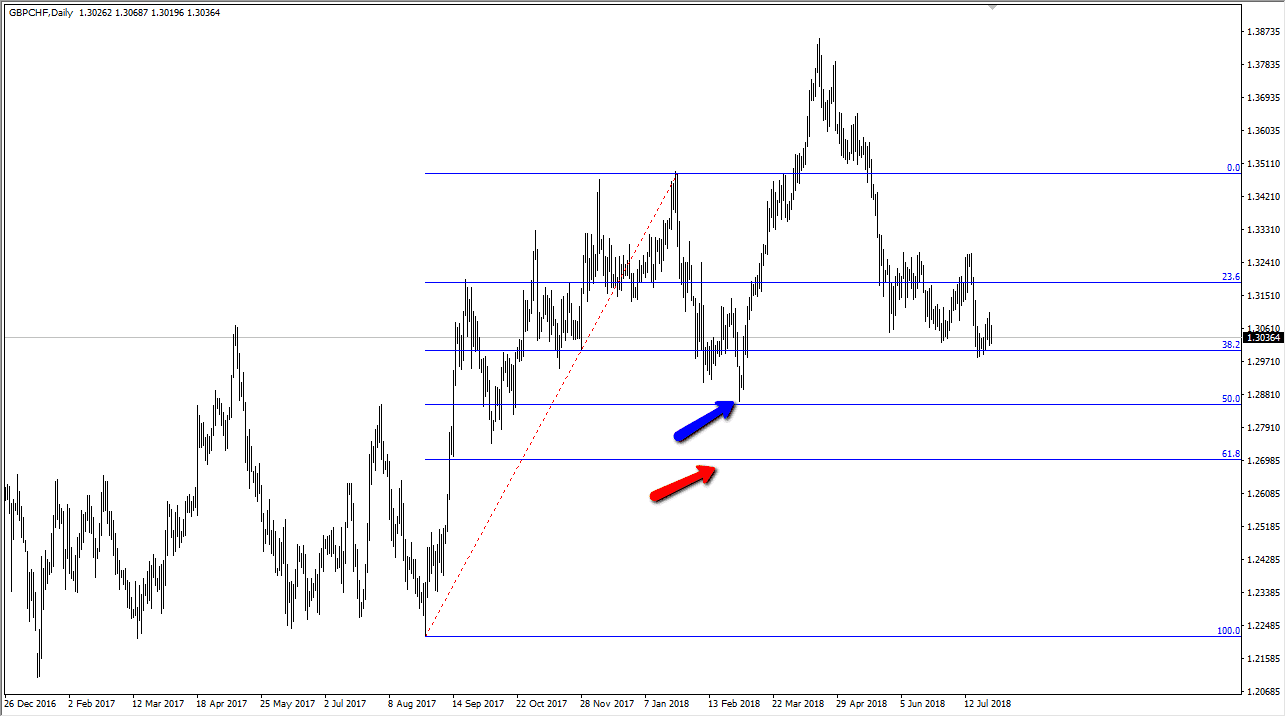

Another example of a “set and forget trading strategy” is using a longer-term Fibonacci retracement based system. In the example below, you can see that I have the same chart that I highlighted for a moving average crossover system. This time, you can see that there is a blue arrow at the 50% Fibonacci retracement. Quite often, longer-term traders will take the 50% Fibonacci retracement from a swing high as a buy signal, and use the next Fibonacci retracement level, just below the 61.8% Fibonacci retracement level in this case, as your stop loss. This case ended up being a roughly 230 pips stop loss, but you are aiming for the market to go back to the highs again at the very least. That would have been a 700 pip target. Obviously, that works out in the end.

The 230 pips stop loss scares a lot of traders, but at the end of the day it comes down to position size. I suppose that the major take away from all of this, your position size truly matters. You’re not going to get rich trading this way, but you can build your account in a relatively stress-free manner. With these types of strategies, it’s only necessary to check the charts once a day. Obviously, there are many other strategies out there, but these are two of the more basic and popular ones.

If you need leverage there is an alternative

There are couple of alternatives if you need to use leverage. One of course is playing the options market. You can go into the markets and sell puts against the SPY as an example. This demonstrates that you believe the market is going to go higher, and automatically builds in leverage. You can buy calls for that matter, there’s a million ways to play options through your stockbroker or futures platform.

However, if you are trading spot FX, the only way I know to use leverage and use a “set and forget trading strategy”, is to simply put your stop loss and your take profit target into the order and turn off the computer. It’s possible, even though it’s tough. One of my favorite trades was shorting the USD/SGD pair. I went on vacation, forgetting that I had shorted the market, but I did have a stop loss put in. When it came back, I was up 800 pips.

In a sense, all trading strategies should be “set and forget.” That’s what stop loss is are for. If you are nervous about a position, the most likely culprit is that you have far too much in the way of leverage applied. Think of it this way: you are going to be much more fearful about losing $1000 then you would be about losing $10.