What is a Trading Gap?

A “gap” in the market occurs when the opening price is either higher than the previous session’s high price (gapping up), or lower than the previous session’s low price (gapping down).

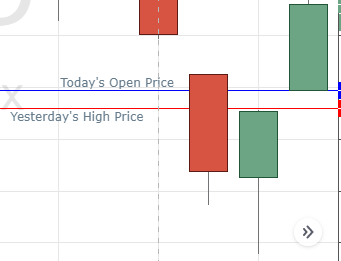

An example of a gap up is shown below. Note how the last day’s open was above the previous day’s high price. The “gap” can be seen between the blue and red horizontal lines:

An example of a gap down is shown below. Note how the last day’s open was below the previous day’s low price.

Gaps can be important in trading because there is a widely held belief among traders that gaps are usually filled quite quickly, which provides an opportunity for Forex traders to make a likely profit, because the most likely short-term direction of the price can be successfully predicted.

A gap is defined as being filled when the current market price returns to enter the price range of the previous session. For example, if on Monday stock A trades between a low of $10 and a high of $11, then opens on Tuesday at $12, the gap will be “filled” when the price reaches $11 again.

It is very easy to identify a price gap visually from a price chart in your trading platform.

Top Regulated Brokers

Price Gaps in Forex

I used examples from the stock market above because price gaps happen far more frequently in stock markets than in Forex markets. This is because the Forex market is open continuously from Monday morning until Friday night, with the exception of a few major public holidays, so opportunities for gaps to occur only really happen over weekends.

In stock markets which close overnight, a price gap can happen on any day.

Some traders look for gaps in Forex markets on a daily basis by deeming trading only “open” during the business hours of the countries relevant to the currencies. I do not believe these strategies are much use, so I will not be covering that here in any detail.

The important thing to know is that in Forex, price gaps will form when the market opens in Asia on Monday morning, or after very major holidays when Forex brokers shut down their price feeds, such as Christmas Day and New Year’s Day.

How Often do Gaps Happen in Forex?

Now we have established that price gaps can only really happen in Forex after a weekend, you are probably asking how often they happen. To answer this question, we should look at historical price data of the two major Forex currency pairs, EUR/USD, and USD/JPY, which together account for more than half of all Forex trading by volume. They are also the cheapest currency pairs to trade.

Between January 2001 and May 2020, the EUR/USD currency pair produced 204 price gaps, while the USD/JPY currency pair produced 215. As almost all Forex price gaps occur over weekends, and as there were 1,008 weeks covered by the time period surveyed, we can say that a price gap is formed after the weekend about 20% of the time in Forex. This means that you are likely to see a price gap in a currency pair on average about once every five weeks.

Now we know how often price gaps tend to happen, it is worth looking at how large the gaps are before we build a gap trading system which can show us how to trade a price gap. The size of a Forex weekend price gap is measured by the distance in pips from this week’s opening price to the high of the previous week’s range, in the case of a gap up, or from the low of the previous week’s range to this week’s opening price, in the case of a gap down.

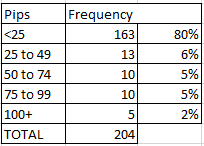

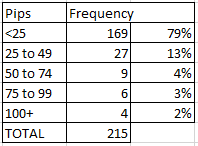

The size of the price gaps observed in the two major currency pairs are shown below:

EUR/USD

USD/JPY

We can see from this data that the vast majority (80%) of weekend price gaps in Forex have tended to be small – less than 25 pips. This fact needs to be considered when building a Forex gap trading strategy.

Now we know how often gaps tend to happen and how large they tend to be, we can ask the really important question – is it really true that gaps usually get filled?

Do Gaps Usually Get Filled in Forex?

Every gap trading strategy I ever saw relies on gaps getting filled more often than not to be profitable. So again, we need to look at what the historical data shows us.

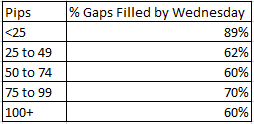

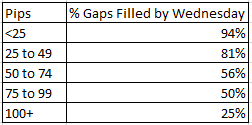

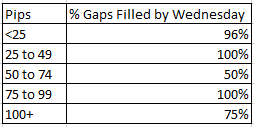

Historical data in the EUR/USD and USD/JPY currency pairs shows that weekend gaps usually have gotten filled before Wednesday in London, i.e. within about 50 hours of the weekly open. However, the bigger the gap, the less likely it is to be filled quickly, as the data tables show below:

EUR/USD

USD/JPY

We can draw some exciting conclusions from this data that can help build a profitable gap trading strategy:

- The smaller the price gap, the more likely it was to be filled quickly.

- All price gaps in EUR/USD were more likely than not to be filled by Wednesday London time, no matter how big they were.

- Price gaps in USD/JPY were more likely than not to be filled by Wednesday London time if they were less than 75 pips wide.

One extra factor worth examining is whether trend has any effect on how likely a price gap is to be filled. For example, in a long-term upwards trend, we might expect gaps down to be even more likely to be filled. Conversely, in a long-term downwards trend, we might expect gaps up to be more likely to be filled.

We can measure the effect of trend simply and effectively by saying that if the price is higher than it was three months ago, there is a long-term upwards trend; if lower than it was three months ago, there is a long-term downwards trend.

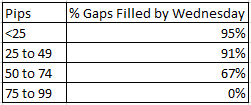

Repeating the analysis by only including gaps that could be filled by movement in line with the trend produces the following historical results:

EUR/USD

USD/JPY

It is clear from this data that weekend price gaps which can be filled in the direction of the trend, as measured by whether the price is higher or lower than it was three months ago, are considerably more likely to be filled by Wednesday than gaps which need to be filled against the trend.

2 Strategies for Trading the Gap

Identifying weekend price gaps in Forex currency pairs and entering trades which aim for the gap to be filled before the end of Tuesday, has historically been a very simple and profitable trading strategy. This strategy can be traded using only the weekly time frame.

Price gaps in the EUR/USD and USD/CHF currency pairs are usually filled quickly. Price gaps in other currency pairs are usually filled quickly if the gap is less than 75 pips in size.

The probability that a weekend price gap will be filled quickly is even stronger when the predicted fill is in the direction of the long-term trend.

This tendency of weekend price gaps to fill in Forex can be exploited simply by entering a trade as soon as the new week opens with the formation of a gap. Take profit should be set for the previous week’s range, while the stop loss should never be larger than the amount of pips targeted by the take profit level.

An alternative method to use within a forex gap trading strategy is to watch the price action on shorter time frames, and then enter a trade in the direction of the fill using a tighter stop loss once the price action indicates a move is likely underway.