The Rise of MT4

MetaQuotes Software Corporation, headquartered in Cyprus, is the developer of the MT4 trading platform. It has dominated retail Forex trading since it was launched in 2005; at one time, the MT4 was generally the only suitable option for the majority of traders. Being the first to disrupt the online brokerage scene, management at MT4 realized an emerging trend in its fledgling phase and capitalized on it well. The original MT4 design was for Forex market makers. In 2010, the MT5 platform, successor to the MT4, was launched. Regrettably, the MT5 failed to gain traction as a multi-asset platform, due primarily to its lack of backward compatibility with MT4—a significant misstep by the development team.

Brokers began to offer non-Forex assets on the MT4 platform but, despite its unrivaled success, MetaQuotes officially (and inexplicably) stopped supporting MT4. While it is available as a download from their website, the disappointing MT5 version installs instead. The MT5 is often referred to by the professional community as the “failed successor platform.” All efforts, by broker and MetaQuotes, to “sell” the MT5 as a superior choice over the MT4 have failed, clear testament to the deep roots the MT4 platform continues to nourish across global trading desks. Read our in-depth comparison of MT4 vs MT5.

Top Forex Brokers

How did MetaTrader4 corner the trading platform market?

MT4 has dominated Forex trading for over fifteen years. It is one of the most versatile trading platforms available, and almost every broker maintains it. The cost to acquire a full license starts at $100,000, but many new brokers opt instead for a White Label solution, generally at a fraction of the cost. While that makes it appealing to brokers, one of the most critical reasons why MT4 was able to corner the trading platform market is its complete support for automated trading solutions and full customization and upgrades via third-party plugins. Retail and professional traders remain loyal, more to the MT4 infrastructure than to the MT4 trading platform, a trend unlikely to change materialistically moving forward.

Another popular trend is social trading, enabled at MT4 through third-party add-ons. Some social-trading focused brokers provide only their proprietary solutions, which neglects tens of millions of existing traders who favor MT4. Due to the ease of development for customized solutions, brokers can offer in-house services on MT4. Finally, the multi-account manager (MAM) feature allows retail account management under the percent allocation management module (PAMM). It supports thousands of micro and small portfolio managers who have built their entire business on the MT4 and its flexibility to implement expert advisors (EAs) or trading robots, together with custom trading indicators. Over 1,200 brokers are known to offer MT4 versus support by only six brokers (as noted on the NinjaTrader website).

Disadvantages of MetaTrader4

No trading platform is perfect, and there are several disadvantages to point out. Brokers who deploy a proprietary trading platform tend to offer higher trading costs on MT4, attempting to direct volume to their solutions. While some complaints about speed exist, at least as compared to MT5 or alternative platforms, minor tweaks to the settings can generally overcome them, and brokers are actively taking steps to minimize latency across the board. MT4 was primarily designed for Forex and futures trading, resulting in generally fewer assets. Since the failure of the multi-asset MT5 platform, brokers started to add CFDs to MT4, narrowing the asset selection gap. It is possible to have access to sufficient assets to allow proper cross-asset diversification, suitable for all retail traders and small portfolio management firms, if the broker wishes to enable it. The lack of flexibility by the MetaQotes team is one of the most notable setbacks of MT4.

What is NinjaTrader?

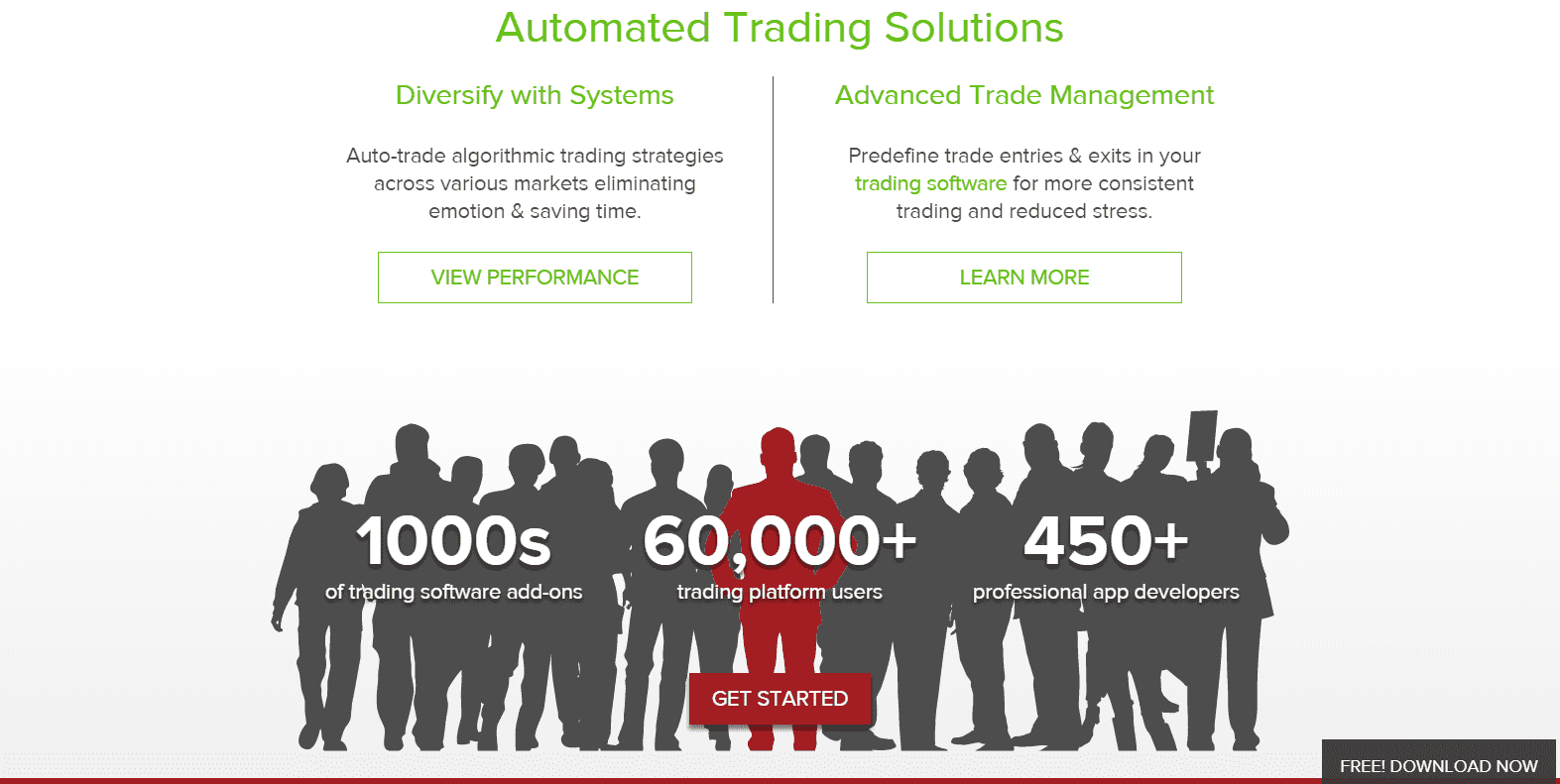

NinjaTrader is the flagship product of the US-based NinjaTrader Group, which was founded in 2003 in an attempt to disrupt the trading platform industry. Over the past seven years, it has only managed to attract slightly more than 60,000 users, a fraction of the tens of millions who consider themselves MT4 traders. Despite this, what is impressive about the NinjaTrader is the 450+ developers who created over 1,000 add-ons, including 408 custom technical indicators. NinjaTrader falsely claims to be the world’s leading futures, Forex, stock, and CFD markets chart provider.

Despite its relatively small “fan base,” NinjaTrader is the leader in independent trading platform development. It confirms the dominance of either MT4 or proprietary trading solutions by well-established brokers. Another misleading claim that NinjaTrader touts is that the platform supports a wide choice of brokers; per its own website, it supports its own brokerage division, as well as Interactive Brokers, Forex.com, Oanda, Ameritrade, and CityIndex. The fact is, NinjaTrader is exclusively focused on the North American market (and even in that, its market penetration is thin). Simply put, it has failed to gain market share elsewhere in the world.

Disadvantages of NinjaTrader

Besides its focus exclusively on the North American market, one of the most significant drawbacks is the lack of streaming data. Users are required to purchase a third-party data feed, though an option for free end-of-day data exists. Supported data feed providers are Kinetick (its preferred partner), eSignal, TradeStation, iQFeed, Cedro Technologies, Portara CQG, Global Datafeeds, TrueData, BitMEX, Lenz + Partner, and Total Cryptos. Depending on the need of the traders and the desired market coverage, obtaining these data streams can result in thousands of dollars in monthly fees. MT4 users can receive the data free of charge from their brokers.

With the 2014 acquisition of Mirus Futures, the NinjaTrader brokerage began offering streaming data free of charge to its clients. The NFA-registered introducing broker serves US clients only, further limiting its potential market reach. NinjaTrader can be leased for $720 per year, with monthly or quarterly payment plans available. Alternatively, it can be purchased for a one-time lifetime payment of $1,099 available in four installments; this option does not include access to data feeds. Due to the associated costs, NinjaTrader is not a viable choice for retail traders; however, clients of the brokerage unit may consider it as an option.

MT4 advantages over NinjaTrader

MT4 is widely available, as almost every broker maintains it. The out-of-the-box version comes with nine time-frames, 30 built-in technical indicators, and 24 graphic objects. Together, they provide traders with the necessary tools for proper market analysis, identification of trading signals, and calculation of entry and exit levels, which are further supported by tick charts. Live data feeds are free of charge, provided by the broker or by MetaQuotes. A streaming news service delivers market-relevant events, and traders may set alerts.

Traders can react to fast-moving markets through instant execution via one-click trading and chart trading. MT4 supports six order types, two market orders, and four pending orders, for proper planning, risk management, and for more complex trading strategies. A trailing stop order is equally available. It is available as a desktop client, a webtrader, and a mobile version. This fully secure platform allows new traders to get started, with all necessary tools, completely free of charge. It has stood the test of time and earned the trust of tens of millions of traders around the world.

NinjaTrader advantages over MT4

Chart customization is superior in NinjaTrader over MT4. The ability to link multiple charts together provides a distinct advantage. For example, a trader can open three EUR/USD charts, displaying various time-frames and indicators; changing one to GBP/USD will change all corresponding ones. Developers also enjoy an advantage as they can code in C#, and NinjaTrader supports all Windows.Net functions, including voice commands by Cortana. MT4 comes with its own language, MQL, and requires some adjustments. NinjaTrader additionally supports the OCO (one cancels other) order function. Free daily webinars assist new traders in using the NinjaTrader trading platform.

Which trading platform is superior for automated trading solutions?

Both platforms fully support automated trading, the most disruptive trend across financial markets, which remains in its infancy. While NinjaTrader has an edge in developer-friendliness, MT4 remains the better choice for automated trading solutions. NinjaTrader lists only 91 automated trading strategies and 408 custom indicators. Conversely, MT4 features 15,466 autonomous trading robots, referred to as expert advisors (EAs), and 6,976 custom indicators. Through the use of a VPS server, often provided as a free service by MT4 brokers focused on automated trading, MT4 solutions can trade the markets non-stop without requiring the presence or connection of the trader.

A fast-growing number of micro and small portfolio managers are deploying solutions developed on the MT4 infrastructure, particularly across Africa, Asia, and Latin America. One slowly growing trend is the use of automated solutions created outside MT4, with an API provided by the broker to connect to MT4 for order placement and management.

MT4 versus NinjaTrader costs and fees

Over 1,200 brokers maintain MT4, but most of them offer the basic version only. The majority of licenses, especially by smaller brokers, are obtained via a White Label solution, which can cost as little as $5,000. That compares to a minimum cost of $100,000 for the full license. Given that, most brokers retain the bare minimum and advertise it as a cutting-edge trading platform. While that claim is inaccurate, the MT4 does support upgrades to achieve the advertised advantage.

More than 22,000 third-party add-ons are available, and while many free ones exist, the quality upgrades often come at a cost. Depending on the trader and strategy, it can cost as little as $50 and increase to above $250. Multiple solutions will increase that cost, but it is entirely possible to trade live markets with all necessary tools free of charge with MT4. That is yet another reason why the MT4 is dominant; by some measures, it accounts for 95% of Forex trading volume globally (excluding Japan).

Across the board, NinjaTrader is considerably more expensive than MT4. The most cost-effective solution of live trading is the one-time lifetime license fee of $1,099, which is comparable to the free version of MT4. Next are the costs for the live data feed, which can be as little as $20 per month to as much as several thousand dollars, depending on the desired asset selection. Third-party add-ons are significantly more expensive to obtain, and can range between $500 and $5,000 in one-time costs; again, that cost is dependent on the requirements of traders.

Final Conclusion

MT4 remains the superior choice across the board. There are some features where NinjaTrader outperforms, but third-party MT4 upgrades address them with a less expensive solution than the costs to obtain a trade-ready NinjaTrader version. The basic version of MT4, as offered by most brokers, is superior to the NinjaTrader's end-of-day set-up, which is available for free but generally unsuitable for traders. Ease of use of the MT4 aside, considering the high costs to bring NinjaTrader on par with an enhanced MT4 trading platform, and coupled with global support for MT4 versus the localized US-focused NinjaTrader, most traders will find a superior solution in an upgraded MT4.