Top Forex Brokers

The Daily Forex research team approached our huge database consisting of more than 120,000 subscribers, mainly Forex traders, and asked questions about their challenges and strategies when trading Forex.

We surveyed 3,127 Forex traders from 32 countries to understand how they analyze data, how they trade, what they find challenging, and what is working well. Below we outline some interesting facts, statistics, trends, and charts about the huge $6.6 trillion Forex market.

Forex Market Statistics

The Size and Daily Turnover in the Global Foreign Exchange Market

The Forex market is the biggest financial market in the world, bigger than the stock, bond, and commodity markets. Forex market daily activity has seen an increase from US$ 1.2 trillion in 2001 to US$ 6.6 trillion in 2019. The global Forex trading market is worth $2,409,000,000,000 (that is $2.4 quadrillion).

Forex is the only market that runs for 24 hours a day (except for weekends). The Forex market is three times larger than the derivatives market and a whopping 35 times larger than the equity (stock) market.

Who Are the Major Forex Market Players?

Forex traders and investors come from a broad spectrum of backgrounds. Most of the market volume in the Forex market is generated by financial institutions such as commercial banks, central banks, hedge funds, investment managers, and multinational corporations. Retail Forex trading only accounts for a mere 5.5% of the entire Forex market globally.

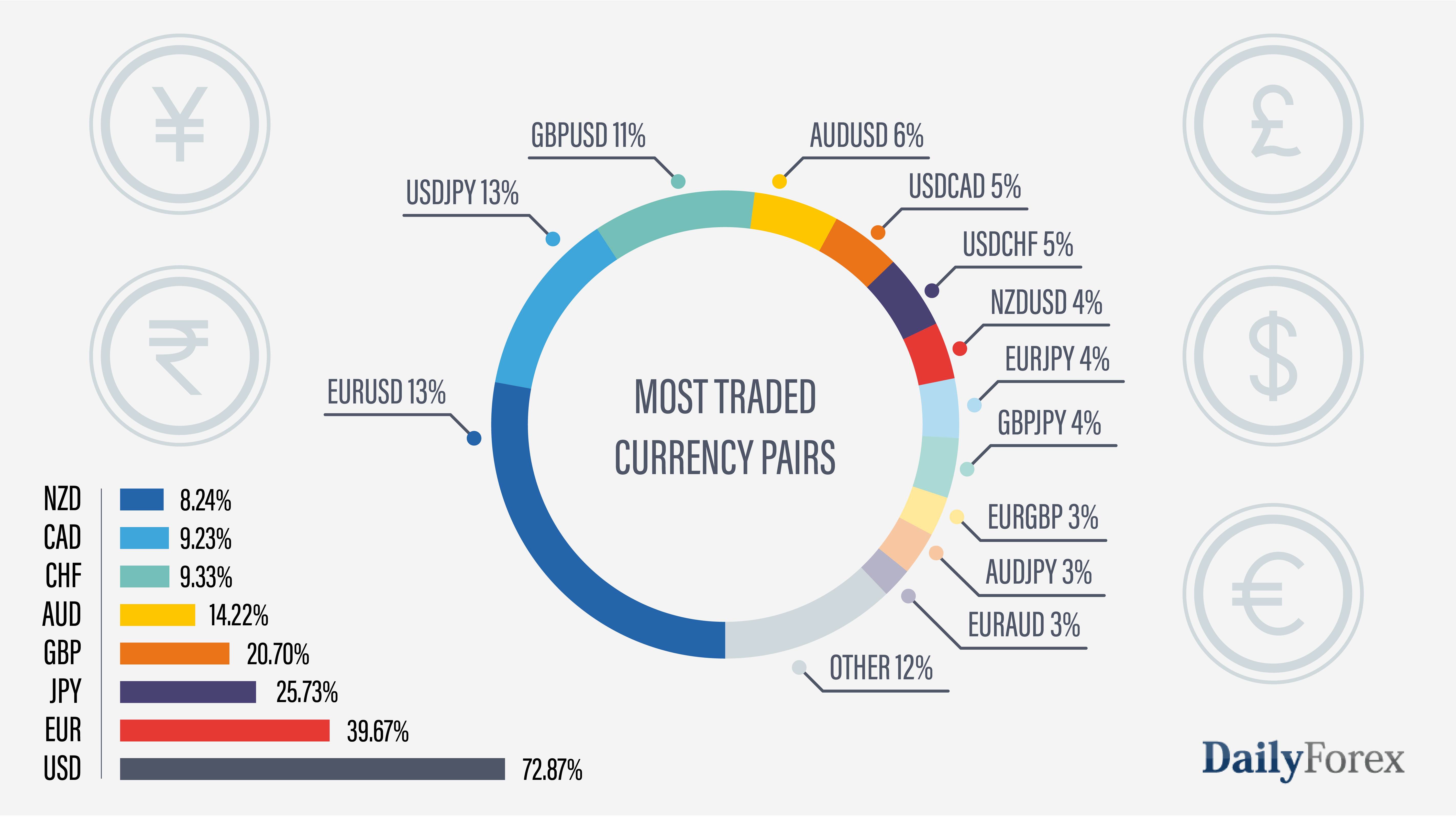

The World’s Most Popular Forex Currencies

There are over 170 different currencies around the world today that make up the Forex market. The US Dollar is the most traded currency in the world. The US Dollar, also known as the "greenback", is part of almost 73% of global trades.

Most of the popular Forex currencies have daily trading signals for beginner and experienced traders.

- The Euro is the 2nd most traded currency, participating in 39.7% of the trades.

- The Japanese Yen (JPY) is the third most traded currency, participating in 25.7% of the trades.

- The British Pound (GBP) is the fourth most traded currency, participating in 20.7% of the trades.

- The Australian Dollar (AUD) is the fifth most traded currency, participating in 11.48 of the trades.

- The Canadian Dollar (CAD) is the sixth most traded currency, participating in 8.0% of the trades.

- The Swiss Franc (CHF) is the seventh most traded currency, participating in 7.0% of the trades.

- The New Zealand Dollar (NZD) is the eighth most traded currency, participating in 5.7% of the trades.

What are the Most Traded Currency Pairs?

More than 70% of the global Forex market transactions happen in only 7 currency pairs known as the majors (EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD, USD/CHF, and NZD/USD)

EUR/USD

The United States Dollar (USD) is the currency of the world’s largest economy and the world’s most dominant reserve currency. The European Union Euro (EUR) is second in dominance and this EUR/USD pair (nicknamed “Fiber”) is the world’s most traded currency pair, taking up the largest chunk of the market’s action.

USD/JPY

The second most popular pair to trade is the USD and the Japanese Yen (JPY). The USD/JPY, also known as “The Ninja”, tends to reflect the political situation between the two economies at any given time. This pair is also referred to as the “gopher”.

GBP/USD

Moving down the list of most popular pairs to trade, the next coupling on the list is British Pound (GBP) and the USD. The GBP/USD is commonly referred to as the “cable” (due to the undersea cables that used to carry bid and ask quotes across the Atlantic Ocean). The pair tends to positively correlate with the EUR/USD.

AUD/USD

The fourth most popular currency pair is the Australian Dollar (AUS) and the USD. The AUD/USD is commonly referred to as the “Aussie”. The Aussie is greatly affected by mining commodities, farming of beef, wool, and wheat.

USD/CAD

The USD and the Canadian Dollar (CAD) are next on the list of most popular currency pairs to trade. This pair is affected by oil, timber and natural gas and tends to negatively correlate with the AUD/USD, GBP/USD, and the EUR/USD.

USD/CHF

The USD to Swiss Franc (CHF) is commonly referred to as the “Swissy”. When uncertainty enters the market, traders tend to bid up the Swiss Franc which has been regarded as a safe haven for traders because the Swiss economy is seen to have lower risk. The pair tends to negatively correlate with the EUR/USD and GBP/USD pairs.

NZD/USD

The last pair on our list of the 7 majors to trade is the New-Zealand Dollar (NZD) to USD. The NZD/USD is also known as the ‘Kiwi’. Changes to monetary policy from the Federal Reserve and Reserve Bank of New Zealand can lead to NZD/USD volatility.

What markets do traders trade?

97% of respondents trade Forex, 43% Gold, 24% stock indices, and 9% cryptocurrencies.

Forex Traders

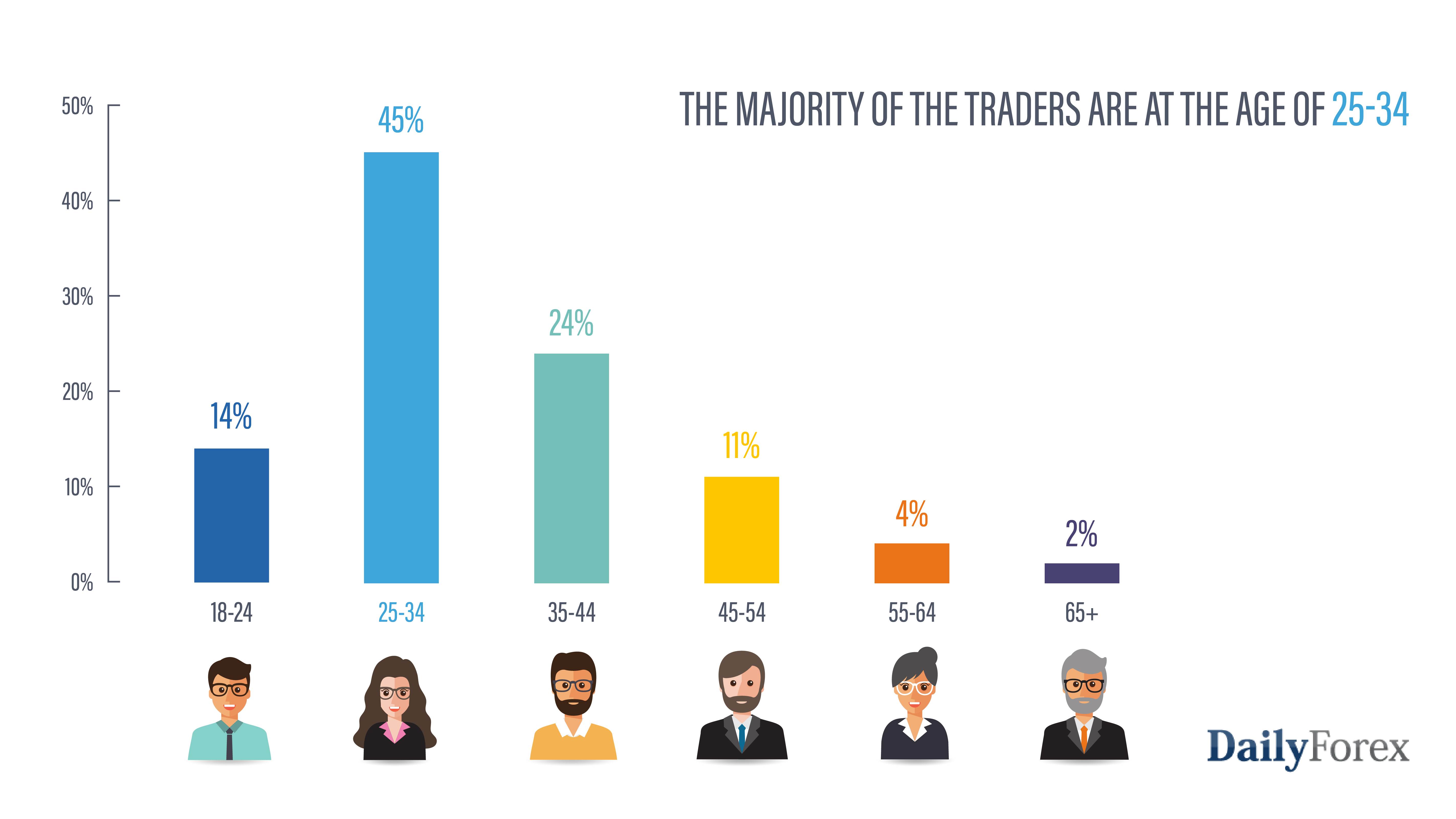

According to our research, women represent only 12.4% of all traders.

The majority of the traders are aged between 25 and 34, as shown below:

Can You Get Rich by Trading Forex?

As we know, all Forex traders lose money on some trades. George Soros and Stanley Druckenmiller are well known as people who have made enormous profits from Forex trading – but this does not mean that every trade they ever made was a winner.

We asked the participants if they think that they can get rich by trading Forex. 88% replied affirmatively.

Can Forex trading be a full-time job?

While 88% of the participants believe that they can become rich by trading Forex, only 12% replied that trading can be a full-time job. 8% of the participants replied that they spend less than 1 hour a day and 52% spend 3-4 hours on daily trading. You should not expect to start an account with a few hundred dollars spending only 1 or 2 hours trading per day and expect to become a millionaire or even make a living by day trading.

What monthly return do you believe that you can achieve trading currencies?

Trading Experience

Forex trading is not a game! As you can learn from the data that we’ve gathered below, experience is one of the key factors for successful trading. Experience and education. One of the good things about Forex trading is that there is plenty of free information, videos and free forex ebooks about it available on the net.

Do traders have any other trading experience before Forex?

72% of Forex traders had no experience trading any other markets before trading Forex.

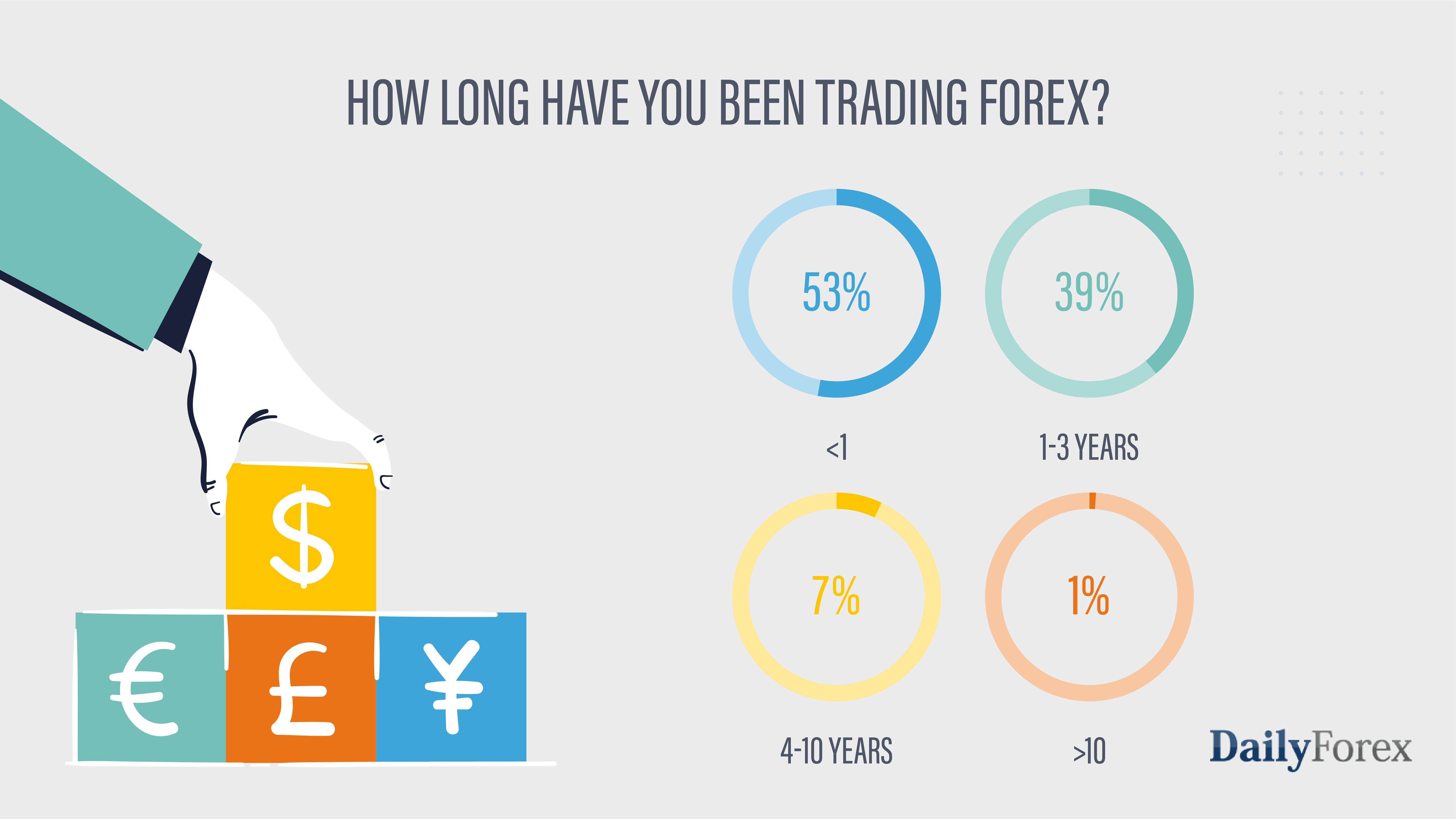

How long have you been trading Forex?

When we divide the total number of traders according to their trading experience, we can see a clear majority (92%) of beginners with less than 3 years’ experience. This figure (as well as the rising search volume on our website) indicates that there are many people entering the trading world, especially in recent times.

39% have been trading for 12 months or less, 53% have traded for less than 1 year and 1% have traded for over 10 years.

Are traders trading live or demo accounts?

70% of those who responded to the survey trade on a live account.

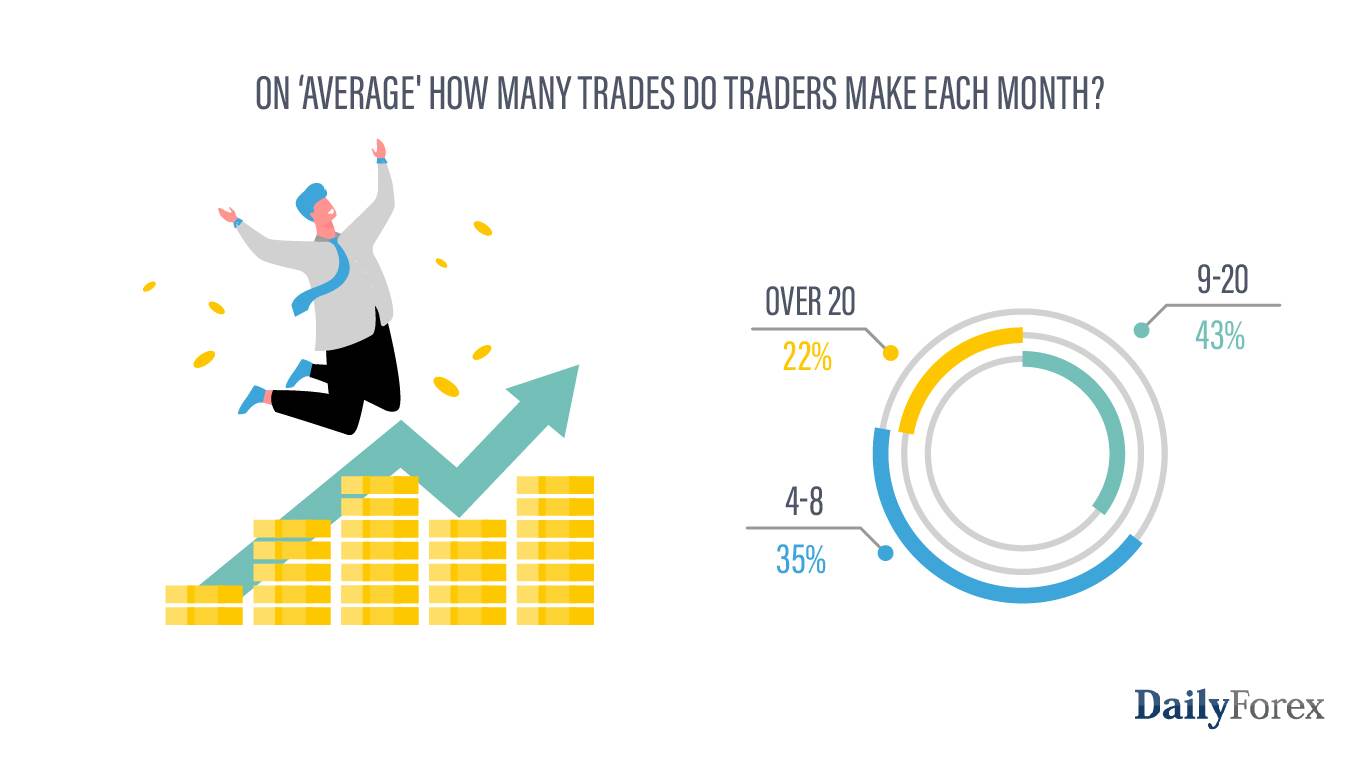

On ‘average' how many trades do traders make each month?

43% of traders make 9-20 trades per month. 35% make 4-8 trades per month and 22% make over 20 trades per month.

How many traders are successful and what is the success rate of Forex traders?

Is it true that 90% of traders lose money? We have asked the participants if on the overall they lose or win money. According to our survey 85% of Forex retail traders do not succeed.

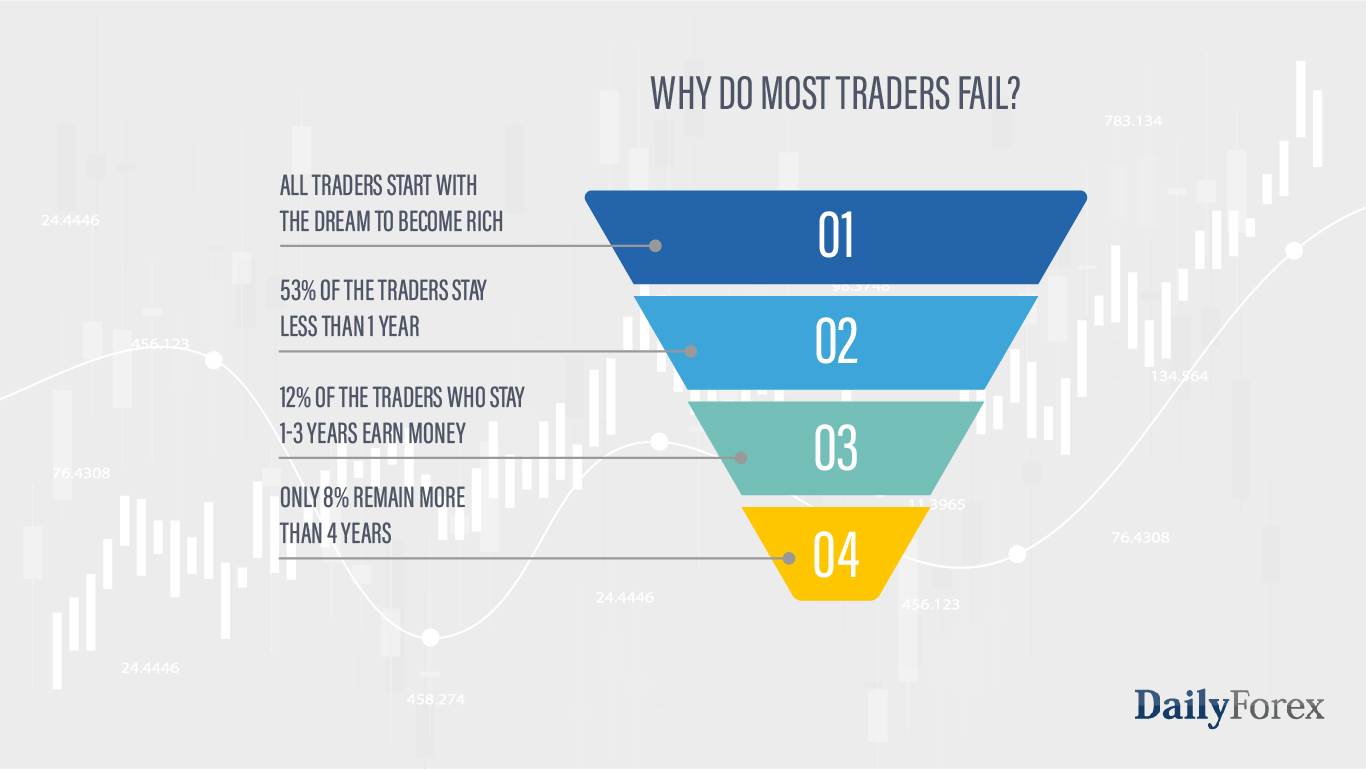

So why do most traders fail?

85% of those who trade for more than 4 years claim to win. In order to become a successful trader, you need a good understanding of the market. Only then can you develop a trading strategy and discipline. Professional traders often say that they lose a lot of money at the start of their trading journey because they lack the knowledge, strategy, or discipline to succeed. The majority of the profitable traders spent at least 4 years losing money before they were able to build a winning trading plan. If you do not have a professional background in financial markets, it could be even harder.

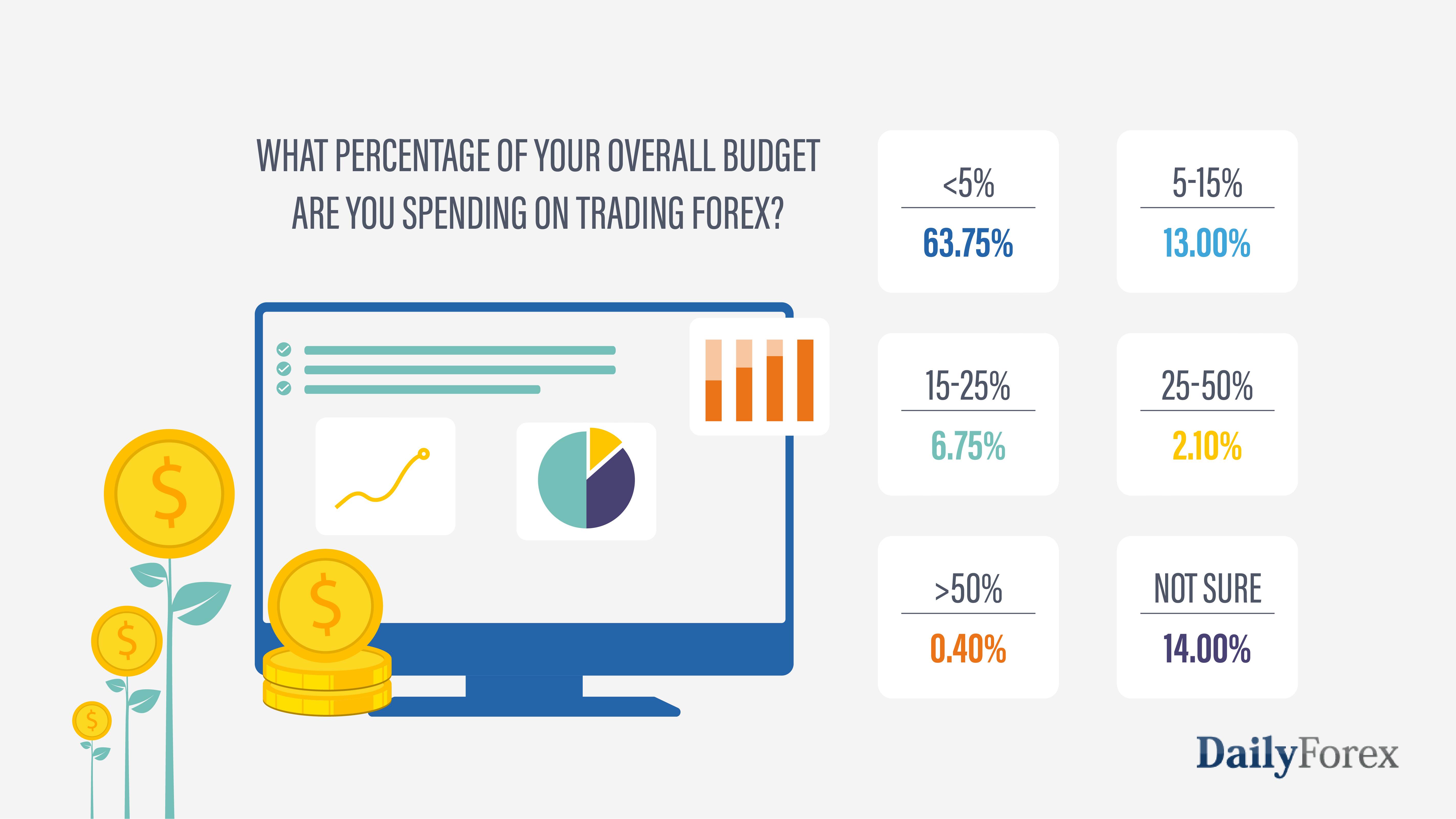

What percentage of your overall budget are you spending on trading Forex?

The majority of the traders we surveyed risk less than 5% of their overall budget on trading Forex.

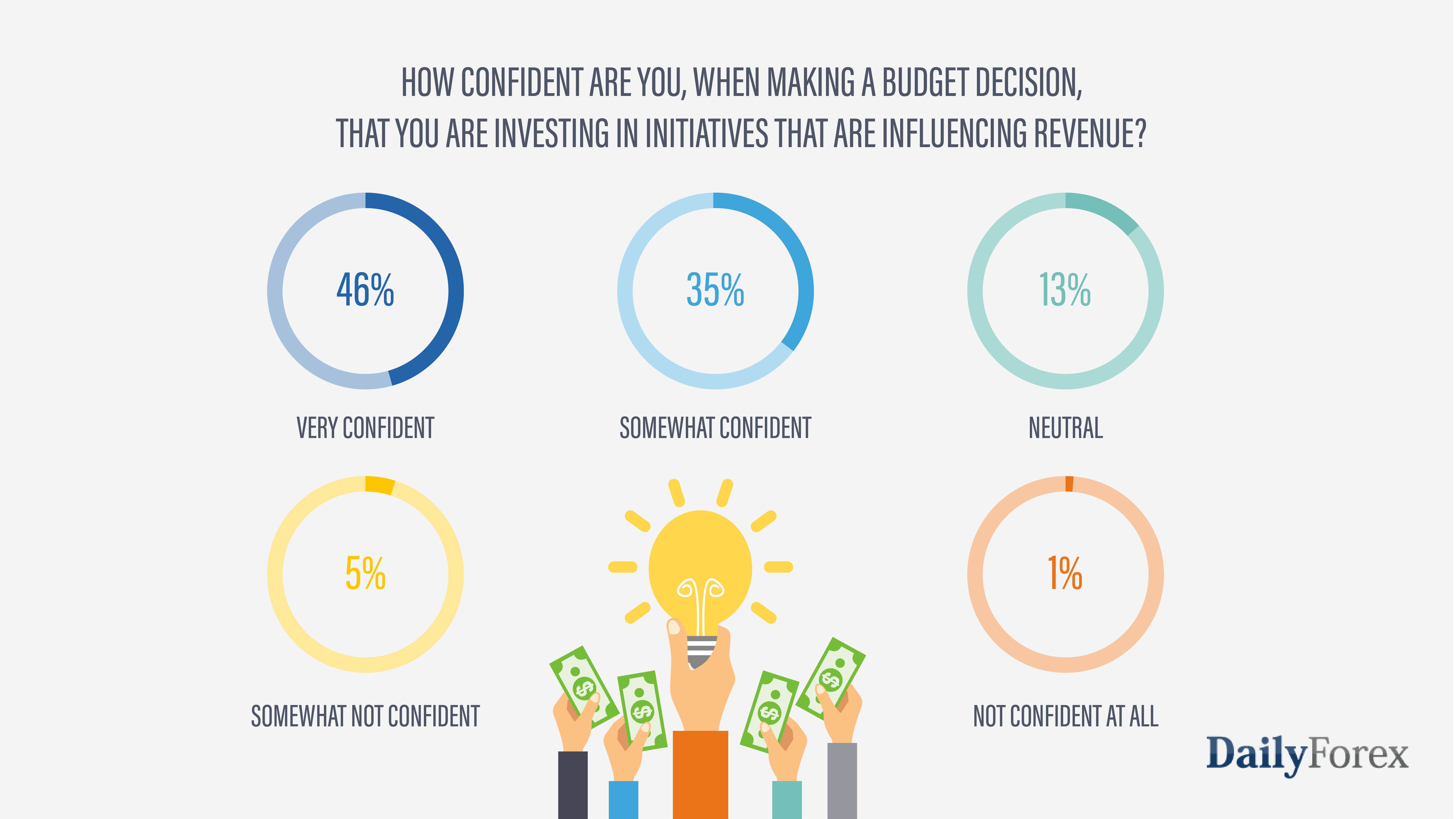

How confident are you, when making a budget decision, that you are investing in initiatives that are influencing revenue?

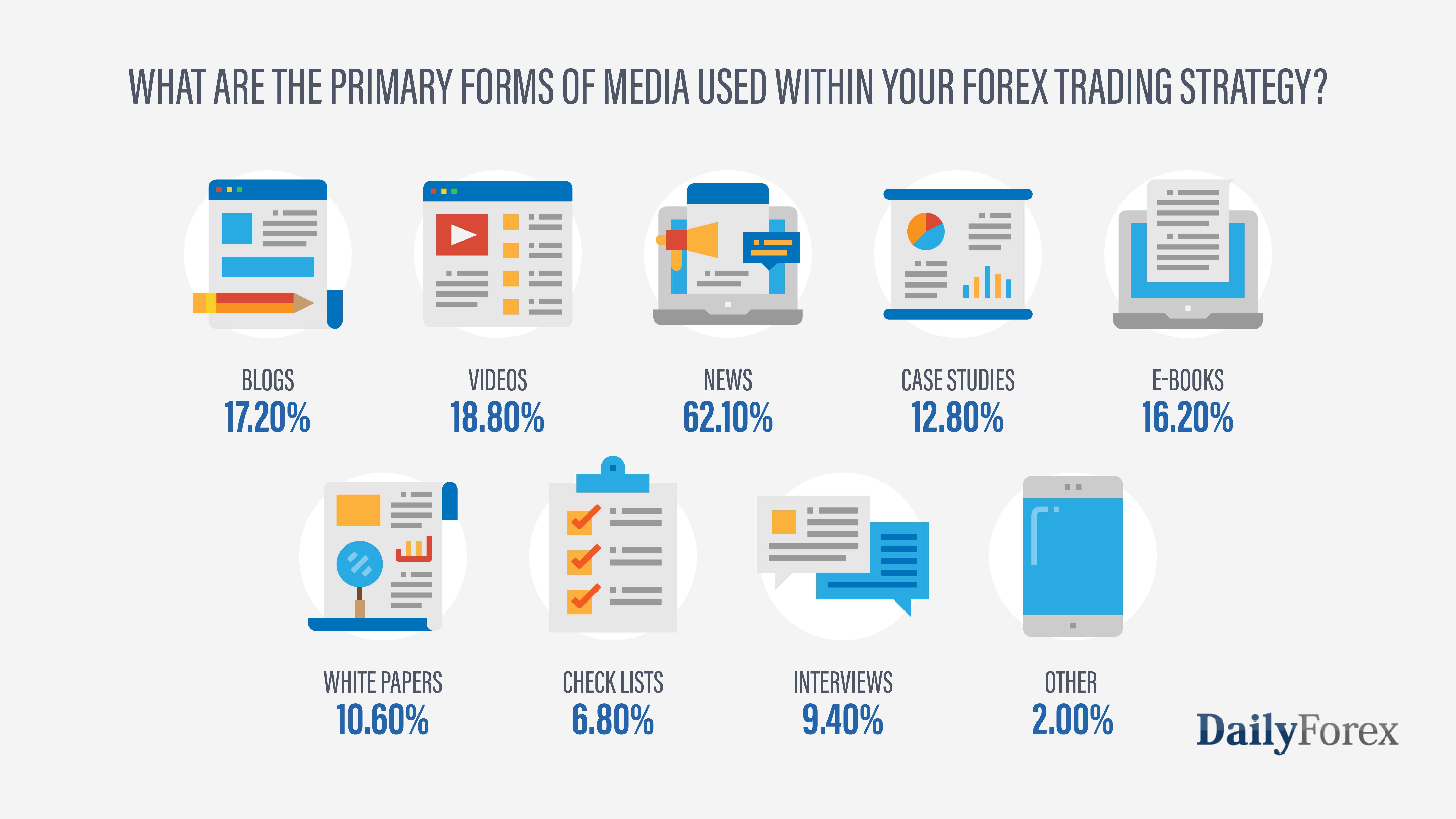

What are the primary forms of media used within your Forex trading strategy?

A majority of the traders (52.6%) rely on news sites as part of their core trading strategy. Case studies, e-books and white papers are complementary as part of the education process.

There is no one-size-fits-all way to understand the market: each country, region, and locality has unique needs, terminology, and means of consuming information.

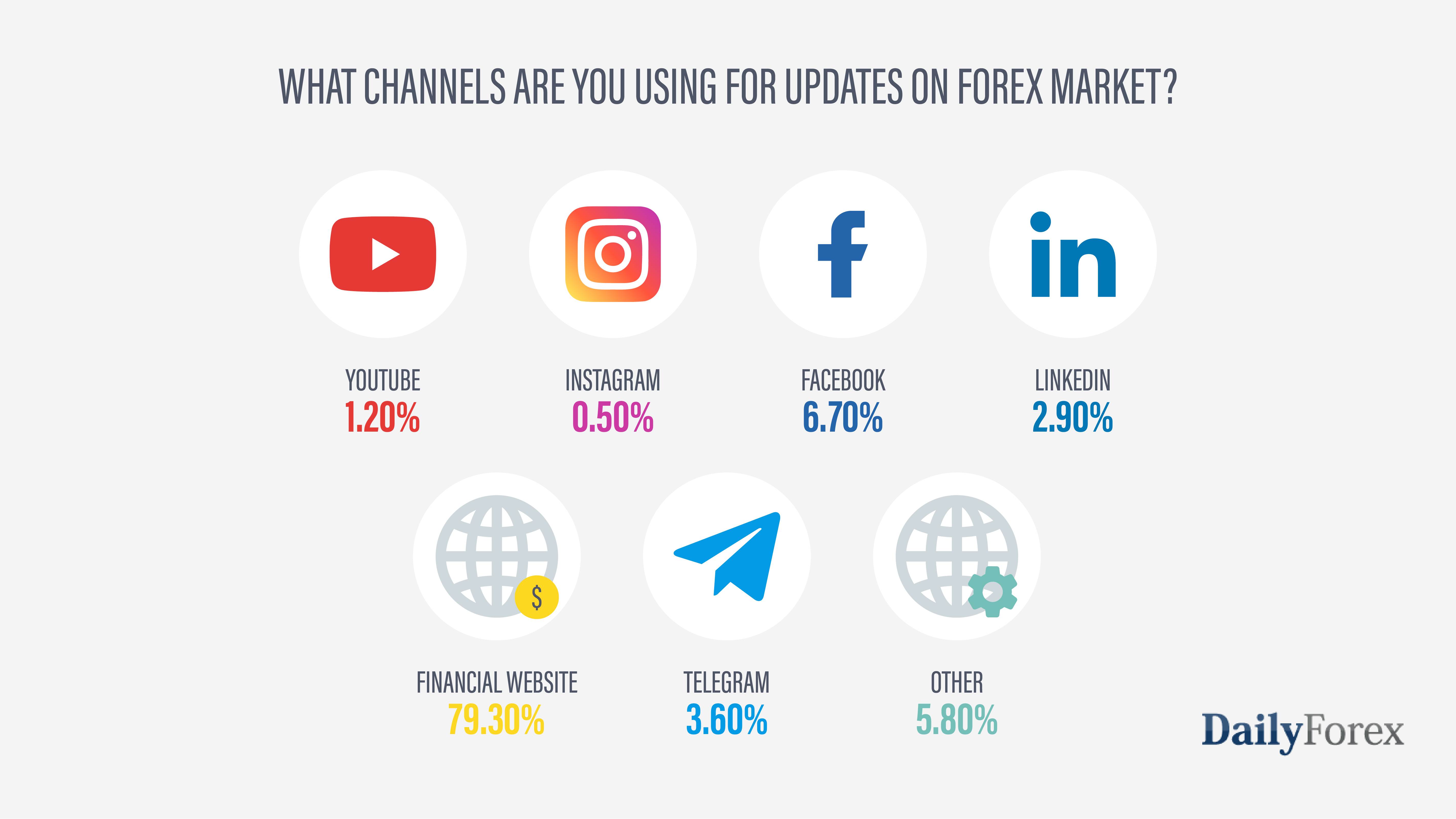

What channels are you using for updates on Forex market?

The majority of the traders rely on financial websites to learn and update about the Forex market. 13.7% of the traders are taking an active part in social media communities such as Facebook, LinkedIn and Telegram.

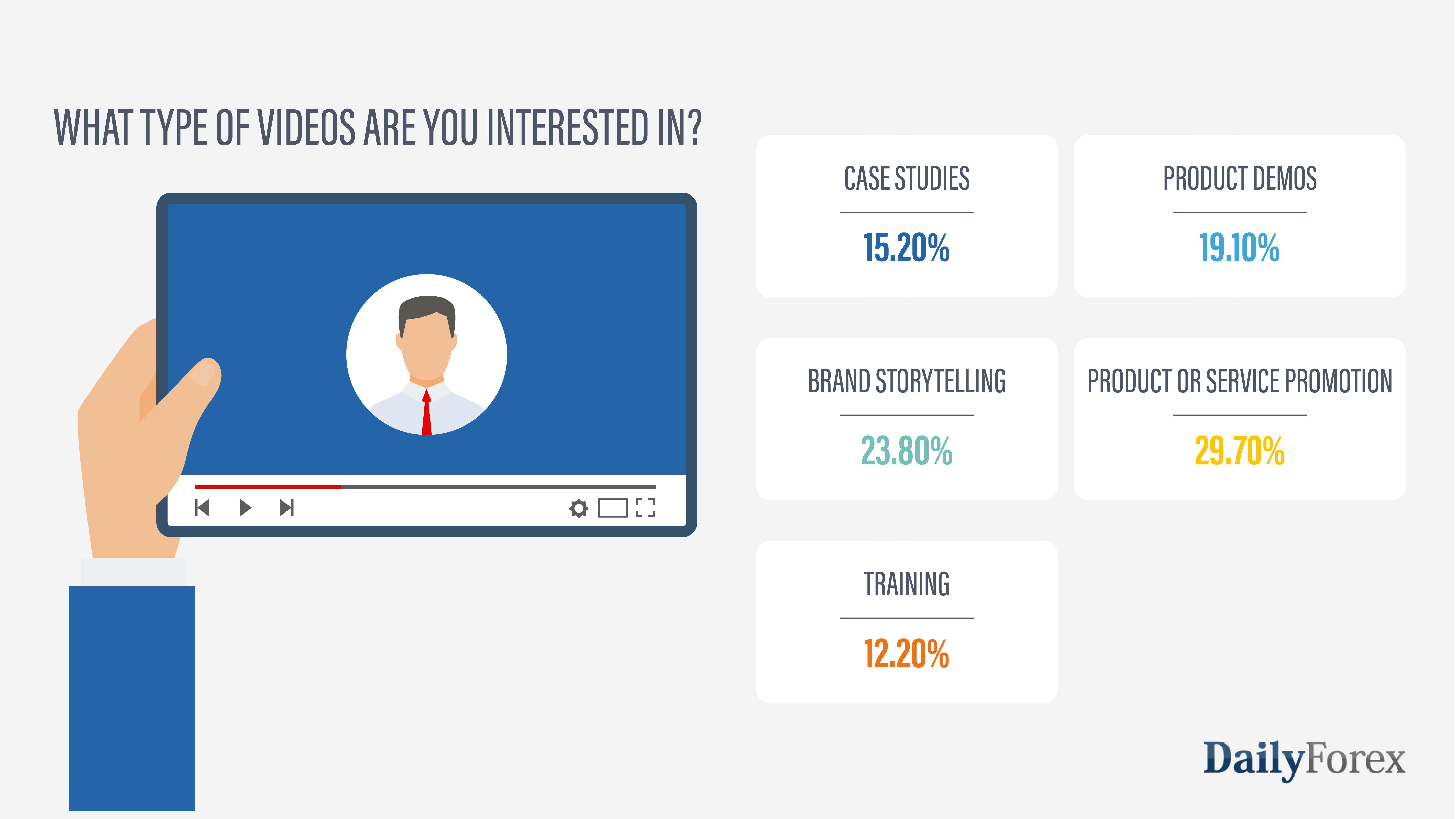

What type of videos are you interested in?

Forex Market Technology

Forex trading is very competitive, and even very small delays in trade execution can be very costly. There is no doubt that technology has an impact on Forex trading. Below you can find informative statistics about Forex trading platforms and tools.

What technology are you using to find a Forex broker?

Over 78% of traders search for a broker using a mobile or tablet device.

Traders prefer Android over iOS. 59.2% of traders have an Android phone, while 40.8% use iOS.

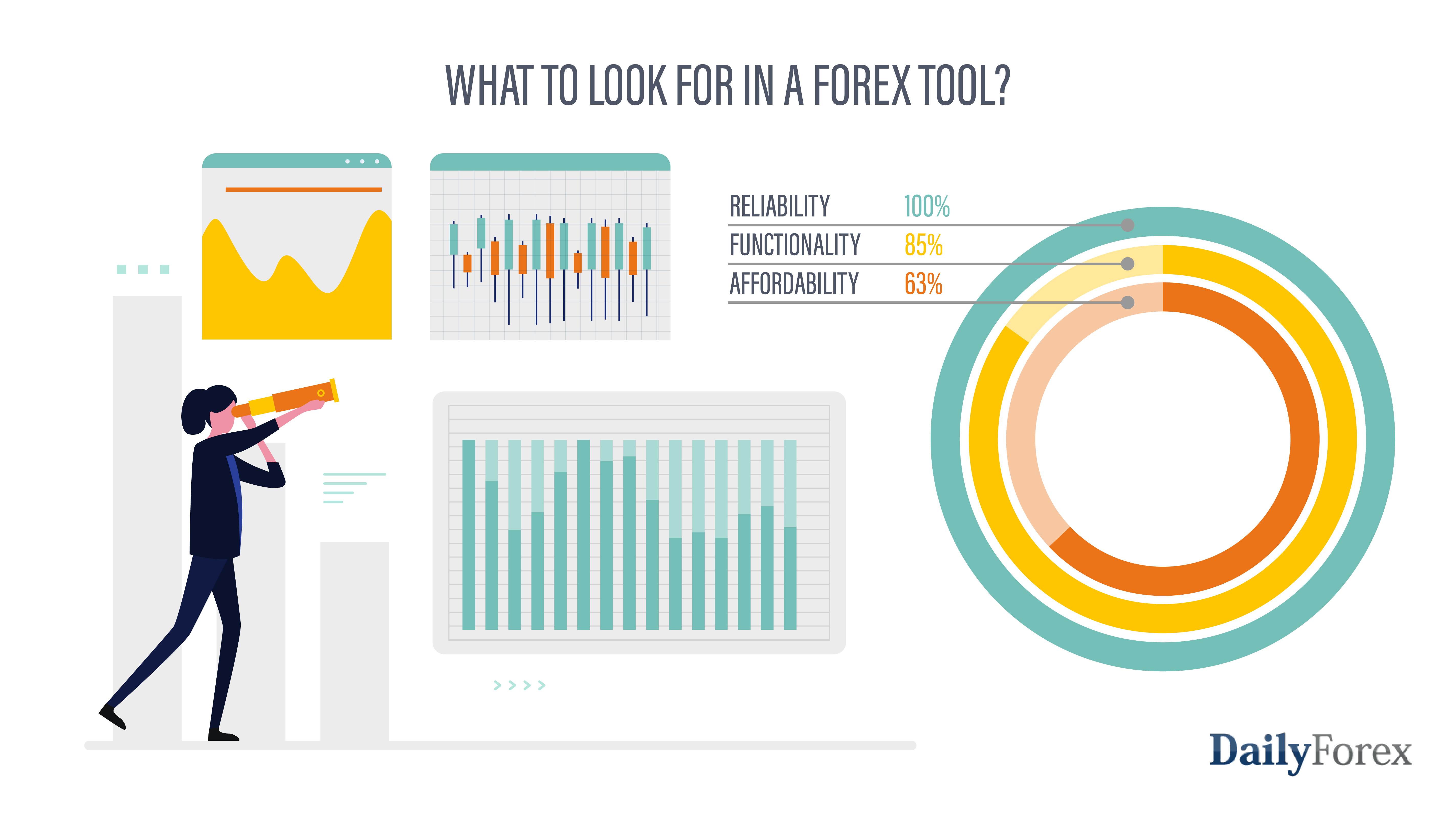

What to Look for in a Forex Tool

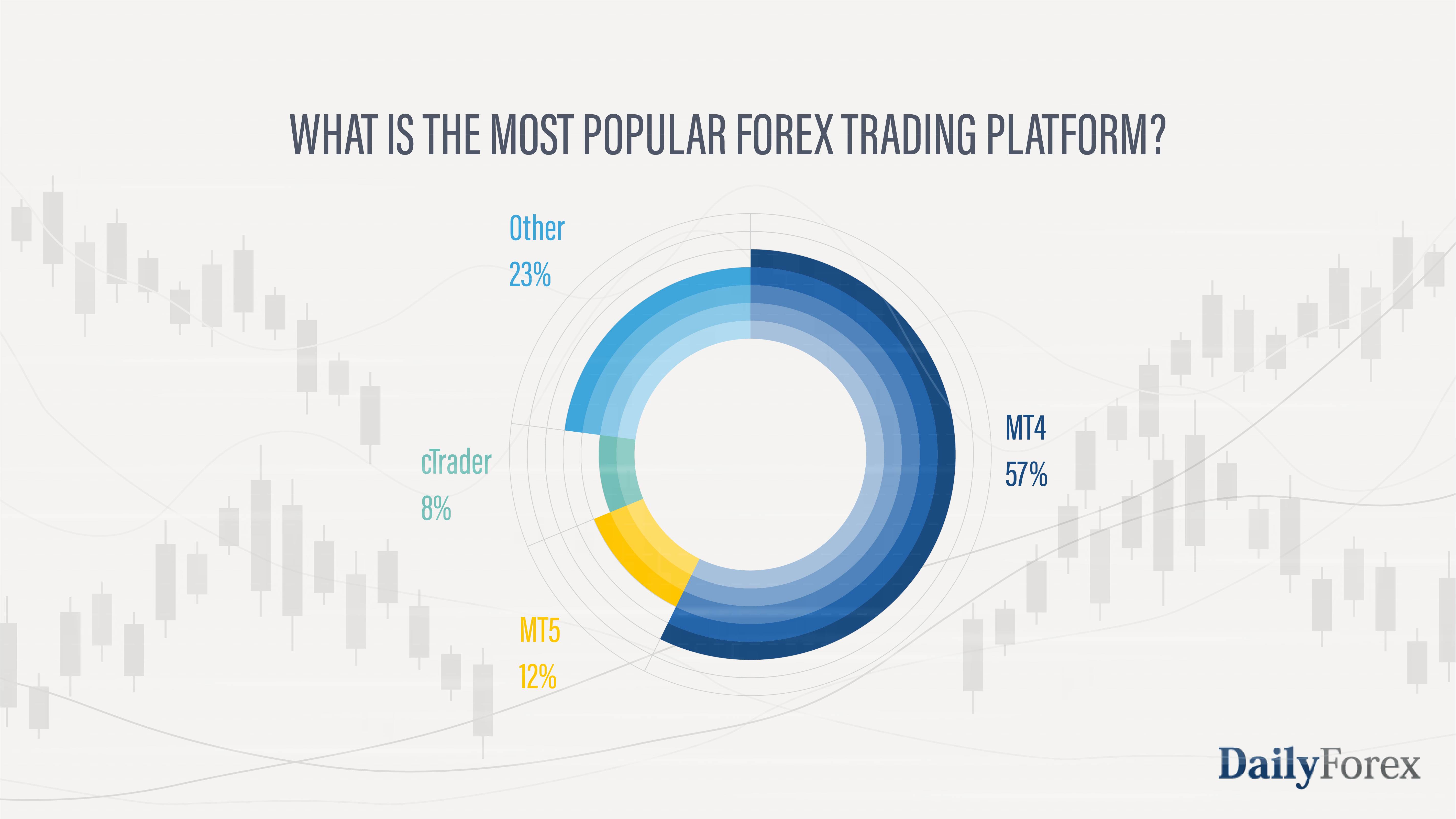

What is the most popular Forex trading platform?

MT4 is the most popular Forex trading platform in the world. 57% of the people who took our survey trade with MT4. Many Forex brokers offer their clients the opportunity to use MT4 as their trading platform. Its closest competitor is MT5, which is also built by MetaTrader. 6% responded that they use cTrader and 18% use other, which is likely to be a broker's proprietary platform.

85% of traders use Windows Desktop.

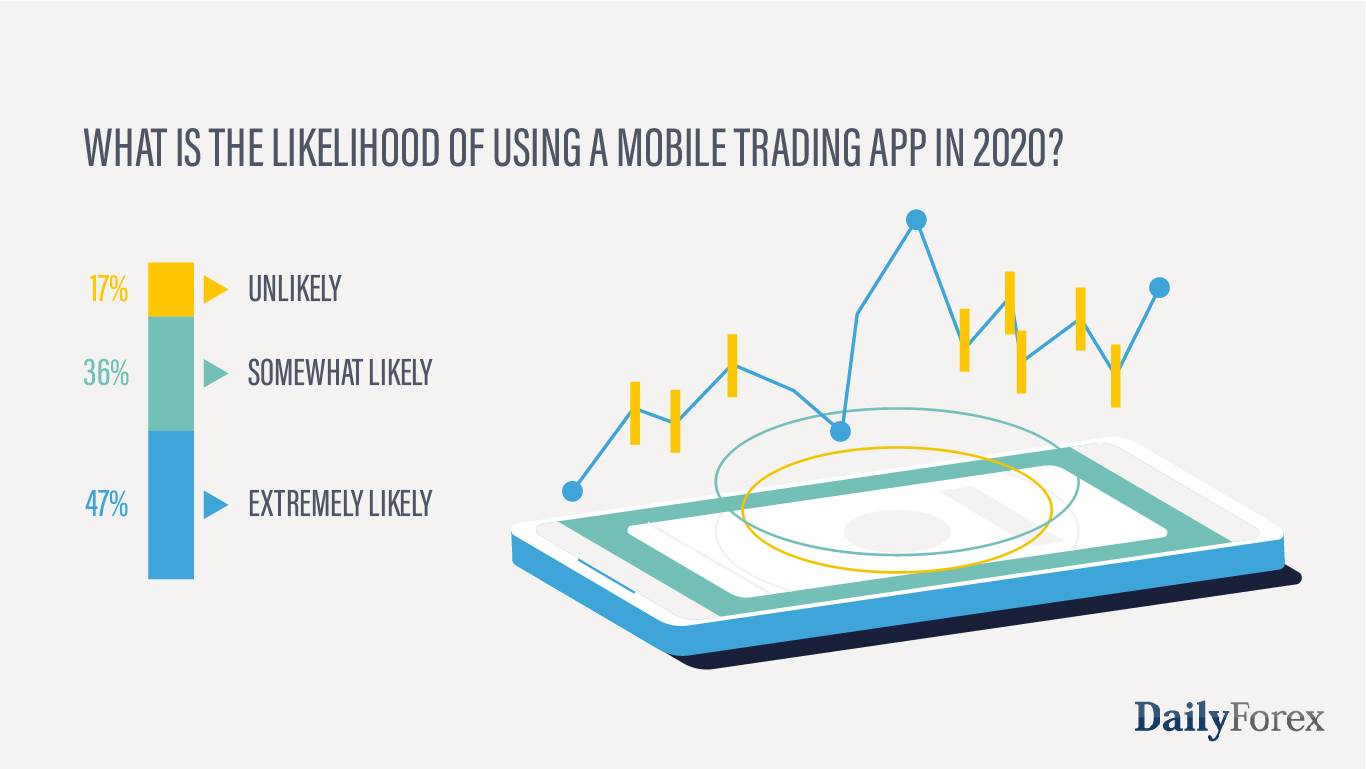

What is the likelihood of using a mobile trading app in 2020?

83% of Forex traders surveyed are extremely or somewhat extremely likely to use a Forex trading app in 2020.

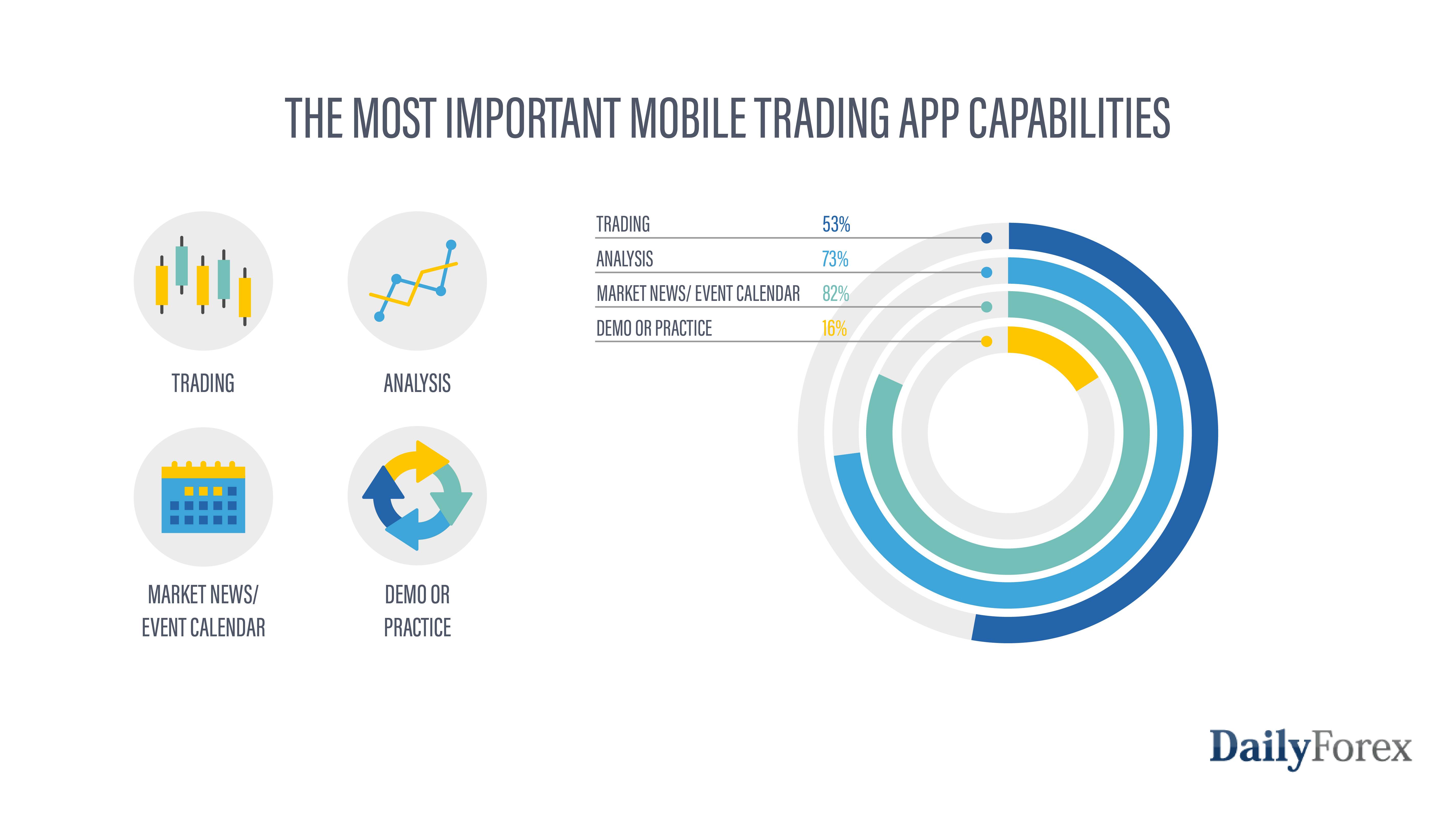

The most important mobile trading app capabilities:

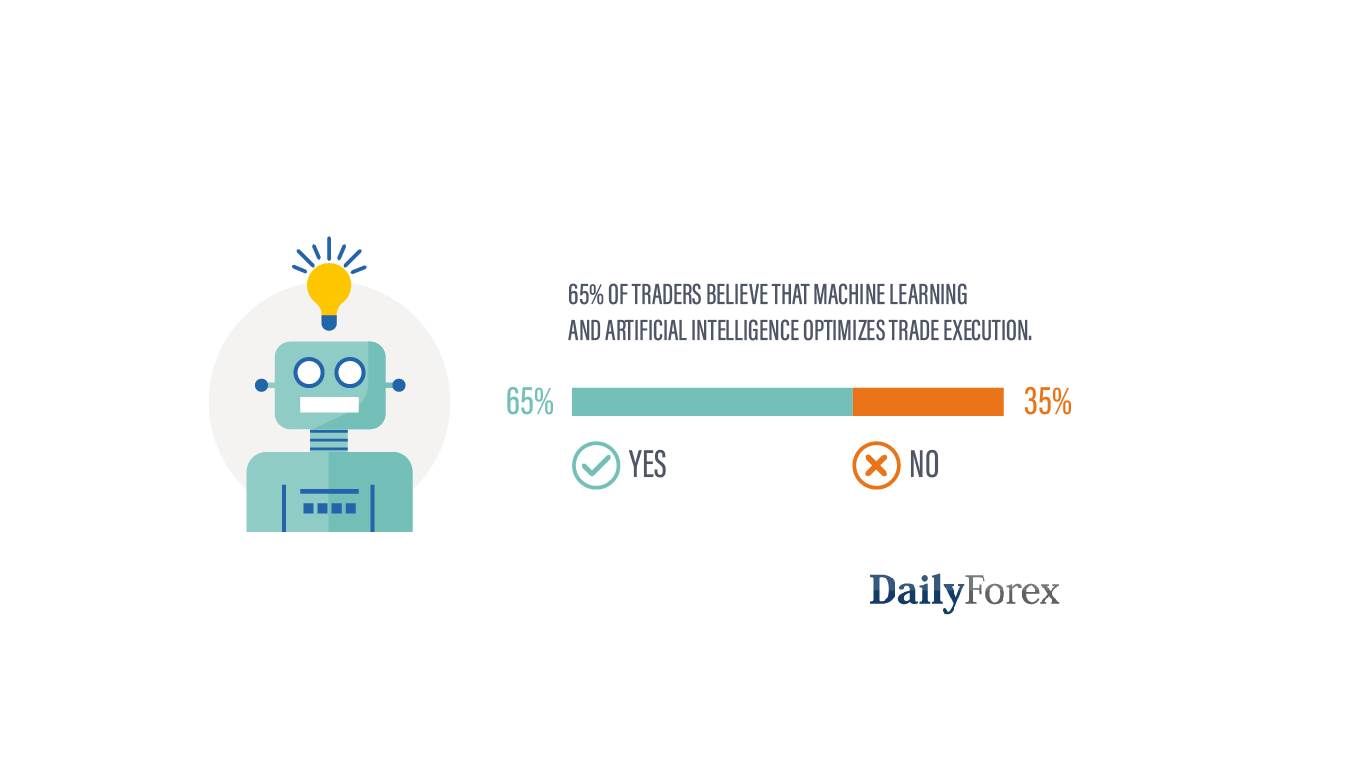

Do you believe that artificial intelligence and machine learning optimizes trade execution?

65% of traders believe that machine learning and artificial intelligence optimizes trade execution.

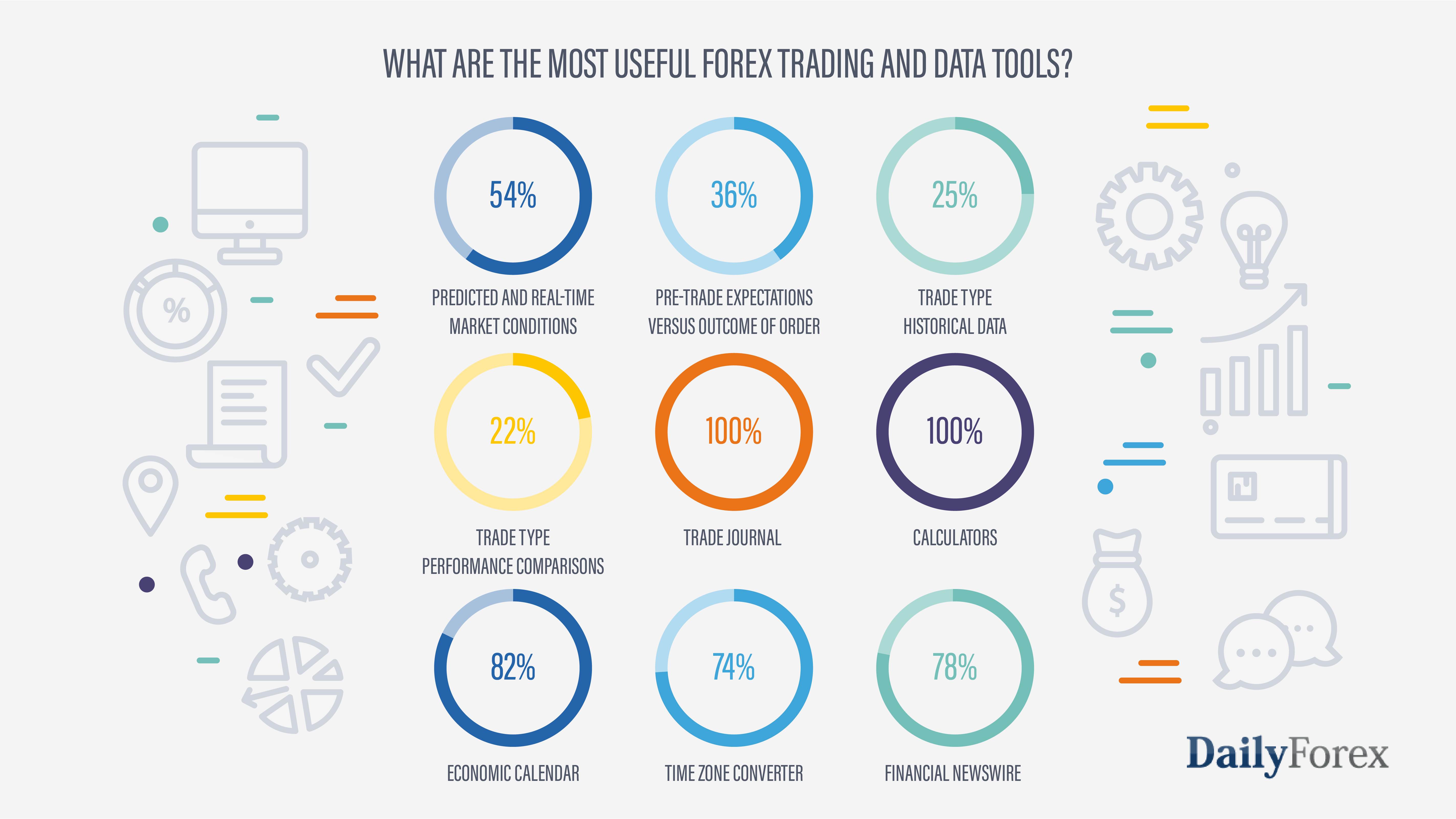

What are the most useful Forex trading and data tools?

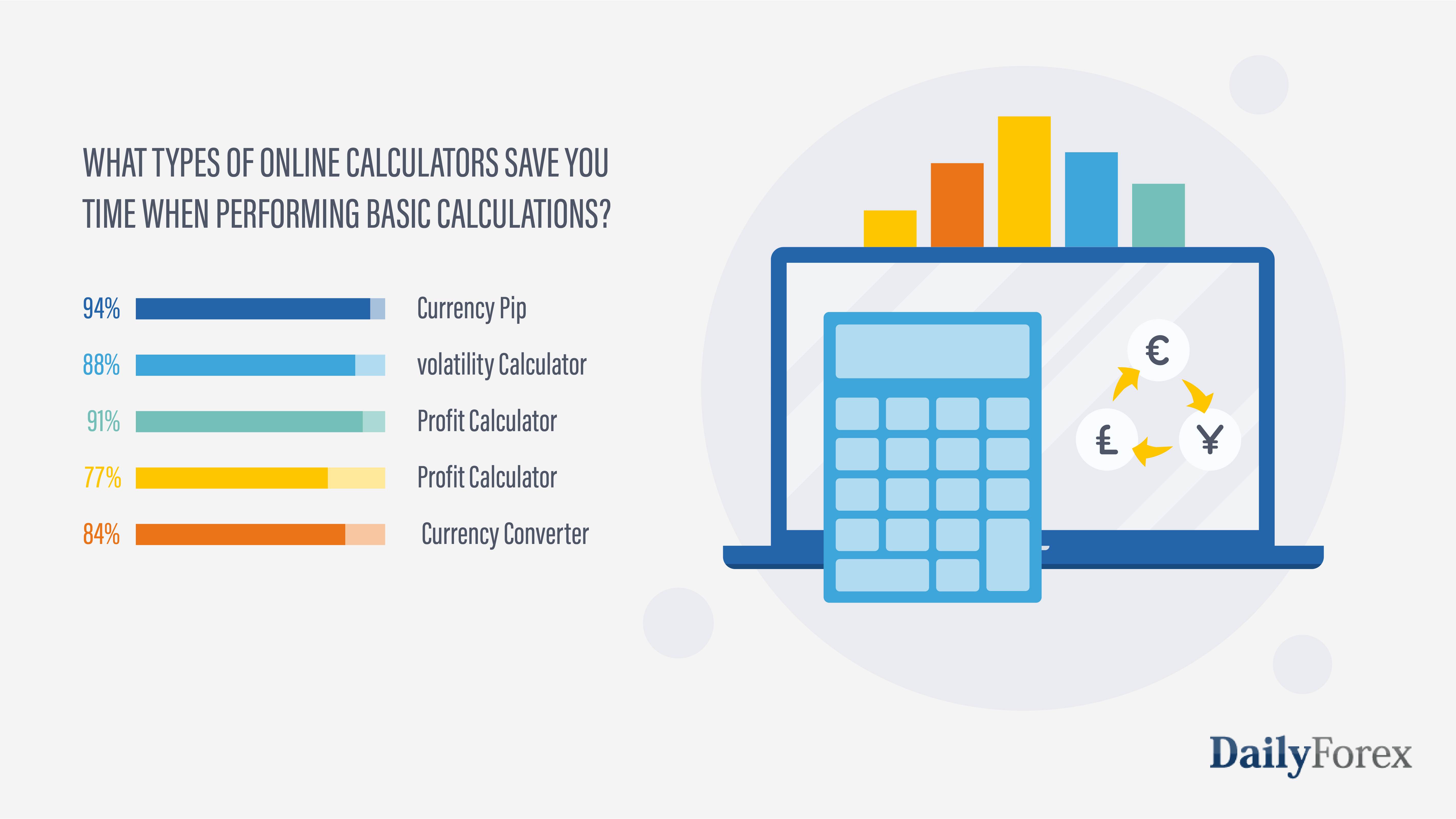

What types of online calculators save you time when performing basic calculations?

Traders are eager to know how to calculate the pips value on different currency transactions. 94% of the traders who responded to the survey stated that they use a currency pip calculator.

Do you use robots to help you trade?

88% of successful Forex traders these days use robots to help them make money.

Final Thoughts

The Forex trading market is bigger than futures and stock (equity) trading markets. Millions of individuals around the world attempt to secure profit from trading Forex. Some of them speculate and others manage a calculated risk on exchange rate fluctuations. Having a working knowledge and trading strategy is essential when entering the Forex market. Despite the COVID-19 outbreak, the Forex trading industry seems stable in 2020. We hope that this survey will help Forex traders to identify and better understand trends, techniques and expectations and become better traders.